XRP whale moves hint at supply squeeze: Is $4 next?

- Recent data showed a significant outflow of XRP by whales from one of the top exchanges.

- Market sentiment was bullish, with expectations that XRP could reach $4 before establishing a new trading range.

Over the past month, XRP experienced a remarkable rally, recording a 148.54% increase in price. However, its momentum has slowed, entering what appears to be an accumulation phase.

This period of consolidation has contributed to a more subdued price trend, resulting in weekly losses of 2.43% and a daily dip of 0.93%.

Analysis by AMBCrypto highlighted the possibility of a price recovery, but there was a possibility that the process may face delays, depending on market conditions.

Whales trigger market-shifting moves in XRP

According to Whale Alert, XRP has seen a significant outflow from Binance, one of the largest cryptocurrency exchanges, over the past 24 hours.

Tracking data showed that 800,000 XRP, valued at $1,927,321,529 at the time of recording, was moved out of the exchange.

Large-scale outflows like this often points to a bullish market sentiment.

Investors transferring sizeable holdings from exchanges to private wallets typically indicate a preference for holding rather than selling, as private wallets are less commonly used for trading.

This trend suggests that whales are positioning themselves for potential long-term gains.

If such outflows persist, they could lead to a supply squeeze, reducing the liquidity of XRP on exchanges and potentially driving up its price.

XRP remains in an accumulation phase, with its price oscillating within a defined range over the past weeks.

XRP could reach $4 after accumulation

The recent whale-driven supply squeeze shows the possibility of a breakout from this phase. Should a breakout occur, XRP could climb by 66.44%, reaching approximately $4.

This accumulation phase in technical term is known as a symmetrical triangle, which involves trading back and forth, within a converging support and resistance.

If a breakout does not materialize, XRP is likely to remain in the accumulation phase, trading sideways without significant price movements, notable gains, or substantial losses until the phase concludes.

AMBCrypto analyzed the market sentiment around a potential bullish move, finding a mixed reaction among investors regarding XRP’s near-term trajectory.

XRP market shows contradictory signals

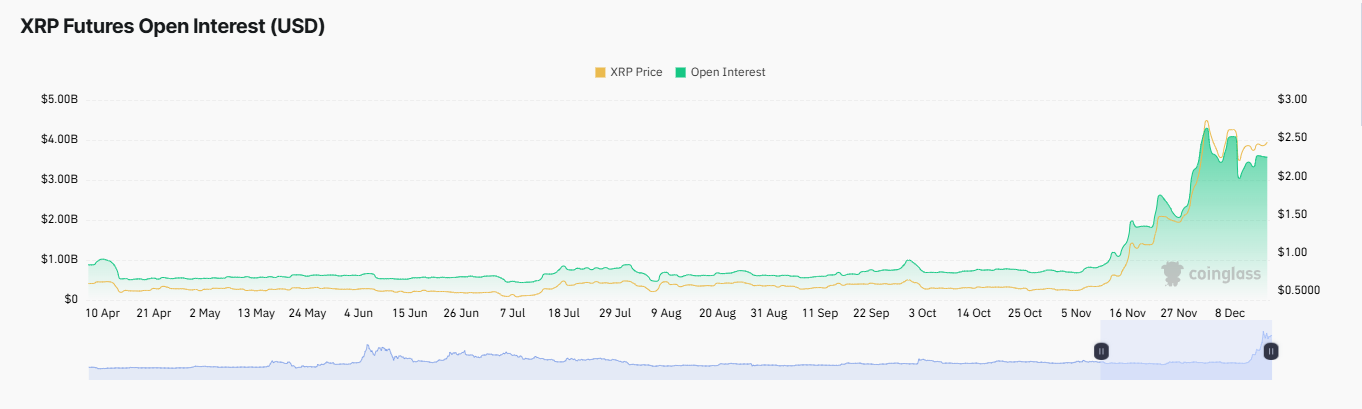

At the time of writing, XRP’s Open Interest (OI) has dropped by 2.35% over the last 24 hours, standing at $0.35 billion.

A gradual decline in Open Interest means that the value of short positions outweighs long positions in the market, suggesting lingering downward pressure on the asset.

Read XRP’s Price Prediction 2024–2025

However, the Funding Rate offers a glimmer of optimism as it remains in the bullish territory with a positive reading of 0.0102% over the same period.

While the bullish Funding Rate aligns with the current positive sentiment, a reversal in Open Interest trends would be necessary to solidify a clear market direction for XRP.