Chainlink: Will $17M whale activity help LINK test $25 resistance?

- Whale withdrawals and resistance tests highlighted Chainlink’s pivotal position at $24–$25.

- Mixed on-chain metrics and declining exchange reserves suggested reduced selling pressure but uncertain momentum.

Over the past week, whale activity has stirred the Chainlink [LINK] market, as a whale withdrew 594,998 LINK, valued at $17.31M, from Binance, including a recent 65,000 LINK withdrawal worth $1.81M.

This development has left traders speculating—are these moves indicative of long-term confidence or preparation for significant market activity? At press time, LINK trades at $24.63, reflecting a 9.11% decline in the past 24 hours.

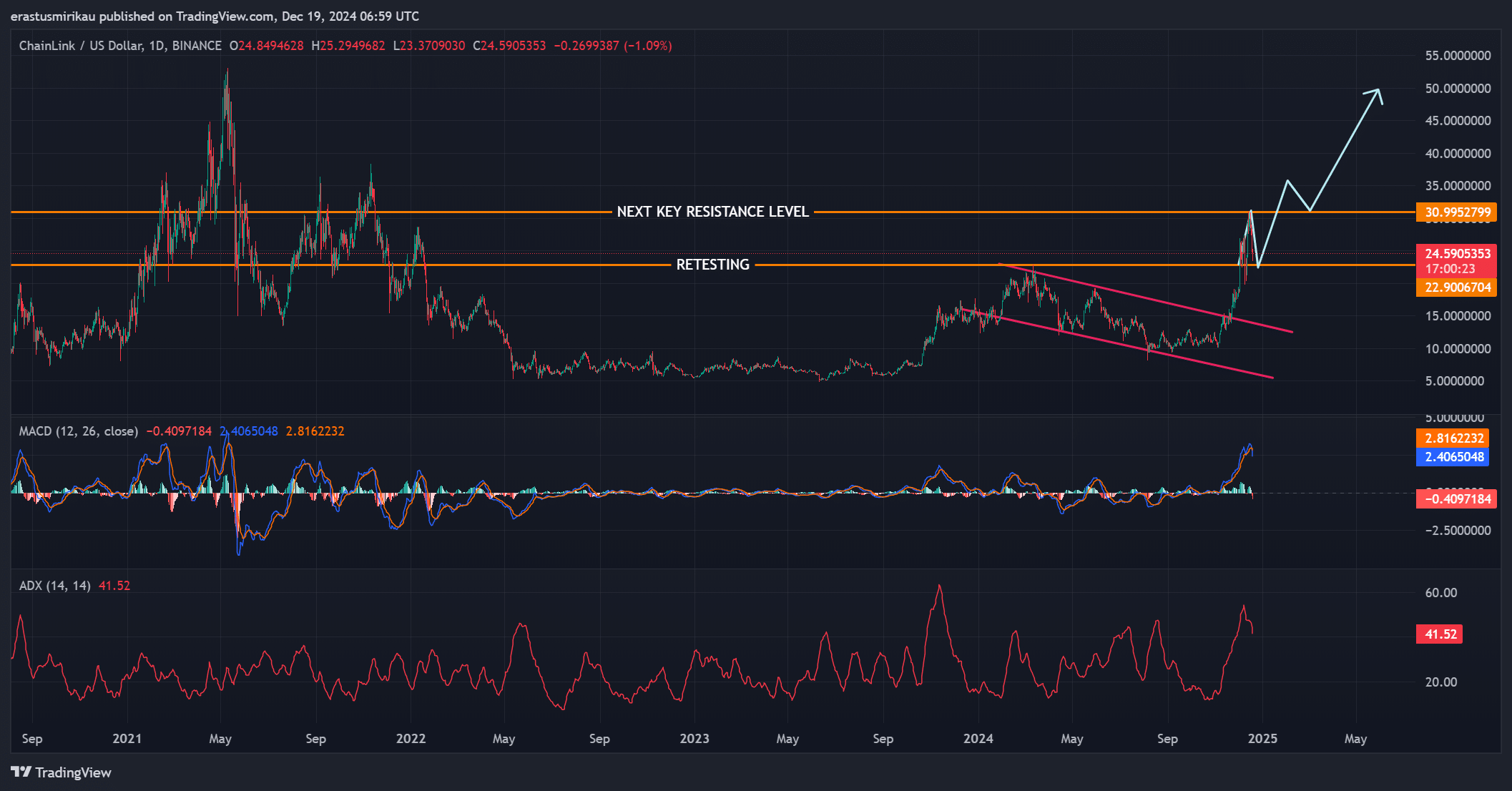

Analyzing price momentum and resistance levels

At the time of writing, Chainlink was testing a crucial resistance zone between $24–$25, a level that has acted as a significant barrier in previous rallies. The MACD suggests that bullish momentum persists, though it appears to be losing strength.

Additionally, the ADX value of 41.52 highlights the strength of the current trend. If LINK can decisively break through this resistance, the next target is $30.99, a key psychological and technical level.

However, failure to maintain this momentum could result in a pullback toward $22, a zone of strong support.

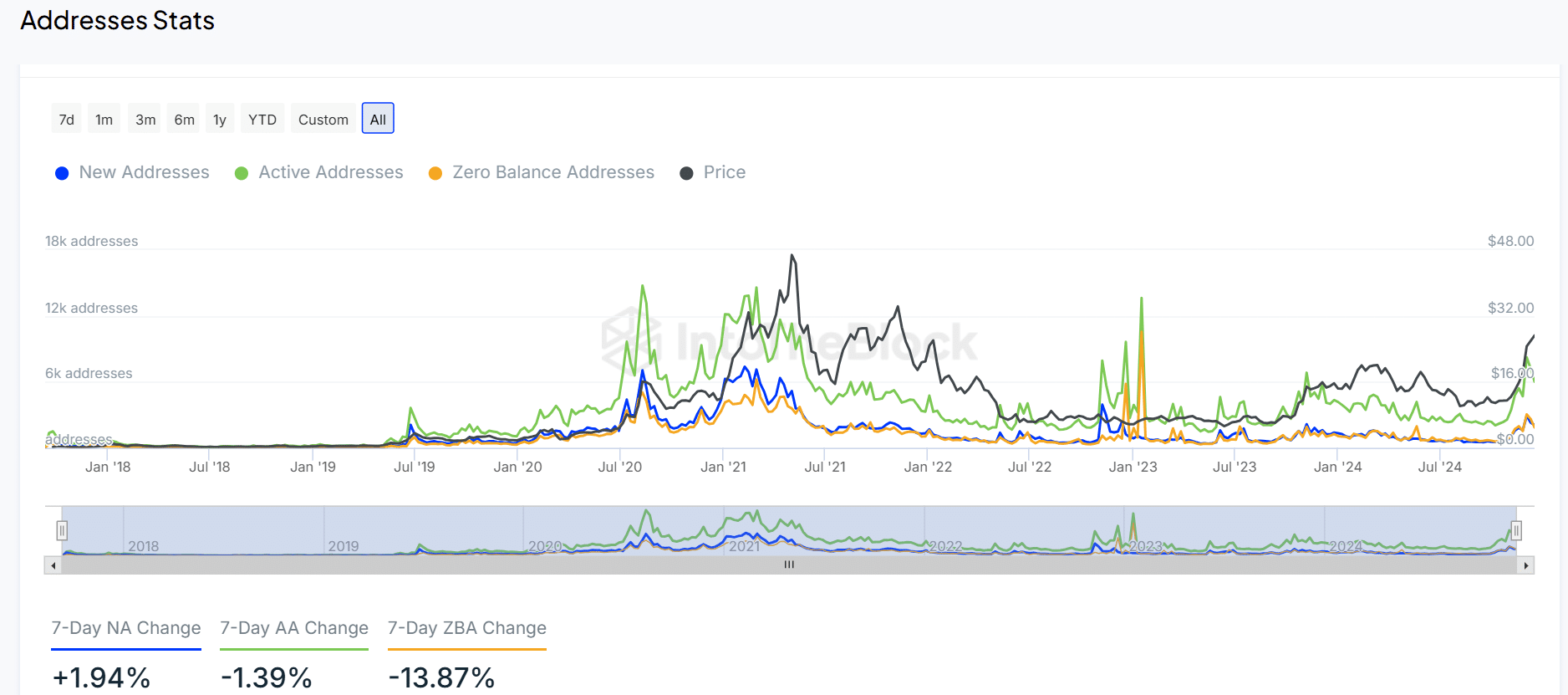

LINK address activity reveals mixed trends

On-chain metrics show contrasting trends in LINK’s address activity. New addresses have increased by 1.94%, indicating fresh interest. However, active addresses have fallen by 1.39%, suggesting slightly reduced engagement.

Additionally, zero-balance addresses have dropped significantly by 13.87%. This shift of LINK holdings to wallets indicates confidence among long-term holders. These mixed signals reveal growing interest but also highlight uncertainties about the asset’s short-term trajectory.

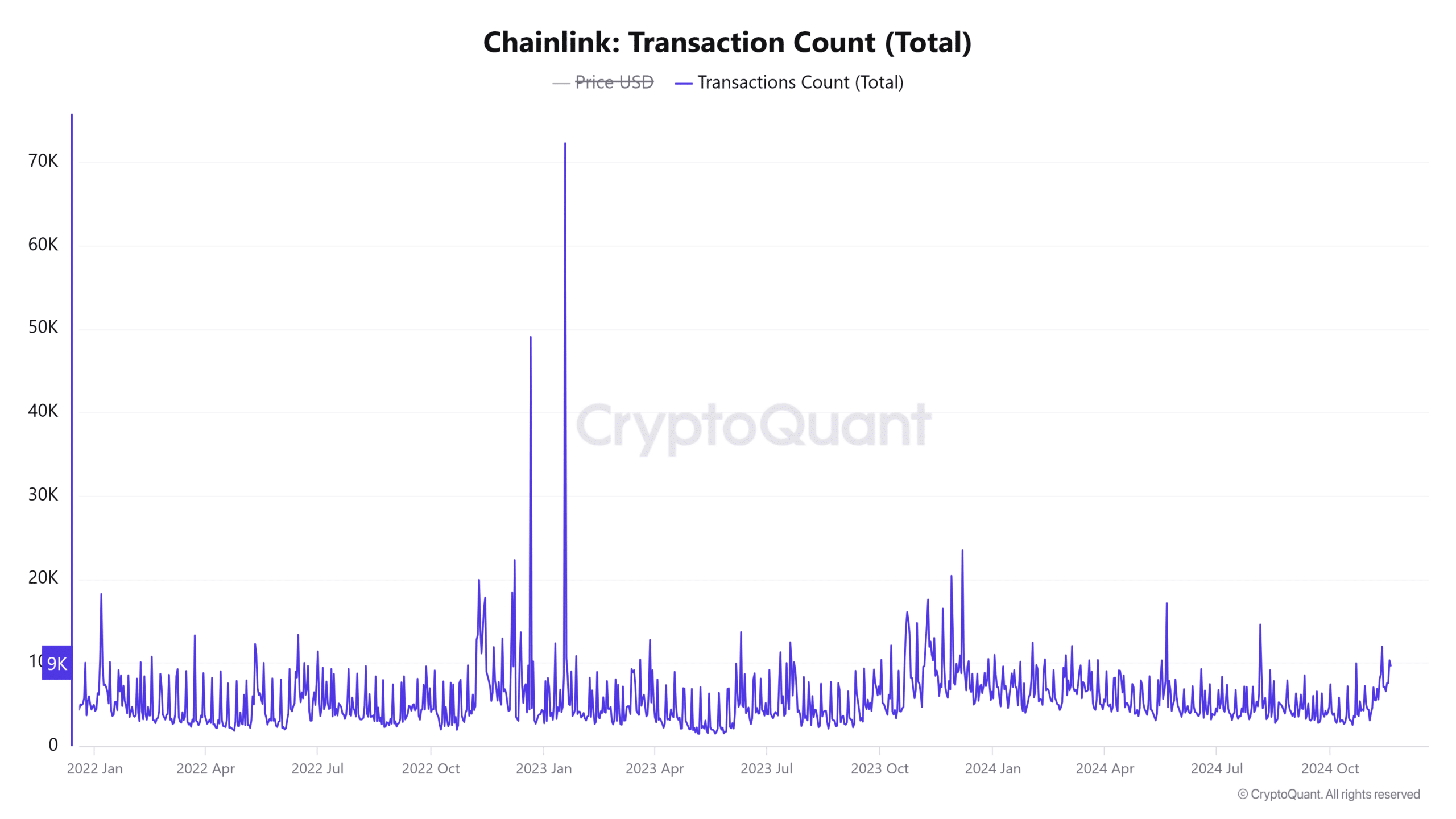

Transaction count reflects growing market activity

Transaction activity has seen steady growth, further reinforcing the narrative of increased market engagement. Over the past 24 hours, the transaction count rose by 0.69%, reaching 12.11K transactions. This uptick points to a growing number of participants actively adjusting their positions.

Whether these movements are in response to the whale withdrawals or the broader market environment remains unclear. However, the rise in transaction volume suggests a market preparing for potentially significant price action.

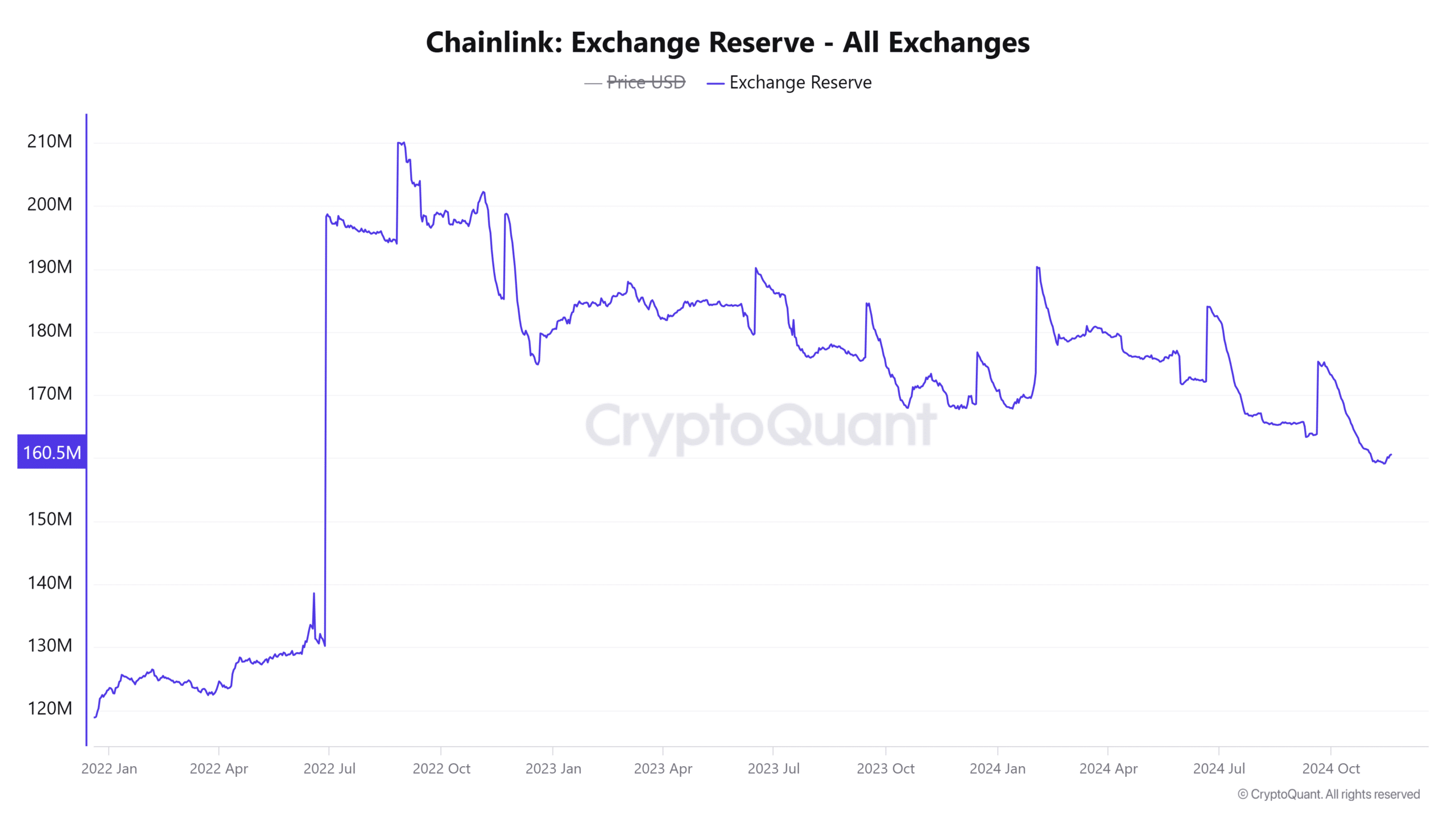

LINK exchange reserves show lower selling pressure

Exchange reserves for LINK have declined slightly by 0.17% over the past week, now standing at 163.1489M LINK. This drop aligns with whale withdrawals and suggests a reduction in immediate selling pressure as large quantities of LINK move off exchanges.

Reduced reserves often signal stronger holder sentiment, as coins exiting exchanges typically indicate long-term storage. This trend supports bullish sentiment but leaves room for caution as liquidity diminishes.

Is your portfolio green? Check out the LINK Profit Calculator

The recent whale withdrawals and price resistance tests place Chainlink in a decisive position. If LINK can sustain its momentum and break through the critical resistance zone, a bullish breakout is highly probable.

However, should momentum falter, a retracement toward lower support levels appears inevitable. For now, LINK’s ability to clear the $25 resistance will determine its short-term market direction.