Breaking down Bitcoin’s week as ‘Trump Trade’ frenzy lifts crypto

- BTC’s 8% election pump outperformed U.S. stocks.

- Whale entities trimmed exposure despite the post-election bullish expectation.

Bitcoin [BTC] surged nearly 8% to a new all-time high (ATH) of $75.410 on the Coinbase exchange on U.S. election night.

Despite slight profit-taking at the time of writing, BTC hovered slightly below the record level and was valued at $73.8K.

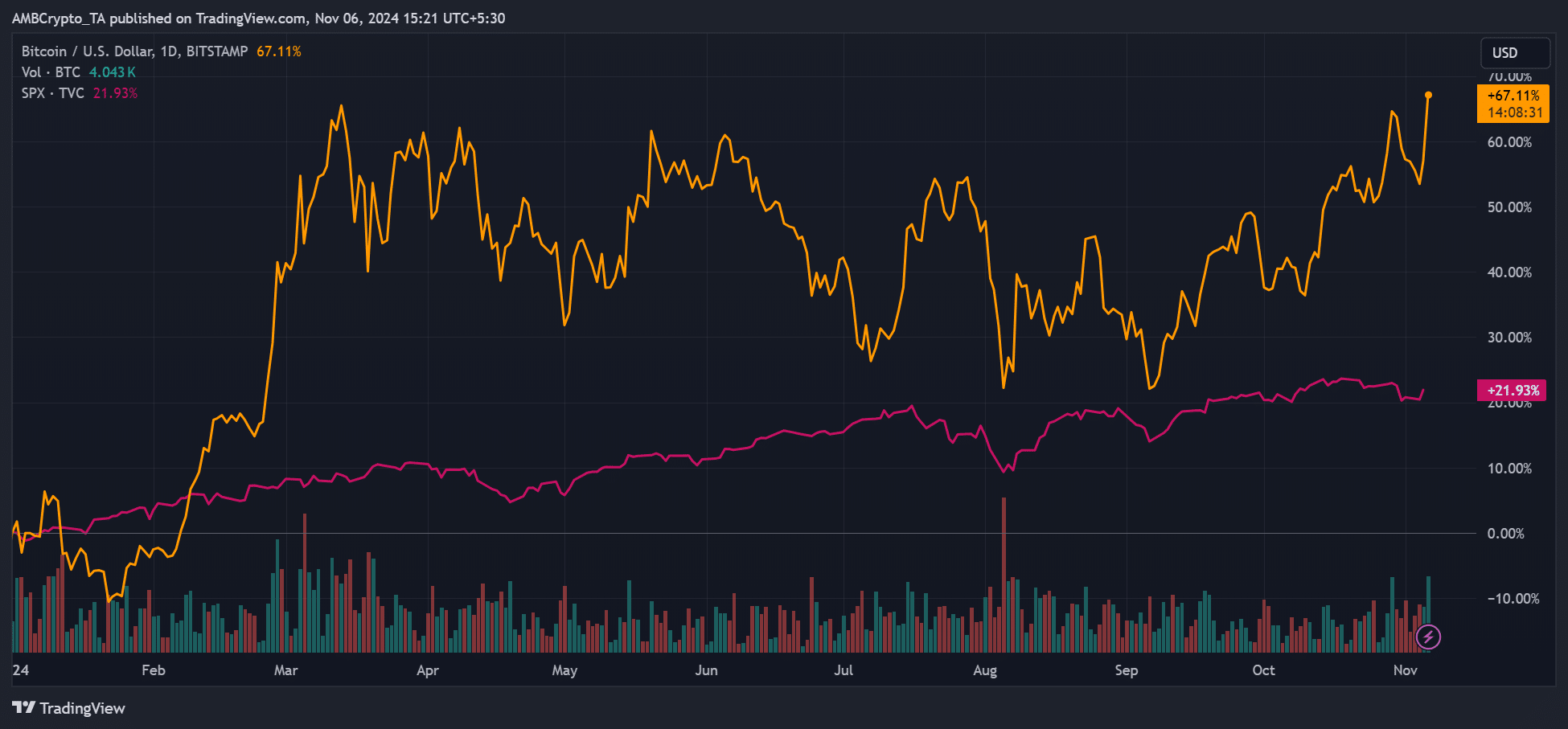

Although all markets rallied following Trump’s apparent lead, the ‘Trump Trade’ seems to have played out better in BTC than U.S. stocks.

In the past five trading days, BTC was up +6% compared to the S&P 500 Index (SPX) and the tech-heavy Nasdaq, which surged only 1%.

On YTD’s (year-to-date) performance, BTC gains extended to 67%, nearly 45% more than SPX’s 22%. In short, BTC outperformed U.S. stocks 3x.

Post-election BTC outlook

Based on BTC’s historical performance after the U.S. elections, the cryptocurrency could continue its stellar uptrend.

According to BTC analyst Stockmoney Lizards, the latest surge could be the starting point for a rally toward the $100K target. He said,

“#Bitcoin. Remember, this is just the beginning. Today and tomorrow, we can expect some volatility. Next weeks will be overwhelmingly green.”

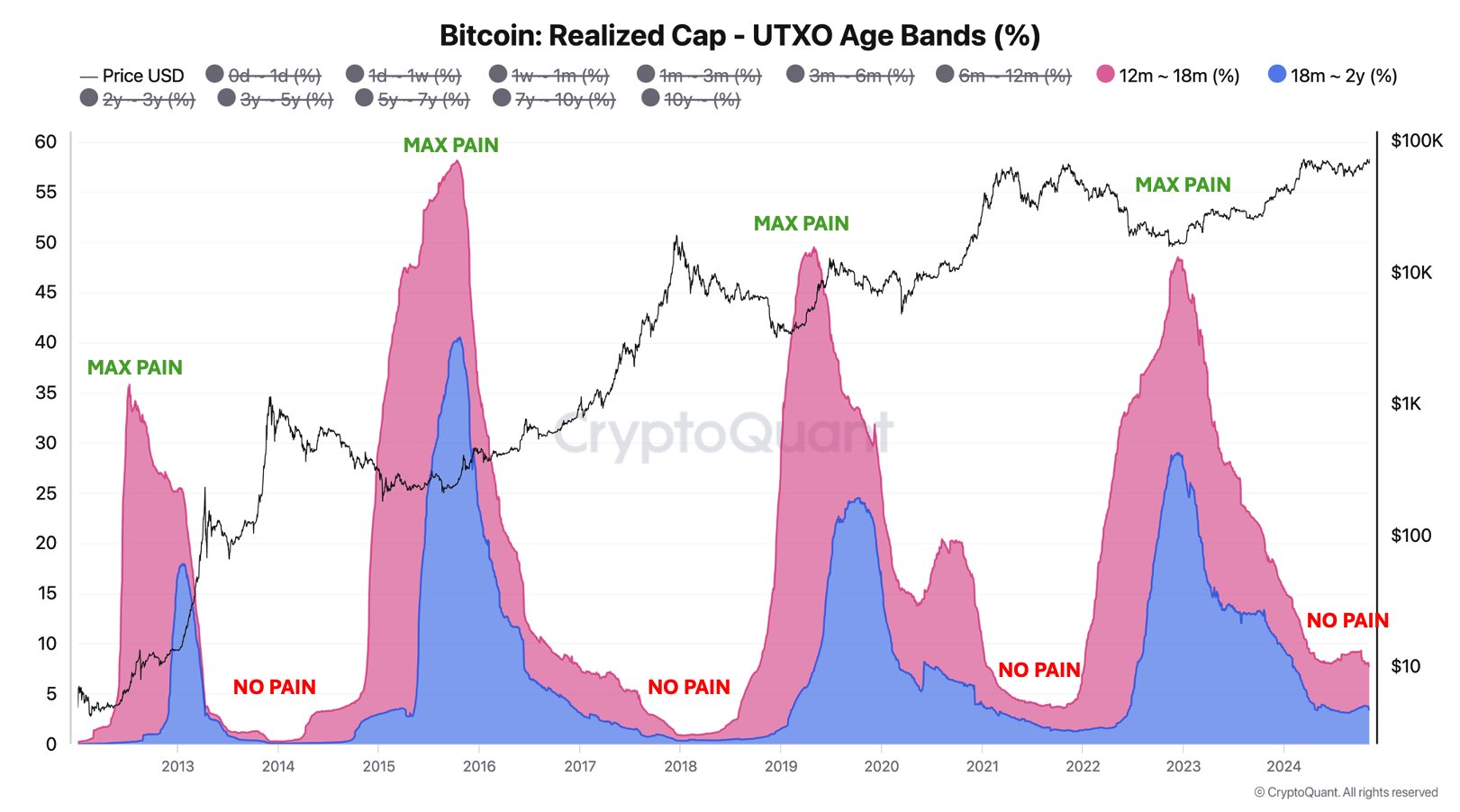

However, CryptoQuant founder Ki Young Ju cautioned that the market shouldn’t overblow expectations on BTC returns. He projected that BTC could pump 30% to 40% max (about $96K to $103K).

He noted that long-term holders (LTH) that have held through the bear market could begin to offload and book profit. Furthermore, Young Ju said,

“It could go up +30-40% from here, but not like the +368% we saw from $16K. Time to consider gradual selling, not all-in buying, IMO.”

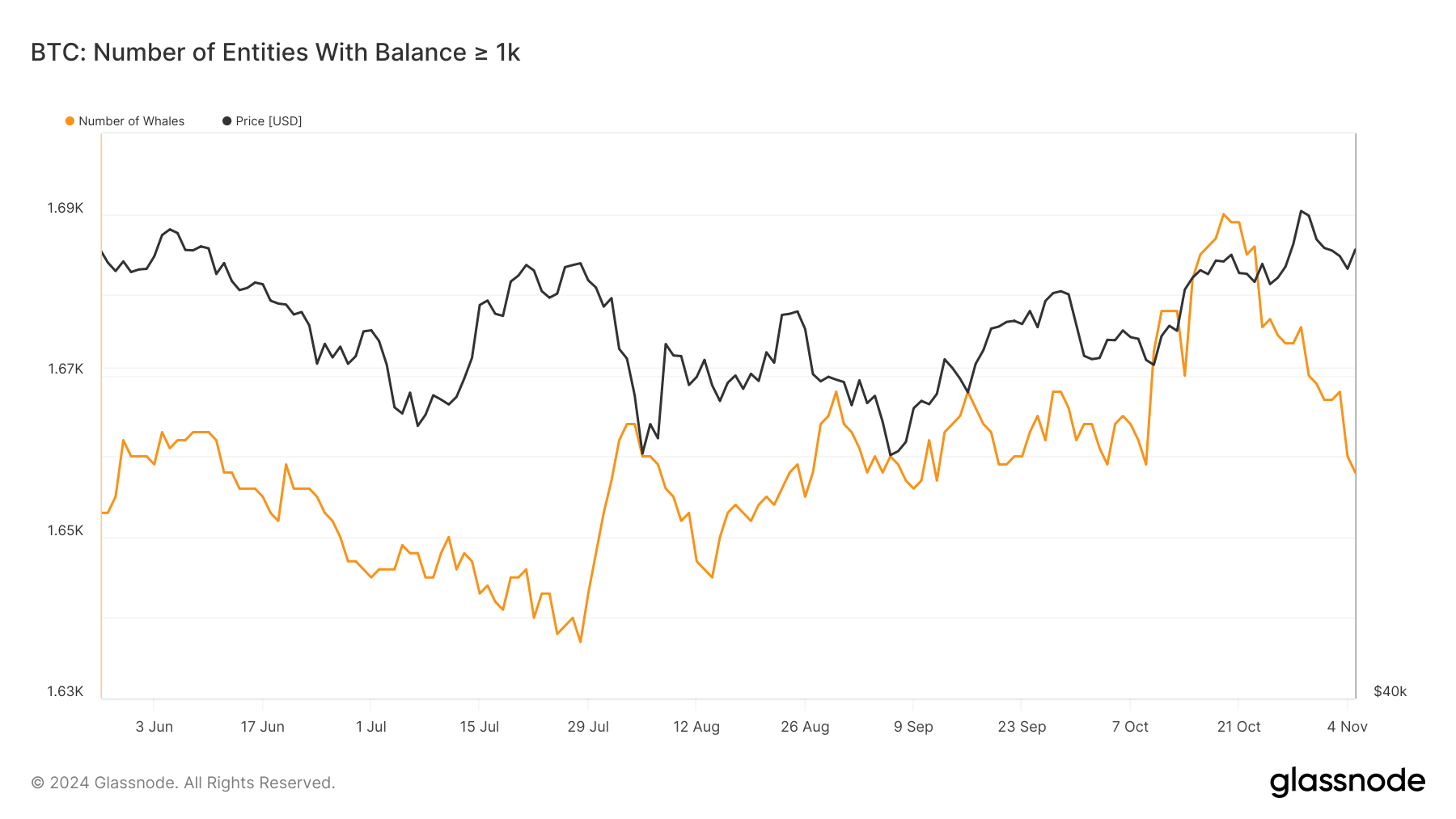

Interestingly, it looked like Young Ju’s outlook could be underway, as revealed by the declining number of whale entities with over 1K BTC.

Per Glassnode data, whale entities with over 1K BTC dropped from 1690 in mid-October to 1658 as of 5th November. This meant some large players trimmed BTC exposure in the past two weeks.

Read Bitcoin [BTC] Price Prediction 2024-2025

It remains unknown whether it’s a pre-election de-risking or a long-term profit-taking trend as BTC prints new ATHs.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In conclusion, analysts’ assessment of BTC’s long-term outlook was positive. During this cycle, BTC could hit the $90K-$100K range.

However, whale entities have begun trimming exposure, a trend CryptoQuant founder believe could intensify going forward.