Render posts 38% gains in 3 days, sets sights on new highs above $7.13

- Render reclaimed the $5.2 level as support, setting up the recent move

- There was strong demand for RENDER in both spot and futures markets

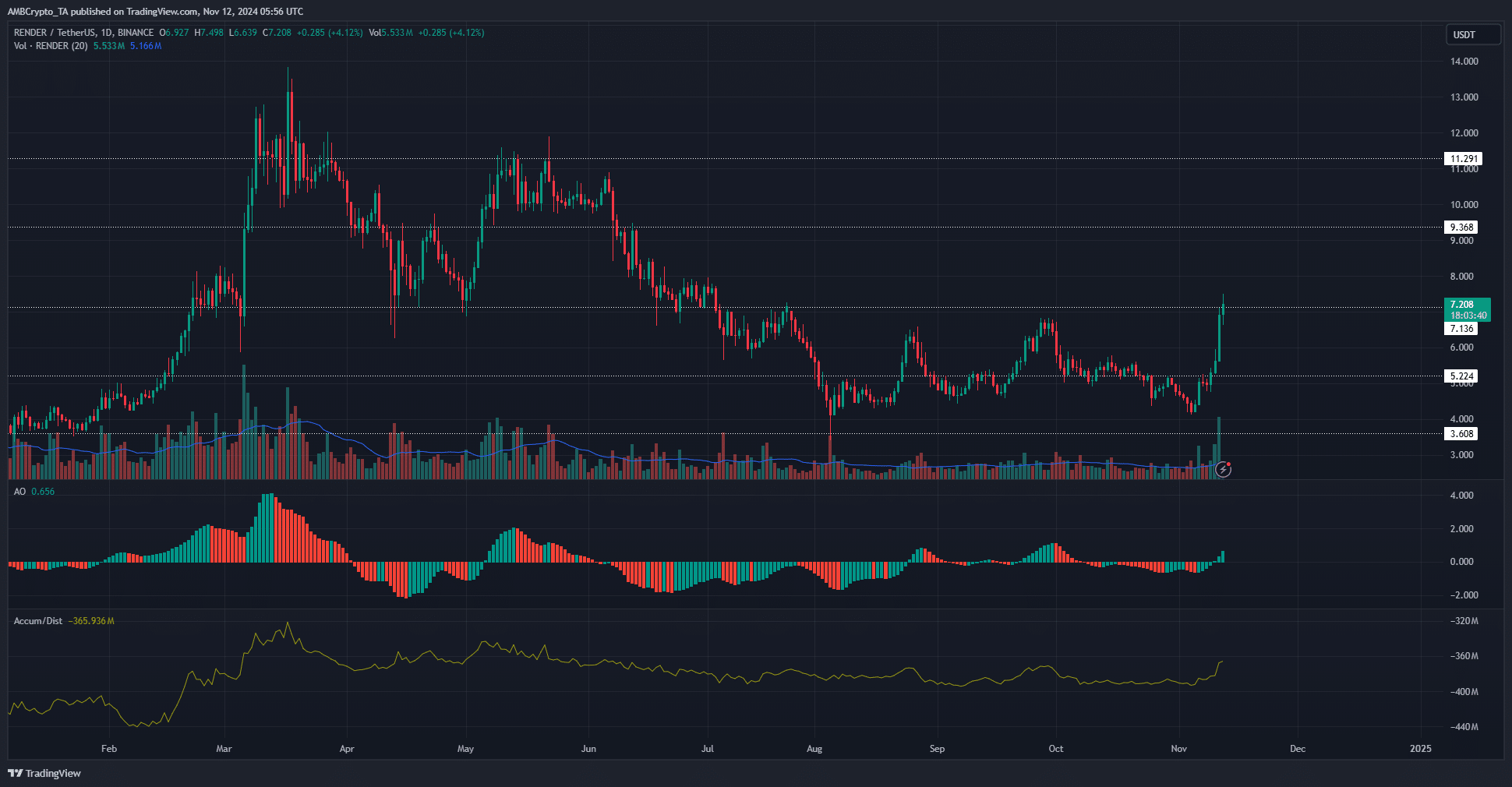

Render [RENDER] was swiftly trending upward. The altcoin’s momentum was sluggish before the key $5.22 level was broken and the market structure flipped bullishly. This was achieved over the weekend, and RENDER has rallied a remarkable 38% in just over two days.

The next higher timeframe resistances were 29% and 56% above current market prices. The token will likely march to these highs and potentially beyond, but a Bitcoin [BTC] pullback could hurt the short-term sentiment.

Render reclaims key level

The token has posted strong gains in the past four days after closing a daily trading session above $5.22. Since then, it has rallied 38.5% and is up by 78.17% from Monday, the 4th of November’s lows.

The Awesome Oscillator formed a bullish crossover a few days after the market structure turned bullish. The A/D indicator also began to climb higher to reflect increased buying pressure.

While the token had struggled to breach the $6.6-$6.85 resistance region, the A/D has steadily moved sideways. The lack of accumulation showed that buyer conviction was likely not strong in the past few months.

Now that RENDER is on the verge of breaking past the $7.13 level, buyers might be attracted due to its strong performance. To the north, the $9.36 and $11.3 are significant resistance levels.

Strong demand spotted in the lower timeframes

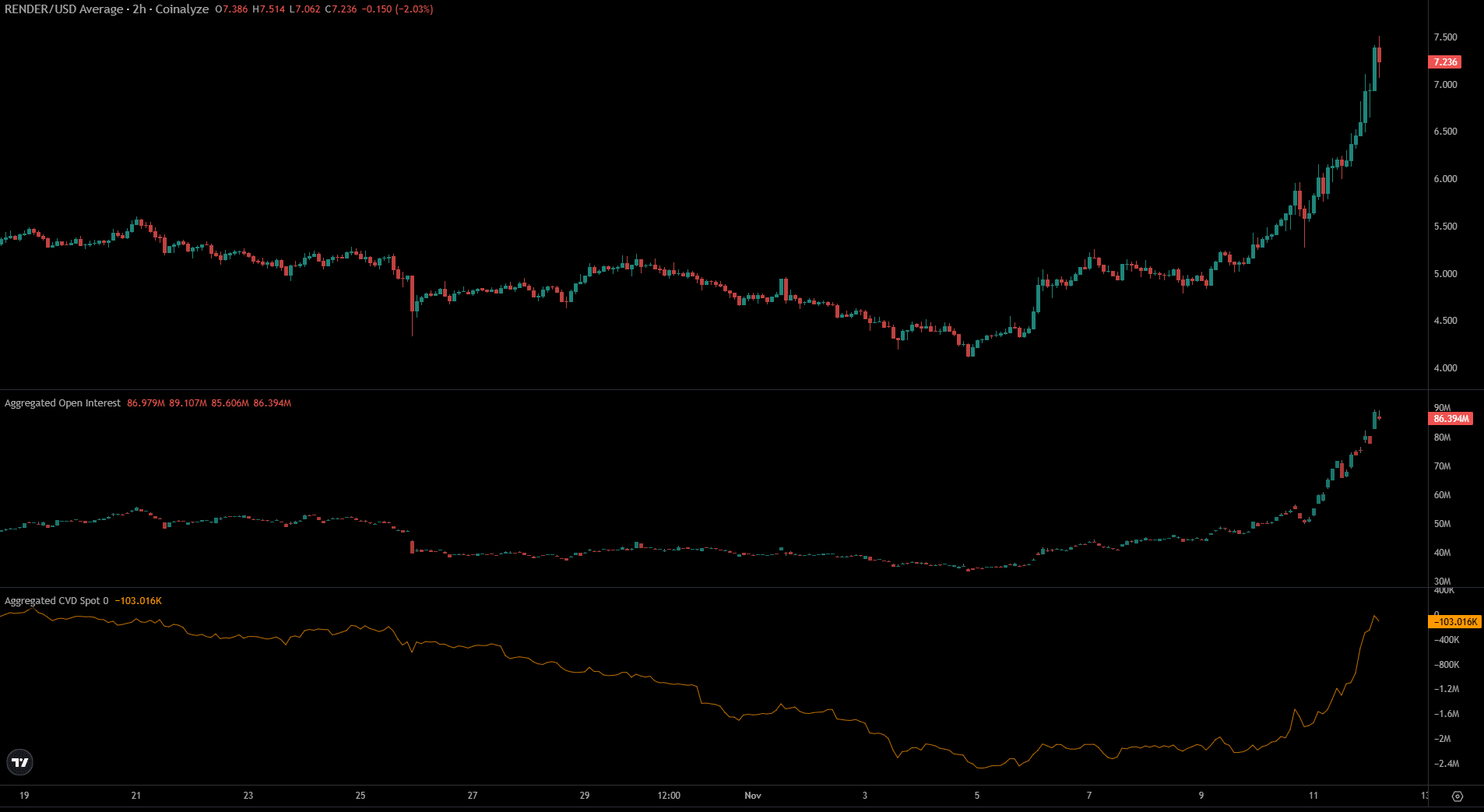

Source: Coinalyze

The past week’s strong gains were accompanied by explosive growth in the Open Interest and the spot CVD. The Open Interest climbed from $43.8 million to $86.4 million in three days.

Is your portfolio green? Check the Render Profit Calculator

The spot CVD had been in decline in early November, stabilized and was spurred higher as sentiment across the market turned greedy. More gains were likely in the coming weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion