Ethereum lags as Bitcoin dominates: Will THIS turn things around for ETH?

- A recap of how Ethereum has been lagging behind compared to some of its top rivals.

- Why Bitcoin dominance could be the key to ETH unlocking explosive growth.

Ethereum [ETH] became the subject of criticism recently, with many accusing the king of altcoins of underperforming. But things could change soon — one main catalyst could be Bitcoin’s [BTC] dominance.

Ethereum gained roughly $100.61 billion in its market cap from its lowest point so far this month. In contrast, Bitcoin gained over $480 billion in market cap during the same period.

Perhaps the biggest measure of its underperformance was the fact that Ethereum has not achieved new ATHs.

As has been the case with some of its top rivals. For example, its TVL peaked at $66.77 billion on the 12th of November. However, this was still lower than its June TVL peak at $72.72 billion.

Transaction data also painted a similar picture. Ethereum’s on-chain transactions peaked at 1.29 million transactions on the 12th of November. This was the highest single day transactions it achieved last week.

However, the number was still lower than its peak daily transaction count in October, which peaked at 1.32 million transactions on the 18th of October.

Another major area where people thought it has been lagging behind was the price action. Note that ETH actually delivered a bullish performance so far in November.

It rallied by 44.61% from its lowest to its highest price in the last two weeks. However, Bitcoin has been in price discovery, while ETH was still miles away from its historic ATH.

Ethereum could redeem itself if…

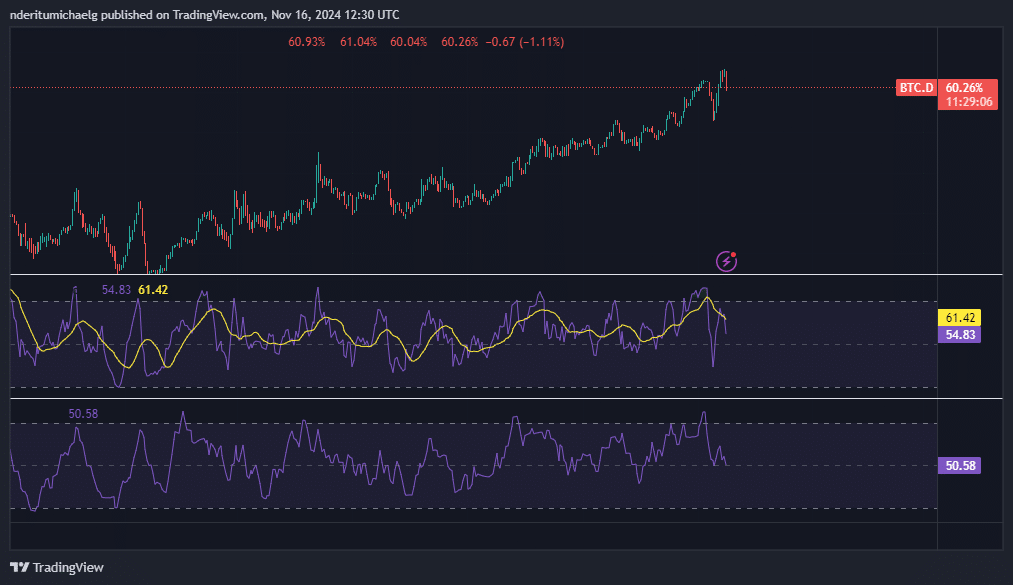

Bitcoin dominance has been on the rise for months, thus indicating that most of the liquidity coming into crypto went into BTC. However, this may soon change if Bitcoin dominance starts declining.

Bitcoin dominance was already looking like it was ready for some downside at the time of writing. This was courtesy of some downside in the last 24 hours and a bearish divergence pattern with the RSI.

Also, its money flow indicator confirmed that liquidity flows may already be in favor of altcoins.

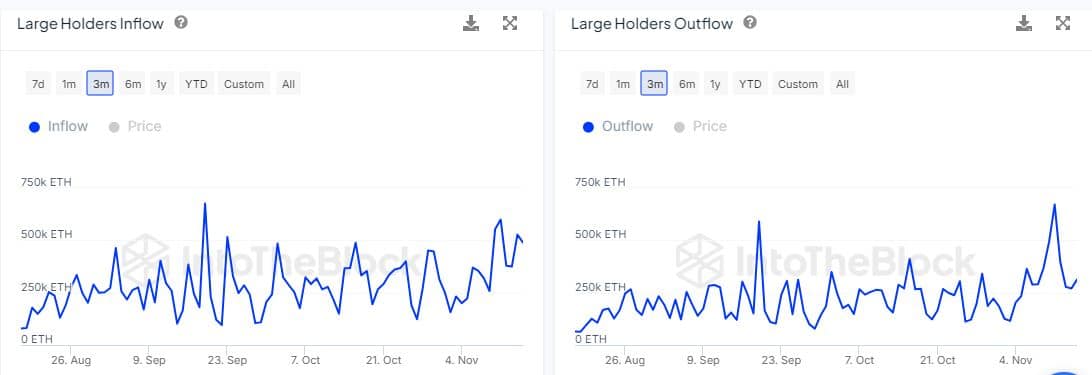

The liquidity flow into Ethereum may already be taking place. The gap between large holder inflows and outflows has been widening.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Large holder inflows were notably higher at over 488,000 ETH as of the 15th of November. However, large holder outflows were notably higher at 312,430 ETH during the same trading session.

This could indicate that ETH is building up more momentum as BTC dominance starts declining.