Is IOTA set for a 50% rally? Market sentiment, metrics have THIS to say!

- At the time of writing, 53.20% of top traders held short positions while 46.80% held long positions

- IOTA could soar by 50% to reach the $0.70-level if it closes a daily candle $0.45

IOTA is making waves in the cryptocurrency realm again owing to its recent price performances. In fact, since the beginning of November 2024, the token has soared by more than 250%, alongside other major cryptocurrencies across the market.

With significant upside momentum on its side, IOTA broke out of its prolonged descending trendline. By doing so, it gained significant attention from both whales and traders.

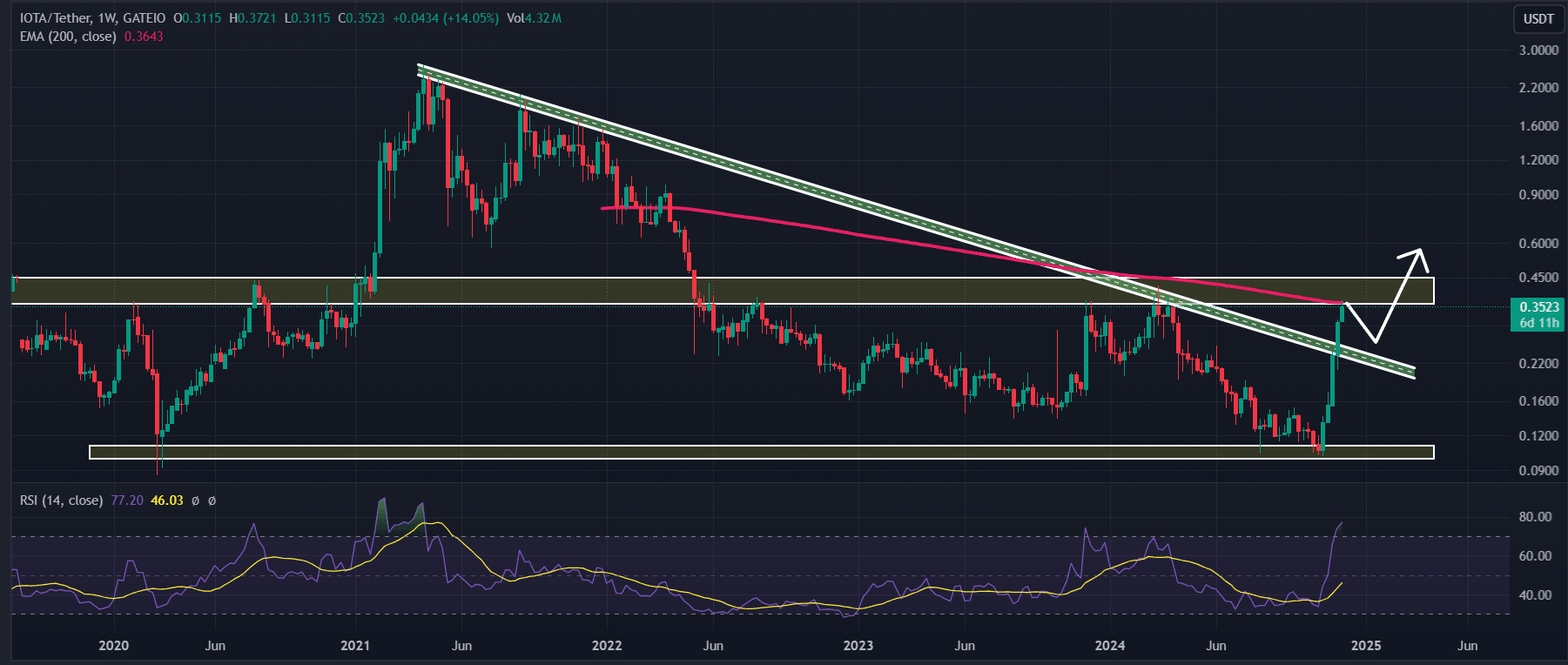

IOTA technical analysis and key levels

AMBCrypto’s technical analysis revealed that following the breakout of the trendline, IOTA appeared to to be struggling near the strong resistance level at $0.36. In addition to the horizontal resistance level, the 200 Exponential Moving Average (EMA) was also acting as a resistance at press time.

Based on the altcoin’s recent price action and historical momentum, if IOTA breaches this resistance level and closes a daily candle above the 200 EMA or the $0.45-level, there is a strong possibility it could soar by 50% to hit the $0.70 level in the coming days.

Meanwhile, IOTA’s Relative Strength Index (RSI) alluded to a potential price correction or decline in the coming days as the asset was in overbought territory.

Bearish on-chain metrics

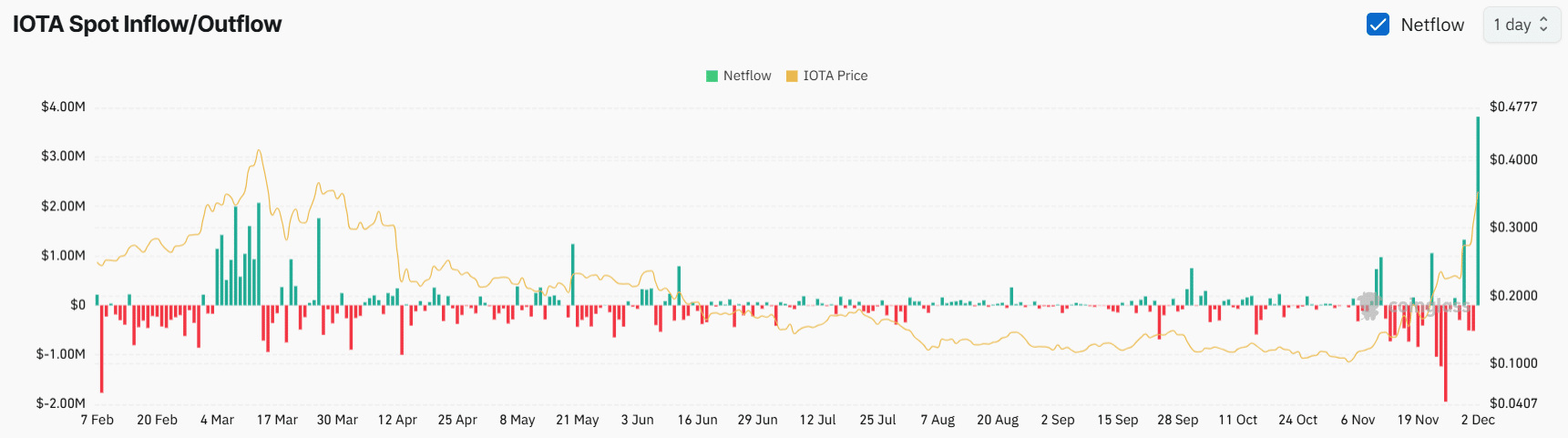

However, this breakout won’t be easy for the altcoin, as exchanges across the cryptocurrency landscape are witnessing notable inflows. This, according to the on-chain analytics firm Coinglass.

$3.8M of tokens inflow

According to IOTA’s spot inflow/outflow data, exchanges recorded a significant inflow of $3.81 million in the last 24 hours. This data suggested that whales and institutions have moved their holdings from wallets to exchanges.

In the finance industry, inflows to exchanges are often referred to as indicators of market sell-offs and potential price drops.

Traders bet on the short side

In addition to the participation of whales, traders appeared to be building short positions, as indicated by IOTA’s Long/Short ratio which had a reading of 0.88. A ratio below 1 signifies strong bearish sentiment among traders. At the time of writing, 53.20% of top traders held short positions while 46.80% held long positions.

This combination of on-chain metrics and technical analysis suggested that traders and investors may be shifting their position towards the bearish side.

At press time, IOTA was trading near $0.34, having recorded a 15% price decline in the last 24 hours. Over the same period, its trading volume surged by 200%, indicating strong participation from traders and investors amid its recent breakout.

![Assessing if Cardano [ADA] can outperform, break $1.50, and top the altcoin market?](https://ambcrypto.com/wp-content/uploads/2025/01/Ritika-3-400x240.webp)