Bitcoin Open Interest reaches new highs despite early days of bull run

- Bitcoin set a new all-time high for Open Interest, reaching $45.8 billion.

- The NUPL metric showed that the bull run is likely still in its early stages.

Bitcoin [BTC] has set a new all-time high as the U.S. presidential election wound to a close, with Donald Trump as the clear victor.

Historical trends suggest that November and December would be strongly bullish months for crypto.

CryptoQuant founder Ki Young Ju insisted that we might not see more than 30%-40% gains here onward, and not the 368% move we saw in the previous cycle.

Yet, Open Interest set a new all-time high of $45.8 billion while Bitcoin also set a new ATH at $76.4k, signaling strong bullish sentiment. Additionally, the on-chain metrics did were not close to cycle top levels yet.

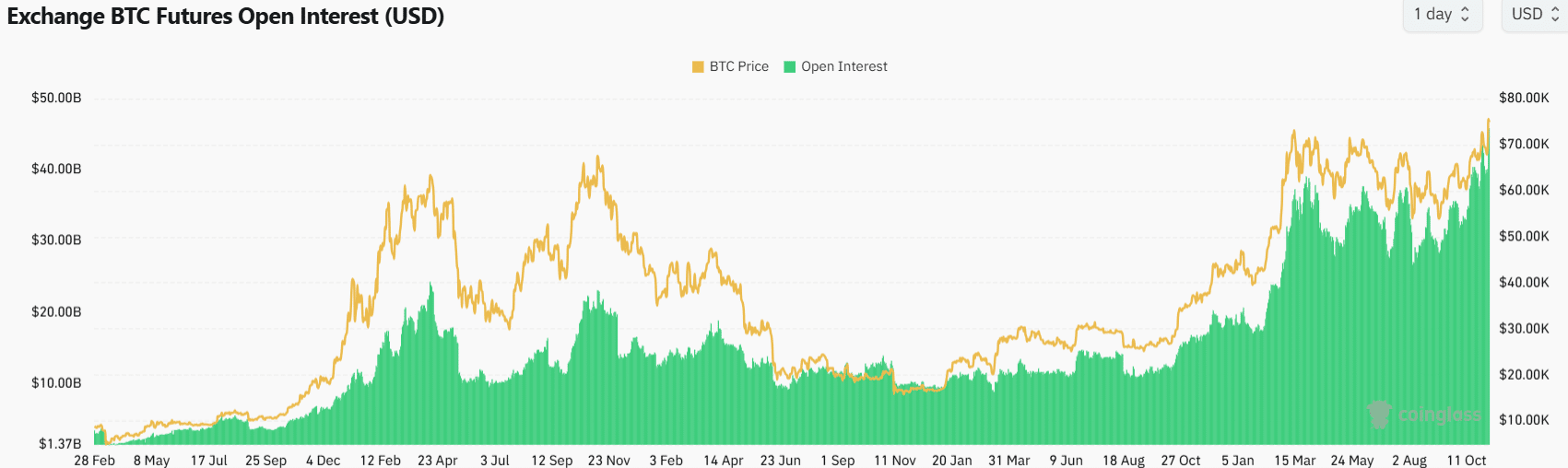

Futures Open Interest soars past 2024 highs

Source: Coinglass

In the past three years, the Open Interest has been growing steadily. The rally from October 2023-March 2024 took the OI from $11.9 billion to $38 billion.

These highs were broken on the 17th of October and then again on the 7th of November.

Rising prices and Open Interest indicate healthy bullish sentiment, although the price discovery phase could see high volatility. Traders should be cautious of deep pullbacks in the coming months.

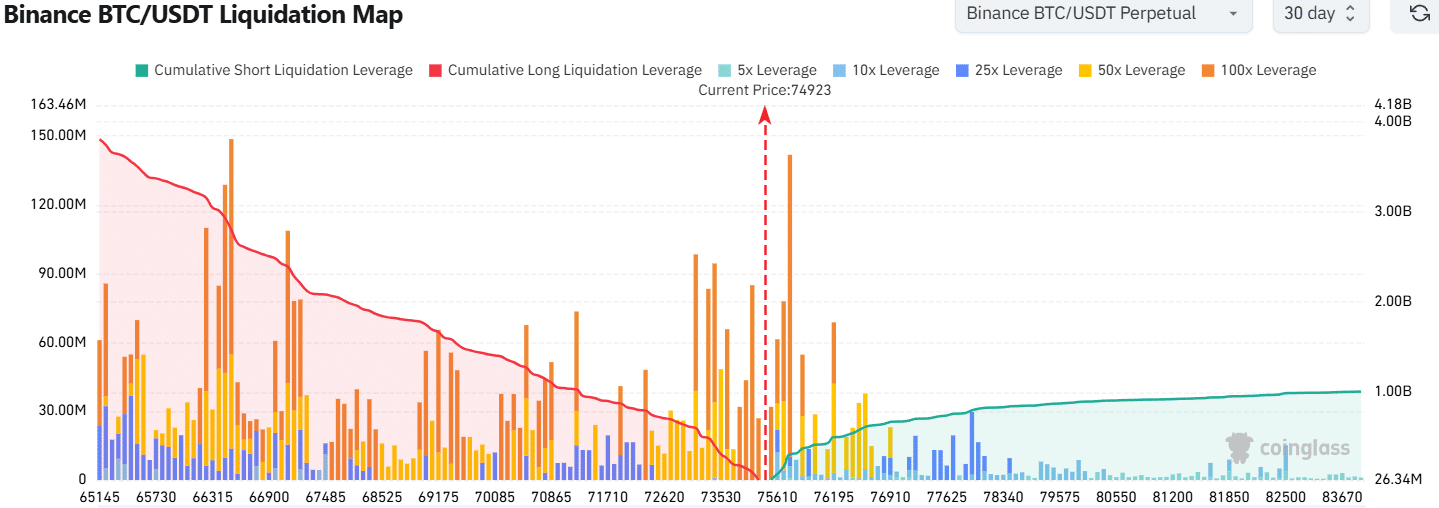

Source: Coinglass

As things stand, some short sellers seem eager to trade against the bullish momentum BTC exhibited over the past three weeks. The liquidation map showed that a cluster of high leverage liquidations levels were present at $75,740.

Long liquidations of a similar size were also present at $73,205, but as things stand, a drop toward $70k would be much more painful than a continued uptrend.

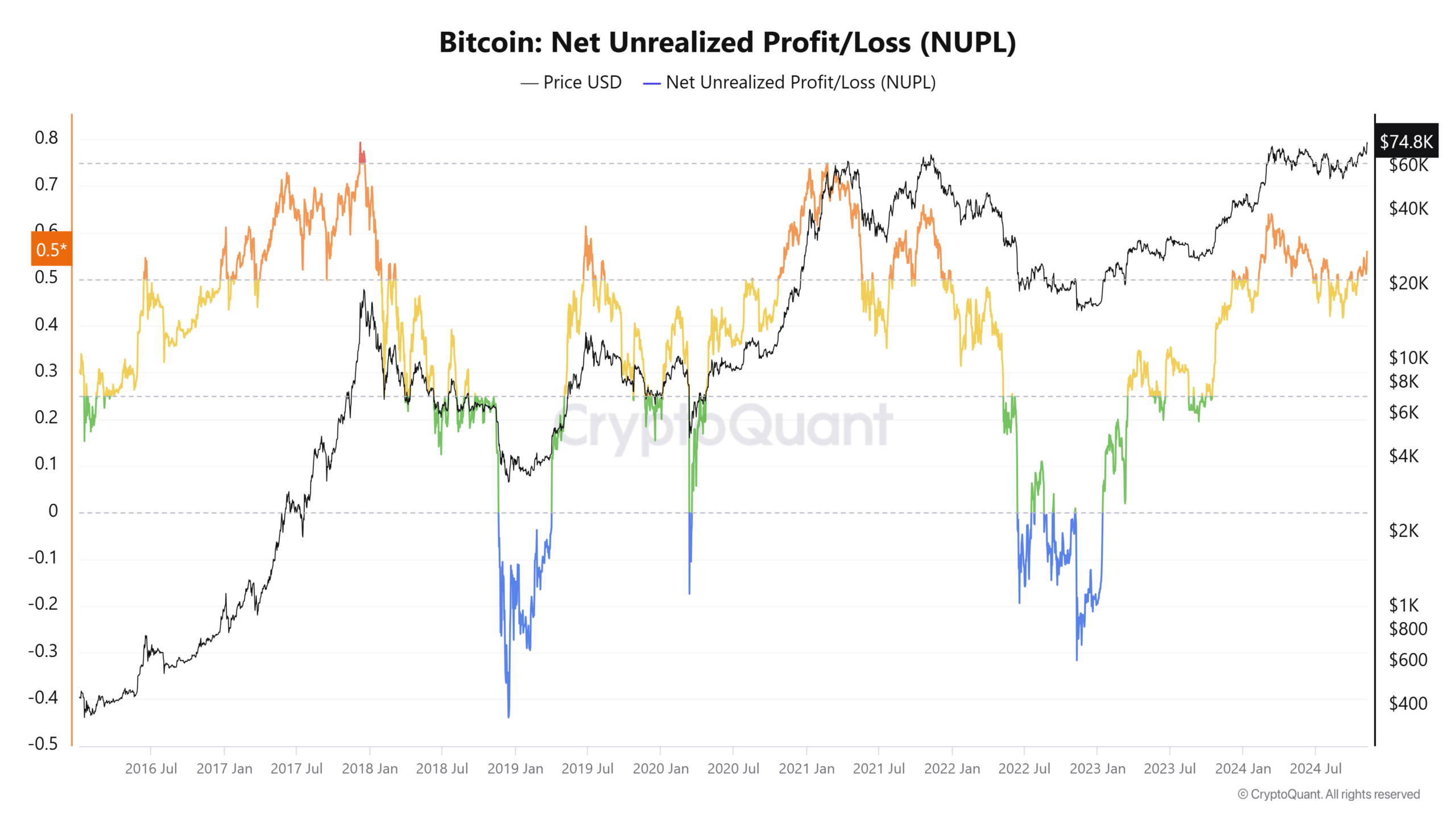

NUPL echoes early bull run stage of previous cycles

Source: CryptoQuant

The Net Unrealized Profit and Loss (NUPL) was at 0.559 at press time. It was at a similar level in December 2016, with Bitcoin prized at $900, and in November 2020 when BTC was trading at $15.4k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The NUPL has reached a high of 0.793 and 0.748 in the past two cycles. A reading of around 0.7 would be a strong sign that a large portion of investors are in profit and that the bull run has likely run its course.

At present, there is a long way to go before that, drawing into question whether BTC will top after a mere 30%-40% move higher.