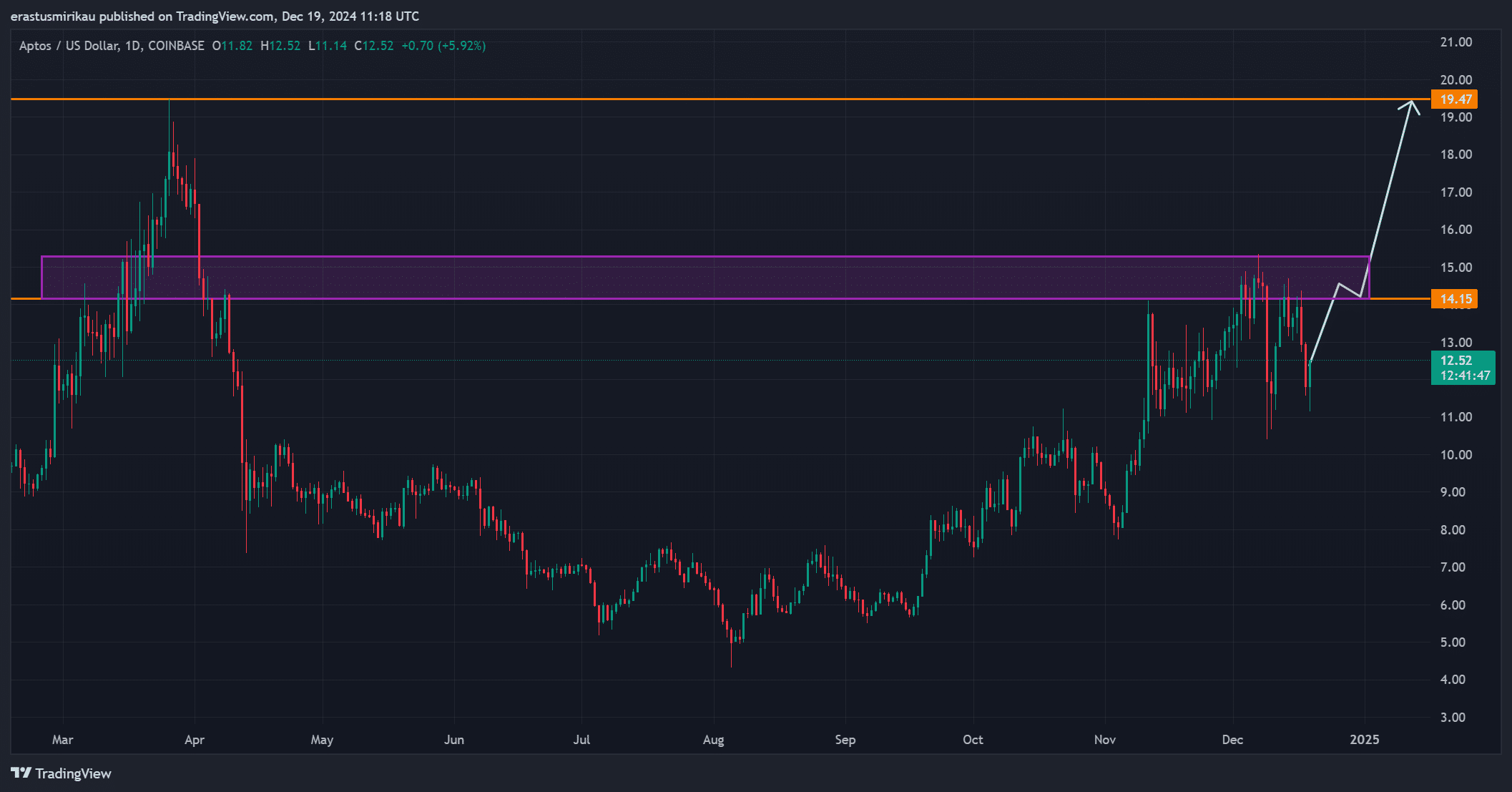

Mapping APT’s road to $19.47 – Here’s what MUST happen!

- Aptos tested critical resistance at $14.15 with Fibonacci levels signaling bullish potential.

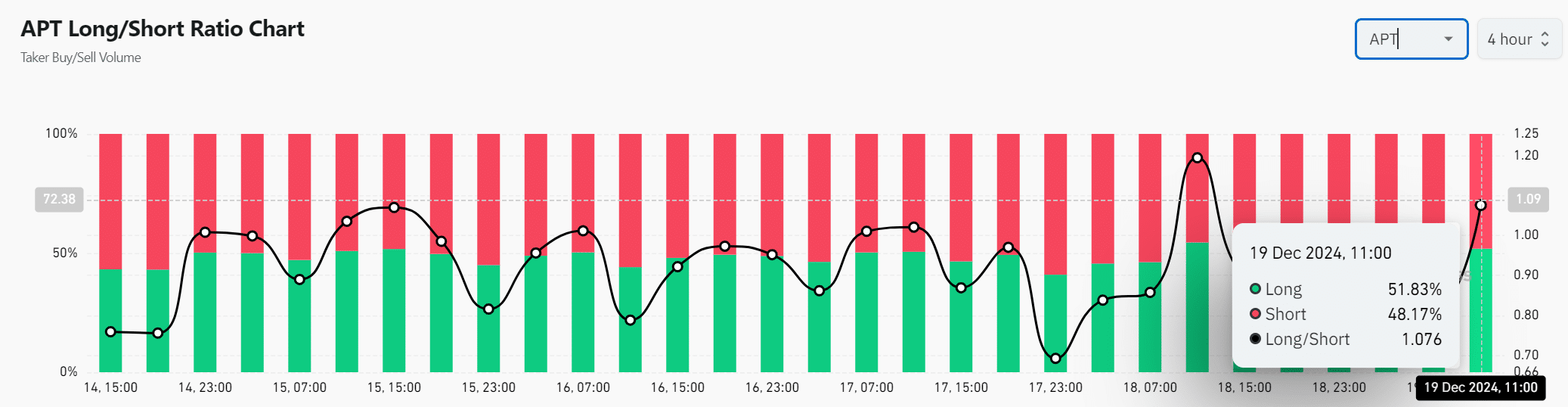

- Market sentiment reflected cautious optimism, with long positions slightly outweighing shorts at 51.83%.

Aptos [APT] has become one of the fastest-growing ecosystems in the blockchain space, experiencing an impressive 7x surge in on-chain activity. Additionally, active users have skyrocketed from 1.3 million to 8.8 million in 2024.

This remarkable growth highlights the network’s growing adoption and utility. However, the question remains: can Aptos maintain this momentum amid rising scalability concerns and market fluctuations?

Aptos’ chart analysis

At press time, Aptos was trading at $12.51, reflecting a 3.23% decline over the past 24 hours. The price recently tested support at $11.14 and is now approaching resistance at $14.15.

If APT breaks above $14.15, it could target $19.47, a significant level from its previous high. Conversely, if it fails to clear resistance, it could consolidate around $11.14, where strong buying interest has previously supported the price.

Fibonacci retracement and ADX trend strength

Fibonacci retracement levels reinforced the importance of $11.14 and $14.15 as critical price levels. Additionally, the ADX indicator stands at 20.73, suggesting weak trend strength.

Therefore, Aptos will require heightened buying pressure to drive a sustained breakout beyond resistance and confirm a bullish trajectory.

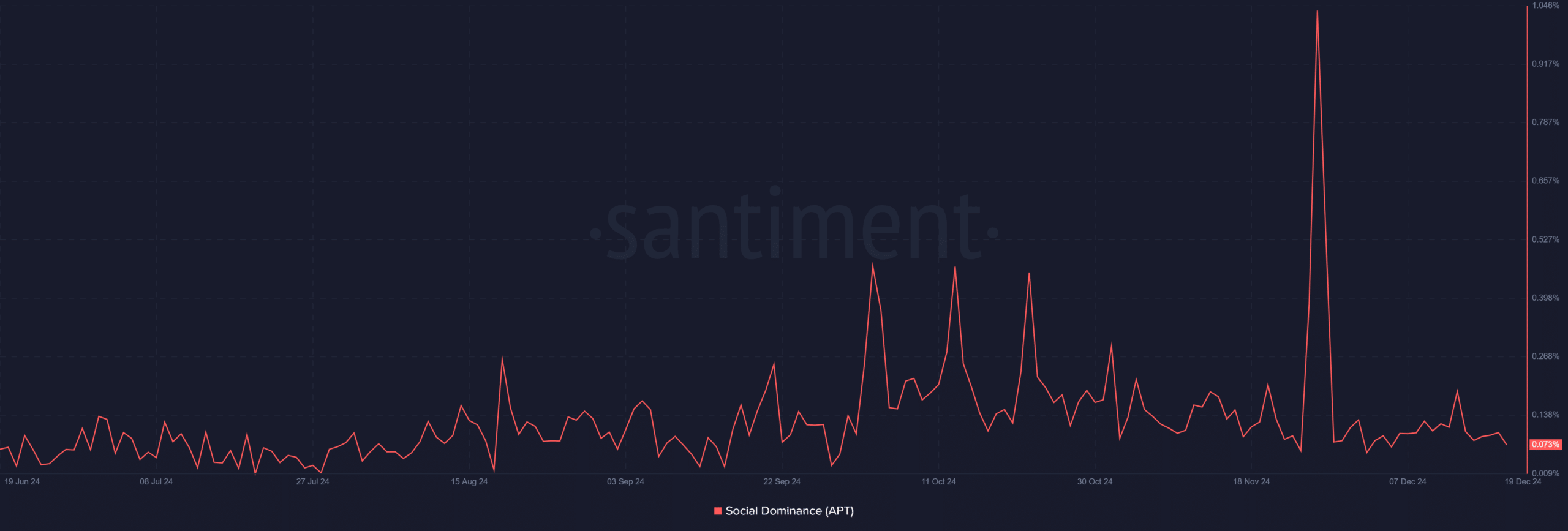

Social dominance signals declining retail interest

Aptos’ social dominance has dropped sharply from 0.1% the previous day, standing at 0.073 at press time. This decline suggests reduced retail buzz and attention, which often correlates with a slowdown in speculative activity.

However, this could also present a quieter accumulation period for long-term investors who remain optimistic about the project’s potential.

Long/Short Ratio and market sentiment reveal cautious optimism

The APT’s Long/Short Ratio shows 51.83% of traders are in long positions, while 48.17% are in short positions. This slightly bullish sentiment reflects cautious optimism in the market. Additionally, Open Interest fell by 10.19%, dropping to $267.45 million.

This decrease signals waning speculative interest, which could limit short-term volatility. However, it also suggests the market is awaiting a decisive move before committing further capital.

Read Aptos’ [APT] Price Prediction 2024–2025

Conclusion: Can Aptos maintain its growth?

Aptos can sustain its growth if it overcomes immediate resistance levels and addresses scalability concerns. With increasing adoption and strong ecosystem utility, the network has the potential to remain a leading player in blockchain technology.

However, its success depends on maintaining market interest and effectively navigating challenges ahead.