As Bitcoin stagnates at $95K, 2 reasons why BTC will remain bullish

- Bitcoin’s price stagnated at $95,000 as rising whale transfers signaled potential selling pressure.

- Increasing MVRV ratio and active address growth suggested optimism despite uncertainty.

Bitcoin [BTC] has continued to hover around the $95,000 price level, with its movement restrained over the past few weeks.

Despite attempts by bears to push the price below this psychological threshold, Bitcoin has maintained its position, displaying resilience but limited upward momentum.

Over the past week, BTC has recorded a modest increase of 1.1%, while in the last 24 hours, it has seen a slight dip of 0.4%, trading at $95,463 at the time of writing.

The stagnation in Bitcoin’s price has prompted analysts to examine underlying market dynamics.

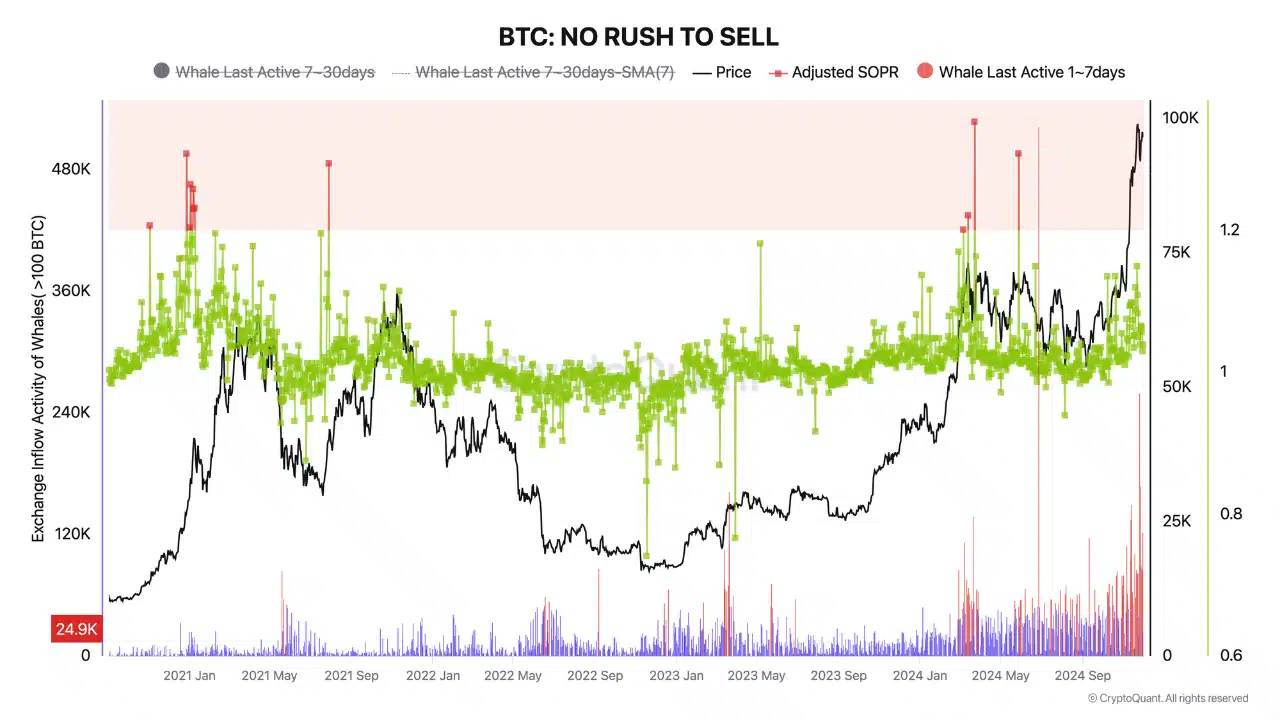

A CryptoQuant analyst, Onatt, highlighted a notable trend in whale activity post the U.S. presidential election, where Donald Trump secured a win.

According to Onatt, there has been a rise in the volume of Bitcoin transferred to exchanges by active whale addresses since the 5th of November.

However, the Adjusted SOPR metric, which measures profit-taking activity, does not yet indicate significant sell-offs.

While the large inflow of Bitcoin could signal potential short-term selling pressure, the fact that these assets have not been sold suggests they may be allocated for other purposes, such as over-the-counter transactions or collateral.

This cautious approach by whales reflects a “wait-and-see” strategy, highlighting the need for vigilance in monitoring these movements for any market impact.

Key indicators to watch

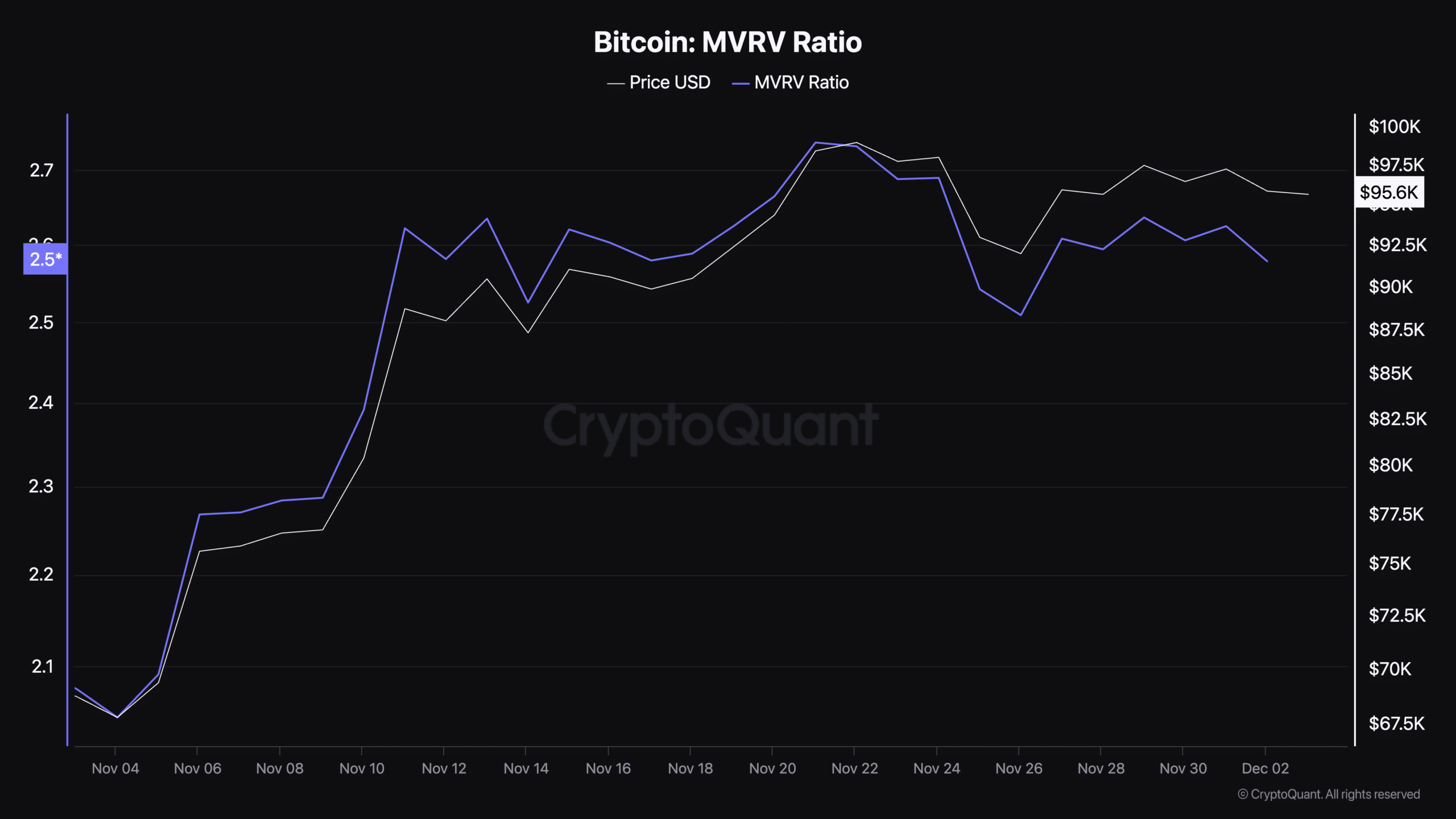

Bitcoin’s trajectory can be better understood with its MVRV ratio and active addresses.

Notably, the MVRV ratio, a measure of market capitalization relative to realized capitalization, helps assess whether Bitcoin is overvalued or undervalued.

A ratio above 1 indicates profitability for most holders, while values of 3.7 signal overvaluation. At press time, Bitcoin’s MVRV ratio sat at 2.57, signaling moderate profitability.

While this level suggests that Bitcoin was not in an overbought zone, it highlighted the need to monitor the ratio for potential signs of market overheating or correction.

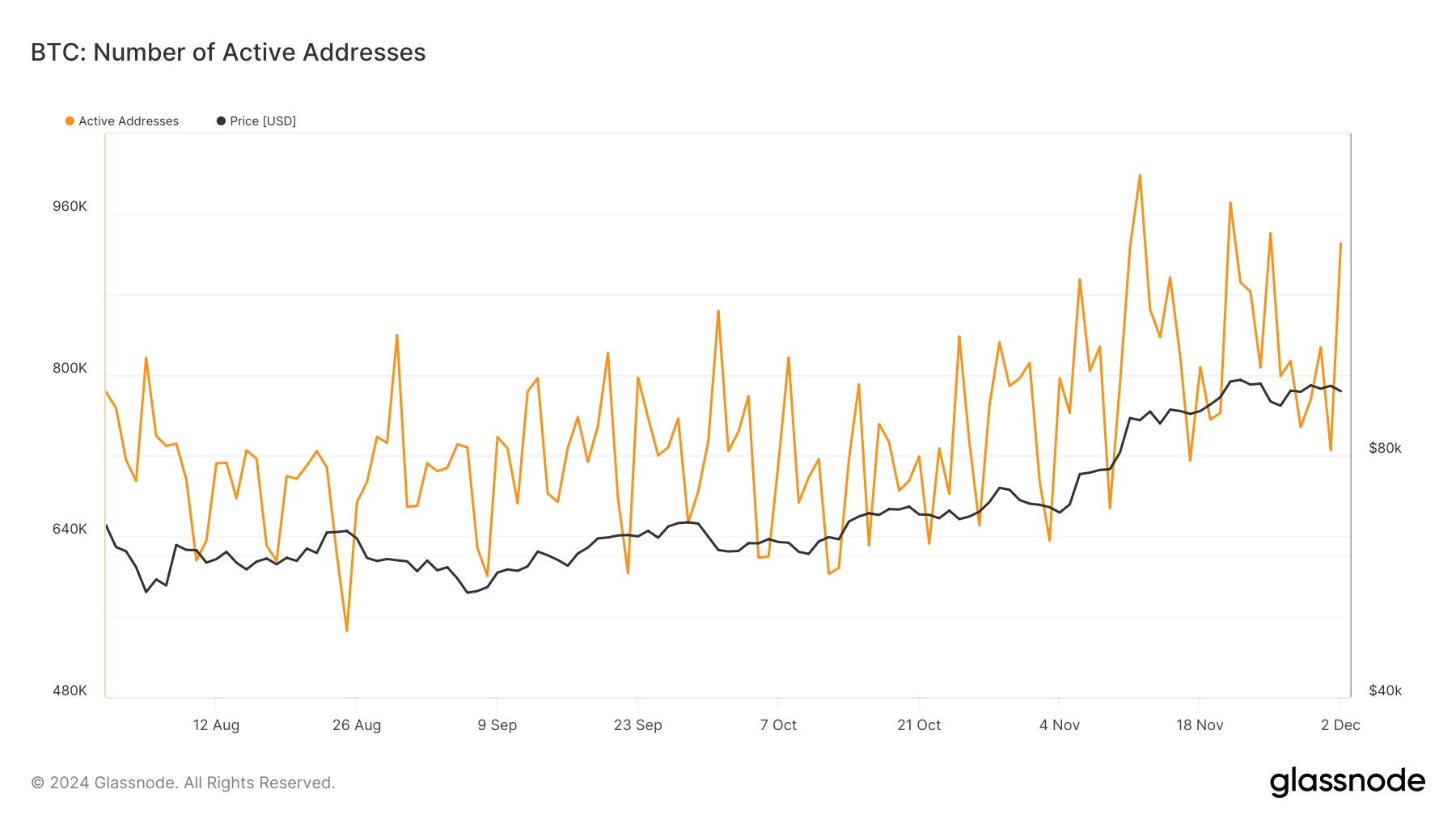

Also, Bitcoin’s active addresses, which serve as a proxy for network activity and retail interest, showed a steady increase in active addresses since August 2024, per data from Glassnode.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although active addresses briefly declined to below 750,000 on the 1st of December, they have rebounded to over 900,000 as of press time.

This resurgence in active addresses indicated growing participation in the network, which could support price stability and potentially signal bullish momentum, if sustained.