Exploring if BONK’s latest breakdown is real or a price trap

- On-chain metrics suggested that the recent breakdown in the memecoin could be a bearish fakeout

- BONK may decline by 20% to hit the $0.0000155-level, if it remains below $0.000020

In the ongoing price correction phase, BONK, the popular Solana-based memecoin breached its crucial support level. However, this breakdown appears to be a fakeout. This speculation is driven by traders’ sentiment and their long-side positions.

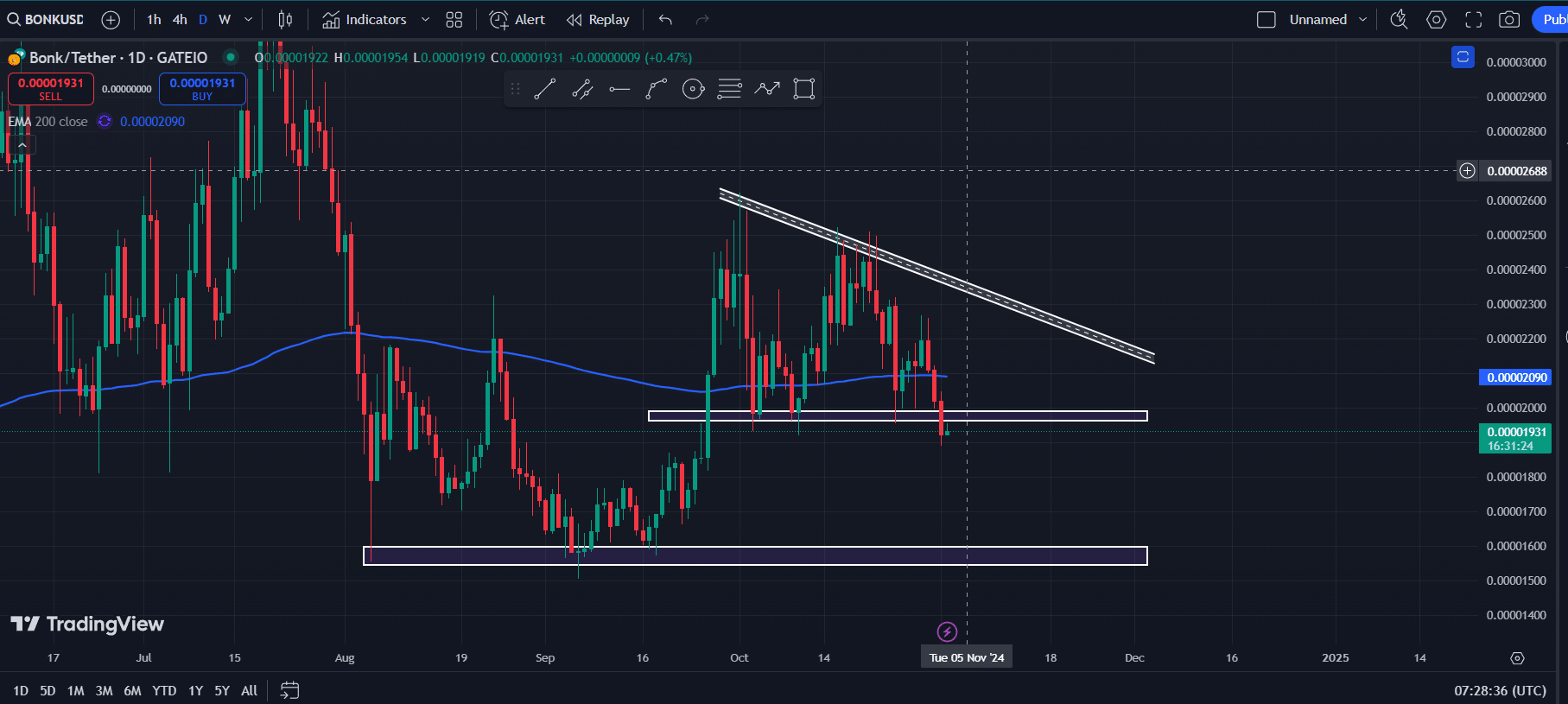

BONK technical analysis and key levels

A look at the memecoin’s charts revealed that BONK broke through a crucial support level at $0.0000196 and closed a daily candle below it. This candle closing below the support partially confirmed that the asset may be poised for a notable decline soon.

If this breakdown follows through, there is a strong possibility that BONK could drop by 20% to hit the $0.0000155 level in the coming days. At the time of writing, the memecoin was trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend.

However, BONK’s bearish thesis will only hold if it remains below the $0.000020-level. Otherwise, it will fail.

Bullish on-chain metrics

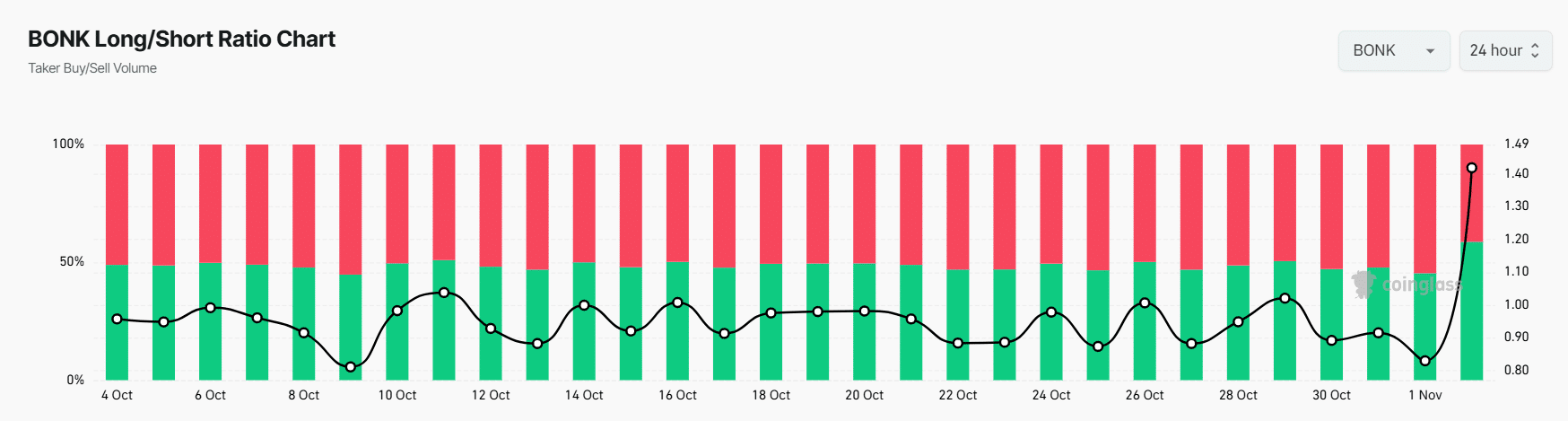

Despite a bearish outlook on the charts, BONK’s on-chain metrics hinted at positive sentiment among traders.

In fact, according to the on-chain analytics firm CoinGlass, BONK’s long/short ratio stood at 1.42 at press time – Its highest level since the beginning of October 2024.

This ratio alluded to strong bullish sentiment among traders. At the time of writing, approximately 60% of top traders held long positions, while 40% held short positions.

BONK’s Open Interest also declined by 6.2% in the last 24 hours, indicating reduced interest from traders. This also suggested that traders have been liquidating positions due to the altcoin’s latest price decline.

Major liquidation levels

Here, it’s worth noting that the major liquidation levels are at $0.0000189 on the lower side and $0.00001962 on the upper side, with traders over-leveraged at these levels, according to Coinglass.

If the market sentiment remains bearish and the price drops to the $0.0000189-level, nearly $100,000 worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to $0.00001962, approximately $71,100 worth of short positions will be liquidated.

Taken together, all these on-chain metrics revealed that despite a notable breakdown of the support level, bulls have been dominating BONK memecoin. While sentiment among traders can change at any time, at press time, it did lean bullish.