Cardano breaches $1 mark: Factors fueling ADA’s rise

- ADA has continued its positive trend with a 6% rise as of press time.

- The unrealized profit/loss volume surged for the first time since 2023.

Cardano [ADA] has made headlines by breaching the significant $1 mark, a level not seen in over a year. This milestone has been supported by a combination of on-chain activity, social engagement, and price momentum.

With bullish sentiment building, can Cardano sustain its upward trajectory?

On-chain metrics support price action

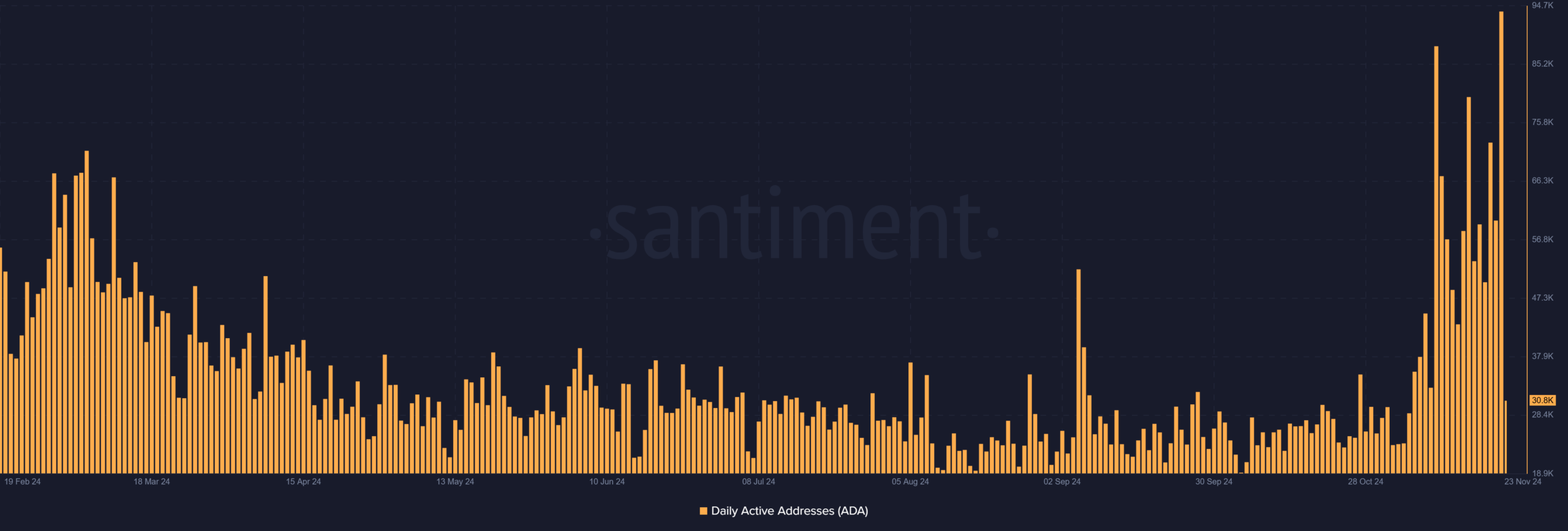

According to AMBCrypto’s analysis of Santiment data, Cardano’s daily active addresses have surged, indicating heightened user activity.

Over the past weeks, the number of active wallets and interactions within the ecosystem has spiked dramatically, coinciding with ADA’s price rally.

At the end of trade on the 22nd of November, the number of active addresses was almost 94,000. This was the first time in months such a number had been recorded.

This increase in activity reflected growing utility and investor confidence.

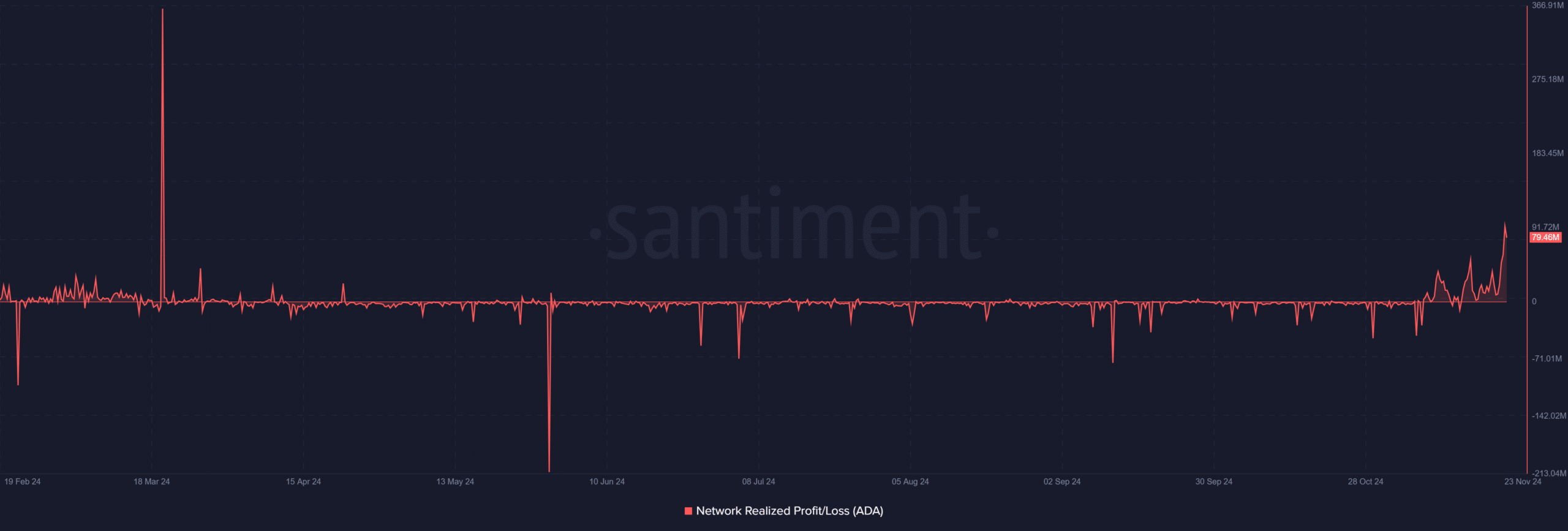

Moreover, Cardano’s Network Realized Profit/Loss spiked to almost $94 million in the last trading session, suggesting that many investors have capitalized on the recent price movements.

This aligned with the broader market sentiment, where ADA has consistently posted gains over the last few weeks.

Social volume, sentiment boost Cardano

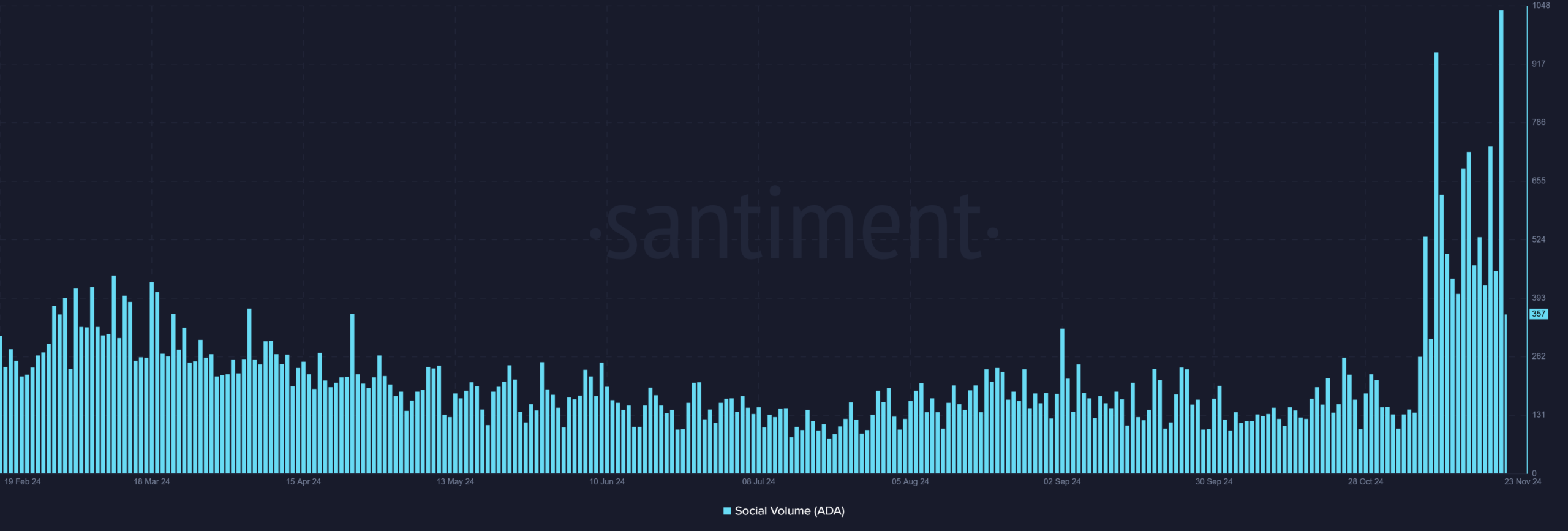

Cardano’s social volume explosion underscored its growing prominence in the crypto space.

Social volume tracks the number of mentions and discussions surrounding ADA across social media platforms, and the recent spikes highlighted a surge in community interest.

Per AMBCrypto’s analysis, the Social Volume spiked to over 1,000 in the last trading session on the 22nd of November, a level not seen in months.

Historically, heightened social activity has correlated with price movements, attracting new investors and reinforcing bullish sentiment.

Cardano’s technical indicators signal strength

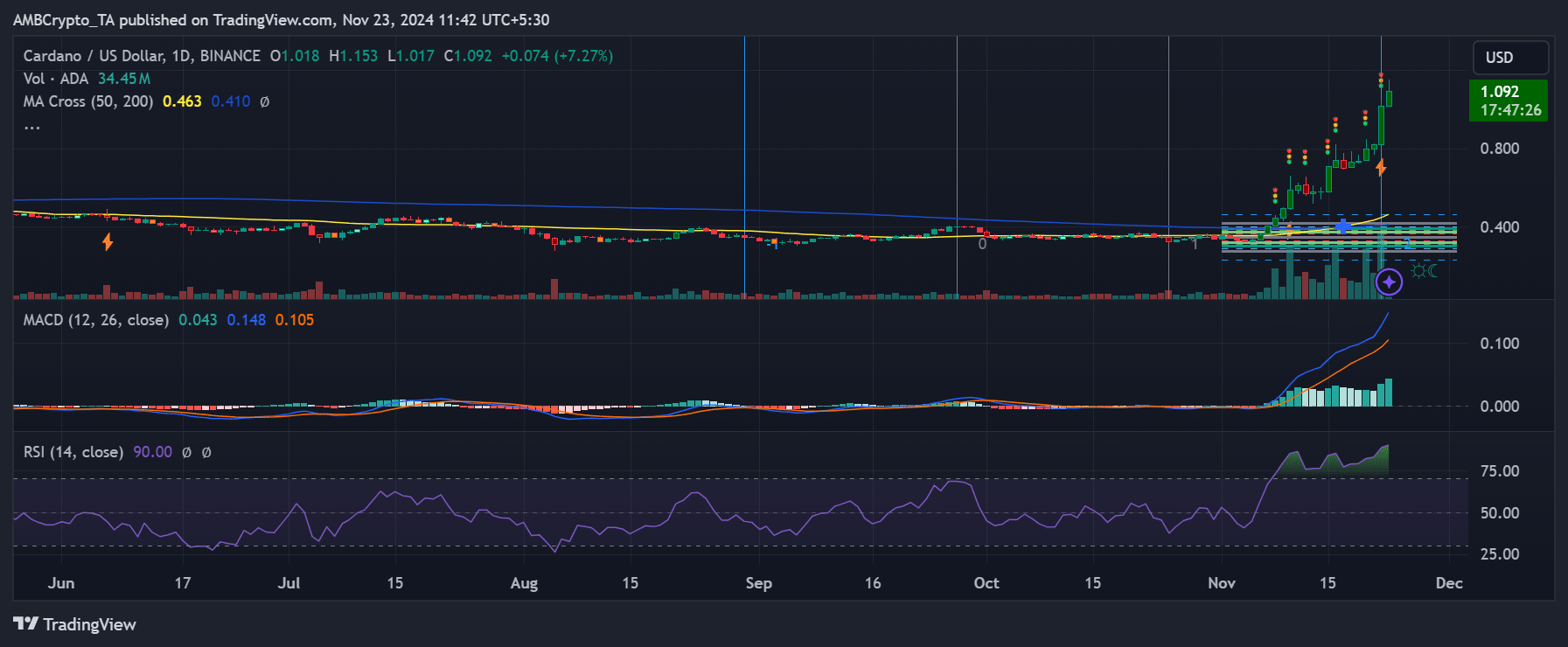

From a technical perspective, Cardano’s movement above the $1 threshold was supported by strong indicators.

Notably, the RSI (Relative Strength Index) showed that ADA was in the overbought region at press time, reflecting strong buying pressure.

The MACD (Moving Average Convergence Divergence) confirmed this bullish momentum, with its lines diverging upwards, signaling continued positive sentiment.

The price chart also highlighted the critical role of ADA breaking through the 200-day moving average, which was a strong resistance level.

With this level now acting as support, ADA appeared well-positioned to maintain its bullish stance, provided broader market conditions remained favorable.

The Fibonacci retracement tool provided more perspective on ADA’s price action.

After breaking through critical resistance levels, ADA has surpassed the 61.8% retracement level of its previous downtrend—a key bullish signal.

The next critical Fibonacci target lies near $1.10, which ADA is approaching with strong momentum.

Furthermore, the 78.6% retracement level at approximately $1.20 could serve as the next major resistance, providing investors with a clear roadmap for potential profit-taking or further accumulation.

Realistic or not, here’s ADA’s market cap in BTC’s terms

The breach of the 61.8% retracement and the approach toward higher levels suggest that ADA is on a path to reaching new highs.

While market conditions remain volatile, the bullish signals and metrics indicate that Cardano’s upward journey has solid footing and may have more milestones ahead.