USDT inflows hit record highs: What this means for Bitcoin and the market

- The USDT exchange reserve has surged to its highest in history.

- The surge coincides with BTC’s ATH and general market capitalization.

The stablecoin market has witnessed a significant milestone, with USDT recording over $1.5 billion in exchange netflow twice within seven days.

This massive inflow has spurred discussions on its implications for market liquidity, buying power, and the potential ripple effect on Bitcoin and other cryptocurrencies.

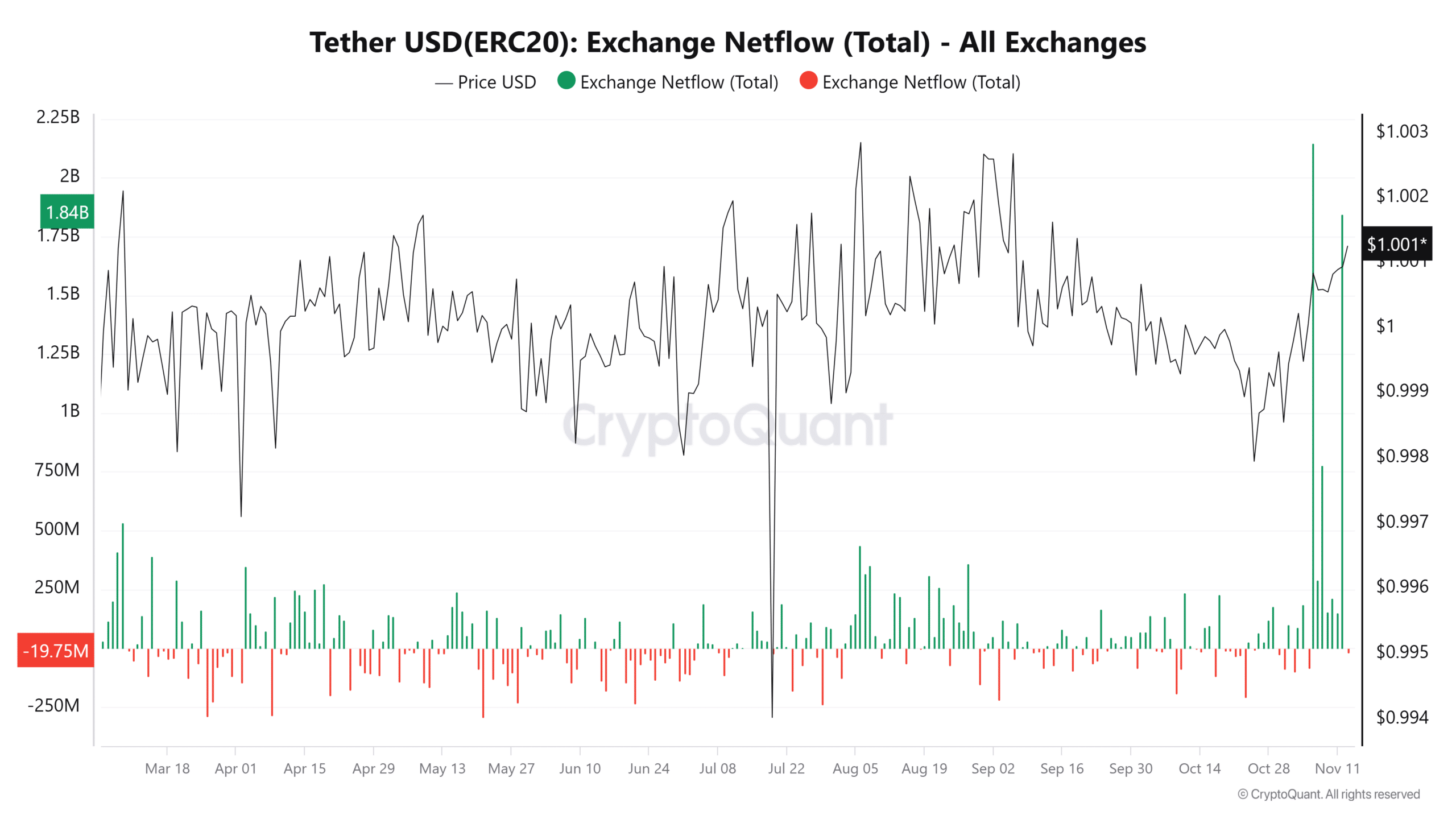

USDT exchange netflow hits historic levels

The recent surge in USDT exchange netflow highlights a robust influx of liquidity into the cryptocurrency market. As per the chart from CryptoQuant, the total netflow reached $1.84 billion on major exchanges, indicating a substantial inflow of USDT.

This inflow signals an increase in capital moving into exchanges, likely driven by traders positioning themselves for potential market movements.

Also, this was the second time in the month it was seeing a spike in inflows, the first being over $2 billion on 6th November. Such large inflows often precede increased market activity, as traders typically deposit stablecoins like USDT to prepare for buying opportunities.

This dynamic could pave the way for heightened demand for Bitcoin and other digital assets, particularly if sentiment remains bullish.

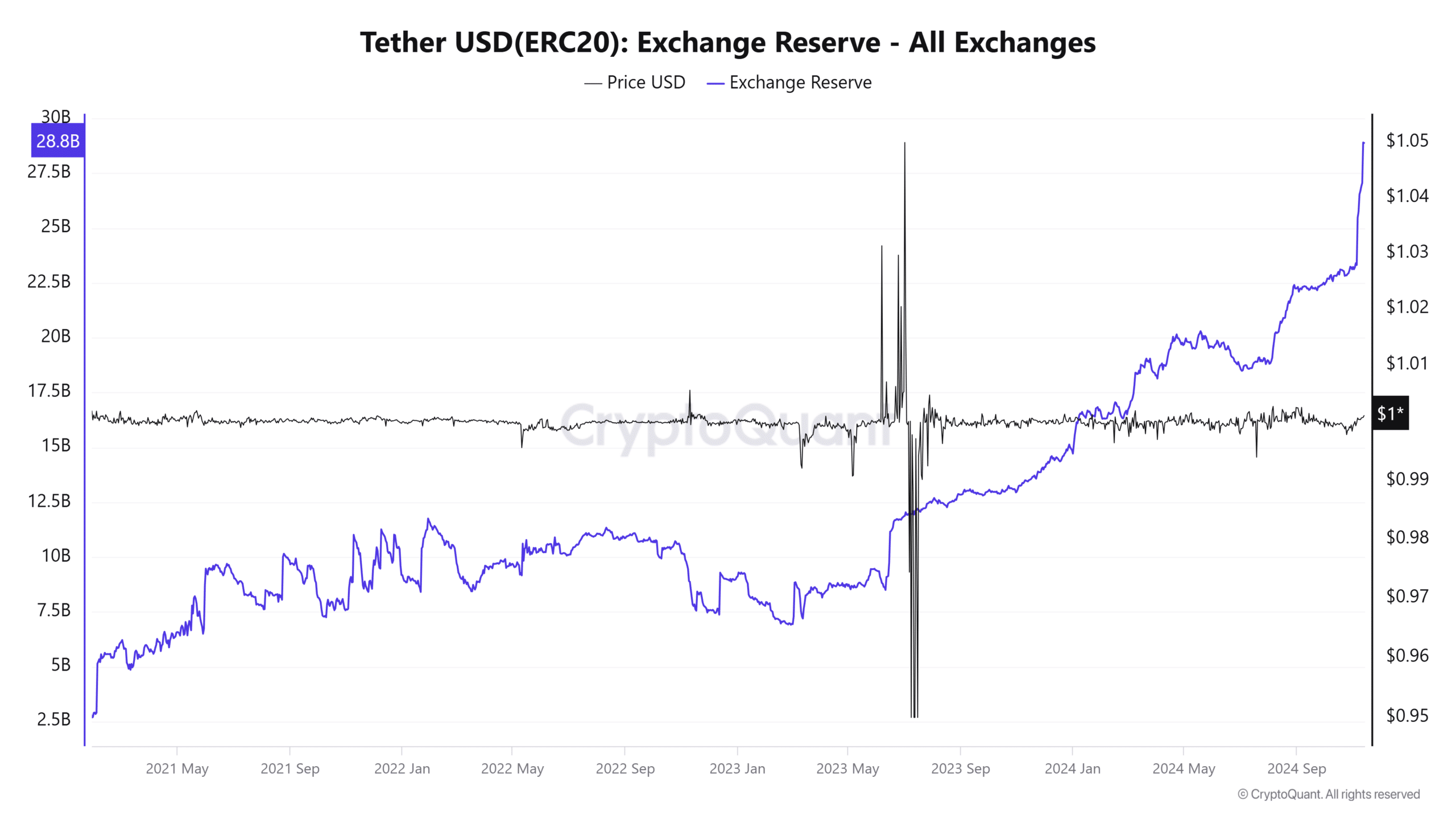

Exchange reserves reflect a shift in market dynamics

The exchange reserve chart showcases a steady climb in USDT balances on exchanges, hitting an all-time high of $28.8 billion. This sharp increase in reserves aligns with the massive netflows.

It suggests a growing pool of USDT liquidity that is ready for deployment.

An expanding exchange reserve implies traders and institutions are actively preparing to capitalize on market opportunities. Whether for spot buying or margin trading, the availability of stablecoin liquidity reinforces the market’s potential for upward momentum.

Bitcoin’s price surge to $88,000 coincides with these developments, underlining the correlation between stablecoin activity and market trends.

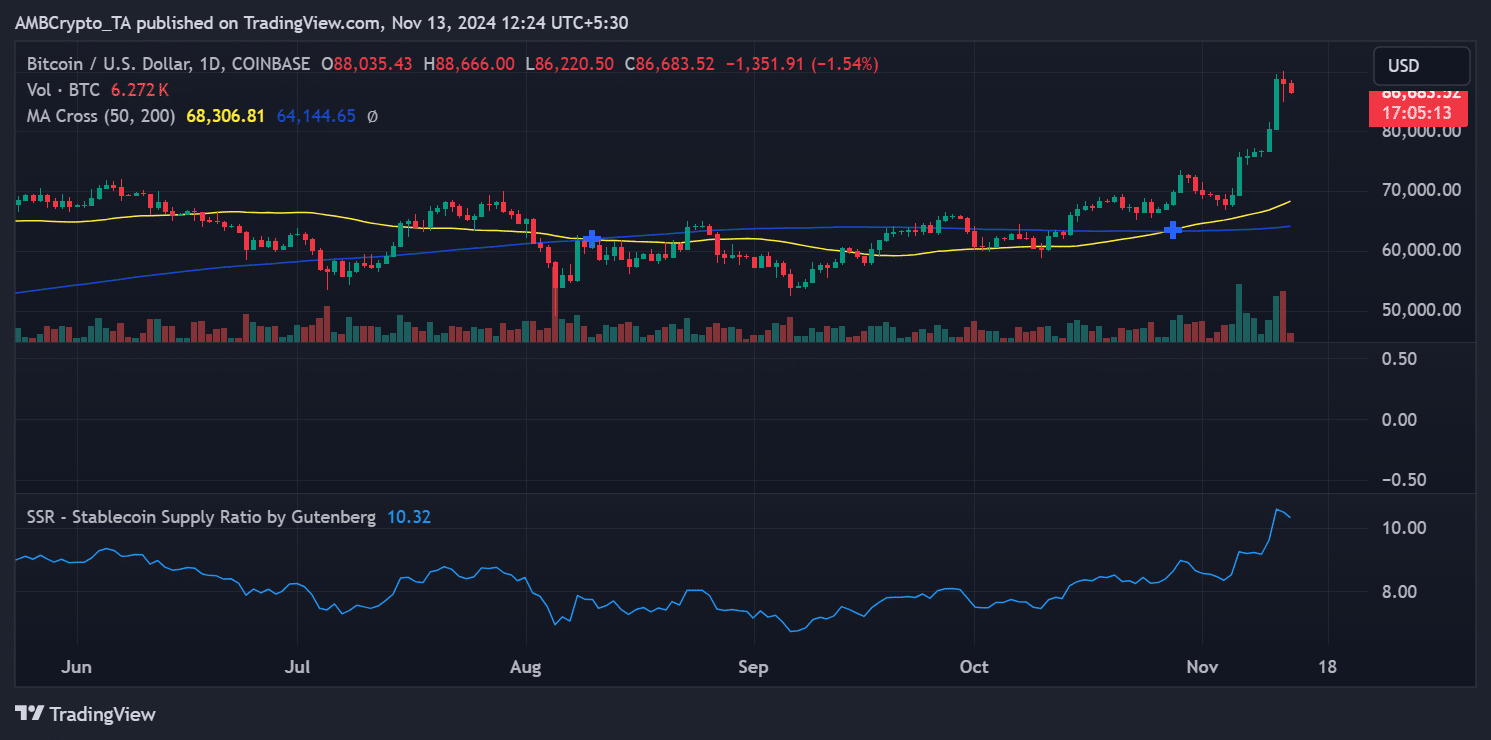

Stablecoin supply ratio indicates high purchasing power

The Stablecoin Supply Ratio (SSR) adds another layer of insight. At a current value of 10.32, the SSR shows that the purchasing power of stablecoins relative to Bitcoin remains elevated.

A lower SSR typically indicates higher stablecoin liquidity than Bitcoin’s market cap, signaling an environment ripe for buying pressure.

With a large pool of USDT on exchanges and a favorable SSR, the conditions appear optimal for further upward movements in the cryptocurrency market.

However, the deployment of this liquidity will depend on macroeconomic factors and trader sentiment in the coming days.

Implications for the market

The recent influx of USDT and its high exchange reserves signal a readiness for significant market activity. While Bitcoin has already surged to $88,000, the stablecoin inflows could sustain the momentum or catalyze a rotation into altcoins.

Monitoring USDT flows and the SSR will be crucial for traders in predicting the next market moves.