Worldcoin: Can WLD reclaim $4 amid sell-off from Smart DEX whales?

- Smart Dex traders and whales sold Worldcoin at an average price of $3.85.

- If this order holds, WLD could pivot to reverse its recent losses.

Smart DEX traders and whales sold Worldcoin [WLD] at an average price of $3.85. The sales by Smart DEX traders occurred at $3.8 while whales sold at $3.9, indicating a potential profit-taking phase.

After these sales, there was a noticeable lack of substantial buying activity, suggesting traders are cautious. Post-sale, only a few have begun to accumulate again, hinting at divided sentiment towards midterm investment potential.

Currently, at $2.4, investors appear to be taking a wait-and-see approach.

The lack of immediate buying post significant sales suggested a potential for further price dips or consolidation at these levels. If WLD can stabilize or show signs of bullish sentiment, it could attract buyers back.

However, given the recent sell-off by significant players, a careful watch on market response in the short-term would be prudent for Worldcoin traders or investors.

This close could illuminate the direction WLD’s price will take following the withdrawal of Smart DEX traders and whales.

WLD’s price action and prediction

Analysis of the WLD/USDT pair showed an extended downtrend throughout the latter half of 2024. The decline was interrupted by a resistance-turned-support level at $1.50.

WLD declined to the $2.41 order block after a rally from $1.50 to $4, where Smart DEX and whales took profits around the peaks. If the order block holds, WLD could pivot to reverse its recent losses.

The MACD showed potential for a momentum shift, as the histogram shortened in the bearish territory, suggesting a decrease in downward momentum.

Furthermore, WLD tested this support multiple times, indicating sustained buyer interest at this level. If the order block support at $2.41 remains intact, WLD could challenge levels above $4 in the short term.

A successful breach of the $6.01 level could lead to a retest of higher resistance at $9.519, marking a potential bullish phase for WLD in the early months of 2025.

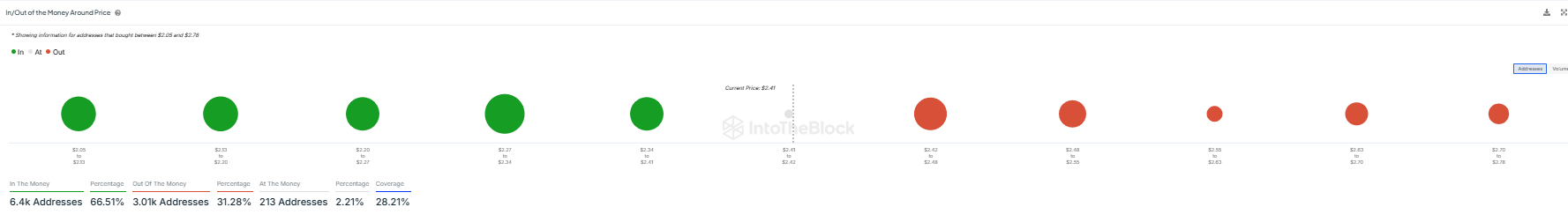

In/Out of the money around the current price

WLD’s profitability around the current price reveals distinct investor positions.

At $2.41, 66.51% of addresses are ‘in the money,’ indicating a potential support level since these holders are profitable. In contrast, 31.28% of addresses are ‘out of the money,’ reflecting unprofitable positions.

If WLD’s price rises, the substantial majority ‘in the money’ could provide a stabilizing effect.

Conversely, resistance could materialize near the upper price points where holders were still at a loss, potentially capping gains.

Realistic or not, here’s WLD market cap in BTC’s terms

This distribution of profitable and unprofitable positions could influence WLD’s price movements in the near term, as holders’ reactions to breakeven points shape the market dynamics.