Is POL undervalued? Whale activity suggests potential upside

- Whales upsized their POL long positions amid the latest 20% discount.

- But is POL undervalued to warrant such additional bids?

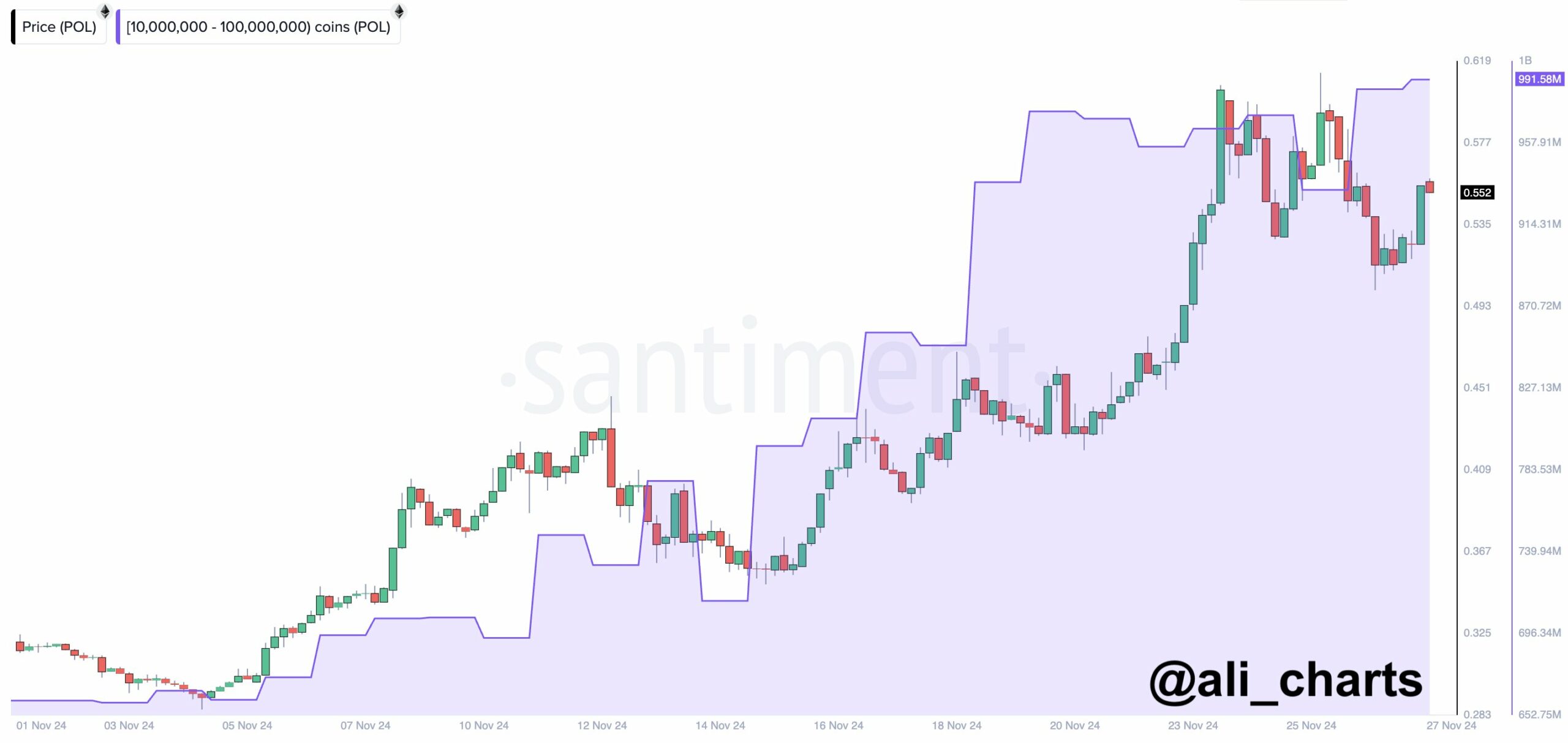

Polygon [POL] whales took advantage of the discounted window offered by the recent price pullback and scooped 59M POL tokens in the past 48 hours. The move comes amid increased altcoin season momentum across all sectors.

It’s important to note that the whales’ bid of approximately 60 million POL is relatively small compared to the total supply of over 10 billion POL.

But do the current valuation and profitability support a massive upside potential as expected by these whales?

Is POL undervalued?

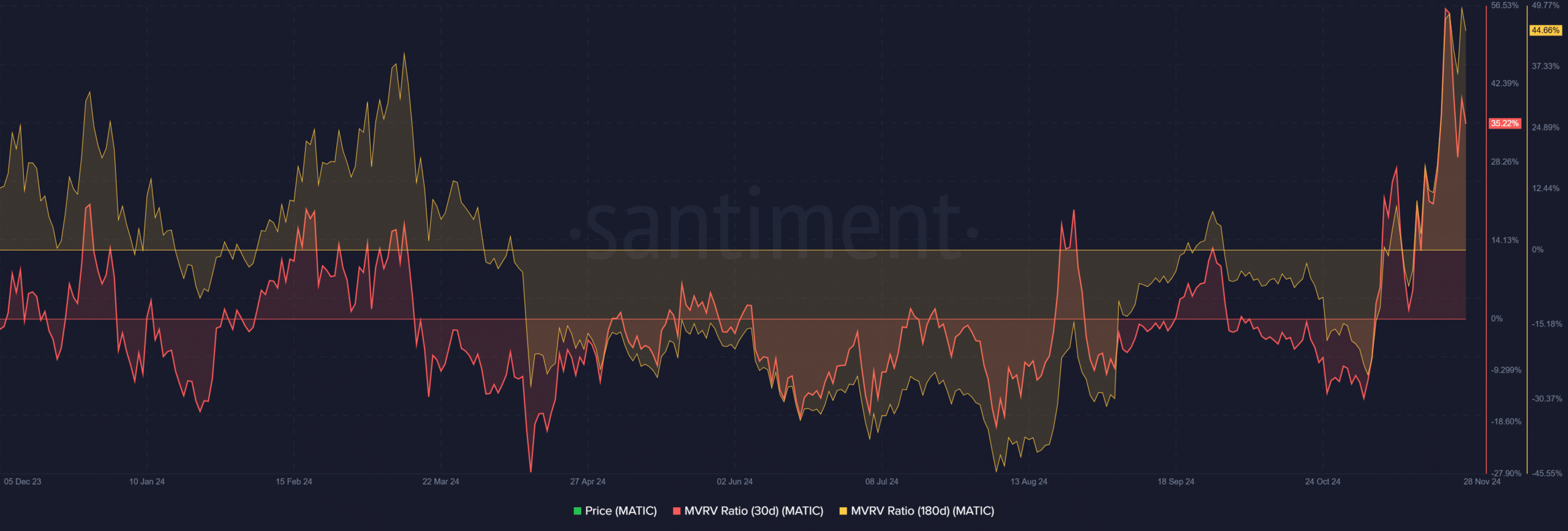

Based on the Market Value to Realized Value (MVRV) ratio, the 30-day and 180-day MVRV had positive readings at 35% and 44%, respectively.

This meant investors who held POL for the past month or six months had +30% in unrealized profit.

For context, not even the recent 20% pullback dented their unrealized profit levels, suggesting they could offload to book profits.

In such a scenario, POL’s upside potential could be limited if short-term holders opt to lock in gains. However, further analysis of profitability amongst POL addresses painted a different picture.

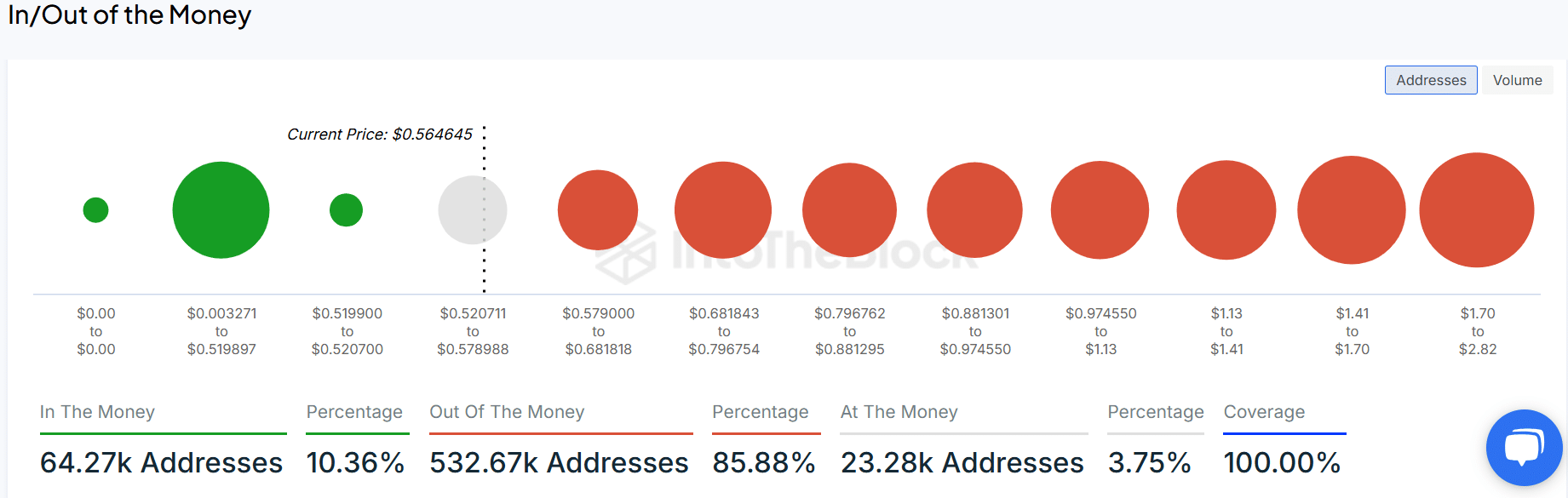

Despite the double-digit unrealized profit seen by short-term holders, according to IntoTheBlock data, they only accounted for 10% of total POL holders in profit.

In other words, over 85% of users (+500K addresses) were still underwater. At the same time, those currently at break-even were less than 4% (23K users). This means most holders were still at a loss despite the ongoing rally.

The vast losses meant that users could hold to at least break even and recover their initial capital, rather than sell at a loss. If so, that could be a net positive for POL’s upside rally and, by extension, support the recent whale moves.

Price action analysis

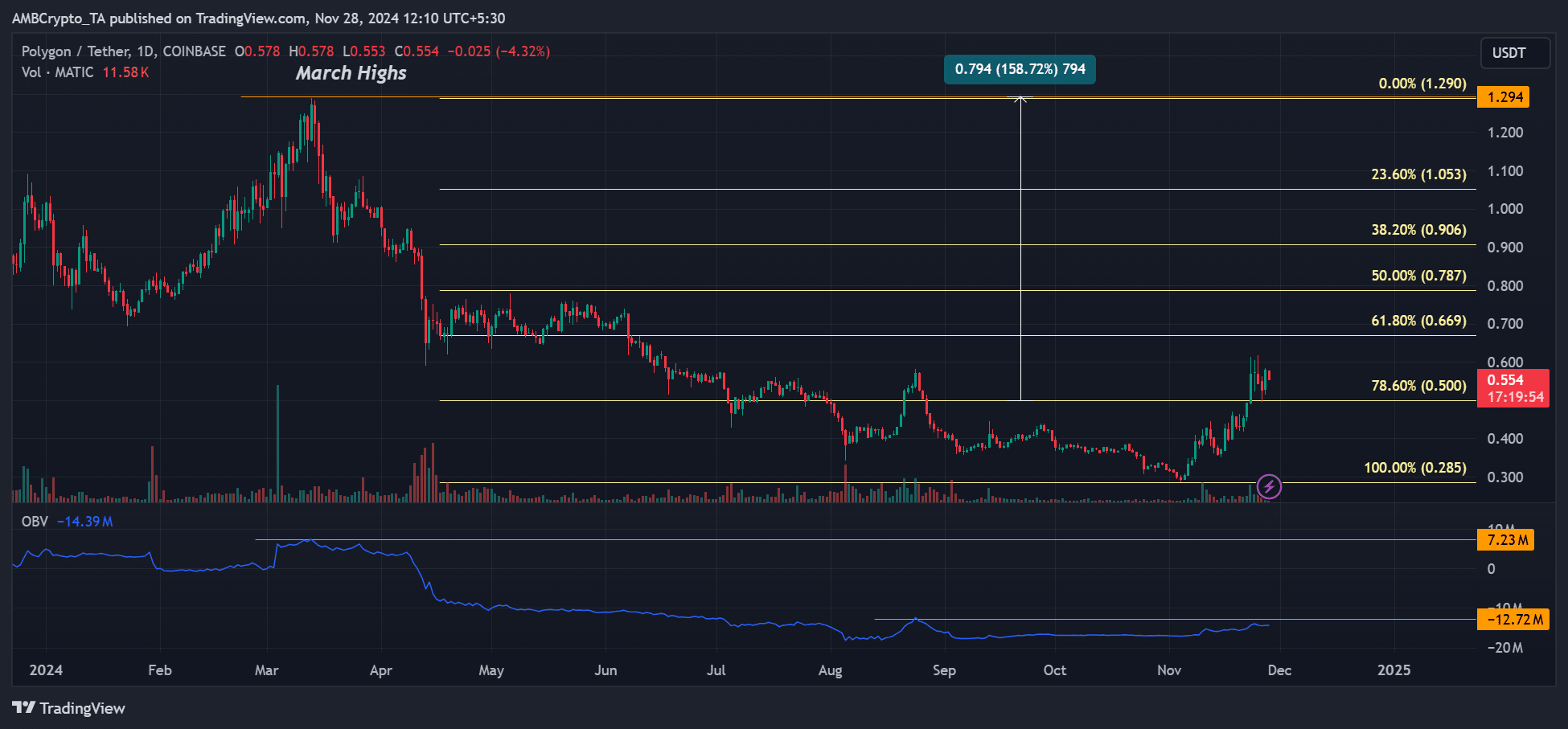

On the price chart, POL had a lot of headroom for its uptrend to continue, as shown by the low On Balance Volume (OBV). AMBCrypto had previously projected that a move above $0.6 could accelerate the price recovery.

Read Polygon [POL] Price Prediction 2024-2025

A decisive surge above $0.8, which coincided with a three-month price range in early 2024 and 50-61.8% Fib levels, could be a strong signal for the uptrend continuation.

If POL targets March highs of $1.2, nearly 160% of potential gains could be tapped.