Chainlink’s latest breakout could push LINK’s price by 35% – All you need to know!

- LINK’s Open Interest (OI) surged by 9.5% indicating growing trader interest in the asset

- Major liquidation levels were at $13.55 and $14.40, with traders over-leveraged at these levels

The crypto market’s prevailing sentiment seems to be quite unpredictable right now thanks to the high volatility. In the middle of such uncertainty, Chainlink (LINK) formed a bullish price action pattern on its daily chart, with the altcoin now poised for a notable upside rally.

In addition to the crypto’s bullish price action, on-chain metrics and positive market sentiment further supported LINK’s bullish outlook.

Technical analysis and key levels

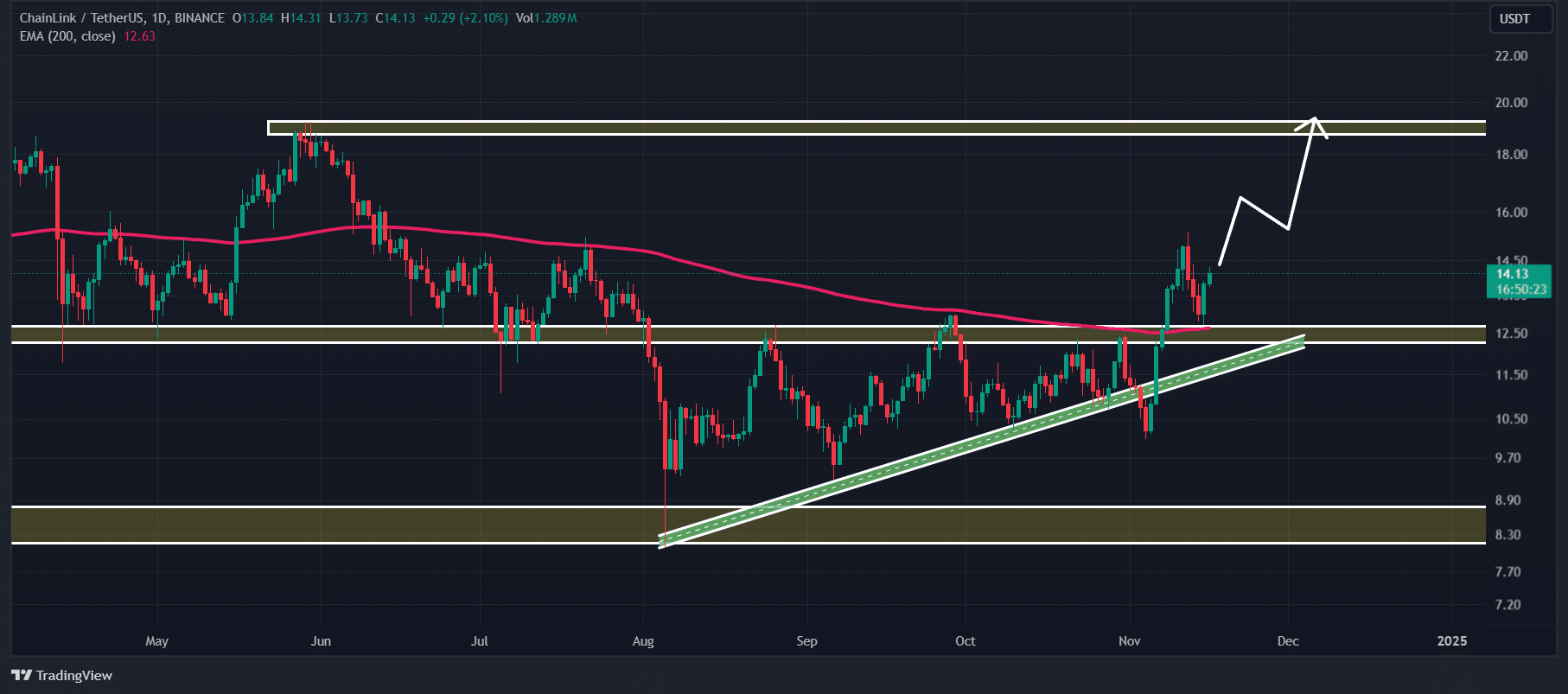

According to AMBCrypto’s assessment, LINK has successfully retested the breakout level of the ascending triangle price action pattern. At the time of writing, it seemed to be moving in an upward direction.

Based on its recent price action and historical momentum, there might be a strong possibility that LINK could soar by 35% to hit the $19-level in the coming days.

At the time of writing, LINK was trading above the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend. Additionally, the asset’s Relative Strength Index (RSI) pointed to potential upside momentum in the coming days.

Bullish on-chain metrics

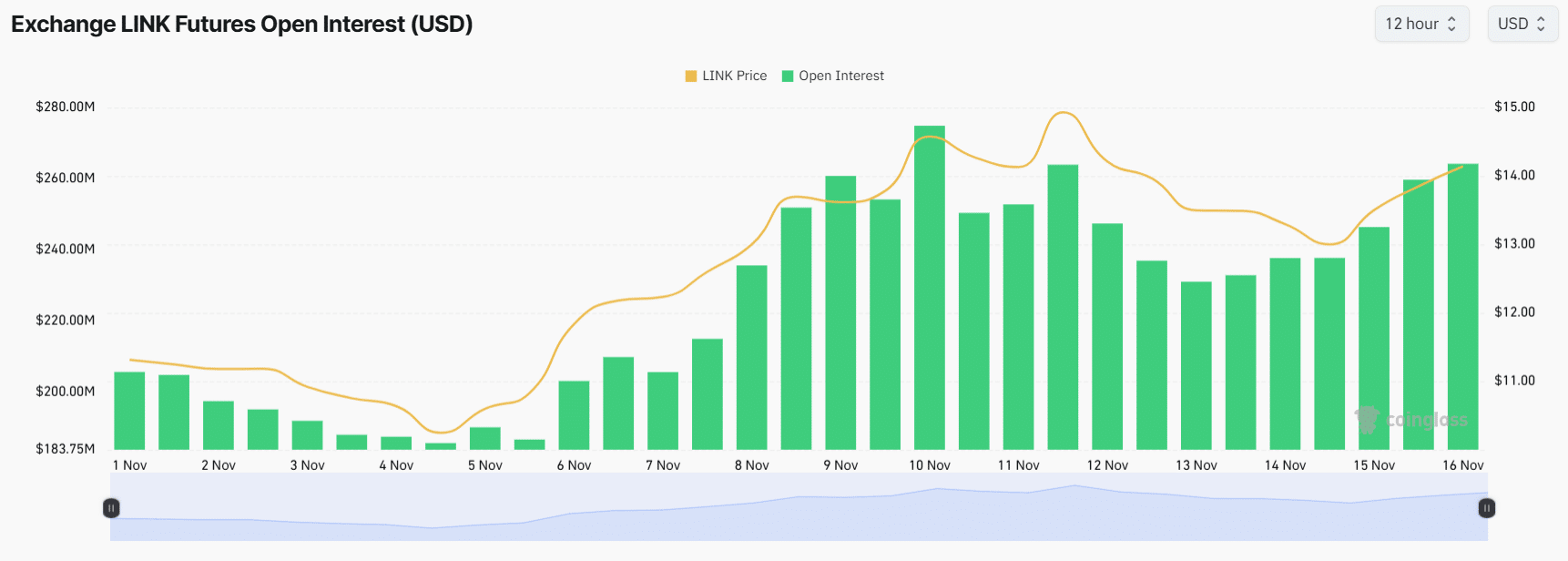

Besides technical analysis, on-chain metrics further supported LINK’s bullish outlook. In fact, according to the on-chain analytics firm Coinglass, LINK’s Open Interest (OI) surged by 9.5% in the last 24 hours, with the same continuing to climb too.

The rising OI can be interpreted as a sign of growing trader interest in the asset and a hike in open positions.

Major liquidation levels

At press time, major liquidation levels were at $13.55 on the lower level and $14.40 on the upper side, with traders over-leveraged at these levels.

If the sentiment remains unchanged and the price climbs to the $14.40-level, nearly $2.44 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price drops to the $13.55-level, nearly $5.10 million worth of long positions will be liquidated.

A combination of these on-chain metrics and technical analysis suggested that bulls have been dominating the asset. This could help LINK reach the projected level in the coming days.