Bitcoin vs Gold: Peter Brandt predicts BTC will outperform gold by 122%

- BTC could outperform gold by an extra 122%.

- The market’s expectation of a US BTC reserve jumped by 10 points.

Bitcoin [BTC] has outperformed gold since November as an analyst expects an extra 122% rally against the global reserve asset.

According to renowned technical chartist and trader, Peter Brandt, one might soon need 89 ounces of gold to buy 1 single BTC coin.

Brandt’s projection was based on the bullish cup and handle formation on the BTC/gold ratio chart.

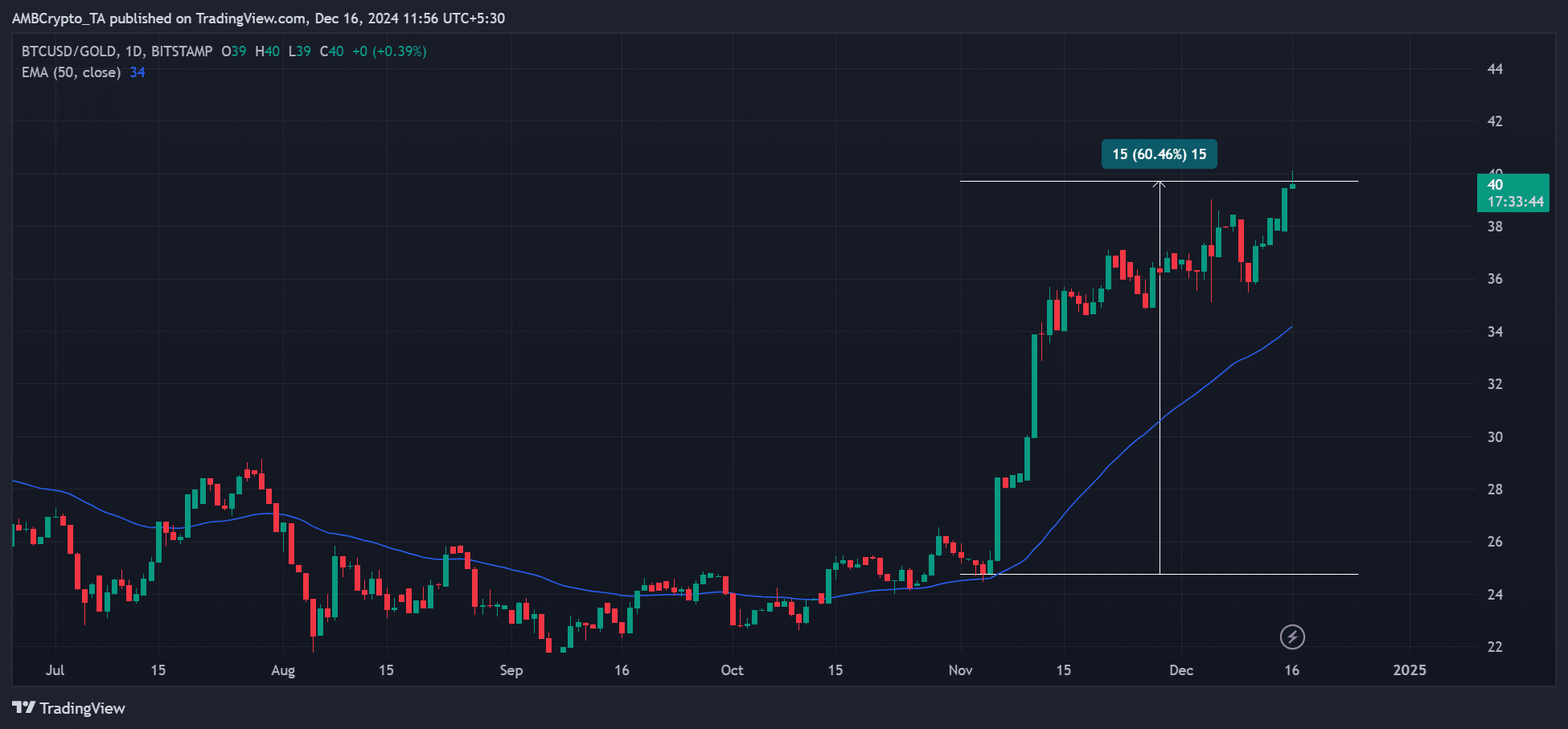

For context, the BTC/gold ratio tracks the relative performance of BTC against gold. It recently hit a new high of 39 and broke above resistance, which could make the bullish 89 target possible.

BTC: Next global reserve?

Since November, BTC has outperformed gold by 60%, with the BTC/GLD ratio soaring from 25 to 40. The remarkable BTC performance was accelerated by pro-crypto Donald Trump’s win in the US presidential elections.

One of the upcoming administration pledges was to set up a national BTC reserve and most market insiders believe this could happen on day 1.

According to Strike CEO Jack Mallers, the president-elect was exploring a ‘day 1 executive order for a BTC reserve.’

This could accelerate Brandt’s breakout projection of 89 for the BTC/gold. This implied about 230K per BTC if hit.

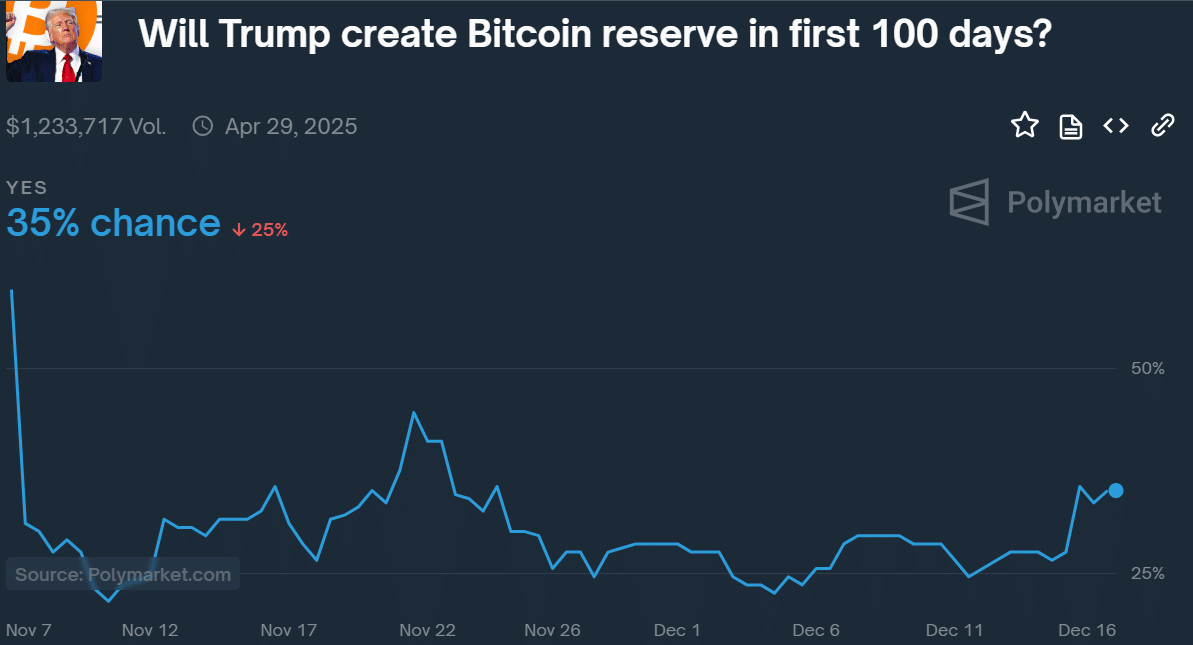

At press time, prediction markets were pricing a 35% chance of Donald Trump creating a BTC reserve within the first 100 days of his administration.

This was a 10% jump from last week’s odds, suggesting the market was increasingly optimistic of such an outcome. If created, BTC could aggressively compete with gold as a global reserve asset.

Whether Brandt’s $230K per BTC target will be hit this cycle remains to be seen. But most asset managers had a $150K-$200K price target for this cycle.

In the meantime, BTC hit a new all-time high of $106.6K and was valued at $105K ahead of the Fed rate decision on the 18th of December.