LCX crypto jumps 90% in 7 days with volume up 120%: Next stop?

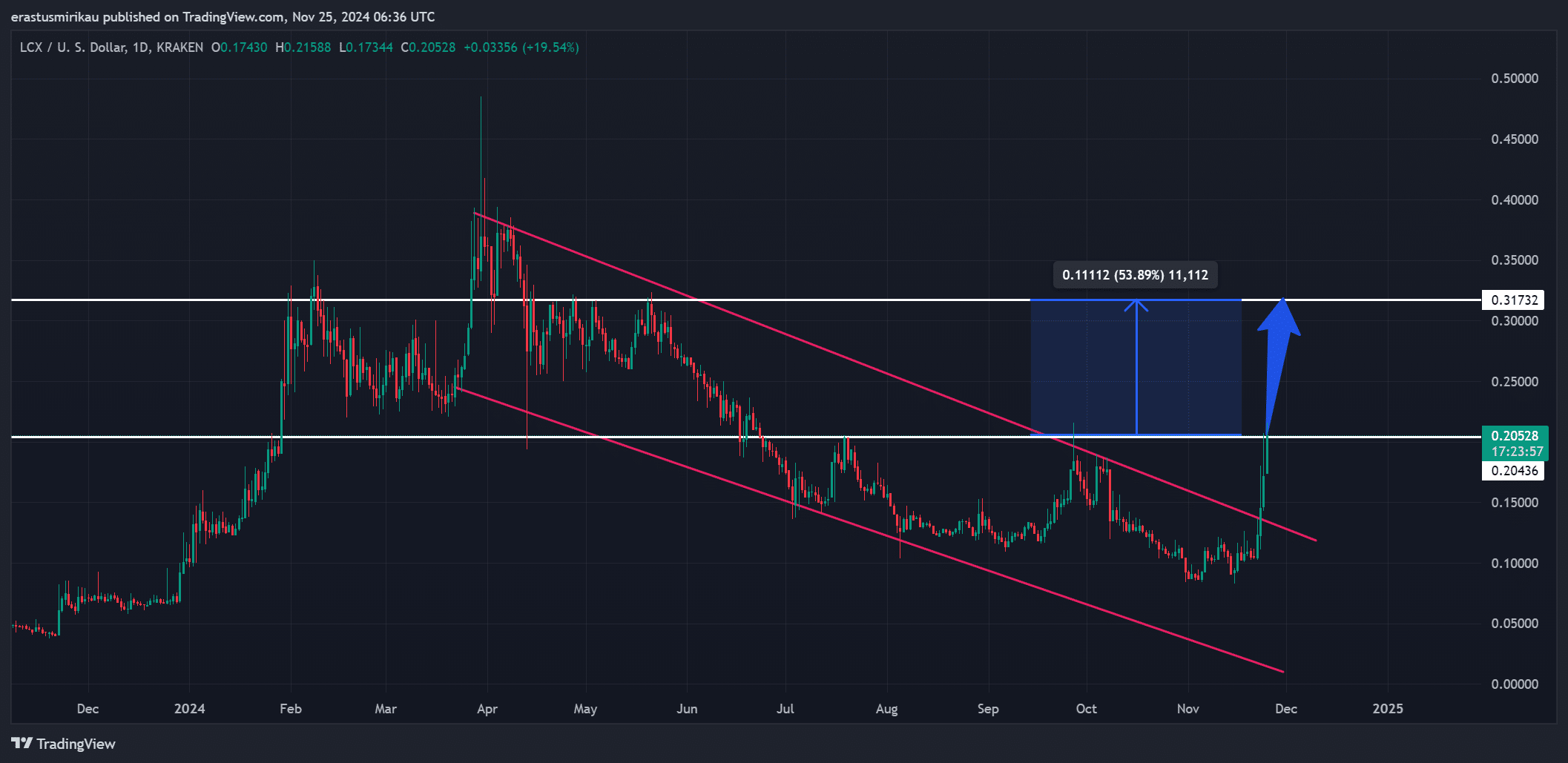

- LCX breaks a descending channel, targeting $0.31732 with bullish momentum building rapidly.

- On-chain signals and rising activity support the rally, but overbought RSI demands caution.

LCX crypto [LCX] has taken the crypto market by storm with a staggering 90% rally in just seven days, capturing the attention of traders worldwide.

At press time, LCX trades at $0.20528, boasting a trading volume surge of 120% in the past 24 hours. But what’s fueling this remarkable performance, and can the momentum continue?

Breaking the descending channel with key resistance in sight

LCX recently broke free from a prolonged descending channel that had capped its price since early 2024. This breakout marks a clear shift in momentum, as bulls pushed the price up by 19.54% intraday.

Consequently, the focus now shifts to the critical resistance level at $0.31732, representing a potential 53% upside.

If LCX can sustain this upward trajectory, it could signal an extended bullish rally. However, failure to hold above the previous support-turned-resistance at $0.173 might invite bearish pressure.

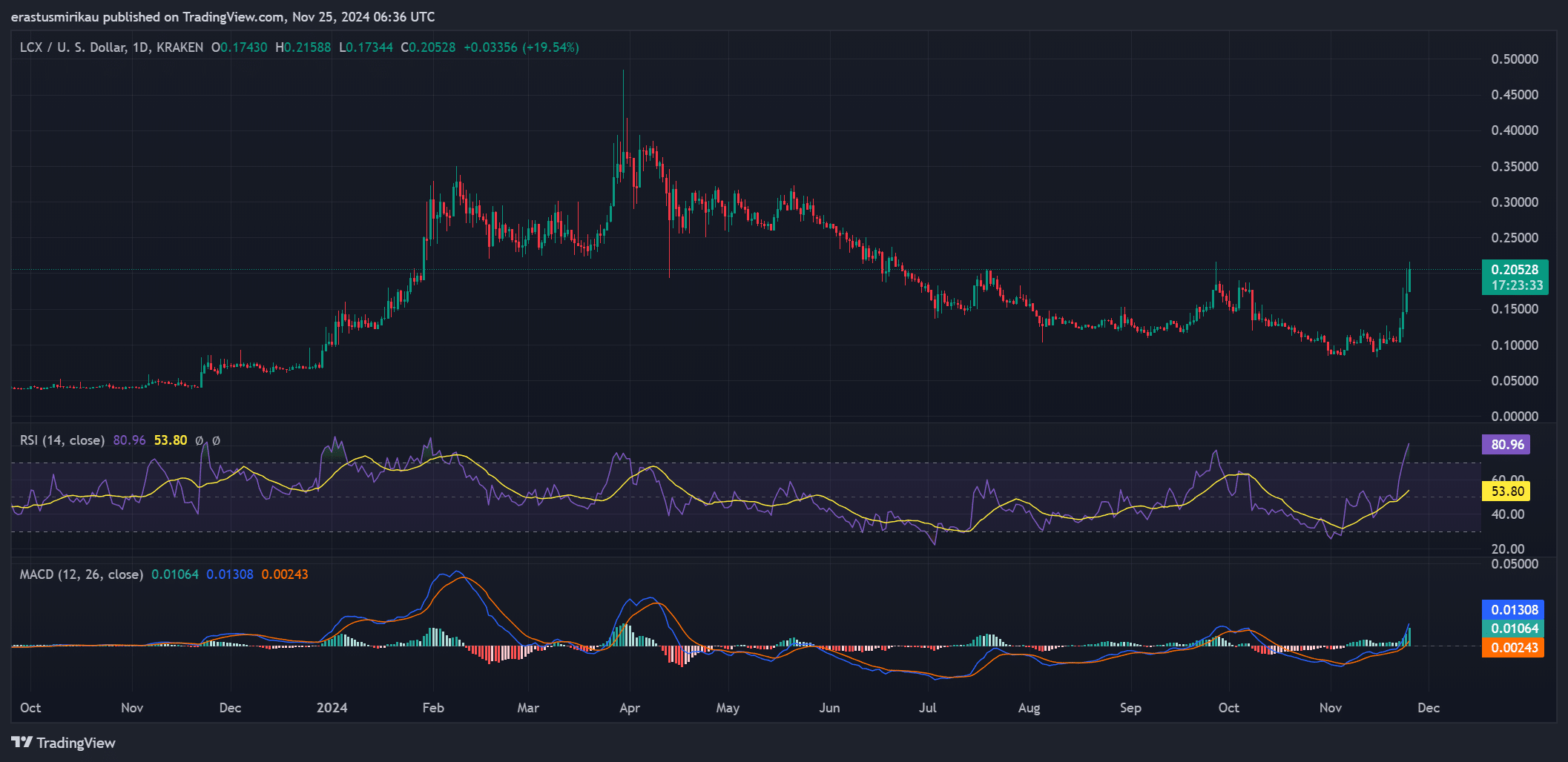

MACD and RSI paint a bullish yet cautious picture

The MACD indicator shows strong upward momentum. The MACD line has crossed into bullish territory above zero, and the widening gap between the MACD and signal lines confirms buyer dominance.

Additionally, the RSI has spiked to 80.96, indicating overbought conditions. While this reflects intense buying activity, it also warns of a potential short-term pullback if traders begin taking profits.

Therefore, while momentum remains on the side of the bulls, caution is warranted.

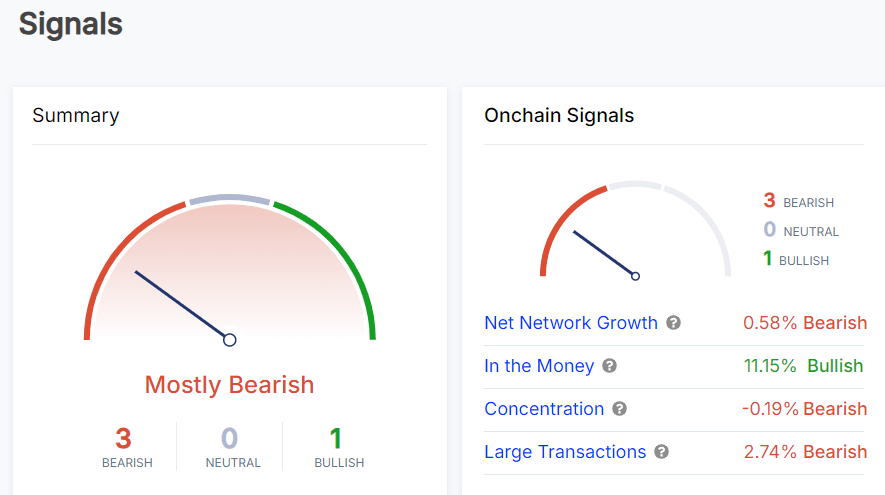

On-chain signals show mixed metrics

On-chain data provides a nuanced picture. While 11.15% of holders are “in the money,” signaling profitability, other metrics suggest caution.

Net network growth, for example, is up only 0.58%, while large transactions have decreased by 2.74%, pointing to waning interest among larger investors. Consequently, while retail activity appears robust, institutional participation might be limited.

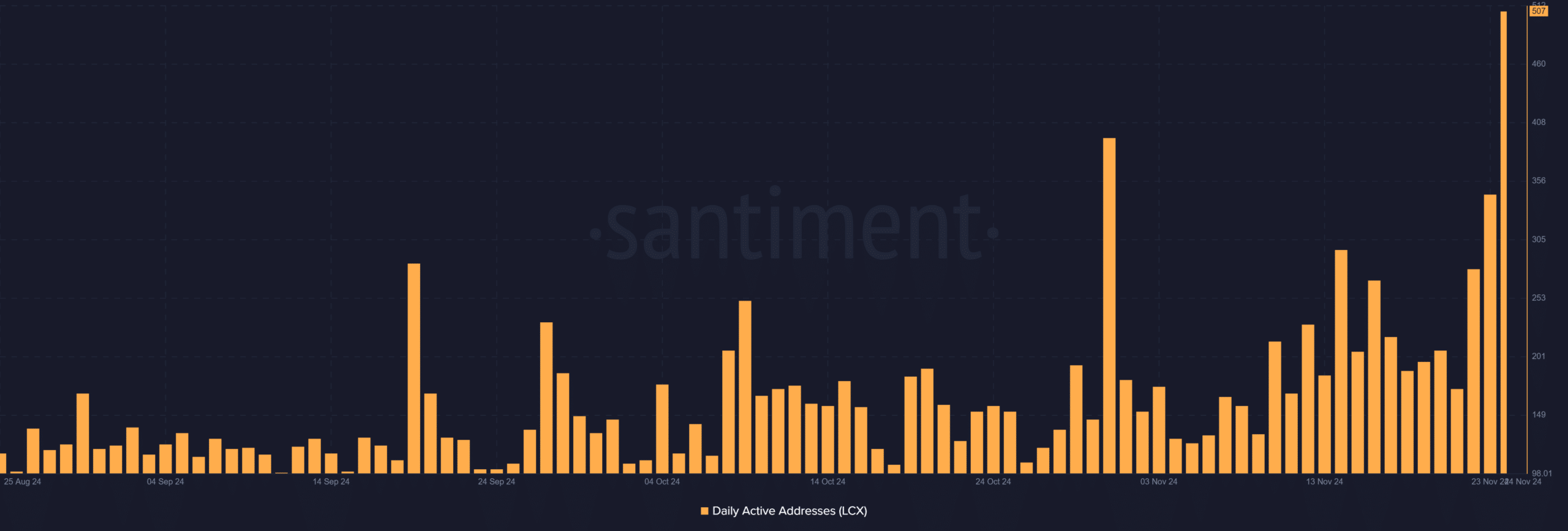

Daily active addresses surge alongside price

LCX’s daily active addresses recently surged to 507, a significant increase that aligns with the token’s recent rally. This growth in user activity adds credibility to the rally, as heightened network engagement often correlates with price increases.

Can LCX sustain its momentum?

LCX’s current rally is fueled by technical breakouts and rising user activity. However, overbought RSI levels and mixed on-chain signals raise questions about sustainability. If LCX clears the $0.31732 resistance, it could unlock further upside.

However, a failure to maintain its current levels may lead to a pullback. For now, LCX appears poised to continue its bullish trajectory, but traders should keep a close watch on key resistance levels and market sentiment.