Bitcoin: Why $148 billion in stablecoin inflows might concern you

- Bitcoin outflows from exchanges peaked at $148 billion when it hit $88K, establishing a strong support base.

- Now, an even more robust base has emerged, a signal you should approach with caution.

With a capped supply of 21 million, Bitcoin’s [BTC] market cap has soared past $2 trillion, with each BTC valued at $102,383 at the time of writing. Clearly. the stakes have never been higher.

While Bitcoin still trails traditional 20th-century assets with $450 trillion tied up in bonds and real estate, the king coin’s rapid jump from $67K to $102K in just 40 days signals a future that’s hard to ignore.

But, as is often the case with fast gains, the short-term outlook for Bitcoin is far from certain.

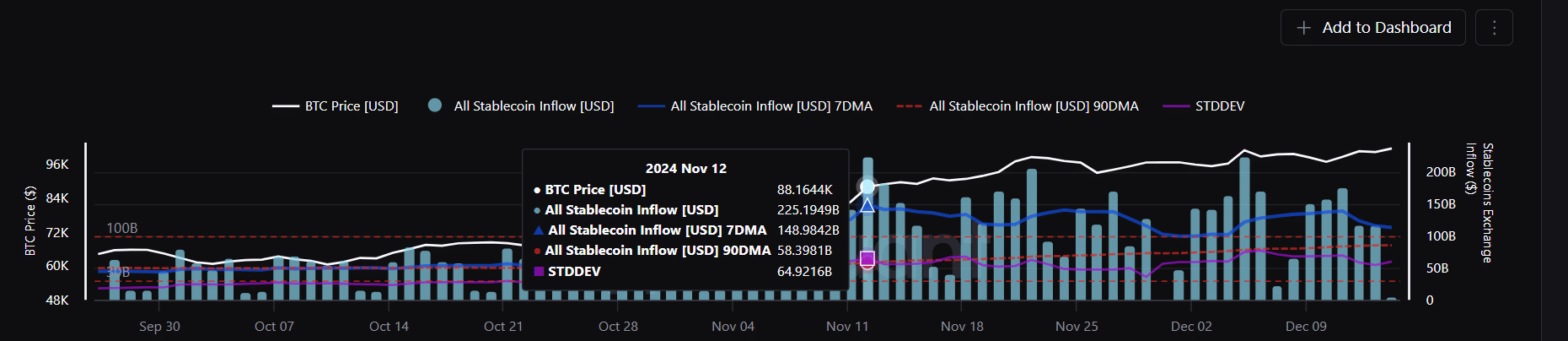

With $148 billion in stablecoins flooding the market at the $88K mark, these investors have already bagged a 15% profit, making this price point look like a golden entry.

As history shows, the temptation to cash out at a significant gain could be too strong to resist. This creates a high-stakes situation, putting investors’ risk appetite to the test as the market braces for potential sell-offs.

Massive stablecoin influx could be a warning signal

Typically, when stablecoins flood into exchanges, it signals a bullish outlook. Investors are positioning themselves to buy Bitcoin once market volatility settles.

This trend became particularly clear during the election, when the “Trump pump” brought in massive liquidity, with $2 billion worth of USDT minted.

Economically, the influx of stablecoins was directly tied to a surge in Bitcoin demand, pushing its price to $88K in under a week.

The demand for BTC peaked at this price point, with $148 billion in stablecoins, especially ERC-20 tokens, flooding into exchanges.

Clearly, investors were confident that BTC would breach $100K, at least before the election pump runs its course.

This brings us to some compelling insights: First, these investors are comfortably “in-the-money,” poised to either HODL or cash out at a profit.

Second, with the election pump losing steam, the market desperately needs a fresh catalyst to keep these holders from hitting the sell button.

And third, if selling does kick off, the big question is whether the market has the strength to absorb the pressure.

Despite December being well underway, BTC has yet to post a new all-time high, a milestone briefly reached over a week ago when it hit $104K.

Since then, it’s been in a holding pattern, leaving market watchers divided on its next move.

Are Bitcoin investors losing their risk appetite?

The $88K mark has clearly proven to be an attractive entry point. This was also demonstrated when Bitcoin dropped just over 5% to $90K, four days after testing the $99K level for the first time.

But before it could dip further, a 4% rebound the next day quickly brought it back into the green. Since then, bears have tried twice to push Bitcoin back to that level, but each attempt has failed.

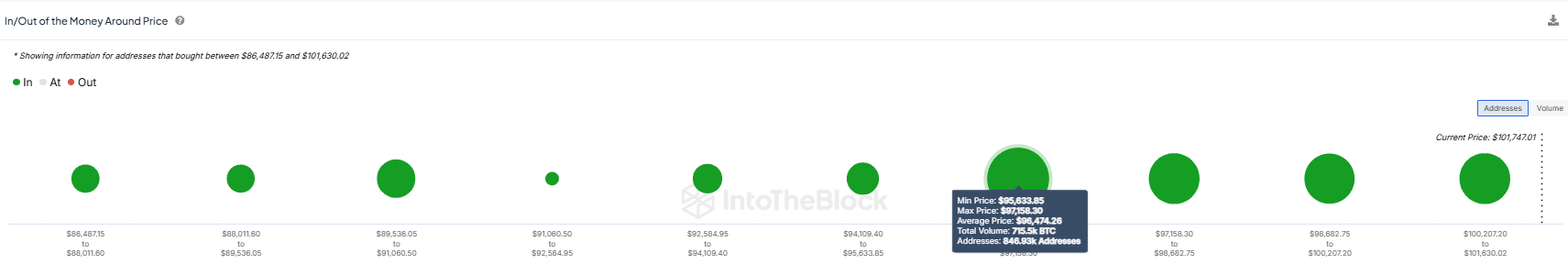

As a result, a new bottom has formed between $94K and $96K.

Why is this important? The chart above shows a significant surge in stablecoin inflows, with $131 billion flowing into exchanges at this price point.

Even more telling, over 840K addresses – marking the highest number of holders at this level – acquired a total of 715.5K BTC.

This creates a strong support base between $94K and $96K, making it critical for BTC to hold above this range if you’re “long” on it.

On the one hand, the data suggests that institutional players are stepping in to absorb the selling pressure.

However, there’s a shift happening: investor greed is on the decline. As BTC’s price climbs, many are becoming more cautious, seeing the price as too high to jump in.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This hesitation signals that retail investors may be waiting for a dip before deciding to enter the market. Interestingly, the stablecoin market points to the $96K level as an attractive entry point.

This could be something to keep an eye on in the coming days.