Bitcoin: THIS group starts selling BTC – Troubling times ahead?

- A notable shift is occurring among BTC holders, signaling potential changes in market dynamics.

- Bid-ask imbalances suggested that selling pressure prevailed, which could potentially trigger a downturn.

Bitcoin’s [BTC] profitability has waned following the recent market correction, with its gains now reduced. As of the latest data, BTC has posted a 19.86% increase.

Despite a modest 0.37% price increase, there is lingering skepticism about whether BTC can sustain these gains, as selling activity continues to weigh on the market.

Long-term holders begin selling Bitcoin

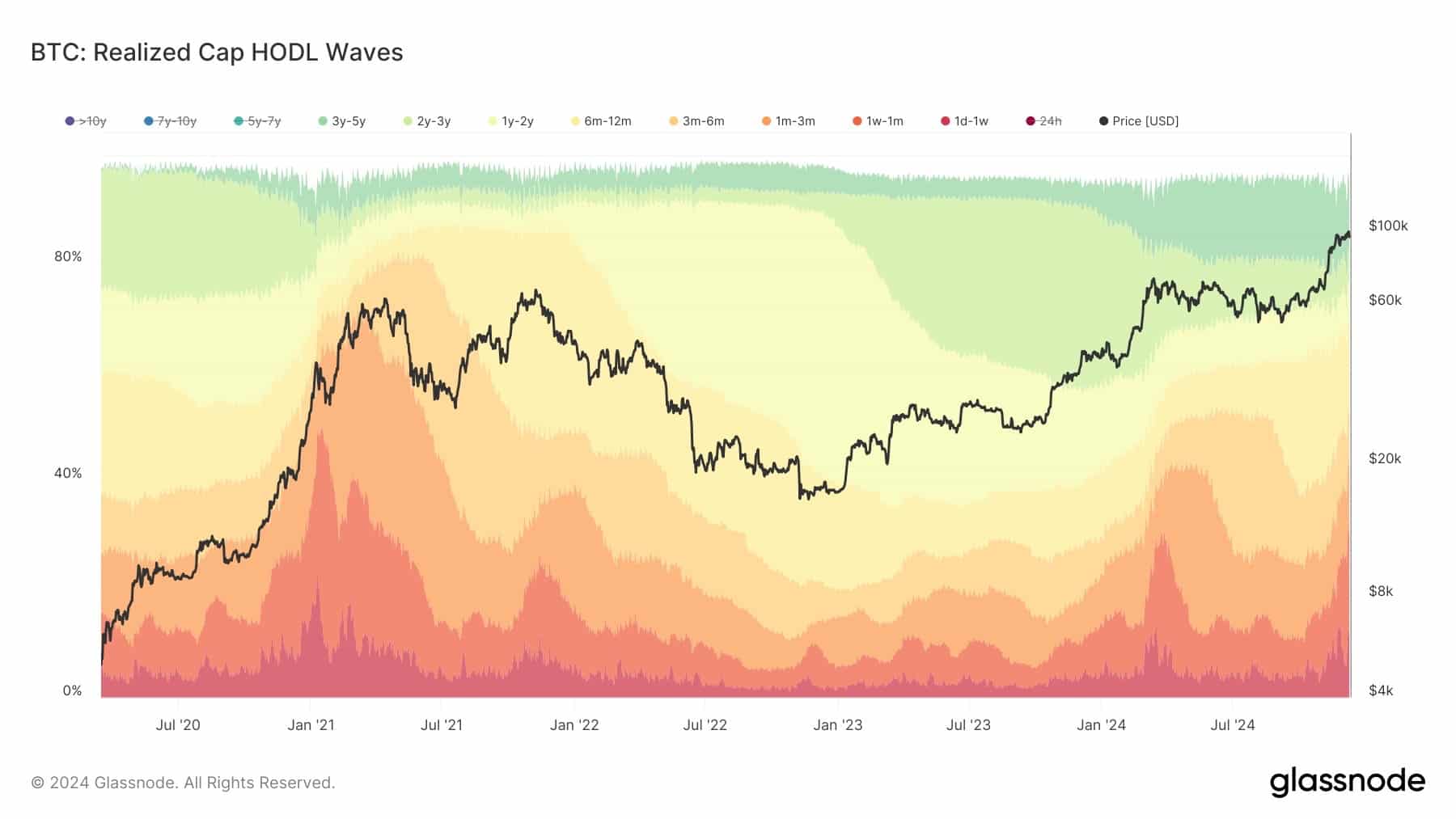

Data from Glassnode revealed that long-term holders of Bitcoin have been engaging in profit-taking activities, except “Ultra Long-Term Holders,” who have held their BTC for more than seven years.

Long-term holders are defined as addresses that have held BTC for over six months (180 days).

As of the latest data, the proportion of BTC held by this cohort has dropped by approximately 10%, decreasing from over 60% to around 50%.

The changing distribution of BTC ownership is shaping the market’s progression. Typically, during early stages, long-term and ultra-long-term holders control a large share of BTC.

However, as selling pressure increases, this balance shifts.

This shift is currently empowering short-term holders with greater influence in the market.

However, until short-term holders account for 70-80% of the market, which has not yet occurred, the market remains in its early to mid-range phase.

During the peak of the last bull run, the distribution of BTC between short-term and long-term holders was approximately 20% to 80%, respectively.

In contrast, current data from Coinglass shows a more balanced market, with both sides holding around 50%.

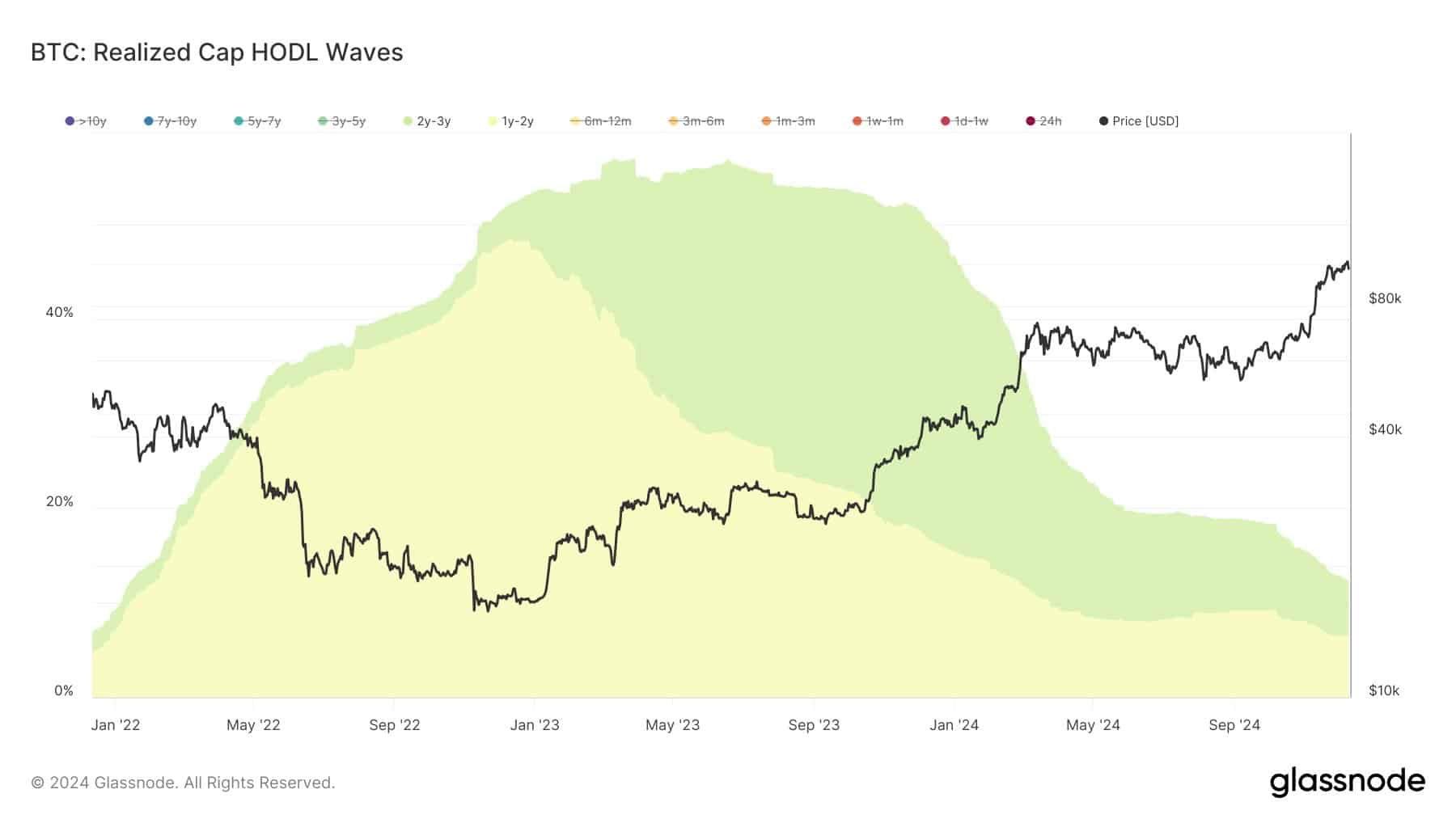

Long-term holders losing interest in BTC

Long-term holders of Bitcoin are losing interest at a faster rate than anticipated.

This trend has been observed across distinct cohorts of long-term holders: those who have held BTC for 1–2 years, 2–3 years, and 3–5 years, particularly after accumulating during the bear market between June and November.

These cohorts have begun significantly downsizing their holdings, as indicated by the recent trends in the market chart.

Specifically, the 3-5 year cohort, which peaked at 15.3%, has since decreased to 13.9%. If selling pressure intensifies, BTC could see further declines.

Unlike previous market cycles, the introduction of Bitcoin spot ETFs has added a new dynamic to the market.

Institutional investors, who have been accumulating BTC over the past months, are now starting to sell, with their holdings dropping from 25% to 16%.

However, there is still potential for a market rally. Since long-term holders have not yet sold in large quantities, it suggests they may be waiting for prices to rise further before taking profits.

Low demand for BTC puts pressure on price

Recent data from Hyblock shows a 50% bid imbalance in 1-2% of the order book depth, as indicated by vertical dots on the chart.

This imbalance suggests the market is currently in a sell phase, characterized by low demand (fewer buyers) and high supply (more sellers), which puts downward pressure on Bitcoin’s price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Simultaneously, data from CryptoQuant reveals an increase in the amount of BTC available on exchanges, with approximately 22,289 BTC being deposited.

This has caused a gradual rise in Exchange Netflow, further contributing to the growing supply of BTC on exchanges.