TROY token soars 80% in a day – Should you brace for a correction?

- TROY was trading near levels last seen in July 2023.

- The intense demand in recent days, if it continues, could push prices much higher.

TROY [TROY] token has gained nearly 72% since Monday’s trading session opened. The preceding week was also strongly bullish, and the token surged by 259% before retracing over the weekend.

The uncertainty around the U.S. elections has kept many investors and traders sidelined, but TROY token was unfazed. The $38.7 million market cap token has been trading since January 2020 and is up nearly 300% in ten days.

Traders should prepare for more gains

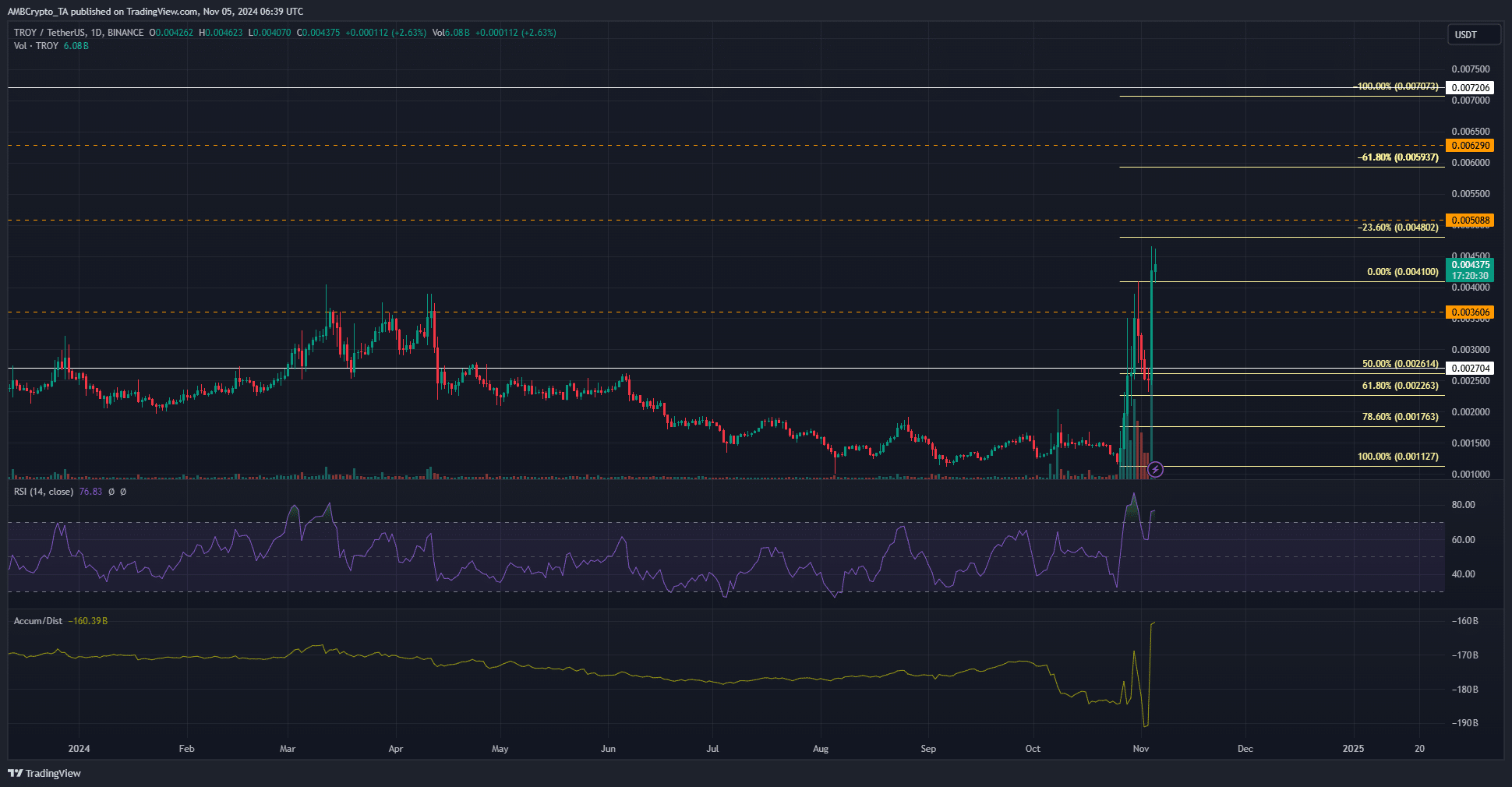

Since May, the TROY token has been in a downtrend. From the high on the 24th of April to the low on the 25th of October, TROY had shed 58.88% in just over six months. The recent price surge took prices to the highest they have been since July 2023.

The A/D indicator on the daily timeframe noted strong bullishness and high demand. The RSI was beyond the overbought threshold but does not necessarily indicate a pullback is imminent.

Traders can use a bearish divergence between the price and the RSI to sell TROY and re-enter after a pullback.

The Fibonacci levels highlighted the $0.0048 and $0.0059 as the next bullish targets.

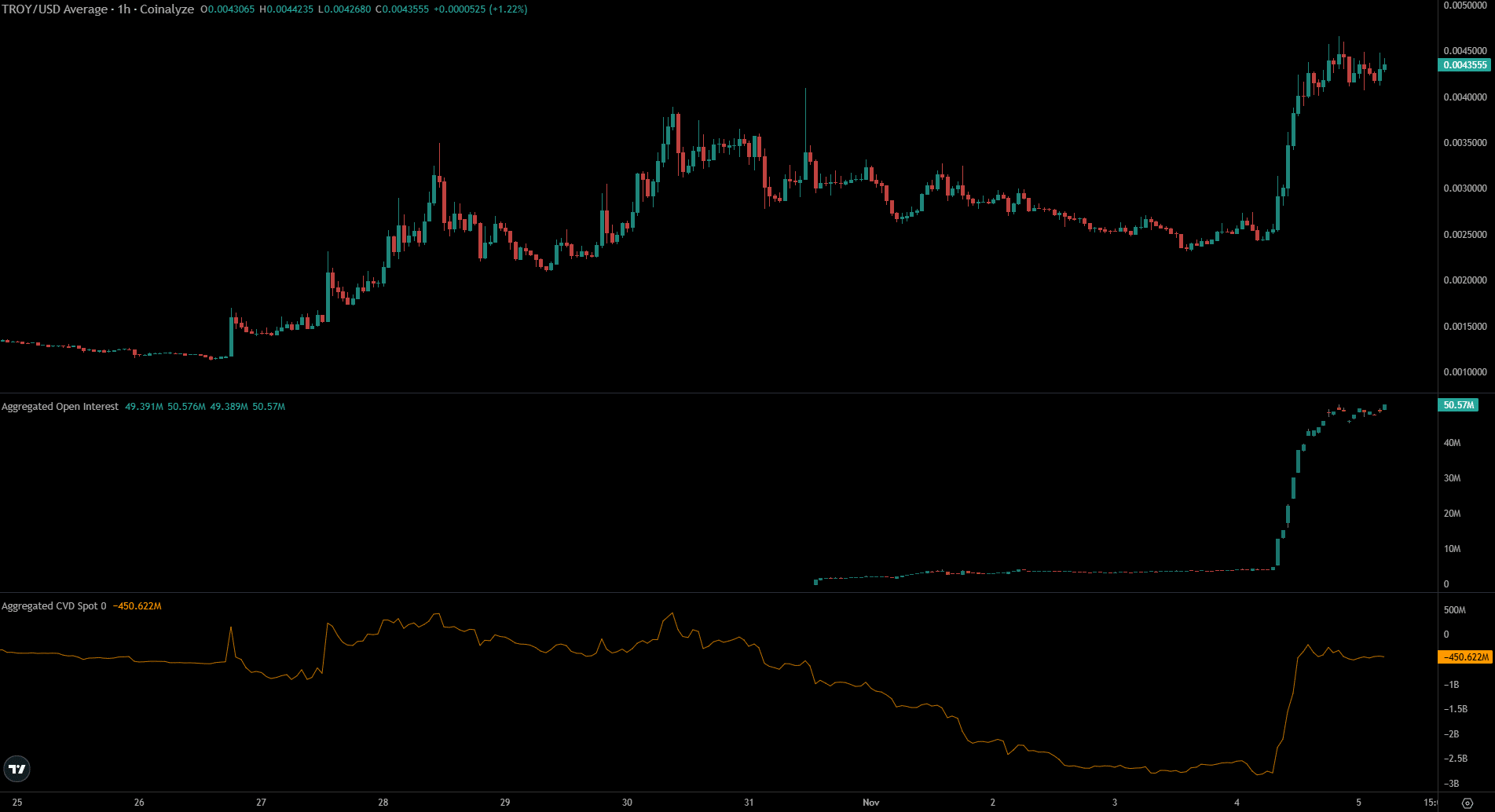

The high influx of Open Interest could see long positions hunted

The price is up by nearly 300% in ten days and the Open Interest gathered nearly $40 million more in the past 24 hours. It swelled from $4.3 million to $50.57 million, a nearly twelve-fold increase.

This meant that speculators were keenly bullish, but also presented the possibility of a liquidity hunt to flush out overeager bulls.

Is your portfolio green? Check the TROY Profit Calculator

The spot CVD also jumped higher. The demand in the market was high and the low market cap of the asset meant further growth was likely, but holders will need conviction. New entrants must be careful to limit their risk and not get caught bag holding TROY token.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion