How can BNB traders benefit from its short-term price swings?

- BNB flipped its long-term trendline resistance into support

- Derivatives data revealed a bullish edge as the price consolidated above its key EMAs

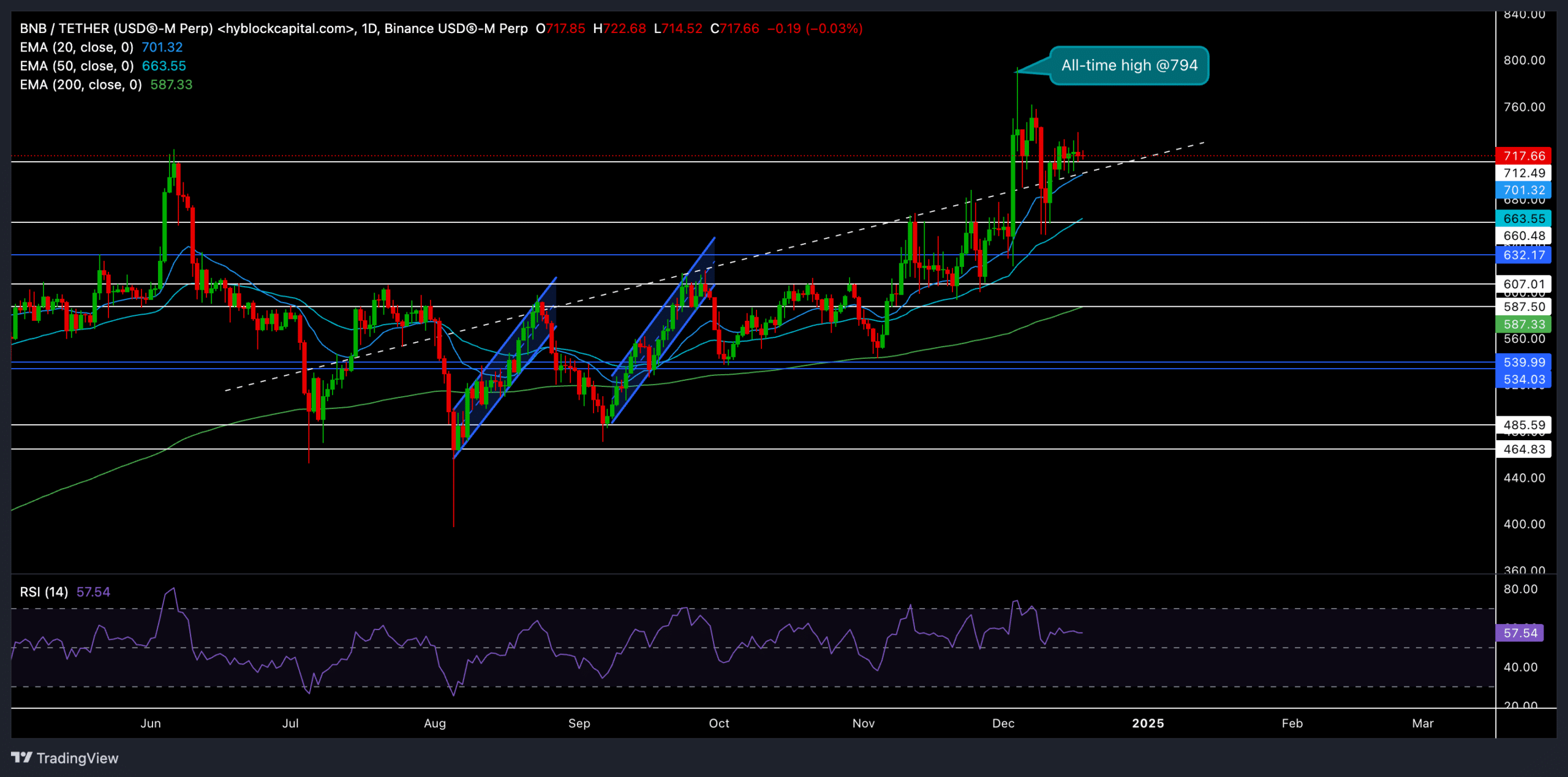

After snapping off its long-term trendline resistance, Binance Coin [BNB] found a new all-time high (ATH) at $794 on 4 December. This surge was fueled by broader bullish sentiment in the crypto market, mainly Bitcoin’s [BTC] recent HIKE.

At the time of writing, BNB was trading at $715.86, consolidating near its critical support zones.

BNB consolidates at key support

BNB’s price action on the daily chart reflected strong bullish resilience as it maintained levels above its 20-day, 50-day, and 200-day EMAs. However, after touching its new ATH recently, the price action consolidated over the last few days.

A decisive close below the $712 support may expose BNB to a pullback towards the 50-day EMA at $663, which could act as strong dynamic support.

The Relative Strength Index (RSI) stood at 57, well below the overbought zone. This suggested room for further upside should broader market sentiment favor the bulls.

The $712 support level now stood as a key near-term support. If bulls defend this level, a potential retest of the $750–$760 resistance zone could follow. A close above this zone could put BNB into a price discovery phase.

Derivatives data suggests bullish sentiment

BNB’s derivatives market data reflected growing trader interest. Volume rose by 70.85% to $1.7 billion, showing much more activity after the recent uptrend. Open Interest also increased by 2.89% to $950.9 million, indicating that new positions are entering the market. Here, it’s worth noting that Options Open Interest also jumped by 62.49%.

Interestingly, the long/short ratio (over the last 24 hours) was at 0.8882, suggesting a slightly cautious sentiment overall. However, traders on Binance have been feeling quite optimistic, as reflected in their long/short ratio of 3.3085. Plus, top traders held onto a strong long bias with a ratio of around 2.4.

BNB’s consolidation near the critical support indicated a potential rebound opportunity for bulls. While the broader market sentiment, particularly BTC’s trajectory, will remain crucial, traders can look for a rebound from its near-term EMAs to gauge a sustained uptrend.

On the other hand, dropping below $712 could invalidate the bullish setup and provoke a retest of the 50-day EMA.

Traders should closely monitor Bitcoin’s momentum and BNB’s price action around key levels before making trading decisions.