Identifying XRP’s price targets after Ripple’s stablecoin gets NYDFS approval

- XRP was up 280% year-to-date, a sign of investor confidence.

- It is in a retracement phase and the support at $2.2 has held firm so far.

Ripple [XRP] was trending higher over the past month following the U.S. presidential election results that buoyed the entire crypto market. In particular, Ripple might benefit from increased regulatory clarity.

This could explain the increased capital inflow and investor confidence in recent weeks.

On Tuesday, in a post on X (formerly Twitter), Ripple CEO Brad Garlinghouse revealed that the company’s stablecoin has obtained regulatory approval from the New York Department of Financial Services.

The much-awaited RLUSD stablecoin is Ripple’s attempt to capture a portion of the $200 billion stablecoin sector, which is forecast to grow to nearly $3 trillion in the next five years.

XRP has bounced 23% from the lows set 12 hours before press time on the back of this news.

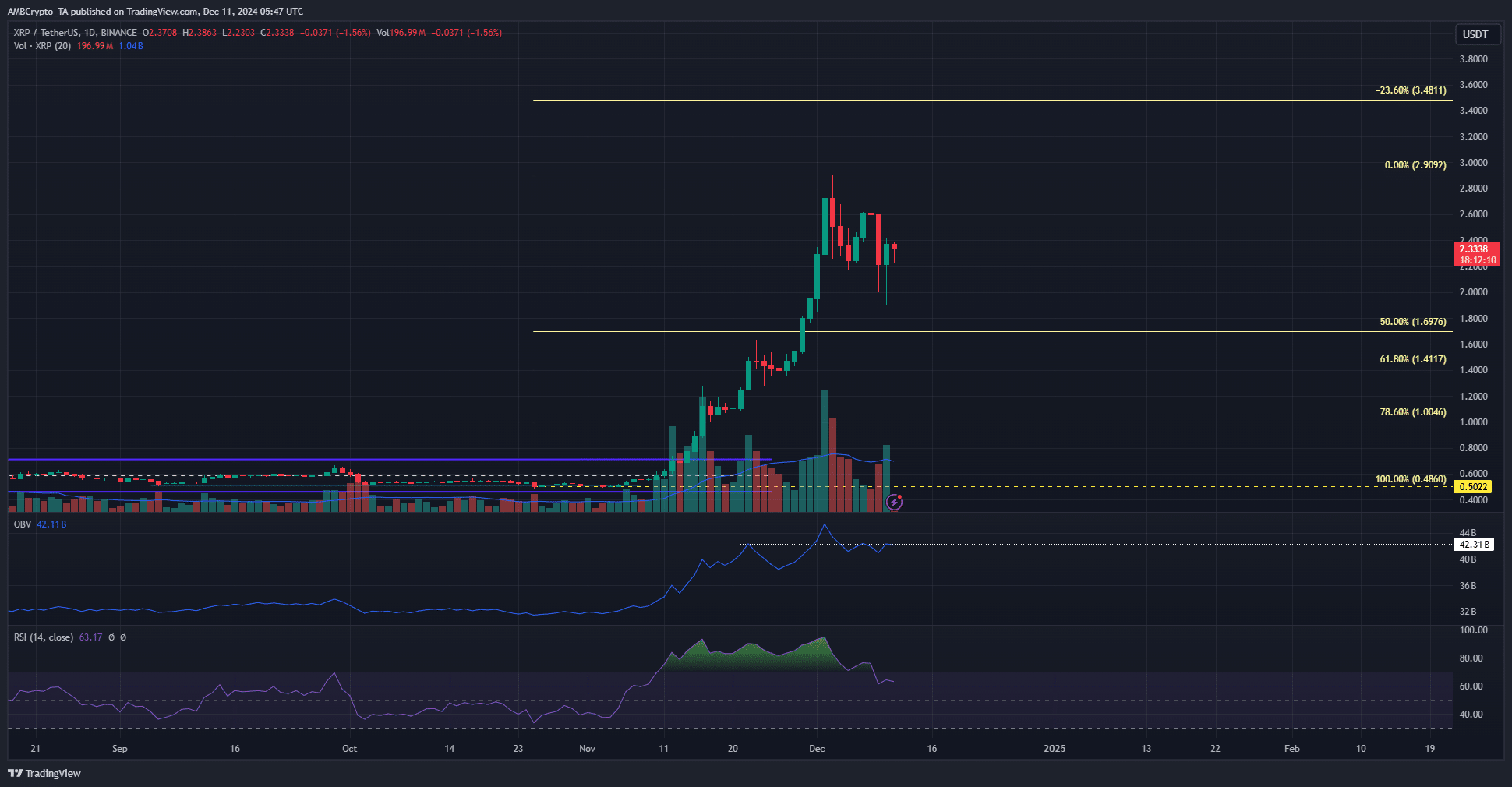

Momentum fading after the $2.9 rejection

After the range breakout a month ago, XRP gained 315% in just under three weeks. Since the local high at $2.9, XRP has retraced 19.41% and was trading above the $2.2 support.

The RSI has formed lower highs alongside the price, showing a drop in momentum.

Yet, the RSI on the daily chart was still above neutral 50 to show bullish momentum was still dominant. Also, the market structure was on the verge of flipping bearishly.

A daily close below $2.17 would change the structure.

The OBV was at a resistance zone from last month after the sell-off of the past ten days. This was another sign that XRP is headed lower in the coming days and weeks.

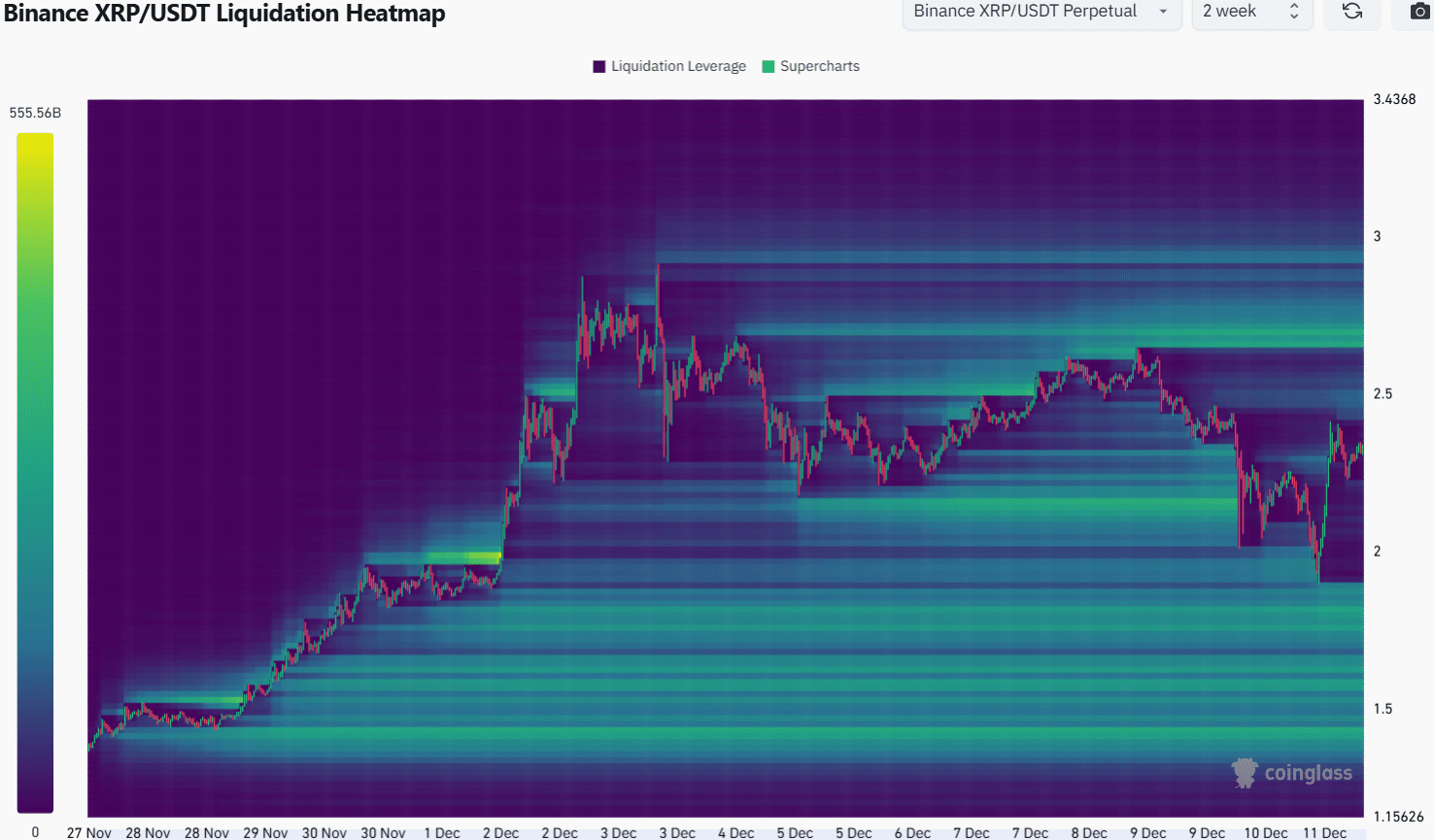

The magnetic zone beyond $2.5 could attract prices

Source: Coinglass

While the short-term bounce from $1.9 was encouraging, it might not indicate an immediate trend reversal. Rather, it is likely that XRP is hunting liquidity and needs time to make its next strong move upward.

Over the next week, the $2.66-$2.72 zone is expected to be tested before the bears take control in the short term.

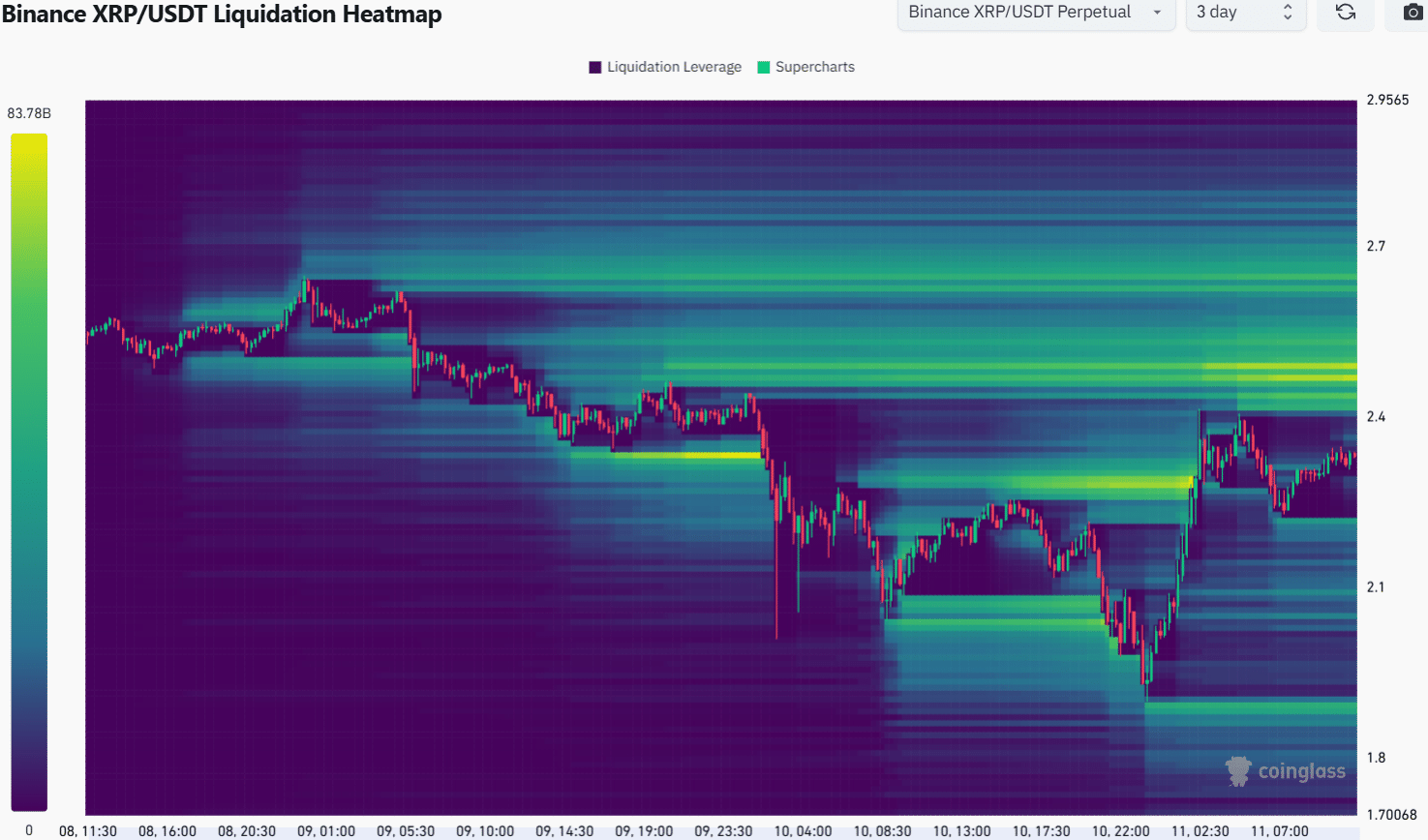

Source: Coinglass

The 3-day liquidation heatmap outlined the $2.45-$2.5 zone as an intense short-term resistance zone. Beyond it, $2.7 also has a sizeable number of liquidation levels.

Read Ripple’s [XRP] Price Prediction 2024-25

Putting the different lookback periods’ liquidation levels together, it is likely that the $2.5-$2.7 zone would be a formidable short-term resistance. A rejection from this area and a drop below $2 appeared likely.

On the other hand, a daily session close above $2.7 and a retest of $2.5 as support would be a sign that XRP is ready for its next leg higher.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion