Assessing how far CAKE’s price recovery can take the altcoin

- CAKE’s recent rally brought it to a crucial resistance level near the 200-day EMA

- Failure to hold above the $1.8 support level may expose CAKE to further downside

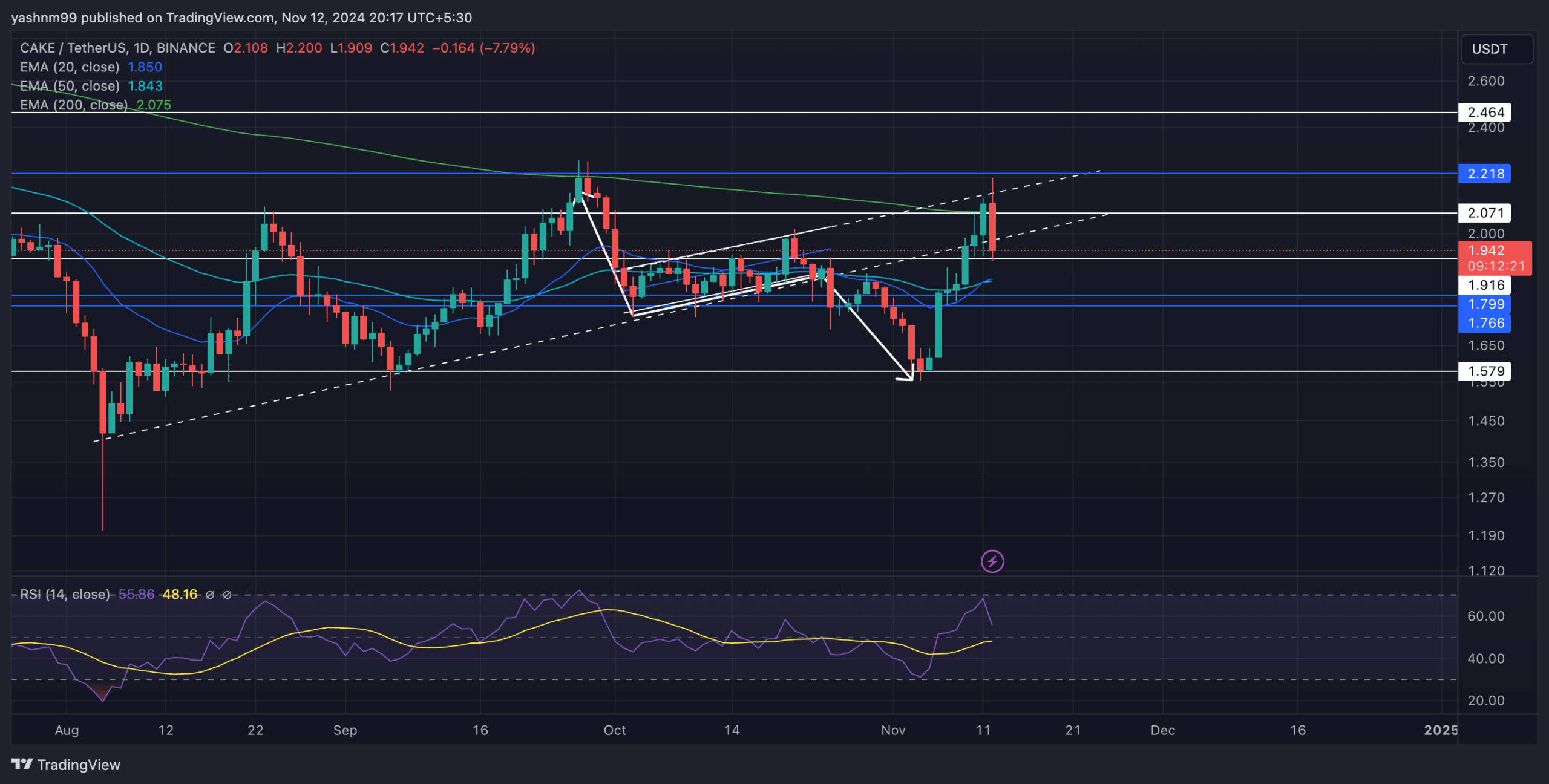

PancakeSwap’s [CAKE] recent recovery faced strong resistance at the 200-day EMA near the $2-mark. Despite a recent recovery from its multi-monthly lows, CAKE, at press time, was at a critical juncture where a sustained breakout could offer bulls some hope.

Can CAKE break above the 200-day EMA?

Recently, CAKE has been having trouble breaking through the 200-day EMA at $2.075, which has been a strong resistance level since April. This EMA has served as a dynamic resistance level for over 7 months, with every attempt at breaking above being quickly sold off.

CAKE was trading at around $1.941, at the time of writing, sitting just above the 20-day EMA at $1.85 and the 50-day EMA at $1.843. Both of these EMAs seemed aligned closely to create an important support area. Although there was some bullish momentum, it faded just below the $2.1 resistance.

Traders should watch the $1.8 support level (where the 20-day and 50-day EMAs meet). A strong close below this level can provoke a downtrend towards $1.579, another significant support level. A bearish crossover between the 20-day and 50-day EMAs could open doors for CAKE to revisit the $1.8 support zone. And, a breakdown below this level may expose the coin to the $1.5 support zone.

The immediate resistance was at $2.071. If CAKE can break this level, it might then aim for higher resistance at $2.2 and possibly, $2.4.

After dipping from the overbought zone, the RSI was at around 55 at press time. This trajectory reaffirmed a fall in buying power over the last few days. A potential rebound from the 50-mark would hint at sluggish sentiment as the price potentially consolidates around the EMAs.

CAKE Derivatives Data revealed THIS

The long/short ratio over the last 24 hours was 0.9324, which indicated a slight preference for short positions. However, CAKE’s long/short ratio on Binance was 2.12. There also seemed to be a noticeable increase in CAKE’s volume, which went up by 56.48% to $52.22 million – A sign of more interest from traders. Additionally, Open Interest rose slightly by 0.51% to $16.5 million, suggesting that traders are optimistic and keep their positions open.

Traders must also closely monitor Bitcoin’s price movement. Especially as broader market sentiment plays a key role in dictating CAKE’s trajectory.