Ethena rises 41% in 7 days: Is $1 next for ENA’s price?

- Euler Labs boosted ENA’s utility with $42k in incentives and a new collateral option

- ENA broke out of a descending triangle on the charts, setting up for potential gains of +100%

A bullish breakout has put ENA firmly on track to $1.20. This breakout has been backed by a 63.42% hike in trading volume to $538.61 million and a 22.15% hike in Open Interest. In fact, the latter recorded figures of $189.05 million, at press time.

New Euler Labs incentives totaling $42,000 further spurred its market momentum. Especially as traders actively positioned themselves to capitalize on ENA’s upward potential on the charts.

ENA’s descending triangle breakout signals bullish path to $1.20

Ethena’s native token, ENA, recently broke out of a descending broadening wedge pattern on the daily chart, indicating a bullish reversal.

This technical formation, characterized by diverging trendlines, often precedes upward price movements. According to analyst ZAYK Charts, ENA could now register a hike of 100%-120%, with the altcoin possibly targeting price levels between $0.85 and $1.00.

Source: X

A breakout from this pattern is a sign that buyers are gaining momentum, with higher trading volumes supporting this bullish outlook.

If ENA maintains its support above its previous resistance line, it could continue its upward trajectory towards the projected targets.

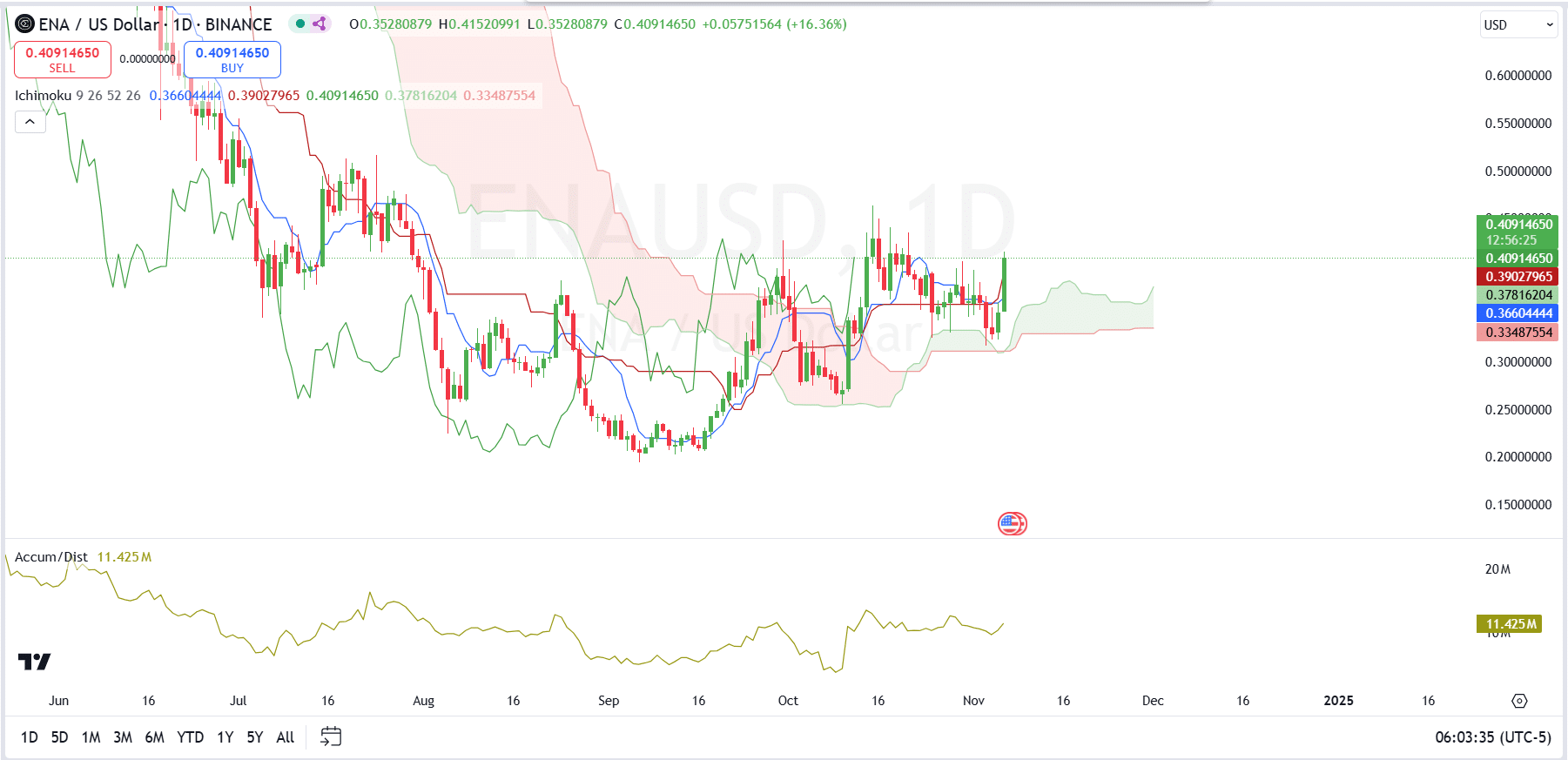

ENA climbs above the Ichimoku Cloud

Technical indicators seemed to align with the bullish sentiment surrounding Ethena too, with the Ichimoku Cloud pointing to an uptrend as ENA moved above the cloud.

The Tenkan-sen line leading over the Kijun-sen supported short-term buying momentum, reinforcing the upward potential in ENA’s price.

Additionally, the Accumulation/Distribution line underlined a steady hike – A sign of sustained buying interest from traders.

Euler Labs enhances ENA’s utility with new collateral options

Euler Labs enhanced its Stablecoin Maxi platform by introducing PT-sUSDE as a new collateral option with incentives totaling approximately $42,000. This initiative includes 25,000 $PYTH rewards and Euler-matching rewards worth around $17,000, aiming to boost user engagement.

Users can now lend sUSDE from Ethena Labs and utilize PT-sUSDE as collateral to borrow sUSDE. This can create additional earning opportunities within the platform.

At the time of writing, Ethena’s native token ENA was trading at $0.41, up 21% in the last 24 hours. It had a market cap of $1 billion and a 24-hour trading volume of $301 million.

The introduction of PT-sUSDE as collateral and the associated incentives may positively influence ENA’s value by increasing demand for Ethena’s services.

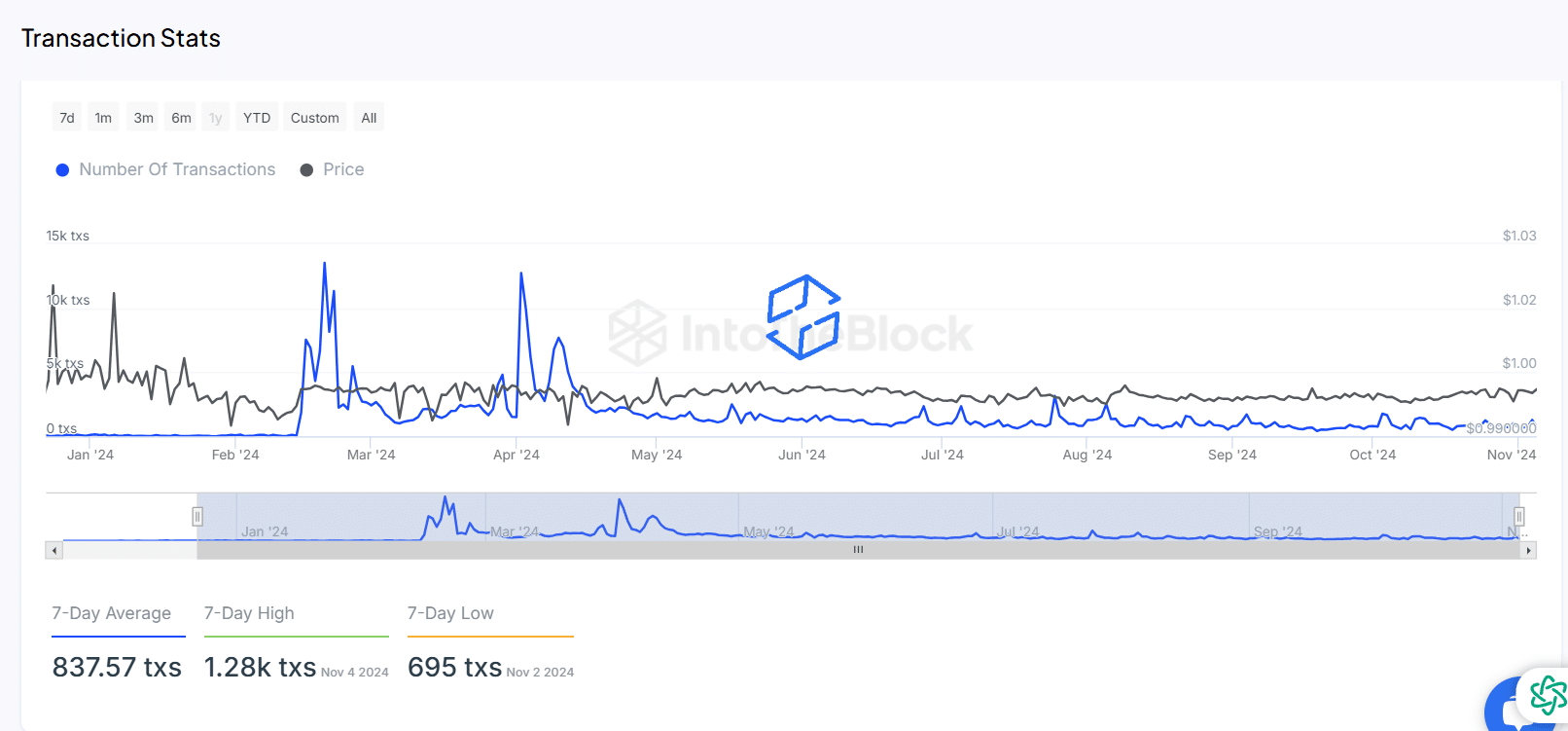

Consistent transaction volume highlights stable demand

Ethena’s transaction data further reinforced its steady market presence, with a 7-day average of 837.57 transactions and a recent high of 1.28k on 4 November 2024.

Steady transaction volumes and a stable price around the $1-mark pointed to consistent demand and minimal volatility in recent months. The stability in price, despite fluctuating transaction volumes, underlined a balanced market environment for ENA too.

These developments, together, collectively pointed to a positive outlook for ENA, with technical indicators and rising market activity supporting a strong growth trajectory.