Could XRP surge to $8 before 2024 ends? Breakout from 2018 pattern indicates…

- XRP witnessed an over 3% price decline in the last 24 hours.

- Selling pressure was rising, but there were chances of a trend reversal.

After touching $2.8 last week, XRP fell victim to a price correction as it dropped in the last 24 hours. However, a recent analysis revealed that the token might actually still be undervalued. Does this mean XRP will resume its bull rally soon?

Is XRP undervalued?

XRP bulls managed to push the token’s price up by a modest 2% over the last seven days. But the trend didn’t last, as the bears took control of the market and pushed the token’s price down by over 3% in the last 24 hours alone.

At the time of writing, XRP was trading at $2.48 with a market capitalization of over $141 billion.

In the meantime, Ali Martinez, a popular crypto analyst, posted a tweet. According to the analysis, XRP broke above a multi-year bullish symmetrical triangle pattern a few days ago. The pattern emerged in 2018, and since then the token’s price has been consolidating inside it.

Martinez mentioned that he thinks that XRP was still undervalued, considering the multi-year pattern breakout. He pointed out possible targets. First, a conservative target of $8.4 and second, an optimistic target of $48.

XRP’s road going forward

While the aforementioned analysis suggested that XRP was undervalued, the token witnessed a pullback in the past 24 hours. AMBCrypto’s look at the token’s technical indicators revealed a possible reason behind this.

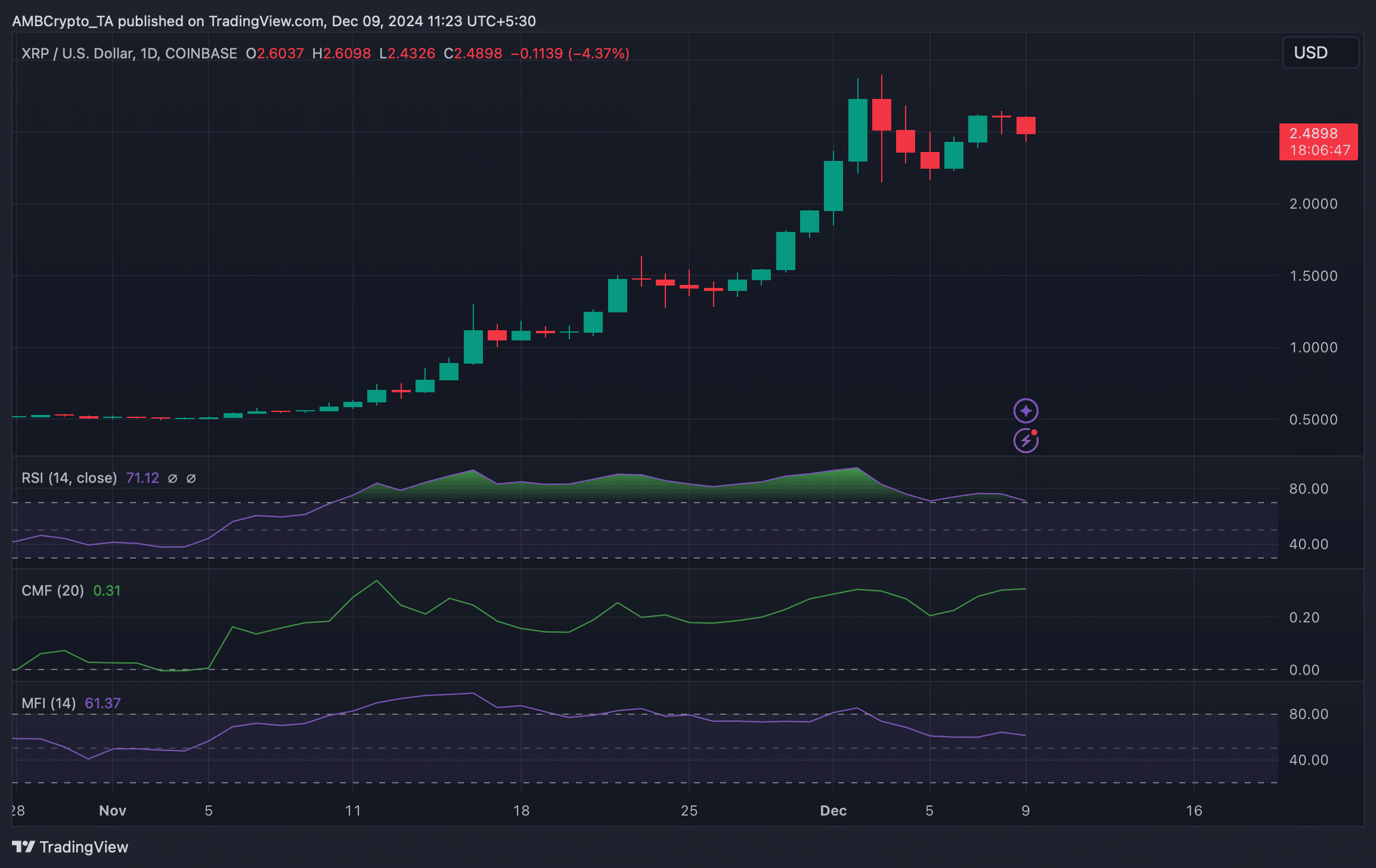

We found that the token’s Relative Strength Index (RSI) dropped from the overbought zone — a sign of increasing selling pressure. The Money Flow Index (MFI) also followed a similar declining trend.

Surprisingly, the Chaikin Money Flow (CMF) told a different story as it moved up. A rise in the indicators means that buying pressure is increasing and that the market or asset may be entering an uptrend.

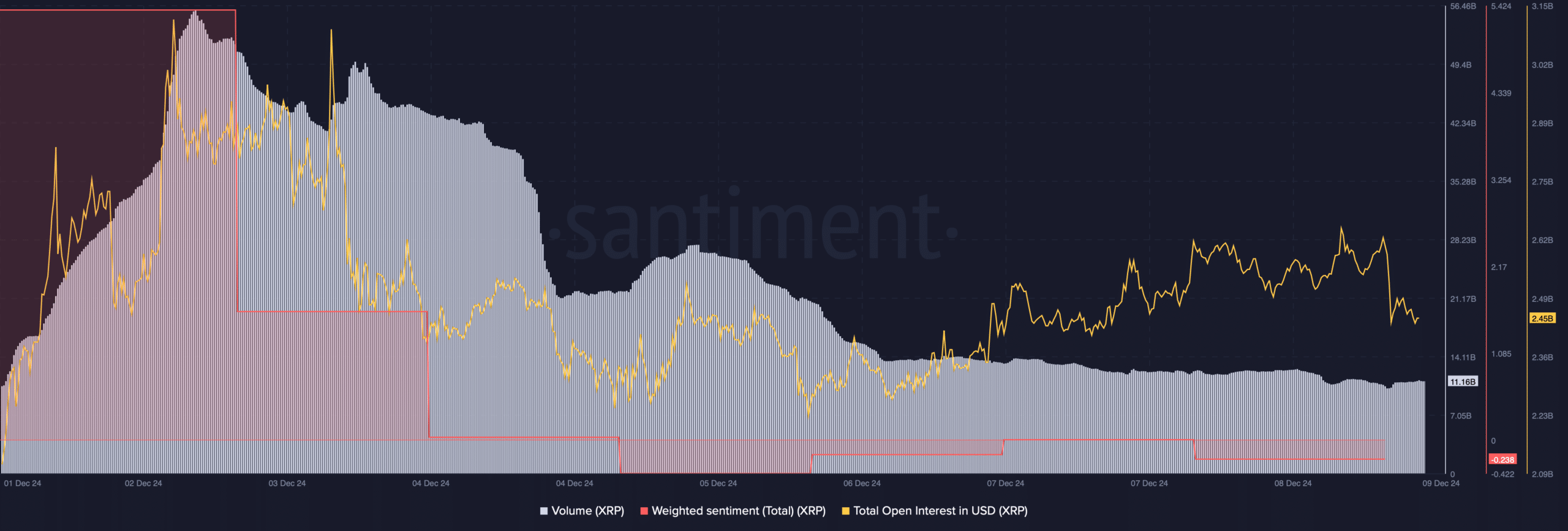

Sentiment’s data revealed that the token’s weighted sentiment entered the negative zone. This suggested that bearish sentiment around the token was rising.

Nonetheless, XRP’s trading volume declined sharply as it spruce action turned bearish. When volume drops along with price, it hints at a bullish trend reversal.

Additionally, the open interest also declined, further suggesting that the chances of the ongoing price trend changing are high.

Read Ripple [XRP] Price Prediction 2024-2025

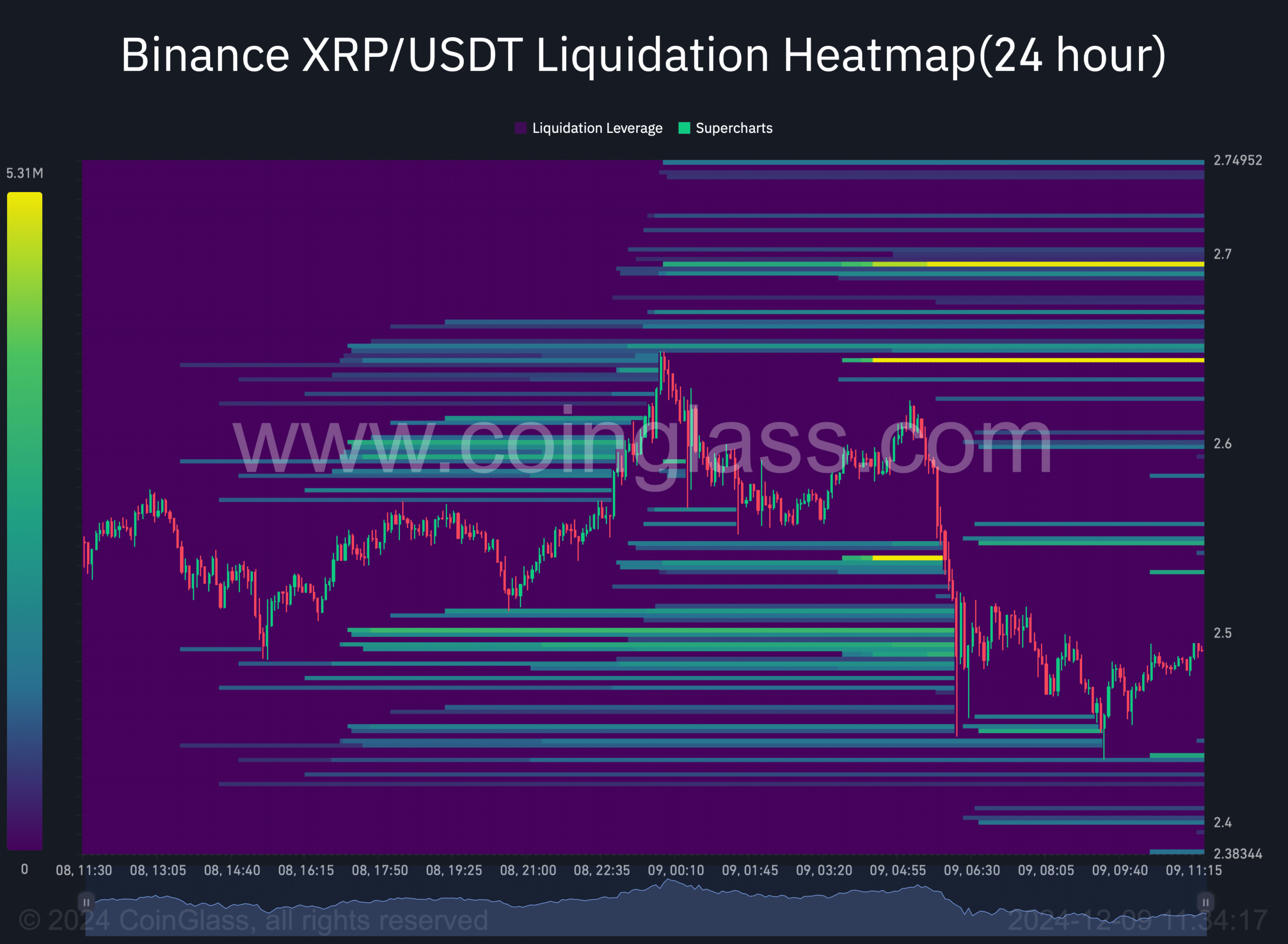

If a bullish trend reversal happens, it will be crucial for XRP to first go above $2.7 in the short-term, as liquidation will rise at that mark. A hike in liquidation often results in price corrections.

But, if the bears continue their domination, then the token might soon drop to $2.43.