What Polkadot’s ‘falling wedge’ breakout means for traders

- The falling wedge breakout signals bullish potential, targeting $24 with $10.88 as key resistance.

- Positive metrics, including oversold RSI and strong social sentiment, reinforce Polkadot’s rally potential.

Polkadot [DOT] has broken out of its falling wedge pattern on the weekly timeframe, a critical signal that often precedes significant bullish rallies.

Trading at $6.83 at press time, with a 1.98% decrease at press time, the cryptocurrency’s breakout and retest phase presents a promising opportunity for traders. The next key question is whether DOT can sustain this momentum and rally toward its midterm target of $24.

DOT’s breakout and price prediction

The falling wedge breakout on Polkadot’s chart highlights strong potential for a bullish reversal. The price is now facing its first major resistance at $10.88, with a midterm target at $24.

Additionally, the recent retest of the breakout level strengthens the technical outlook, suggesting that buyers are entering at critical levels. Therefore, DOT’s trajectory appears poised for a substantial upside, provided the momentum persists.

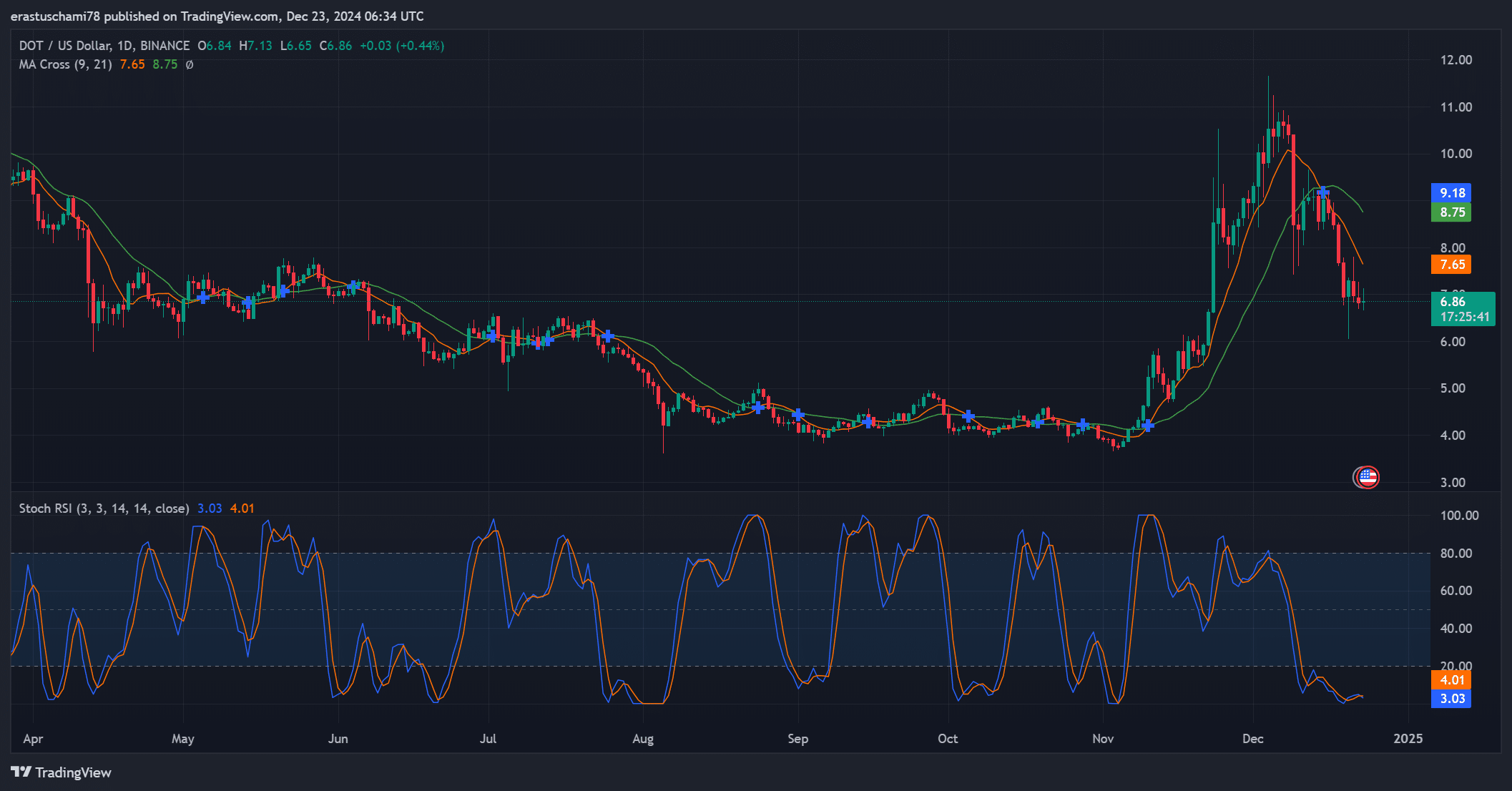

Analyzing the stochastic RSI and moving averages

Technical indicators further support Polkadot’s bullish potential. The stochastic RSI shows oversold conditions, with values near 3.03 and 4.01, indicating a potential price rebound in the short term.

Additionally, while the moving average (MA) crossover on the daily chart hints at short-term consolidation, it also suggests that DOT may soon reverse its downward trend.

Together, these indicators point to a promising outlook for the cryptocurrency in the coming weeks.

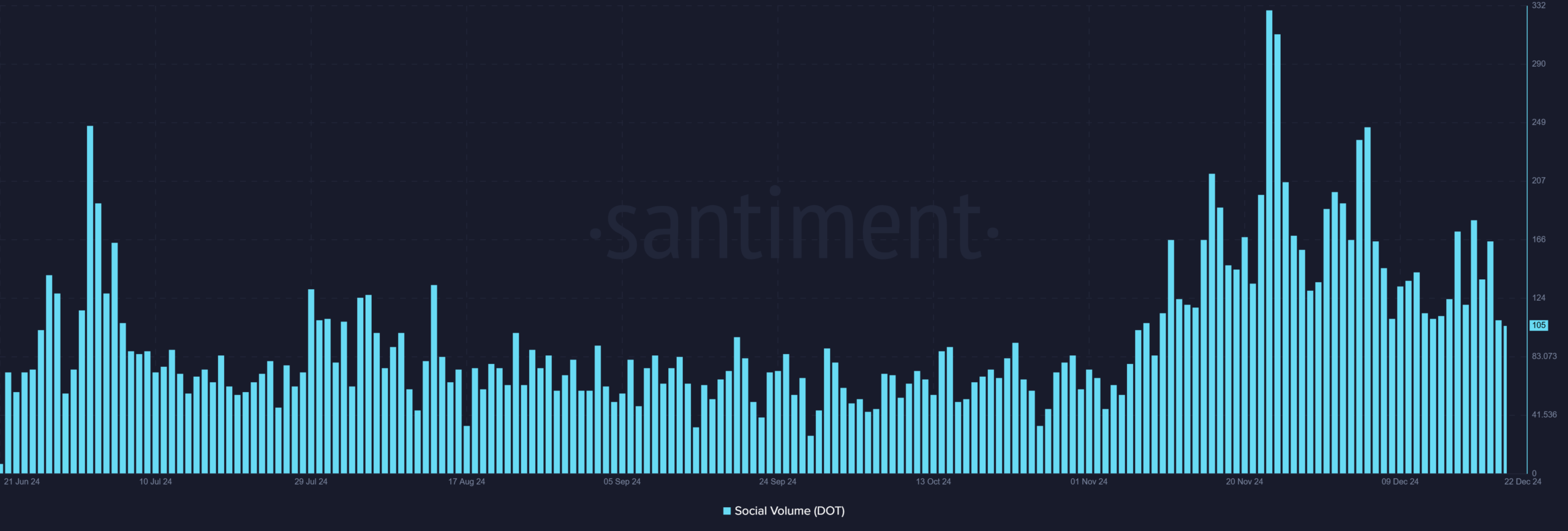

Social volume data, at 105, indicates rising interest in Polkadot, as community engagement across platforms continues to increase. This heightened activity, visible through consistent spikes, often correlates with a renewed interest in the asset.

Therefore, the narrative surrounding Polkadot’s bullish potential continues to grow, creating a positive feedback loop for both sentiment and price action.

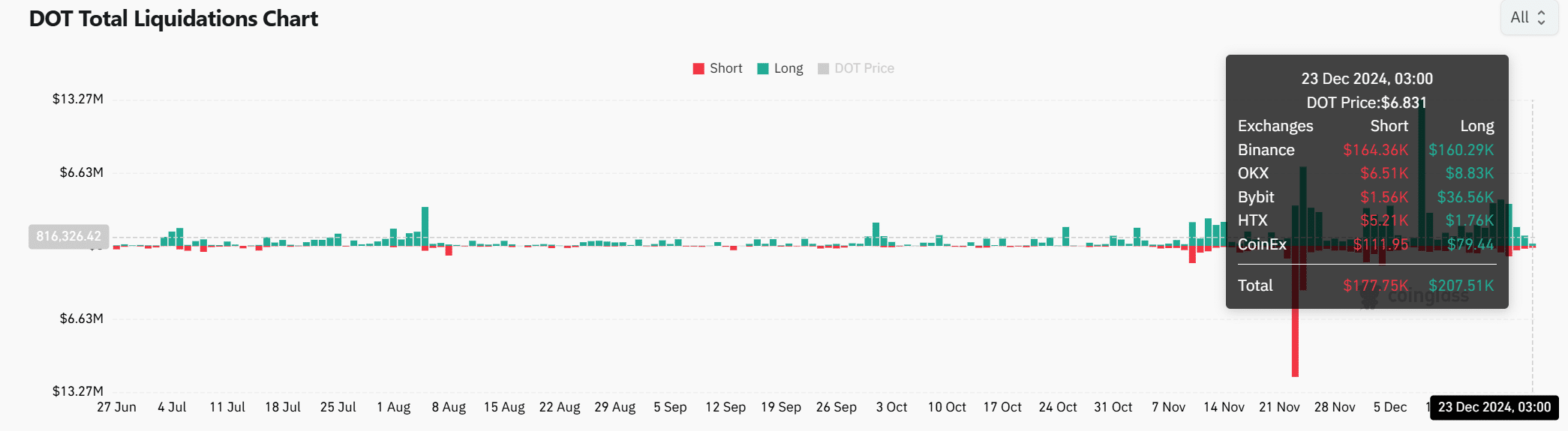

DOT derivatives market supports the bullish outlook

Polkadot’s total liquidations show $207.51K in long liquidations compared to $177.75K in shorts, signaling growing confidence among long traders. Furthermore, the OI-weighted funding rate remains positive at 0.01%, reinforcing bullish sentiment.

These metrics indicate that Polkadot is gaining strength in the derivatives market, further solidifying its upward potential.

Read Polkadot [DOT] Price Prediction 2024-2025

With its falling wedge breakout, bullish technical indicators, and growing social and derivatives momentum, Polkadot appears well-positioned for a rally.

While overcoming the $10.88 resistance is essential, the midterm target of $24 is achievable if the current momentum continues. Polkadot is undoubtedly on track for a significant breakout.