LUNC rises 18% in 7 days – Did Terra Classic’s burn rate help?

- LUNC’s social metrics surged, indicating a rise in popularity.

- Its burn rate also spiked in the last few days.

Like most cryptos, Terra Classic [LUNC] also pushed the accelerator as its price surged in double digits. Meanwhile, an interesting development happened, which had the potential to push the token’s price further.

Therefore, AMBCrypto checked Terra Classic’s on-chain data to find out what to expect.

Terra Classic is breaking out

CoinMarketCap’s data revealed that LUNC bulls dominated last week by pushing the token’s price up by more than 18%. The bullish trend continued in the last 24 hours as the token’s value increased by over 6%.

At the time of writing, LUNC was trading at $0.00009981 with a market capitalization of over $544 million, making it the 130th-largest crypto. The positive price action did have an impact on the token’s social metrics.

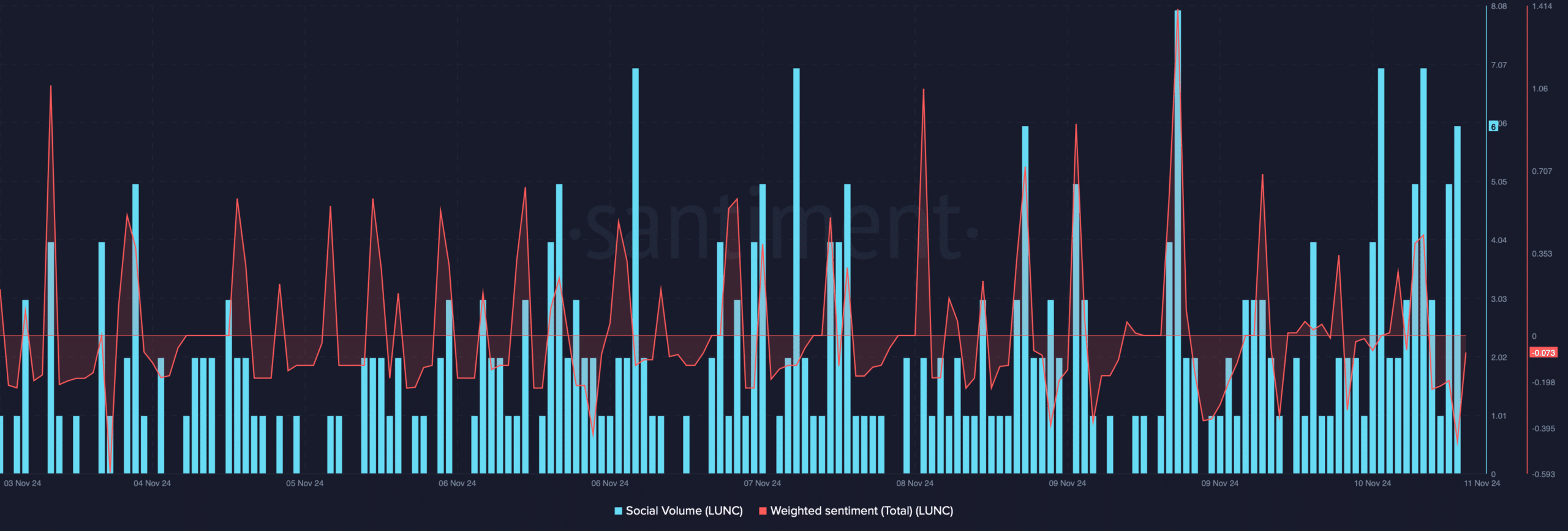

As per our analysis of Santiment’s data, LUNC’s Social Volume increased, reflecting a rise in its popularity. However, after a sharp rise, Terra Classic’s Weighted Sentiment dropped.

This decline asserted that bearish sentiment around the asset is rising, which could contribute to a price correction.

AMBCrypto also found that LUNC’s burn rate increased dramatically in the last few days. Notably, the token’s burn rate surged on the 6th of November.

Generally, a rise in burn rate is an indicator of a deflationary asset. Whenever the burn rate rises, it decreases the market supply, which potentially affects the asset’s price positively.

What to expect from LUNC

We then checked other datasets to better understand what to expect from LUNC as its burn rate increased.

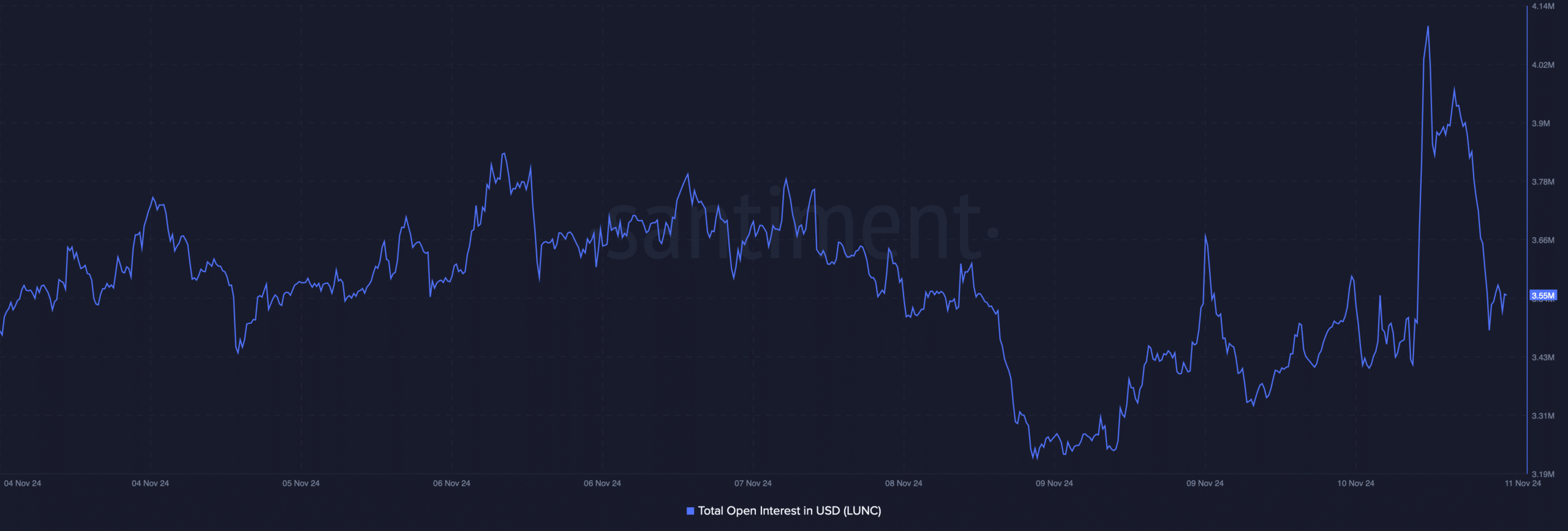

AMBCrypto’s analysis of Santiment’s data revealed that LUNC’s Open Interest dropped sharply after a major rise on the 10th of November.

This meant that the chances of the ongoing price trend changing were high.

However, a few things still remained in the token’s favor. For instance, AMBCrypto’s look at Coinglass data revealed that Terra Classic’s long/short ratio registered an uptick.

So,there were more long positions in the market than short positions, which can be inferred as a bullish signal.

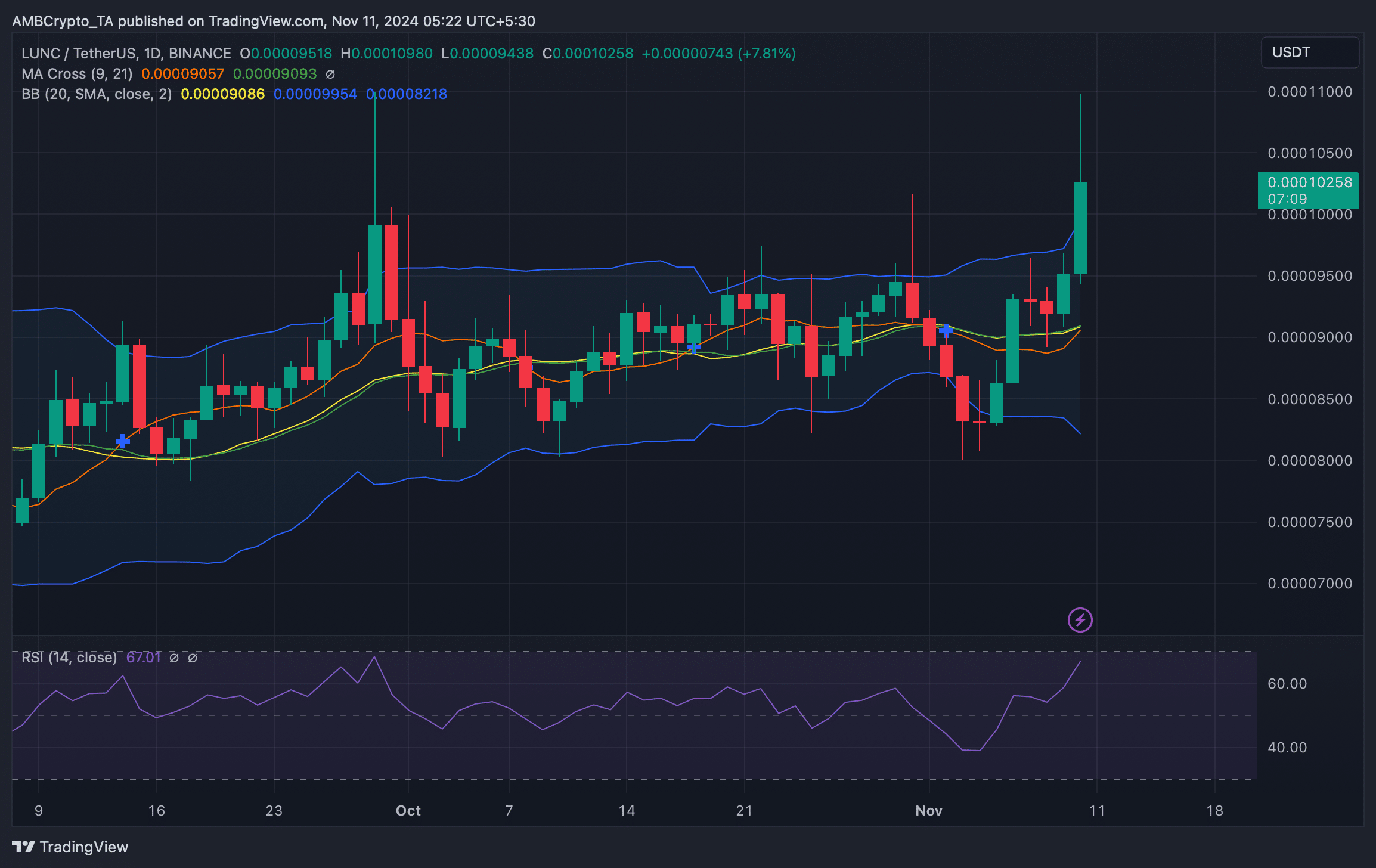

AMBCrypto then took a look at LUNC’s daily chart. We found that the Relative Strength Index (RSI) moved upward, indicating more inflow of money.

Is your portfolio green? Check the LUNC Profit Calculator

Whenever that happens, it suggests a possibility of a continued price rise.

However, Terra Classic’s price went above the upper limit of the Bollinger Bands, meaning that the chances of a price correction can’t be ruled out.