POL hits new lows amidst Polygon’s TVL surge: A chance to invest?

- POL slips into its lowest ever price point after failing to find a bullish footing.

- Assessing whether this could be a good opportunity to buy in.

POL (formerly MATIC) holders must be throwing punches in the air after its latest performance. The Polygon-native token extended its downside into new historic lows but could this be the ideal time to buy back?

POL has been attaining new historic lows at a time when most of the top coins have been attempting to reach previous highs or set new ones.

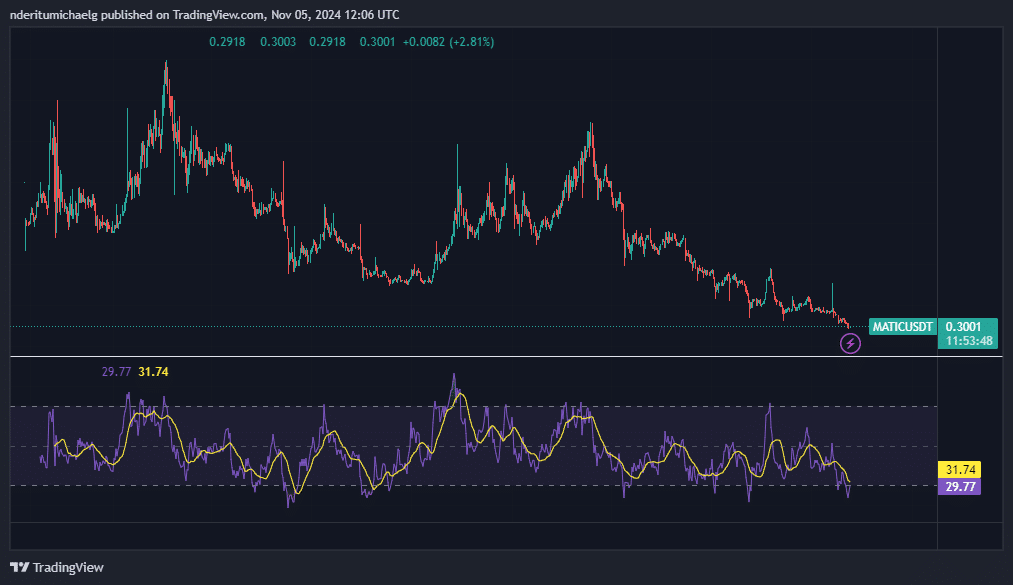

The token traded as low as $0.285 during Monday’s trading session. This was the lowest that the price has attained in its entire existence.

The new all-time low was heavily oversold according to the RSI. But does this mean that it is now a good time to buy back into MATIC at the extreme discount? This would have been an easy question to answer just based on price performance alone.

The continuous downside suggests that MATIC is one of the least attractive coins so far this year, hence the lack of demand. However, a closer look at the Polygon ecosystem performance may offer a glimmer of hope for MATIC holders.

Can Polygon metrics breathe new life into POL?

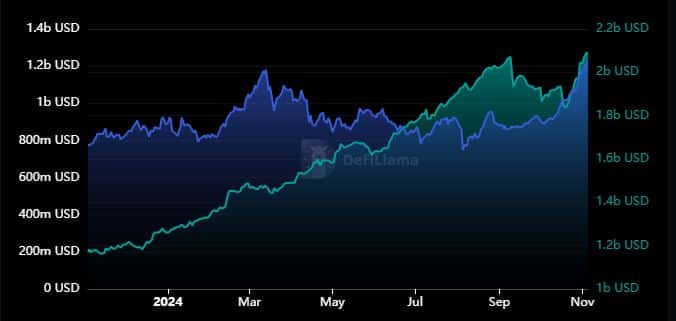

Although POL was mostly in the red in the last 12 months, its native platform Polygon grew in other areas. For example, its stablecoin marketcap was $1.17 billion on 5th November, 2023, but has since grown to $2.08 billion exactly 12 months later.

Polygon’s total value locked (TVL) also achieved a net positive growth from $772.4 million to $1.237 billion during the same period. This suggests that the network is currently more ready for DeFi usage than it has ever been.

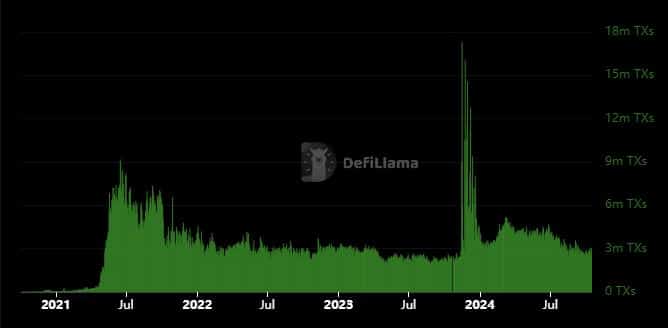

Transaction data revealed that the highest registered number of transactions was over $17 million TXS in November 2023. It has since dropped considerably to the 3 million transactions or within that region in November 2024.

Nevertheless, the November 2023 spike as isolated event that does not necessarily reflect on price.

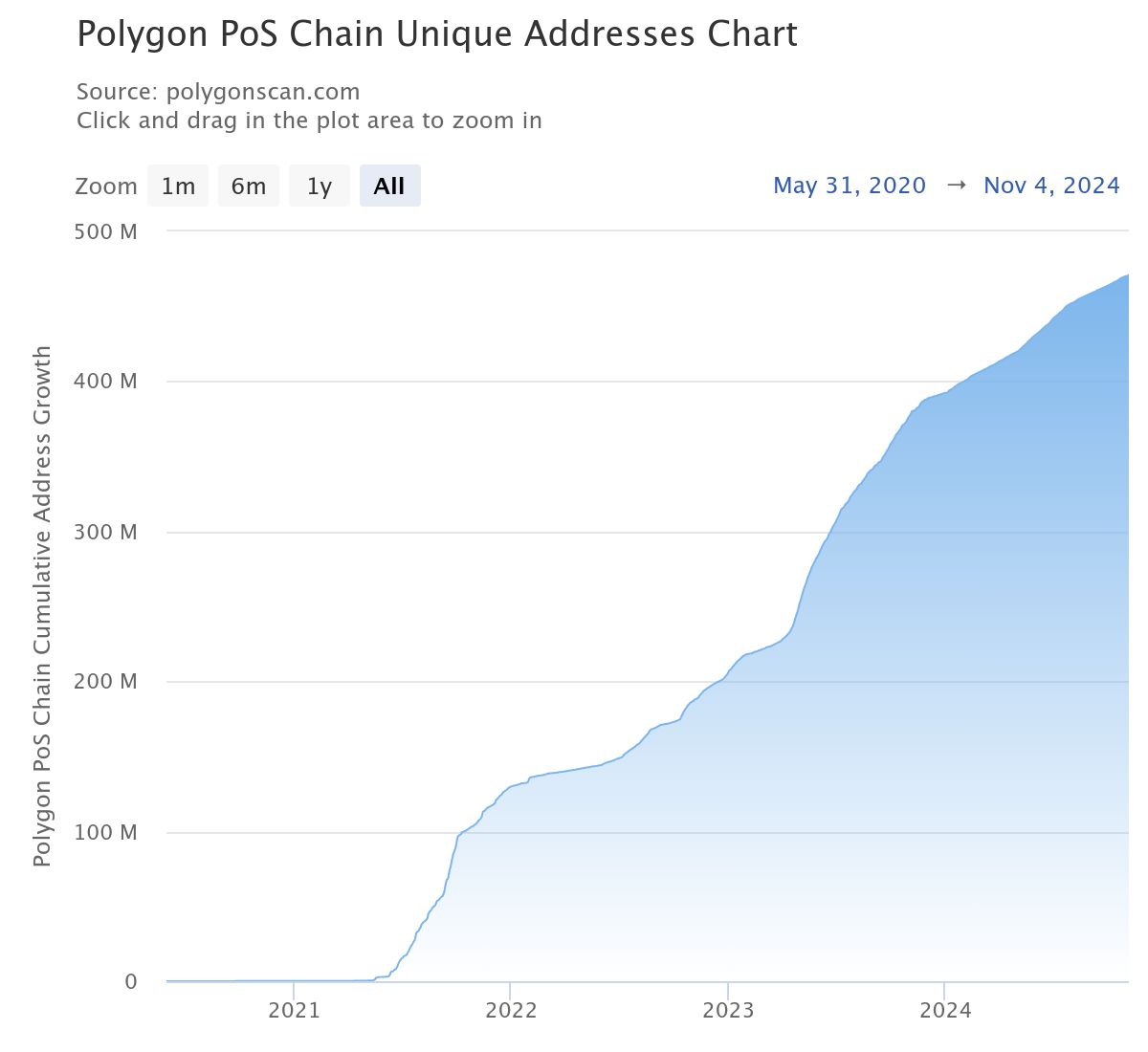

Transaction data has been relatively healthy for the rest of the time. This suggests that network activity may not be linked to POL demand and price action. This conclusion was backed by the observation that Polygon did not experience negative address growth.

The network had just over 379 million unique addresses on 4th November, 2024. The figure has since climbed to 470.9 million MATIC.

Is your portfolio green? Check out the POL Profit Calculator

So, address growth has also been positive, which means the market has become disenfranchised with POL. This makes it difficult to gauge whether the token will regain its attractiveness.

Nevertheless, it would offer one of the best opportunities especially if it could soar back to its ATHs. A rally to the top would be equivalent to a 400% plus gain.