Will crypto recover? Why this ‘dip’ could be exactly what the market needs

- Will crypto recover? It’s the burning question as BTC tumbles back to $94K.

- The path ahead could be volatile – but also ripe with opportunity for those willing to hold firm.

Coincidence or not, the FOMC meeting lined up perfectly with Bitcoin [BTC] hitting an all-time high of $108K. A slight ‘blip’ on the macro front was all it took to send shockwaves through the market.

In a matter of days, the gains of the previous week were wiped out, leaving Bitcoin teetering at a critical $93K support level. What seemed like solid profits is now either cashed out at break-even or hanging on to a loss.

Clearly, these HODLers are holding out for a recovery. But to truly understand if crypto can recover, we must look beyond the speculations and explore the past, present, and future of this volatile market.

Key factors distinguishing the past from the present

History has a lot to teach us in the crypto market, and the number ‘four’ seems to hold a special significance. Every fourth year, the market faces a crucial test, with the following three years feeling the ripple effects.

Think back to 2020, when Bitcoin was thrust into the spotlight as the pandemic disrupted traditional investment avenues like bonds, banks, and government yields.

In response, Bitcoin surged nearly 320%, jumping from $10,000 in October 2020 to $42,000 by January 2021. This marked the beginning of a new era for BTC.

Fast forward to today, and Bitcoin has risen by approximately 140% over the past four years. This growth is driven by a ripple effect of factors, including the post-halving surge, election liquidity, and inconsistent macro trends.

But the real game-changer? Institutional capital injecting into BTC. As AMBCrypto notes, this influx will be crucial in the coming months. Not only will it help the crypto market recover, but it could also steer BTC through the volatile path ahead.

However, there’s a downside emerging this year: ‘overleveraging’. Over the past four years, borrowed capital has flooded the market, creating an added layer of risk.

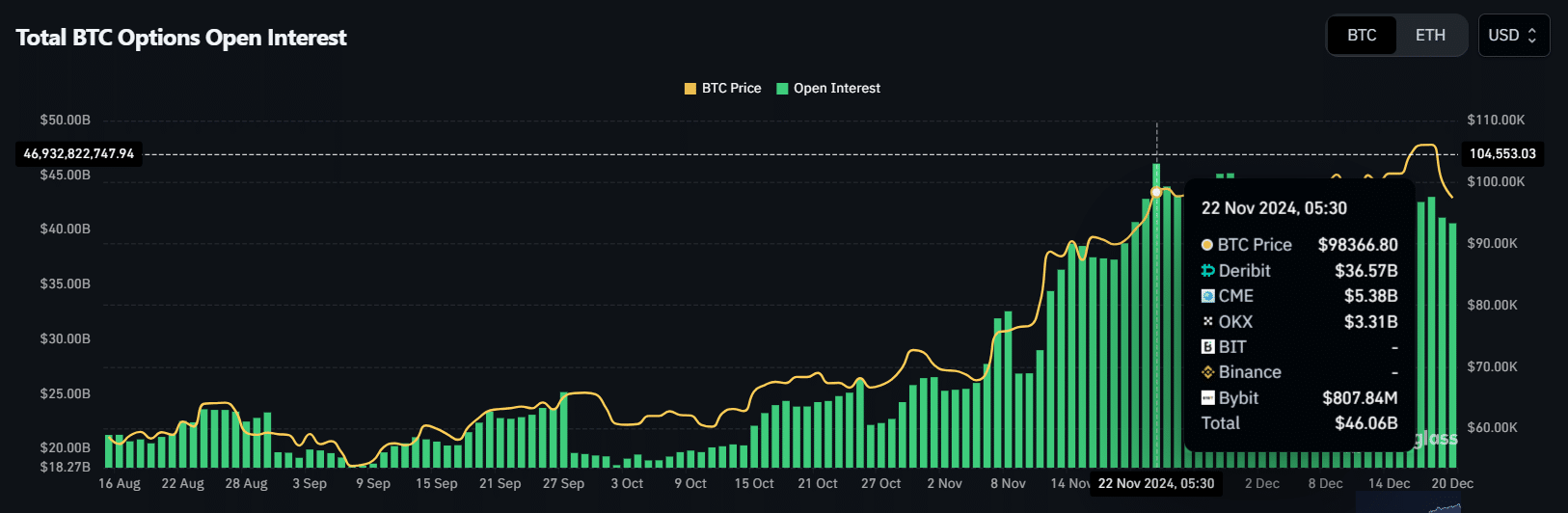

The impact is clear in the surge of open interest (OI), which recently reached an all-time high. As Bitcoin neared the $100K mark, the market saw a staggering $47 billion in leveraged positions, with traders betting on both directions – up and down.

With these factors in mind, when will crypto recover?

The next support line for Bitcoin is shaping up to be a battleground, and for now, the bears are firmly in control.

However, there’s more to this than just market mechanics. AMBCrypto raises an important point: the FOMC rate cut by 25 basis points was intended to signal a “healthy” economy.

The logic behind this is simple: lower borrowing costs should lead to higher purchasing power, which should theoretically support Bitcoin growth.

But the opposite is happening. Instead of fueling Bitcoin’s rise, the dollar is strengthening. This suggests that retail investors are flocking to traditional safe-haven assets, like the dollar and bonds, rather than taking on risk in the crypto market.

This dip could be exactly what the market needs to reset and recover. In fact, a strong entry point could emerge around the $90K mark, reigniting FOMO and bringing buyers back into the fold.

That said, the stakes are high. With $671 million in net outflows from Bitcoin ETFs, it’s clear that investors are becoming more cautious.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Clearly, we’re at a crossroads here. This could be a make-or-break moment for Bitcoin.

As we move forward, it’s essential to keep an eye on the dollar index, ETF flows, and most importantly – who’s holding strong. This is the time for diamond hands to shine, but the road ahead will definitely be rocky.