Will Aave’s 21% surge in 24 hours help the altcoin stay bullish?

- Aave’s Total Value Locked has recently hit an ATH.

- Its token saw strong liquidity inflows and bullish technical trends.

Aave [AAVE] continues to assert its dominance in the decentralized finance lending sector, holding a 45% market share.

This unrivaled position reflects growing confidence in Aave’s platform as its Total Value Locked and token price show a strong uptrend.

Aave’s market share reflected in TVL surge

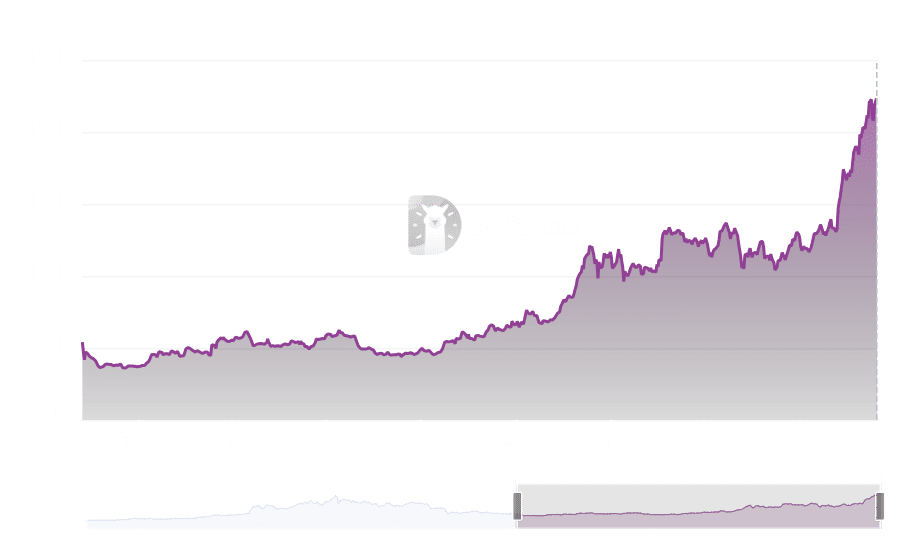

Data from DeFiLlama highlighted a remarkable surge in Aave’s Total Value Locked, which stood at over $21 billion.

This represented a significant portion of the total lending market value, further cementing Aave’s position as the leader in decentralized finance.

The platform’s dominance, nearing 45%, underscores its critical role in the ecosystem and demonstrates its superiority over competing platforms.

A closer examination of Aave’s TVL trend over the past year revealed consistent upward growth, particularly since the beginning of 2024. The analysis showed that the current TVL is the highest in its history.

The recent surge coincides with increased liquidity inflows, driven by both institutional and retail interest in decentralized lending protocols.

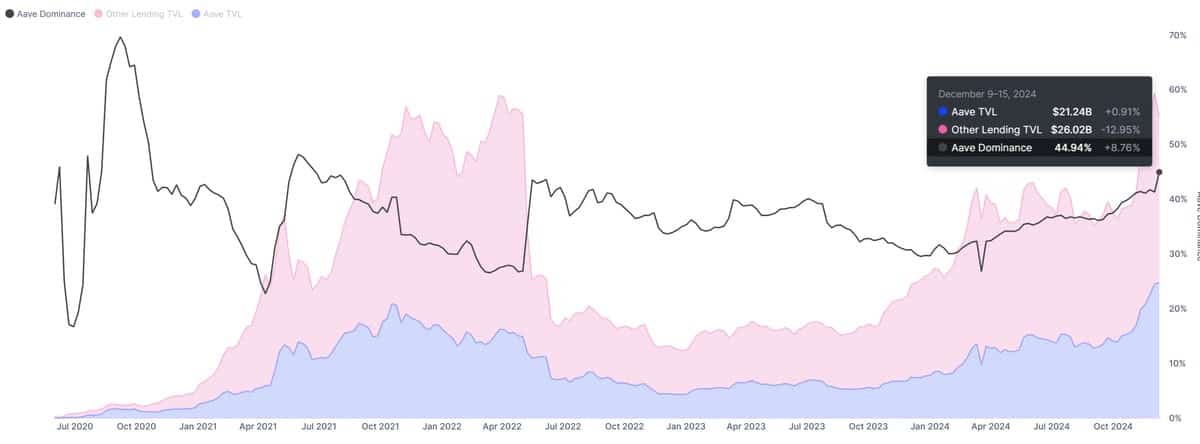

The dominance chart, from IntoTheBlock, illustrates Aave’s stability and resilience in maintaining its leading position.

While other lending platforms have experienced fluctuations, Aave has shown steady growth, recently recording a notable increase in dominance over the past quarter.

These developments further solidify its status as the preferred choice for decentralized borrowing and lending.

AAVE price analysis: Bulls in control

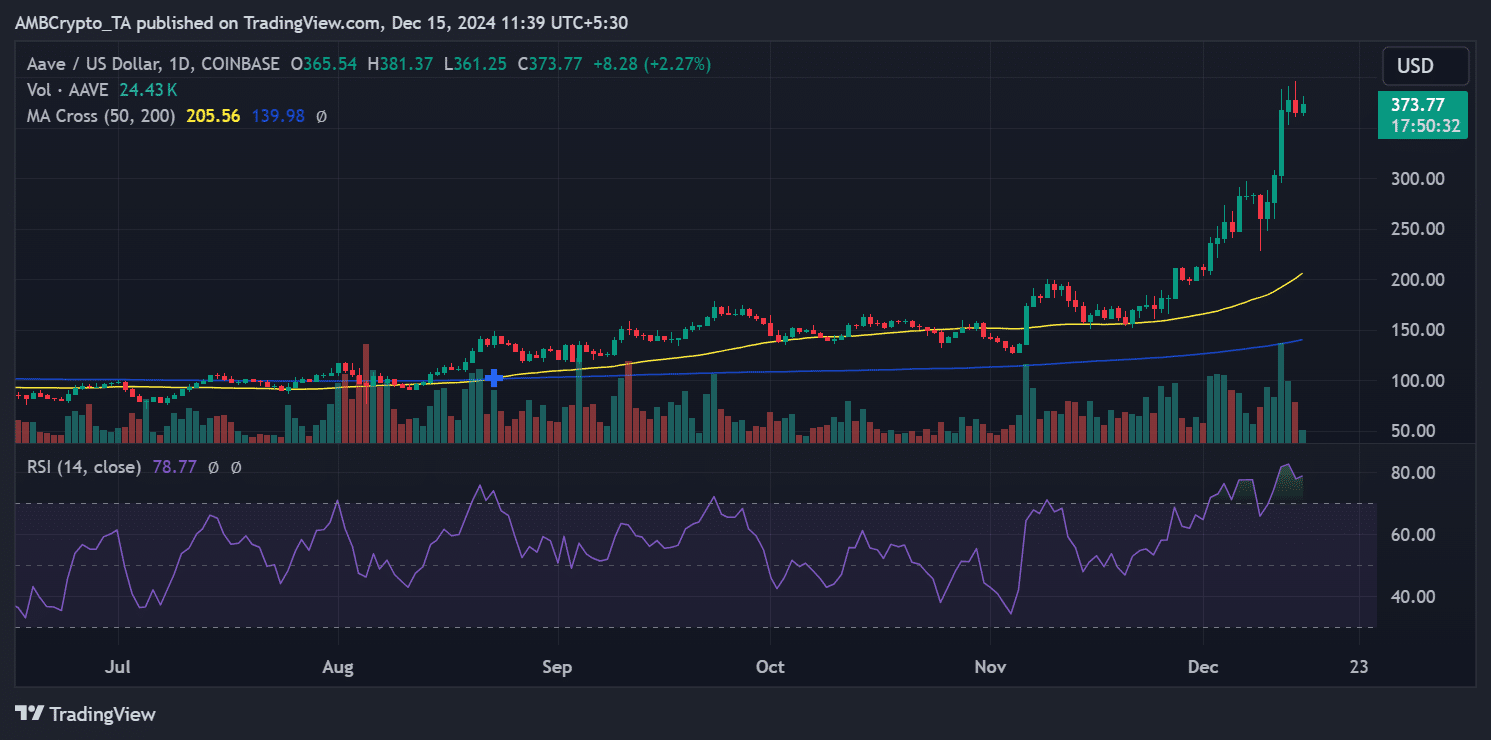

AAVE’s price has reflected the surge in Total Value Locked. Current data from TradingView shows the token trading at $373.77, marking a significant upward trend in the last few days.

Further analysis showed a 21.20% spike on the 12th of December, kickstarting a bullish trend. This bullish momentum has propelled AAVE to rally sharply since November, breaking key resistance levels.

From a technical perspective, AAVE’s price is supported by long-term bullish trends. The token has remained above the 50-day and 200-day moving averages, reinforcing its upward trajectory.

The Relative Strength Index also sits at elevated levels, reflecting strong investor demand despite overbought conditions.

The sharp increase in trading volumes further validates AAVE’s price breakout, indicating strong buying activity.

If the bullish momentum continues, AAVE may target higher resistance levels, with traders closely watching the psychological milestones at $400 and beyond.

Can it maintain its momentum?

Aave’s dominance in the decentralized lending sector places it in a strong position to capitalize on the growing momentum within the decentralized finance space.

Is your portfolio green? Check out the AAVE Profit Calculator

The rising Total Value Locked and bullish token price performance reflect a promising trajectory that could lead to further records in the coming months.

While overbought conditions in the token price indicate potential short-term corrections, the sustained liquidity inflows and market confidence could support Aave’s continued growth.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)