Worldcoin’s 100 largest wallets transfer WLD worth $2.3M to exchanges – Meaning?

- WLD surged by 8.95% over the last 24 hours

- 100 largest Worldcoin wallets have moved $2.3 million worth of tokens into exchanges

After a sustained decline on the charts, Worldcoin [WLD] has seen a turn in fortunes over the past month. In fact, the altcoin recorded a sustained uptrend to hit its 3-months high.

At the time of writing, Worldcoin was trading at $2.34 following an 8.95% weekly hike. Over the aforementioned period, WLD’s value appreciated from a local low of $1.5 to a recent high of $2.8.

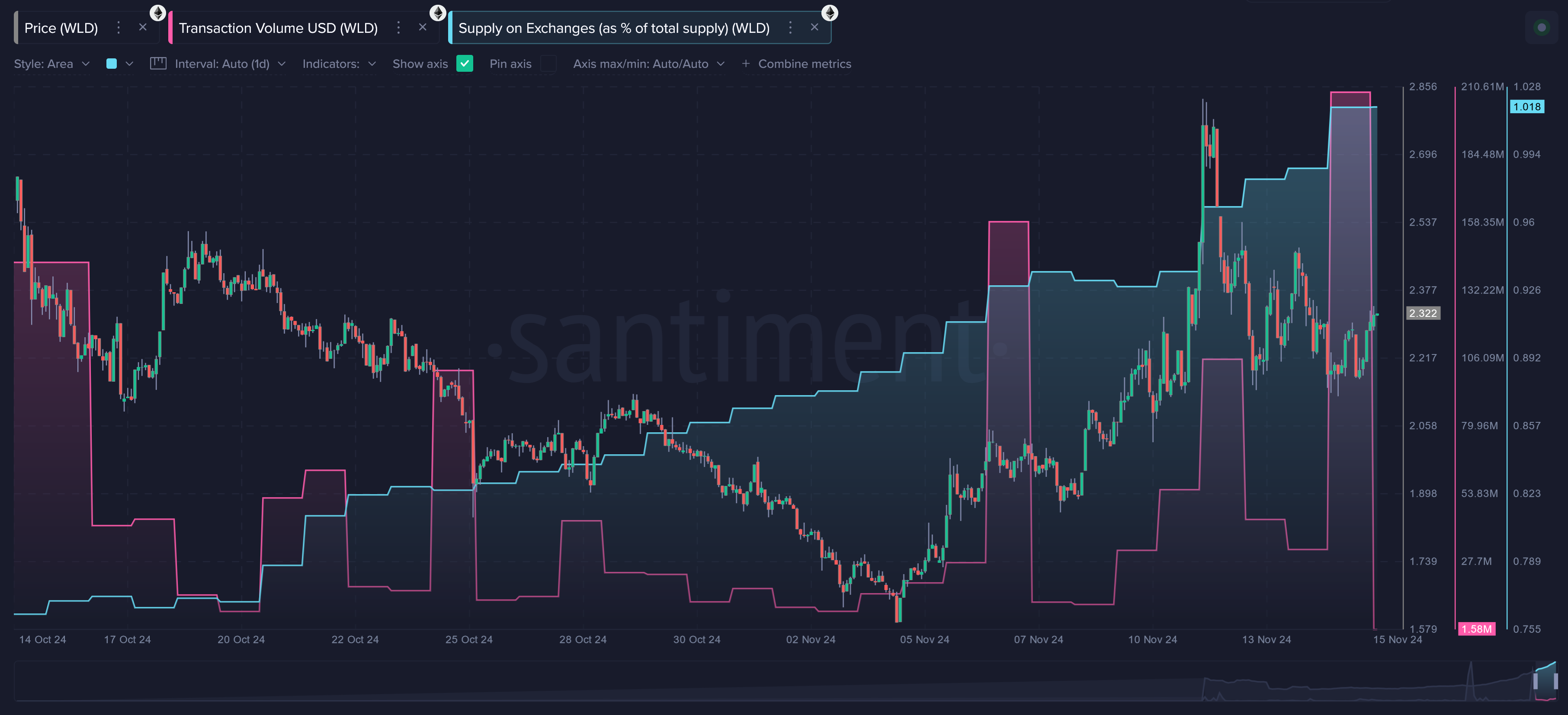

And yet, there has been a recent surge in supply into exchanges. As expected, this has fueled speculations of a potential top on the price charts.

Worldcoin whale deposits to exchanges soar

According to Santiment, the 100 largest Worldcoin wallets have moved $2.3 million or 0.16% of the total supply to Bybit. Based on the platform’s analysis, this is the largest dollar amount of transaction volume day that we’ve seen in recent history.

The surge in supply to exchanges increases the risk of a potential top – Signaling a potential decline. This, because when large holders transfer their tokens to exchanges, it fuels fear among retail traders. Especially since it signals a lack of confidence in the crypto’s future value.

Impact on WLD?

While huge transfers are expected to have an immediate impact on the price charts, this is not the case. On the contrary, WLD was still green across its charts at press time. The worry highlighted above is that, these transfers may be the last signals before a decline.

In most cases, a rise in supply into exchanges means bearish sentiment, especially among large holders.

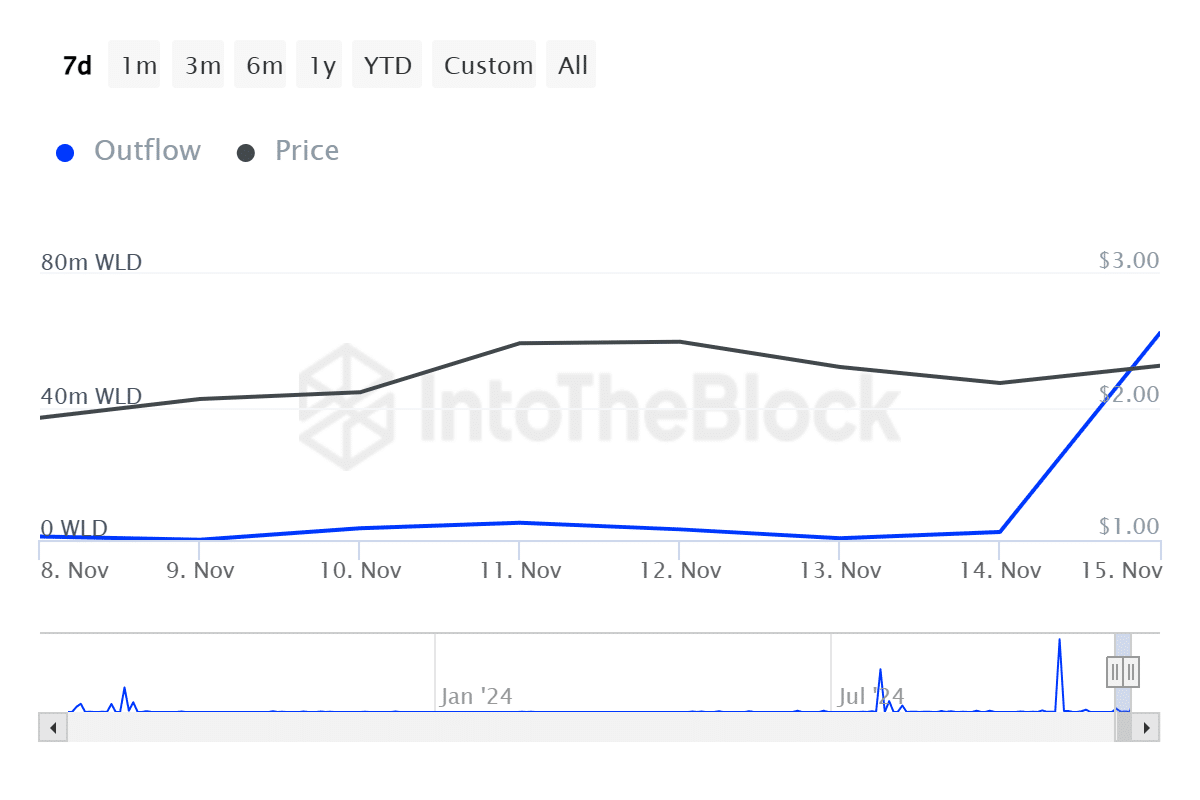

We can see this bearishness among large holders through a rise in outflows.

According to IntoTheBlock, large holders outflows have surged to hit a recent high of 62.25 million. This suggested that large holders have been closing their positions, mostly to maximize their profits with the recent upsurge.

Additionally, Worldcoin’s MVRV long/short difference declined over the past week and flashed a negative reading of -7.67. This alluded to reduced confidence in long-term accumulation or a higher likelihood of large-term holders selling.

Therefore, if both short-term and long-term holders are less profitable, it would mean oversupply in the market leading to price declines.

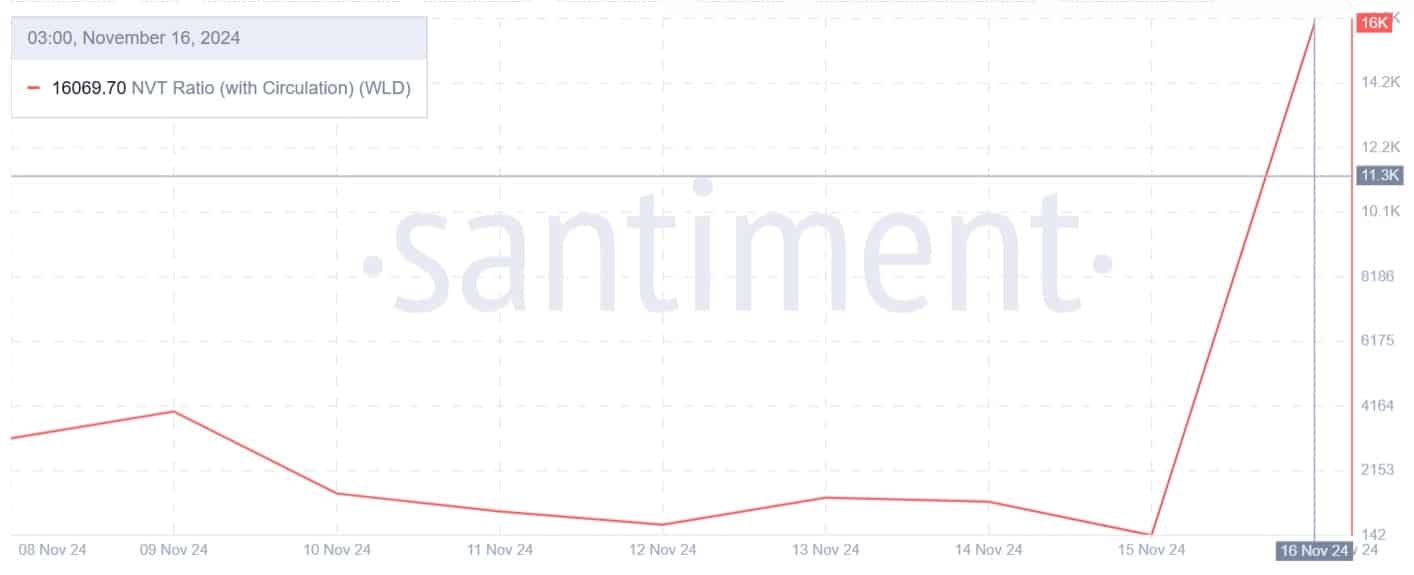

Finally, we can see the potential for a market correction with the rising NVT ratio (with circulation). When this is rising, it warns of a potential pullback, one implying that the market is pricing the asset optimistically. However, this optimism cannot be supported by transactional demand.

Simply put, large holders transferring their assets into exchanges suggested that they have been less optimistic and might sell. This might fuel fear, resulting in volatility. Especially since an oversupply in the market usually results in a price decline.

Therefore, if this trend continues, WLD will decline to $2.1. However, if the market absorbs the selling pressure from these wallets, the altcoin can reclaim $2.6 in the short term.