Bernstein: Why Ethereum ETF staking approval could boost ETH

- Bernstein has gone long on ETH, citing likely ETF staking yield approval.

- Other catalysts include positive ETH ETF flows and institutional interest.

Bernstein analysts are bullish on Ethereum [ETH], citing a likely US ETH ETF staking approval under the Trump administration as a major catalyst.

The research and brokerage firm also cited three other catalysts for the altcoin, terming its recent relative underperformance as a great reward setup.

Part of the analysts’ report, led by Gautam Chhugani, read,

“We believe, given the ETH’s underperformance, the risk-reward here looks attractive’

Ethereum ETF staking approval

Unlike Hong Kong’s ETH ETF, which has staking, the US didn’t greenlight staking yield for the products in July.

According to the analysts, this could change under the Trump administration and offer an attractive yield amid Fed rate interest cuts.

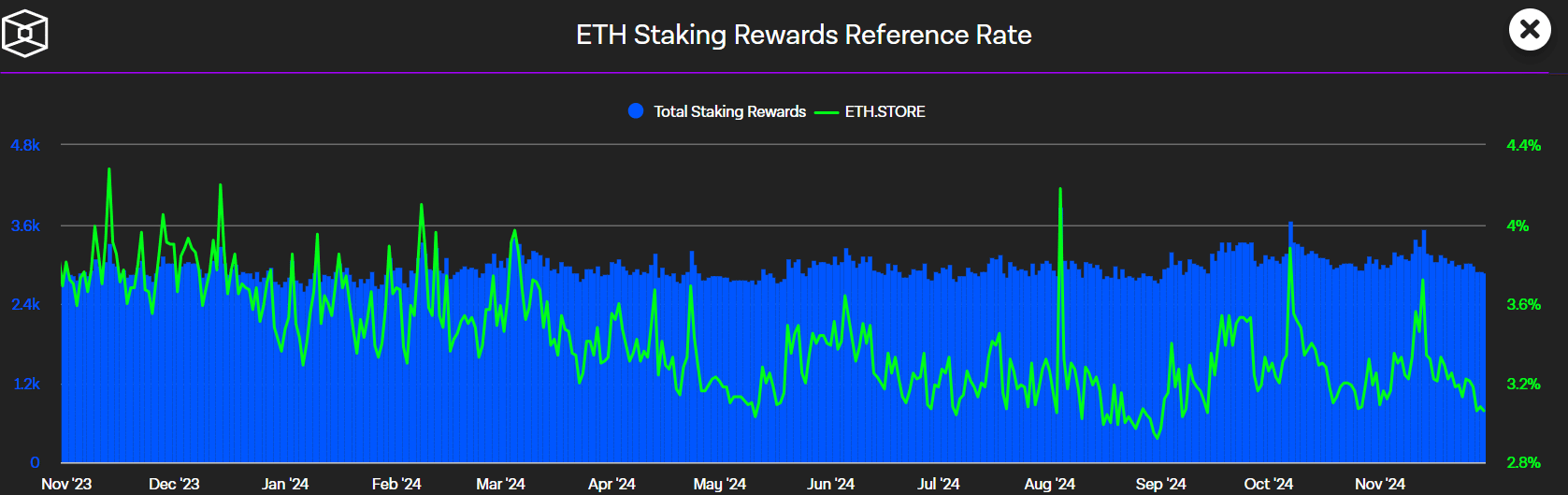

“ETH staking yield may be coming soon… We believe, under a new Trump 2.0 crypto-friendly SEC, ETH staking yield will likely be approved. In a declining rate environment, ETH yield (3% in ETH today) can be quite attractive.”

In May, Galaxy Digital’s Mike Novogratz predicted the same, with a potential timeline of mid-2025 or 2026.

The analysts added that the ETH staking yield, which was 3% at press time, could surge to 4-5% upon ETF staking approval. This could attract more institutional interest in the altcoin.

“The ETH yield feature in ETFs would also leave some spread for asset managers, improving ETF economics, bringing further incentive to push ETH ETF as institutional asset allocators increase digital asset exposure.”

Positive ETH ETF flows

ETH’s strong demand and supply dynamics alongside positive ETH ETF flows were other catalysts highlighted by Bernstein.

Out of 120M ETH in supply, the analysts stated that 28% was staked (about 34.6M ETH), while 10% (12M ETH) was locked in deposit/lending platforms.

This left 60% of ETH in supply untouched in the past year, on what the analysts termed a ‘resilient investor base’ and favorable demand/supply dynamics.

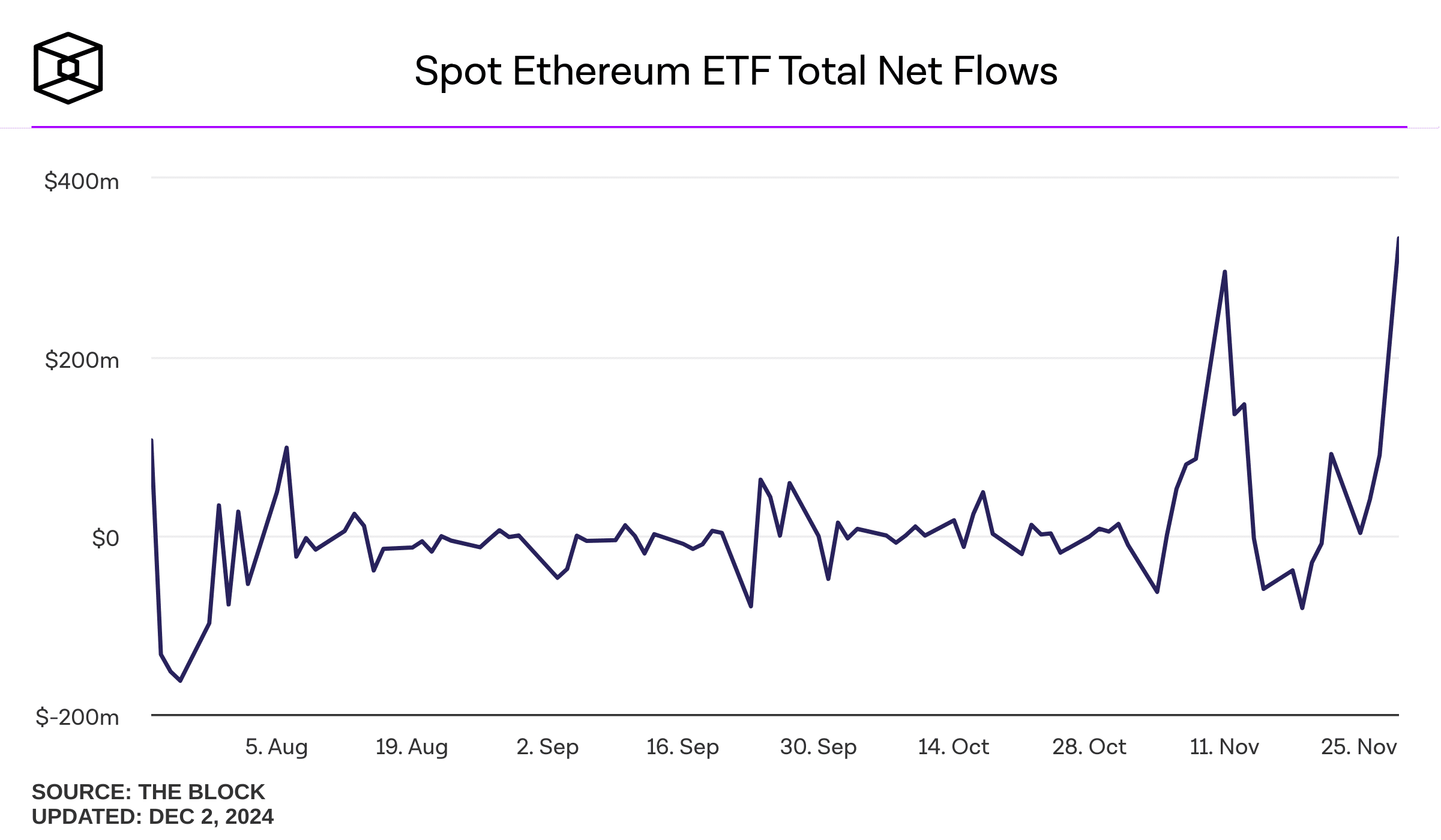

Besides, ETH ETF flows turned positive and even flipped BTC ETFs for the first time.

The ETF’s total net flows have been negative since launch, but that changed in November. Per Bernstein, this could strengthen the altcoin’s strong demand/supply dynamics.

Finally, the high level of trust from large retail and institutional investors in the Ethereum network could boost ETH.

Bernstein cited ETH’s TVL, which stood at about 60% ($89B), as a vote of confidence among institutional players. At press time, ETH was valued at $3.6K, up 47% in the past month.