Uniswap’s trading boom: What does $18B in volume indicate?

- Uniswap’s monthly L2 volume has surged to $18.23 billion, signaling strong investor confidence and market activity.

- Technical indicators and whale activity suggest a bullish outlook for UNI, despite rising selling pressure.

Uniswap [UNI] Protocol’s monthly L2 volume has skyrocketed to $18.23 billion this October, more than doubling from last year’s $7.34 billion. This dramatic increase signals robust growth and heightened activity within the Uniswap ecosystem.

At press time, UNI was trading at $8.02, reflecting a 1.82% increase in the last 24 hours. As the month is not over yet, could this surge in trading volume indicate a bullish trend for Uniswap’s market position and user engagement moving forward?

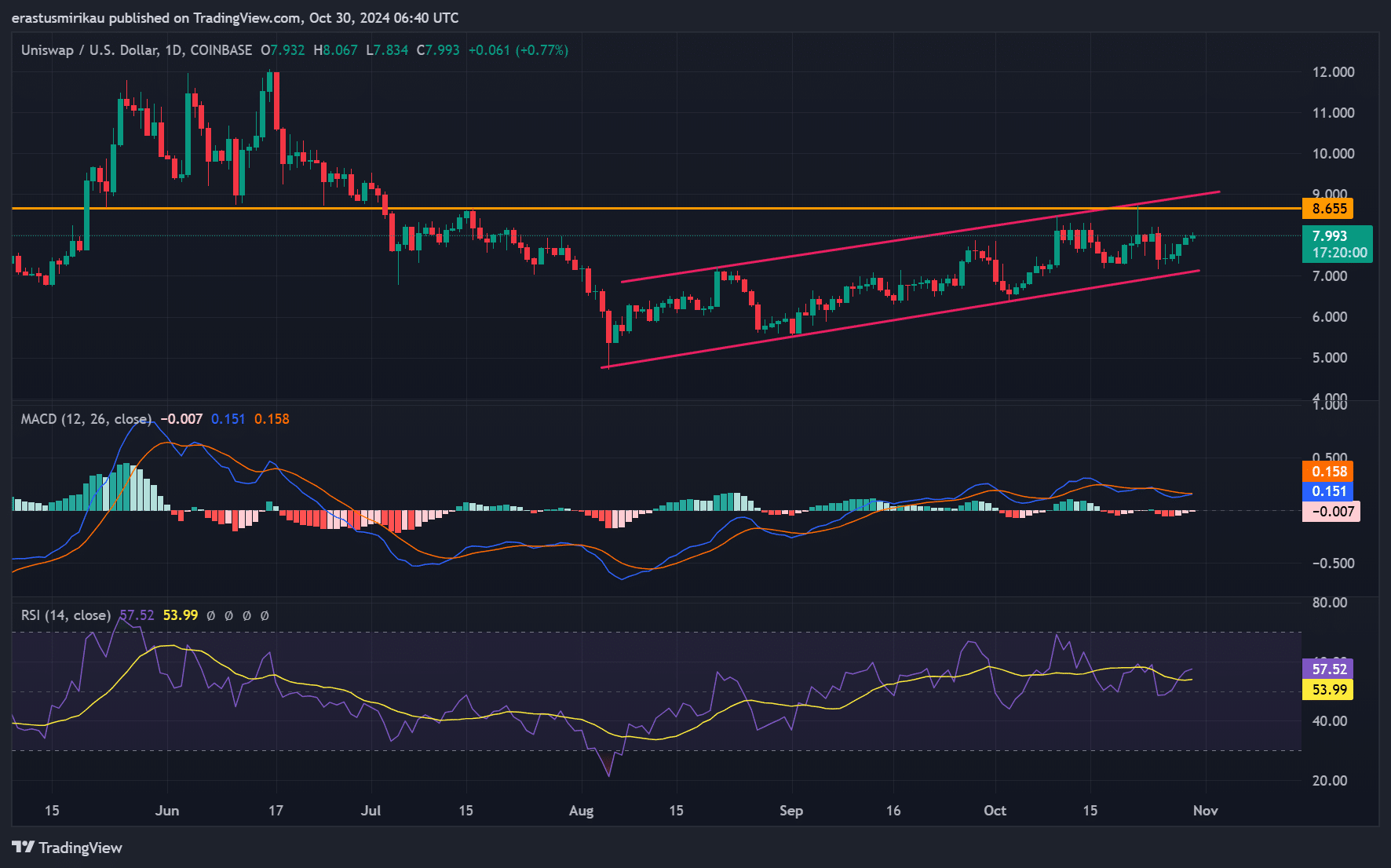

What do the technical indicators reveal?

Analyzing the MACD and RSI offers further insights. The MACD shows a bullish crossover, with the signal line trending upward. This movement typically indicates increasing momentum, hinting at potential price gains.

Additionally, the RSI currently sits at 57.52, suggesting that UNI is in neutral territory but leans towards bullish sentiment. Therefore, this combination of indicators suggests that the market may experience further upward pressure if conditions remain favorable.

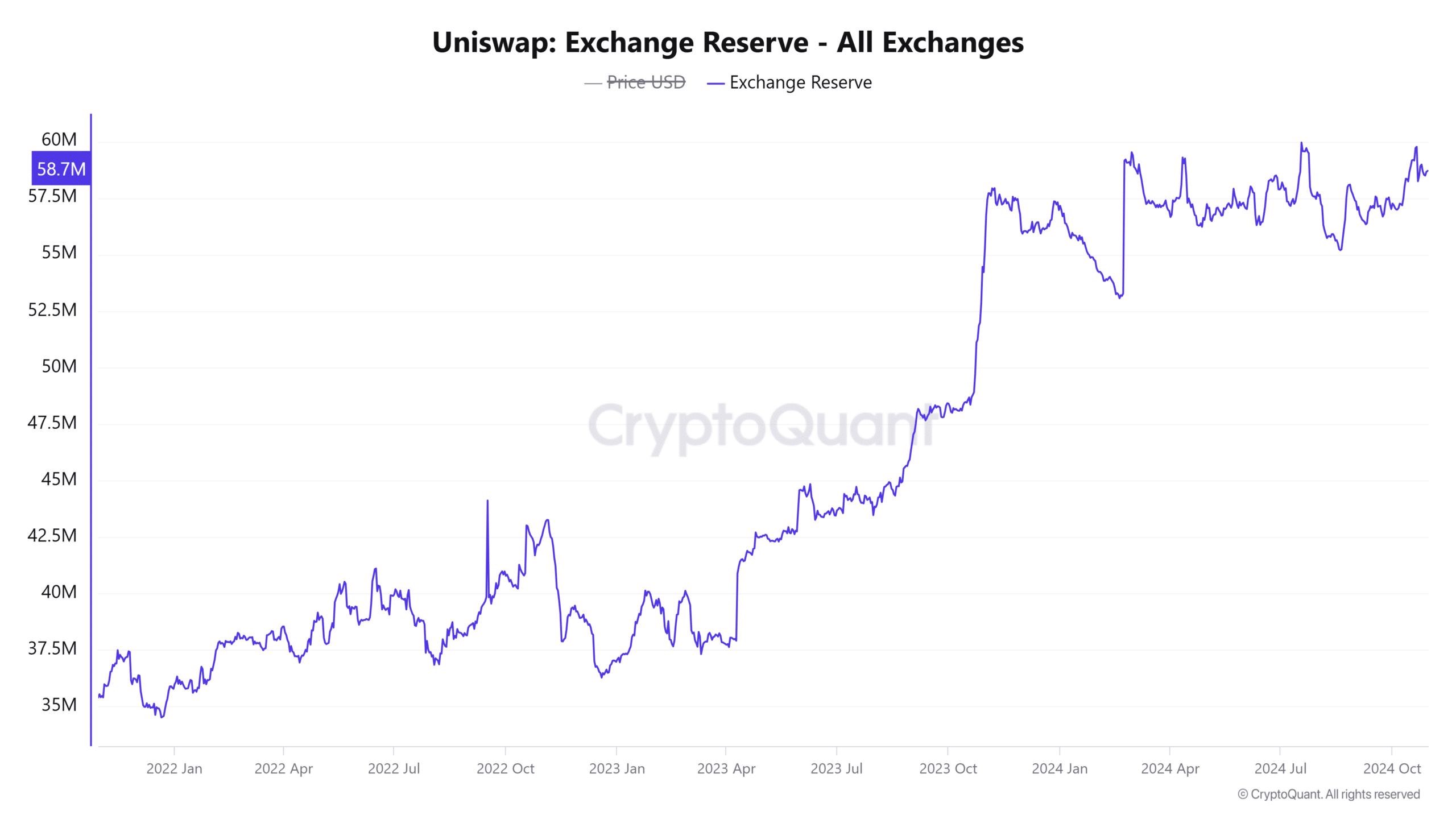

What’s happening with UNI’s exchange reserves?

The exchange reserves for UNI stand at approximately 58.70 million, a modest increase of 0.28% over the past day. This uptick in reserves often signifies increased selling pressure.

However, with rising trading volume and a growing user base, this factor might balance itself out. Consequently, traders should monitor this reserve closely to gauge potential shifts in market sentiment.

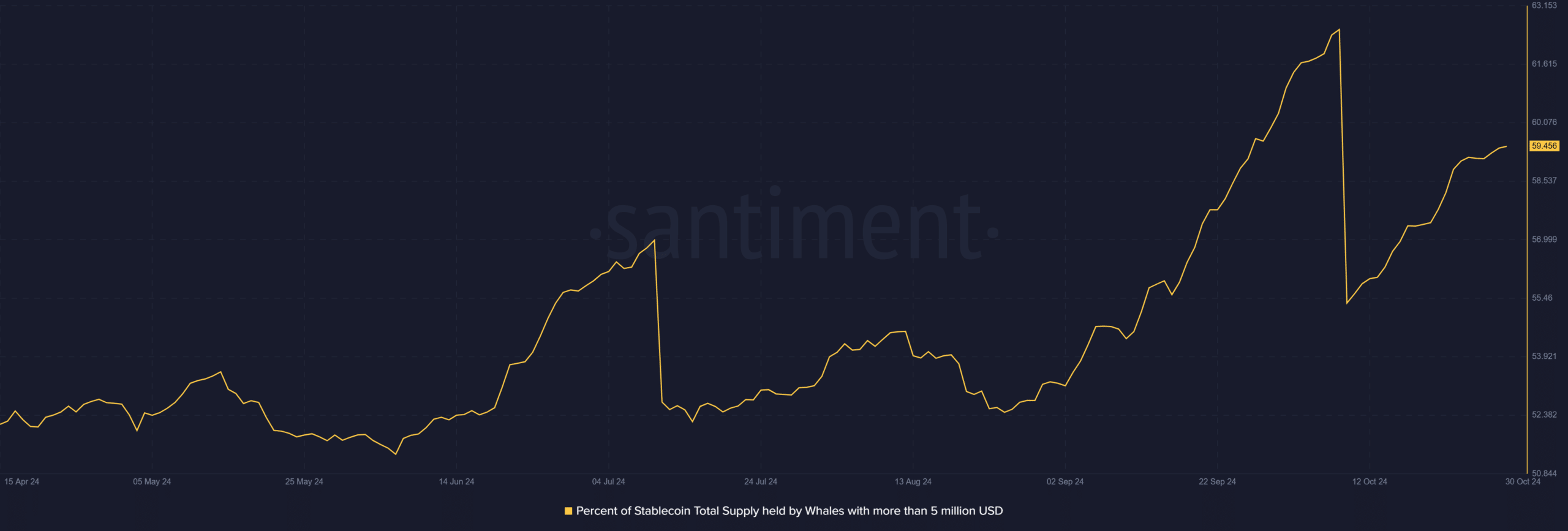

Are whales accumulating UNI?

Whale activity reveals that 59.46% of stablecoin supply remains in the hands of entities with over $5 million. Such concentration indicates a powerful influence on market movements.

These large holders may dictate market dynamics, suggesting that they could either stabilize prices or provoke volatility. Investors must consider this aspect when assessing UNI’s market direction.

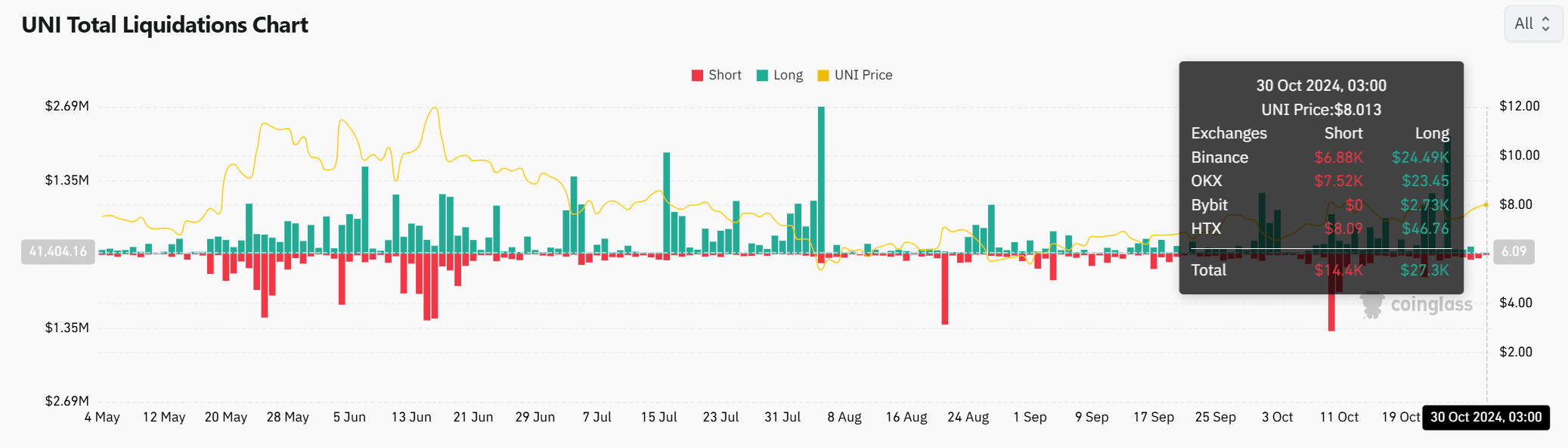

How does liquidation affect the current scenario?

UNI’s liquidation data shows a total of approximately $144.4K in short positions and $27.3K in long positions at the latest count. This imbalance can lead to rapid price swings, especially if market conditions shift suddenly. Therefore, traders must remain vigilant.

Is your portfolio green? Check out the UNI Profit Calculator

Conclusively, Uniswap’s substantial monthly volume growth and favorable technical indicators point towards a bullish trend. However, market dynamics remain fluid, influenced by whale activities and exchange reserves.

If Uniswap can maintain its current momentum, it could well pave the way for further gains in UNI’s price in the coming weeks. Investors should stay alert to capitalize on potential opportunities.