XRP in first major pullback since November: Key price levels to watch

- XRP profit-taking intensifies in the second week of December as bullish activity cools off.

- A recap of XRP spot flows and the state of the derivatives segment.

Just over a week ago, Ripple’s native coin XRP was enjoying robust bullish momentum. It even achieved a new 8-month high in the first week of December, building on the momentum it achieved in November.

XRP has since bulled back from the recent top as traders took some profits off the table. For context, XRP topped out at $2.90 on 3rd December. It has since pulled back to a weekly low (so far) of $1.90, which was equivalent to a 20% pullback.

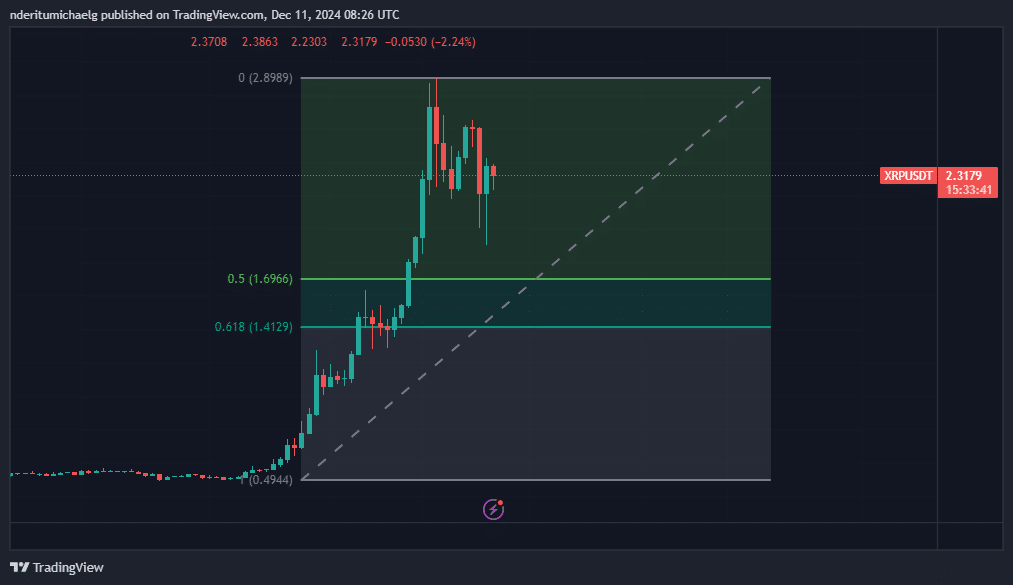

This pullback means we now have a rough idea of where the latest rally and started and ended. Mapping a Fibonacci retracement indicator on the bottom to top range revealed that price could drop to the $1.41 to $1.69 range.

The cryptocurrency exchanged hands at $2.31 at the time of writing. This was after an unexpected pullback during Tuesday’s trading session. This suggests that investors anticipate more upside, hence the resurgence of demand.

Sustained sell pressure as market sentiment shifts away from greed to fear could pave the way for more XRP downside. An assessment of demand and supply forces help paint a clearer picture of the cryptocurrency’s demand levels.

XRP spot flows indicate that the highest spot inflows into the cryptocurrency were observed at the start of December. Inflows peaked at 177.33 million on 1st December and the latest inflow figure on 10th December came in at $11.35 million.

The spot flows also demonstrated a resurgence of outflows in the last 10 days. XRP outflows peaked at $155.79 million as at 4th December. The total outflows in the last 10 days have been higher than inflows, reflecting the pullback during the same period.

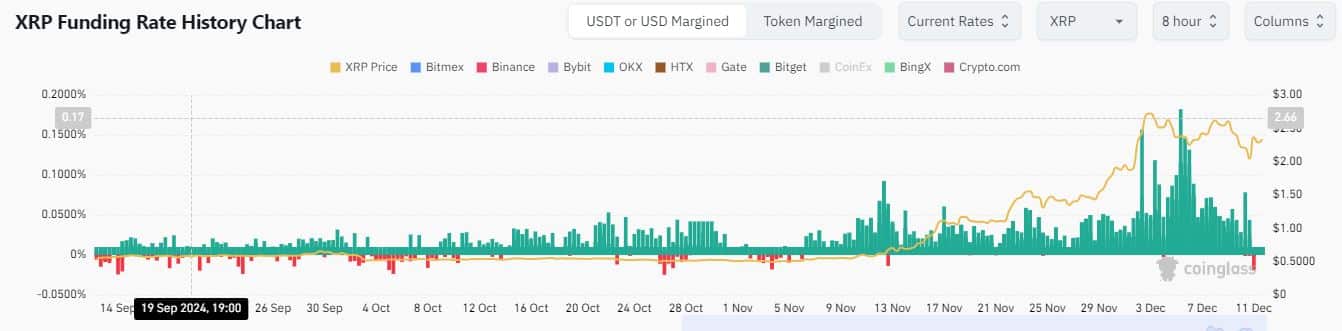

What about the situation in the derivatives segment? Well, according to Coinglass, XRP registered a spike in negative funding rates on 11 December. A sign that there was a surge in short sellers with the rising bearish expectations.

The negative funding rates emerged after days of declining positive funding rates. This was a sign that the previous robust demand has been cooling down.

Read Ripple [XRP] Price Prediction 2024-2025

These observations along with the escalating spot flows indicate growing possibility that XRP could continue its descent.

However, traders should keep an eye out for potential changes including demand-inducing events that could aid XRP bulls. Extreme volatility is expected along the way as was the case on Tuesday due to liquidations.