Helium grows 19% in 24 hours: Will HNT reach $11 soon?

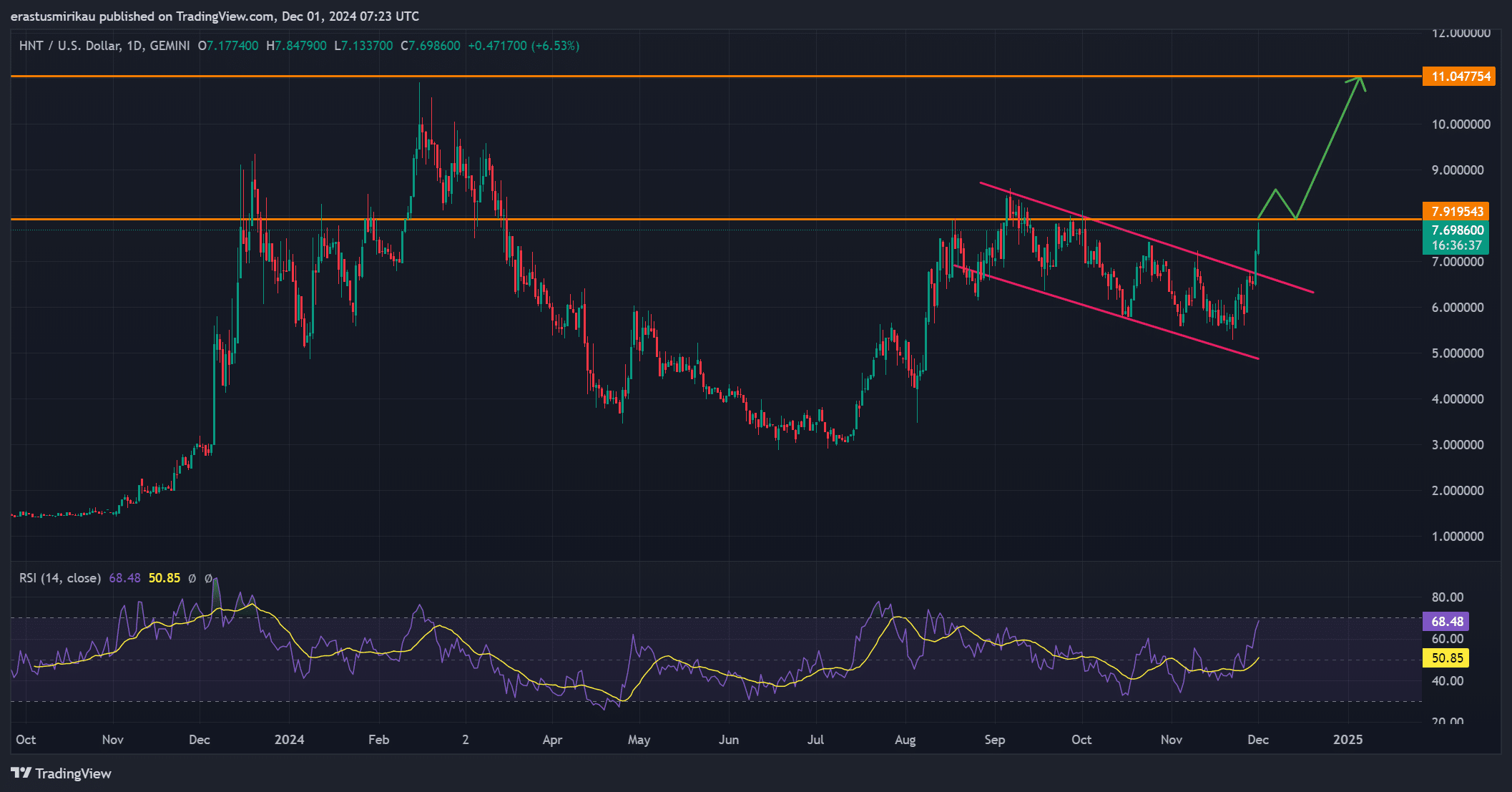

- HNT broke out of a bullish flag pattern, eyeing a key resistance at $7.90.

- Increased social dominance and rising Open Interest suggested continued bullish momentum.

Helium [HNT] has been showing strong upward momentum after breaking out from a bullish flag pattern on the daily chart, with the price at $7.87 at press time, up 19.38% in the past 24 hours.

This surge is accompanied by a significant volume increase of 176.42%, bringing total trading volume to 51.86M.

As HNT approaches the critical resistance level at $7.90, it is poised for potential further gains.

With favorable technical indicators and growing market interest, the coin could be on the verge of a significant rally, possibly heading toward $11 in the near future.

What does the bullish flag breakout mean for HNT?

Helium’s breakout from a bullish flag pattern signals increasing bullish momentum. A flag pattern typically follows a sharp upward move, followed by a period of consolidation, before breaking out again.

This suggests that it could continue its uptrend.

However, the token faces a crucial resistance at $7.90. A successful breakout above this level could push it toward $11, making this a key point for traders to watch.

HNT’s RSI was 68.48 at press time, approaching overbought territory. While this could indicate a short-term pullback, an RSI between 70-80 often accompanies strong bullish trends.

Therefore, unless Helium experiences a sharp correction, the coin could continue to climb.

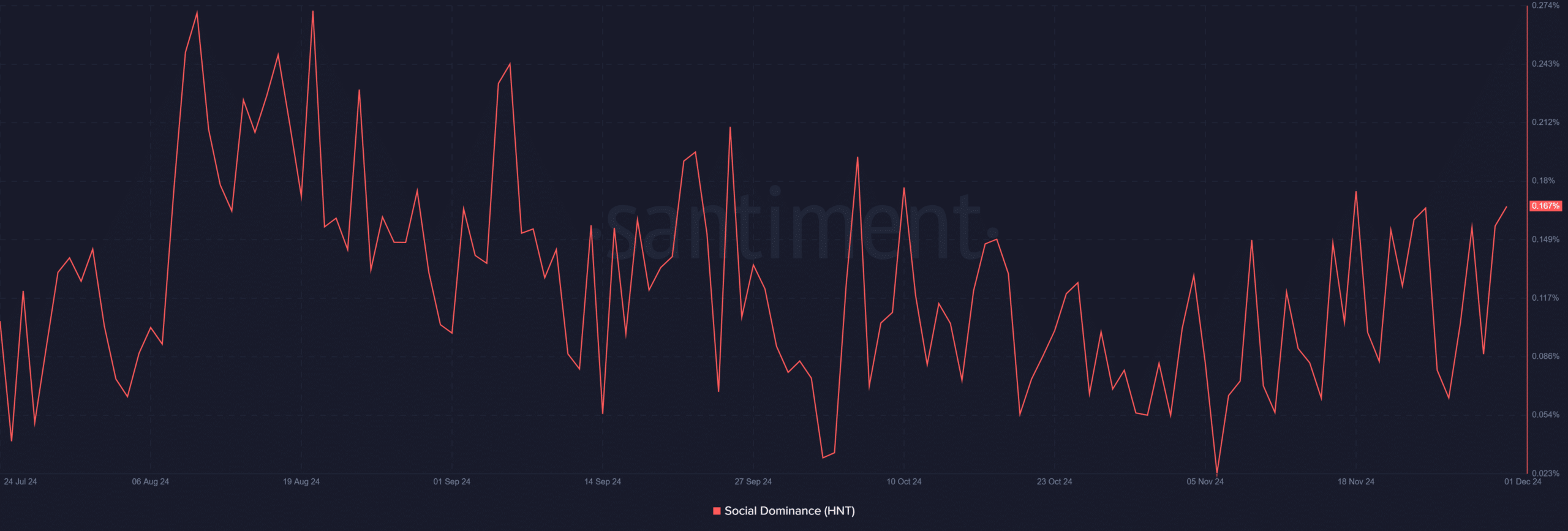

How is HNT’s social dominance impacting its price?

The social dominance has risen from 0.156% to 0.167% in the past 24 hours. This increase suggests growing awareness and discussions surrounding the coin, which could lead to more market interest.

Consequently, heightened Social Dominance often drives price movements as traders take notice of the token’s growing presence.

This uptick in social attention could help fuel HNT’s momentum and support its breakout toward higher price levels.

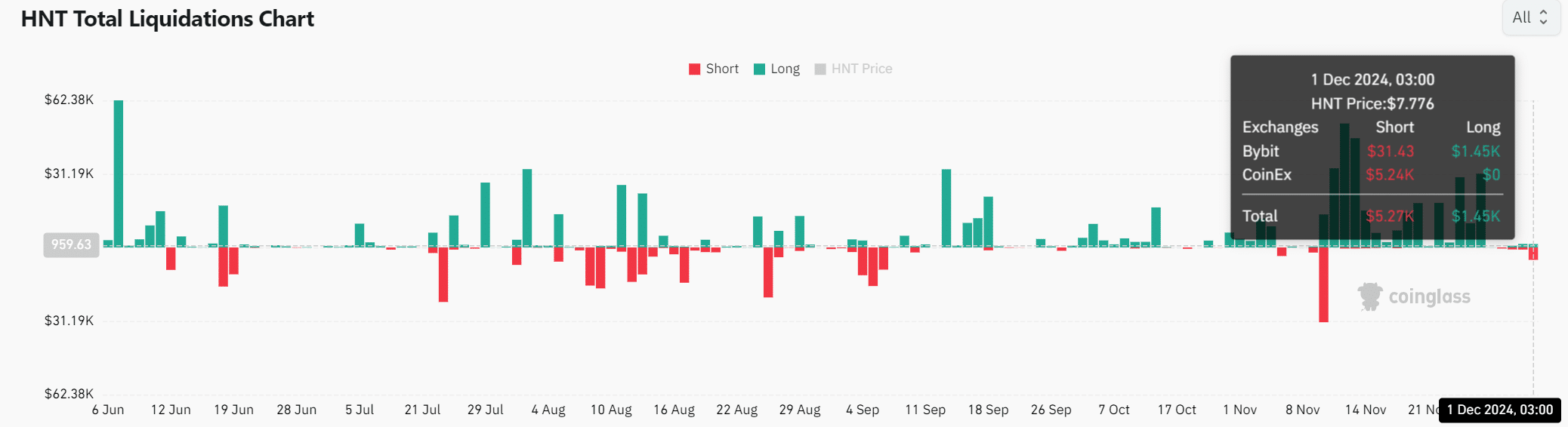

What does the liquidation data indicate about market sentiment?

HNT’s liquidation data shows a bullish market sentiment. Shorts have been liquidated at $5.27K, while longs have been liquidated at a smaller value of $1.45K.

This suggests that more traders are positioning for upward price movement, reinforcing the current bullish trend. As shorts are forced to cover, the buying pressure could further drive the price higher.

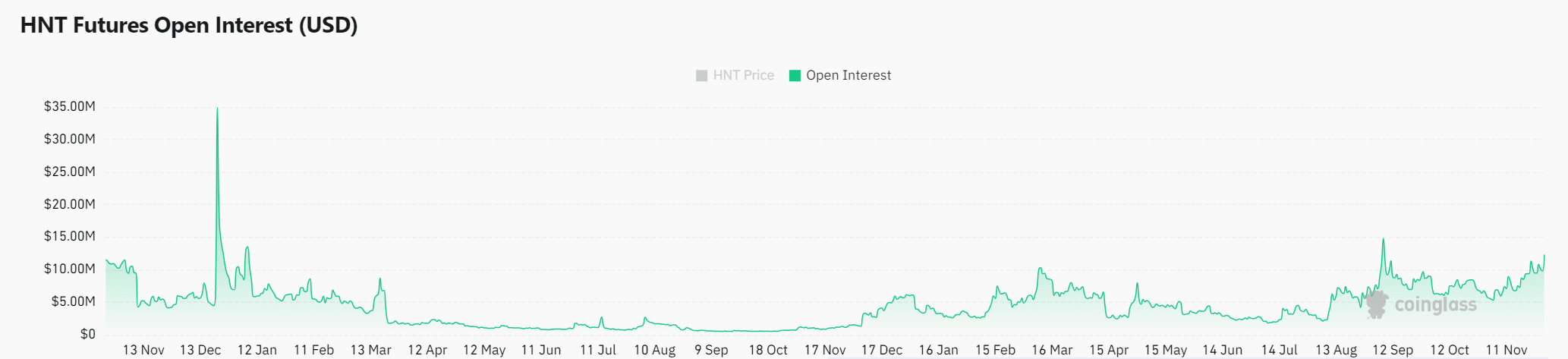

Surge in Open Interest

Open Interest for HNT has surged by 18.29%, reaching $12.27M. This spike reflects increased trader participation and growing confidence in HNT’s potential for further gains.

As more positions are opened, the surge in Open Interest strengthens the case for continued upward momentum.

Is your portfolio green? Check out the Helium Profit Calculator

Conclusion: Can HNT break through to $11?

HNT’s breakout from the bullish flag pattern, rising social dominance, and increasing open interest suggest strong bullish potential. If HNT can break the $7.90 resistance, it could move toward $11.

However, the RSI indicates the possibility of a short-term pullback. If the bullish momentum persists, HNT is likely to continue its ascent.