Here’s how Bitcoin’s 3-month-high volatility fueled crypto liquidations

- Bitcoin’s volatility hit a 3-month high on the charts

- Buying pressure on the coin increased, hinting at a price hike soon

As Election Day in the United States draws closer, several sectors have responded differently. And, crypto wasn’t insulated from it all either.

In fact, owing to the same, Bitcoin’s [BTC] price volatility hit a 3-month high. Hence, the question – Will this have a broader impact on the crypto market?

U.S elections affecting crypto?

The crypto market’s volatility started to rise ahead of the U.S election result date. AMBCrypto found that the overall crypto market’s volatility shot up and hit 66.7, at the time of writing. As expected, Bitcoin led this changing trend, with BTC’s volatility touching a 3-month-high.

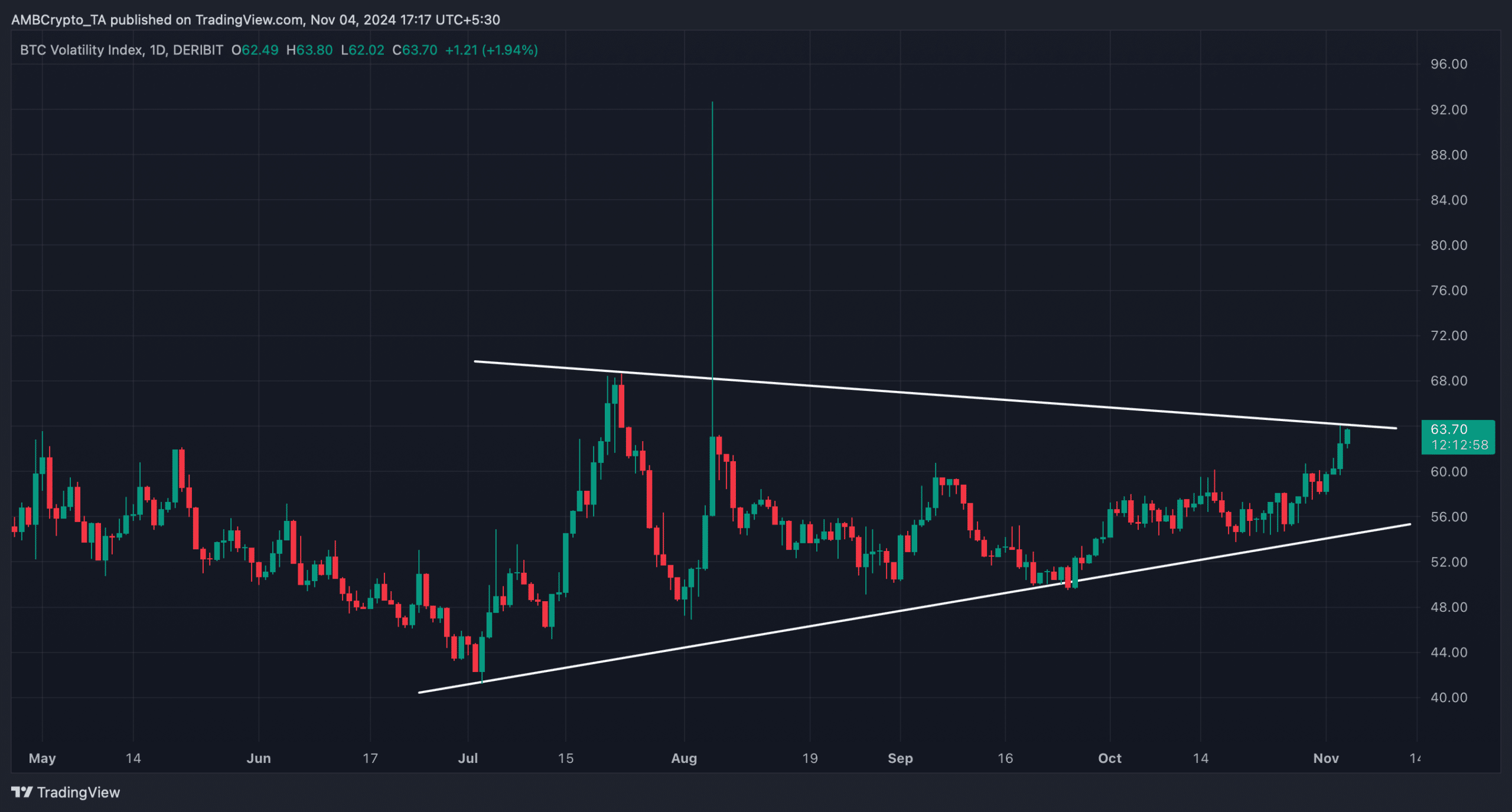

Here, the interesting part was that a pattern appeared on the volatility chart. To be precise, the pattern appeared in July and since then, the volatility chart has been consolidating inside it.

At the time of writing, BTC’s volatility was testing the resistance of the pattern as it had a value of 63.72. If the chart jumps above the resistance, then investors might see more volatility post the election results.

Apart from this, AMBCrypto also found that liquidations in the crypto market rose.

The good news was that in the case of Bitcoin, most of this liquidations came from long positions – A bullish sign. This was the case as more long positions hinted at greater bullish sentiment across the market.

Will BTC’s rising volatility push it up?

Since BTC’s volatility has been on the rise, AMBCrypto checked the king coin’s on-chain data to find out whether the outcome of this development will earn investors profit or push them into loss. Our analysis of CryptoQuant’s data revealed that BTC’s exchange reserves have been dropping, meaning that buying pressure on the coin was high.

A hike in buying pressure generally translates into price hikes. In fact, over the last 24 hours alone, BTC witnessed a marginal price hike and was trading at $68.75k.

However, not everything was working in the king coin’s favor. BTC’s aSORP revealed that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

Additionally, amidst the ongoing buzz around the U.S elections, investors are not considering buying BTC, with the same evidenced by the red Coinbase premium.

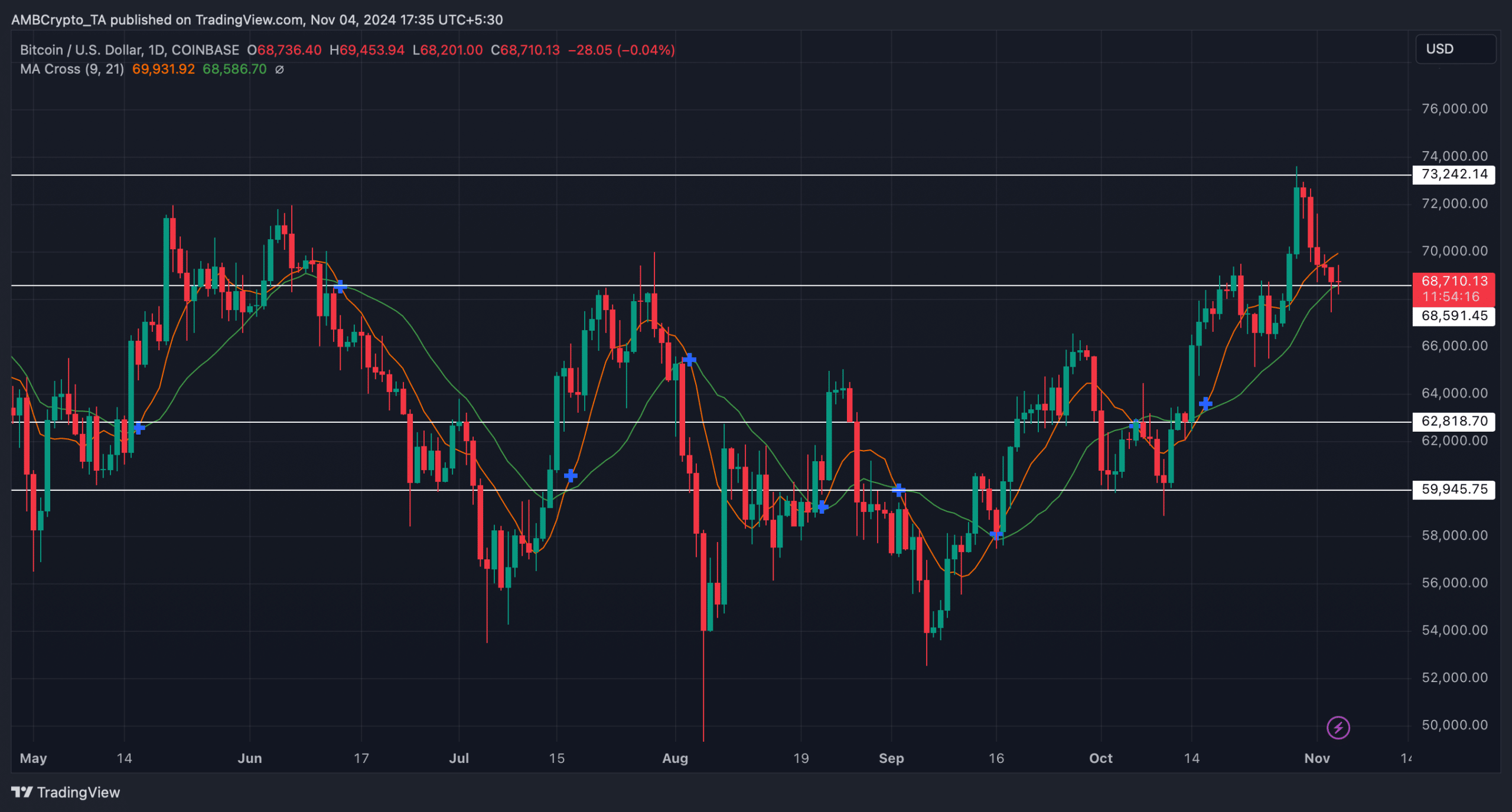

Finally, we checked BTC’s daily chart to better understand what to expect. As per our analysis, BTC seemed to be testing a support level.

Read Bitcoin (BTC) Price Prediction 2024-25

The technical indicator MA Cross suggested that the bulls were leading, indicating a successful test. Therefore, if BTC’s volatility increases even more, its price might move towards $73k again.