Ethereum bulls have a decision to make as ETH drops below $3.8K

- Buying pressure on ETH remained high in the last few days.

- Technical indicators supported the possibility of a price increase.

As the market condition remained bearish, Ethereum [ETH], like most other cryptos, also witnessed corrections.

The latest pullback has now become a test for the bulls, as the king of altcoins was failing to breach the $3.9k resistance.

Ethereum bulls under pressure

ETH witnessed a more than 3% price correction in the last 24 hours, pushing its price under $3.k. At the time of writing, the king of altcoins was trading at $3,760.02 with a market capitalization of over $452 billion.

While the token’s price dropped, the Ethereum Foundation made a move. Spot On Chain recently posted a tweet revealing that the Ethereum Foundation just sold 100 ETH for 374,334 DAI.

This brought their total ETH sale in 2024 to 4,366 ETH for $12.21 million at an average price of $2,796.

To see whether this selling trend was dominant in the market, AMBCrypto checked other datasets.

Thankfully, not all investors were selling their holdings, which can support bulls to kickstart a recovery and allow ETH to cross $3.9k again.

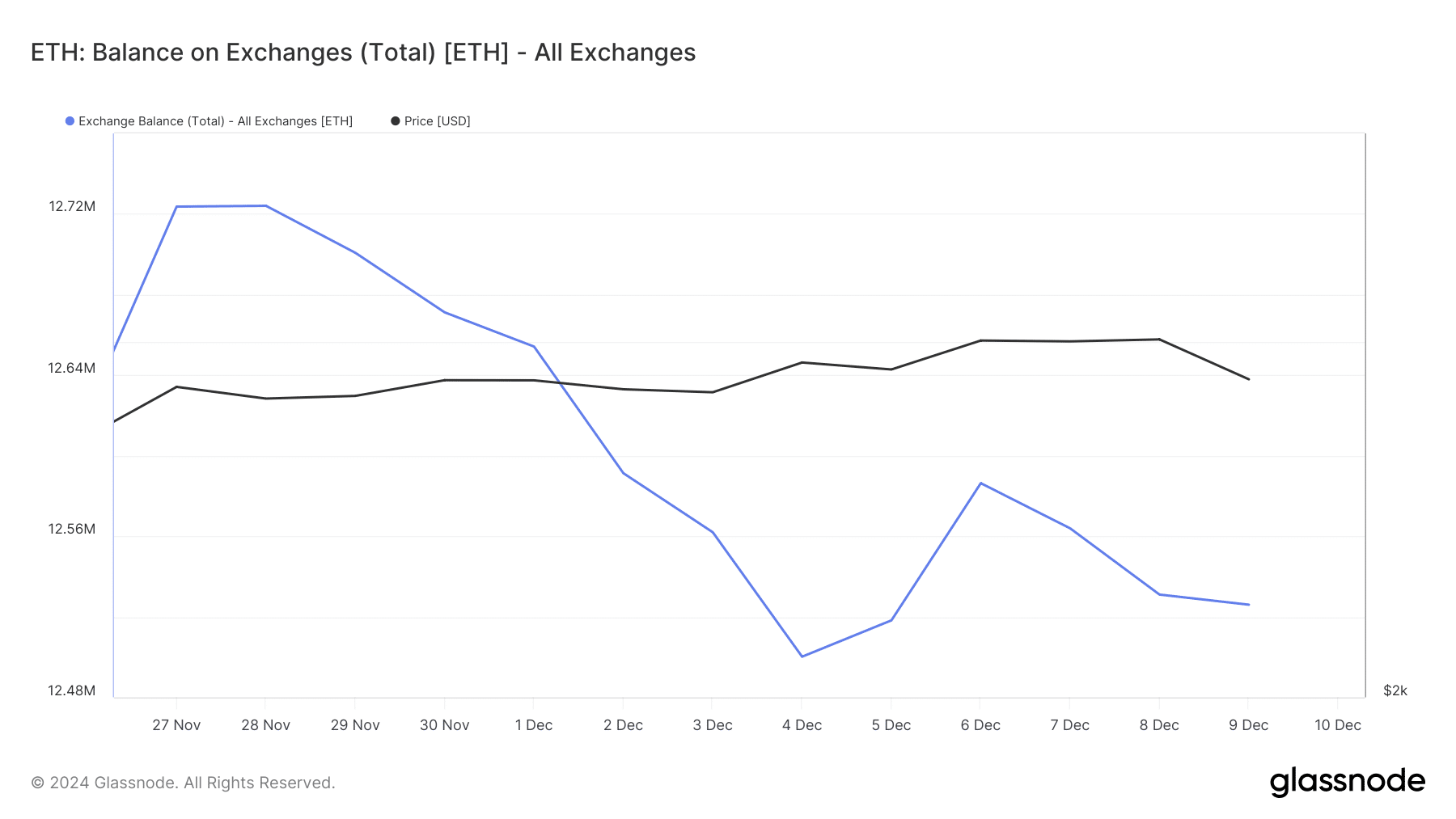

This trend was evident from the decline in ETH’s balance on exchanges over the last two weeks.

Hyblock Capital’s data revealed that after a spike, ETH’s sell volume declined to 9.6. For starters, a number closer to 0 indicates less selling pressure, while a value closer to 100 hints at high selling pressure.

However, the whales chose to move the other way around. As per CFGI.io’s data, whale sentiment reached 61.5%—a sign of high whale movements for selling.

Will ETH bulls reverse the bearish trend?

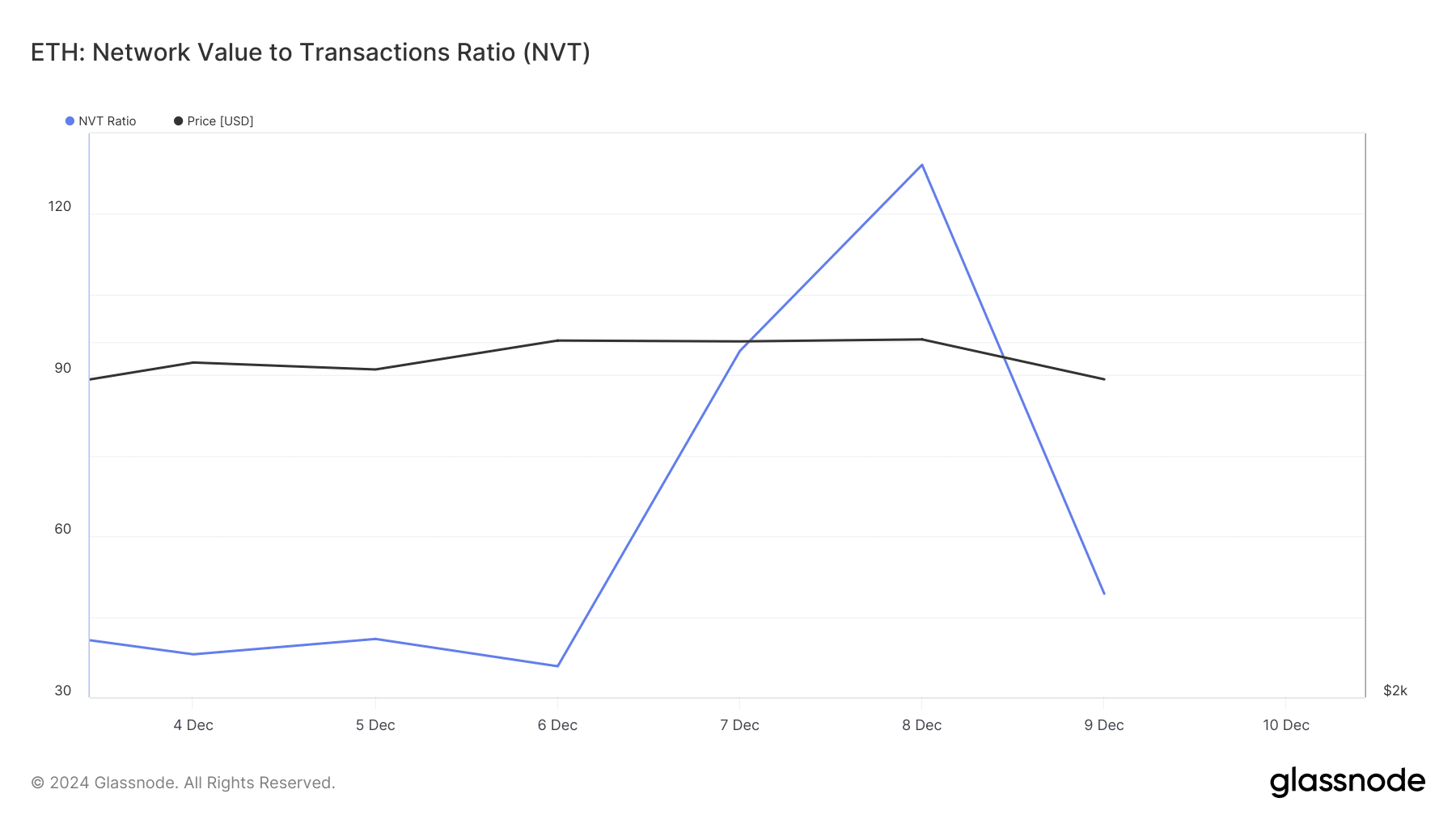

Though whales decided to sell, ETH bulls might still manage to push the token’s price up. Ethereum’s NVT Ratio registered a decline in the last e days.

Whenever the metric drops, it means that an asset is undervalued, suggesting a price rise in the coming days.

Apart from this, AMBCrypto also found that ETH’s Long/Short Ratio increased in the 4-hour timeframe.

This meant that there were more long positions in the market than short positions, which usually hints at rising bullish sentiment around a token.

A few of the technical indicators also suggested that Ethereum bulls could make a comeback. For instance, the technical indicator Relative Strength Index (RSI) registered a slight uptick.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The Chaikin Money Flow (CMF) also moved up. A rise in CMF indicates that buying pressure is increasing and that the market or asset may be entering an uptrend.

Therefore, Ethereum bulls might successfully pass the test and help ETH’s price move up again in the near-term.