LimeWire crypto surges 62% in 24 hours: Is LMWR still undervalued?

- LMWR has surged by 62.13% over the past 24 hours.

- Market indicators suggest that LimeWire is till undervalued.

Since hitting a local low of $0.1707 a week ago, LimeWire [LMWR] has experienced a strong upswing to reach a 5-month high of $0.47.

However, since this price spike, it has experienced a market correction. In fact, of this writing, LimeWire was trading at $0.3975. This marked a 62.13% increase over the past 24 hours.

Over the same period, the altcoin’s trading volume has surged by 672.12% to hit $56.92 million while the market cap has surged by 51% to $114.42 million.

Equally, it has gained on weekly and monthly charts hiking by 103.46% and 226.74%. Despite this price up, LMWR remains approximately 79.53% below its all-time high of $1.92.

The question that arises after the recent pump is whether LimeWire can sustain the rally.

Can LMWR sustain its rally?

According to AMBCrypto’s analysis, LMWR is currently experiencing a strong upward momentum. As such, the altcoin is seeing increased buying pressure with buyers dominating the market.

We can see this dominance from buyers through a rising Stoch RSI. After making a bullish crossover a week ago, this has spiked to 99. Such a surge shows that buying pressure is higher than selling pressure.

This phenomenon is further evidenced by a positive CMF. At press time, LimeWire’s Chaikin money flow (CMF) was 0.06 implying that buyers outweigh sellers.

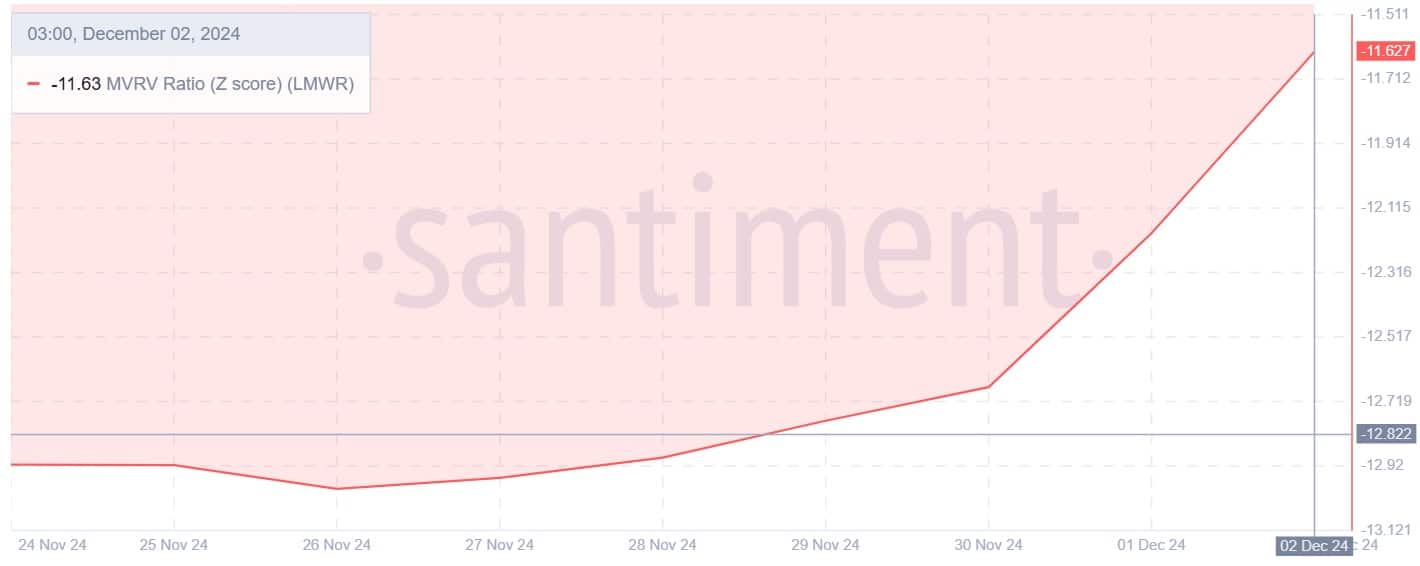

Looking further, LimeWire’s MVRV ratio Z score remains below zero even though rising. As such, the MVRV score was -11.63 as of this writing after a slight rise from -12.19.

When the MVRV score is negative, it suggests that LMWR’s current price is below the average cost basis implying that the market is undervaluing the altcoin.

Historically, a negative Z score creates a buying opportunity. As such, this preceded market recovery as undervaluation attracts more buying pressure thus reducing impacts from sellers.

Therefore, this indicates that LMWR is undervalued and has room for growth as the market has yet to realize its true value.

Simply put, LimeWire is potentially undervalued. These lower prices have created a buying opportunity which has resulted in strong buying pressure. With buyers dominating the market amidst bullish sentiment, LMWR could make more gains in price.

Therefore, if the current conditions hold, the altcoin will find the next resistance around $0.70.