Can Solana break $260 again? Why whale support may not be enough

- Solana whales are seizing the ‘dip,’ snapping up bargain-priced tokens in hopes of a major rebound.

- But for this comeback to happen, two key conditions need to align.

Solana [SOL] surged from $157 on election day to an all-time high of $264 in just 20 trading days, breaking through the $260 ceiling and cementing itself as a standout performer in the market.

This rapid ascent highlights SOL as a notable beneficiary of both external and internal trends.

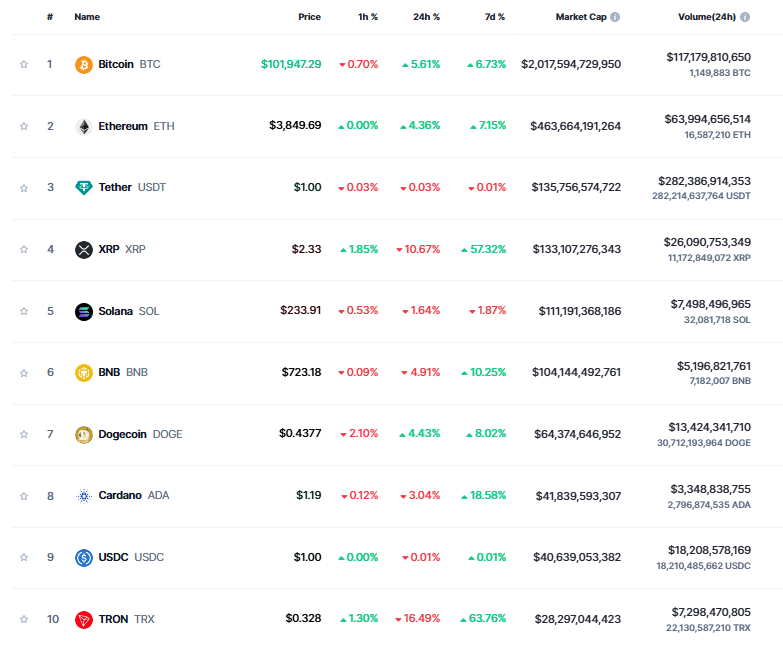

Externally, SOL’s rally paralleled Bitcoin’s momentum, with BTC solidifying its position as a favored asset class, driving broader market inflows and pushing Solana to new highs.

Internally, Solana’s reputation as an “Ethereum Killer” has bolstered its appeal, strengthening its position across key metrics. However, in the past two weeks, SOL has faced significant resistance at its new ATH, leading to a pullback below $240.

A rebound could occur under two key scenarios: first, intense FOMO triggered by Bitcoin breaking the $100K mark, which may spill over to SOL; second, flipping $240 into support, setting the stage for a fresh phase of price discovery.

If these conditions align, SOL could be on the verge of breaking out to a new ATH. So, what are the odds?

Potential for growth as big players eye the dip

Typically, altcoins experience a massive influx of capital once BTC enters a high FUD (fear, uncertainty, and doubt) area, a phase Bitcoin has just broken through by reaching the historic $100K milestone.

As a result, a break to a new ATH for Solana might seem too ambitious for now, as investor focus has shifted toward Bitcoin.

However, it could be crucial to keep Solana in the game in the short term, potentially preventing it from dipping below $220, as investors are likely to keep their options open to absorb the risk of a potential Bitcoin correction, should market sentiment turn bearish.

This optimism is further supported by a neutral RSI, signaling a buying opportunity for investors seeking outsized returns once Bitcoin approaches an overheated state.

Whales appear to be following this strategy, with big banks scooping up SOL at discounted prices after the coin’s price dropped more than 60% in the past two weeks.

Their backing could help Solana reclaim the $240 price band in the coming days. Once this threshold is regained, the conditions mentioned above will play a critical role in determining Solana’s next direction.

Solana needs to reclaim its dominance

As noted earlier, Bitcoin’s big break has created conditions ripe for altcoins to surpass psychological levels. However, Solana may be lagging in this regard.

Over the past 24 hours, as the social media frenzy surrounding the $100K excitement intensified, Ethereum holders seized the opportunity for a bigger bite, with its momentum equally in the green.

Although it might be too early to comment, Solana has struggled to generate a similar reaction from investors, remaining trapped in a lower price range.

However, there’s a silver lining: the large HODLers are holding strong. This makes their support even more critical, as it will be key to absorbing the mounting selling pressure, especially with retail investors shifting their focus away from Solana in favor of other alternatives.

Therefore, a breakthrough above $240 could ignite a surge of FOMO, acting as a powerful psychological catalyst and laying the groundwork for a new ATH.

Still, it all comes down to the “Crypto King”

The long-awaited anticipation has finally come to rest as BTC reaches $100K for the first time. Greed is bound to skyrocket as analysts predict even more upside, despite growing signals of an overheated market.

For altcoins, it’s a do-or-die moment. Intense profit-taking could cement their reputation as a ‘safe haven,’ prompting traders to quickly diversify their portfolios and hedge against potential risks.

In this context, Solana stands at a critical juncture, offering bulls a prime opportunity to target a home run, especially with whale support in its corner. Yet, sustained momentum will depend on a surge of retail interest.

Read Solana’s [SOL] Price Prediction 2024–2025

This interest is likely to spark once Bitcoin reaches its peak, triggering massive sell-offs – an opportunity Solana must be ready to leverage.

Therefore, for now, $240 appears achievable. However, for Solana to reach a new ATH beyond $264, whale support alone may not be enough. Retail investments and Bitcoin hitting its peak will be two key factors to watch.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)