Bitcoin price prediction: BTC headed to $168K? Mayer Multiple says it might be

- The Mayer Multiple, a widely followed price indicator, suggests BTC has significant potential for an upward move.

- Premium indexes reveal notable buying activity from Korean investors, which has supported BTC’s price action.

Bitcoin [BTC] was trading at $95,646 at press time, down 7.89% from its high last week. While the daily decline stands at a modest 0.52%, this indicates that selling pressure has eased, potentially creating space for further gains.

According to AMBCrypto, the pullback to the $90,000 range aligns with Bitcoin’s overall bullish trajectory as the asset eyes a move toward higher levels.

Bitcoin price prediction: BTC set for a rally to $168,000

According to analyst Ali Charts, Bitcoin remains on a bullish trajectory despite its recent price decline.

This current price correction is viewed as part of a larger market structure that could propel the cryptocurrency to $168,000 region—a potential peak derived using the Mayer Multiple (MM).

The Mayer Multiple, an indicator available on Glassnode, calculates potential market tops and bottoms by dividing BTC’s current price by its 200-day moving average.

Based on this metric, the market’s potential top is indicated at an MM of 2.4 (red line), corresponding to approximately $168,494. Meanwhile, the bottom is defined at 0.8 MM (green line), or $56,141.

It is important to note that the Mayer Multiple, currently at 1.3, reflects a fair valuation for BTC but does not directly dictate market direction.

However, with room to climb toward the MM peak of 2.4, BTC could rally to $168,494, a level that would place it in overvalued territory.

Institutions and large investors keep BTC intact

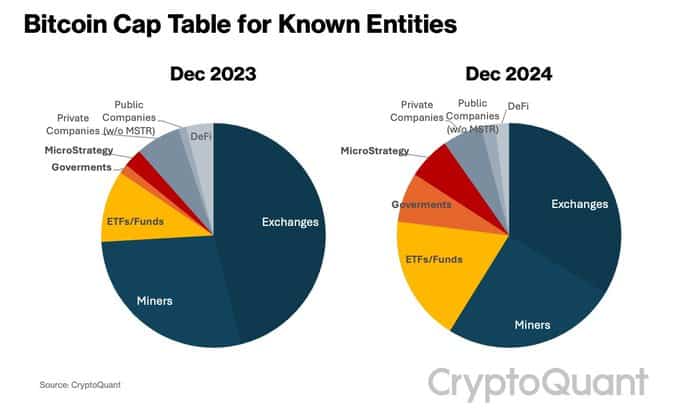

Institutional and large-scale investors are playing a major role in Bitcoin’s keeping its price range. Recent data highlights a surge in interest from these entities as the cryptocurrency regains popularity.

According to CryptoQuant, this group has significantly increased its share of Bitcoin’s Known Entities Cap Table, rising from 14% last year to 31% at the time of reporting.

If this buying trend continues, it could positively impact Bitcoin’s trajectory by further cementing its position in mainstream financial markets.

AMBCrypto’s analysis of U.S., Korean, and traditional investors revealed that bullish sentiment persists, suggesting continued confidence in BTC’s potential.

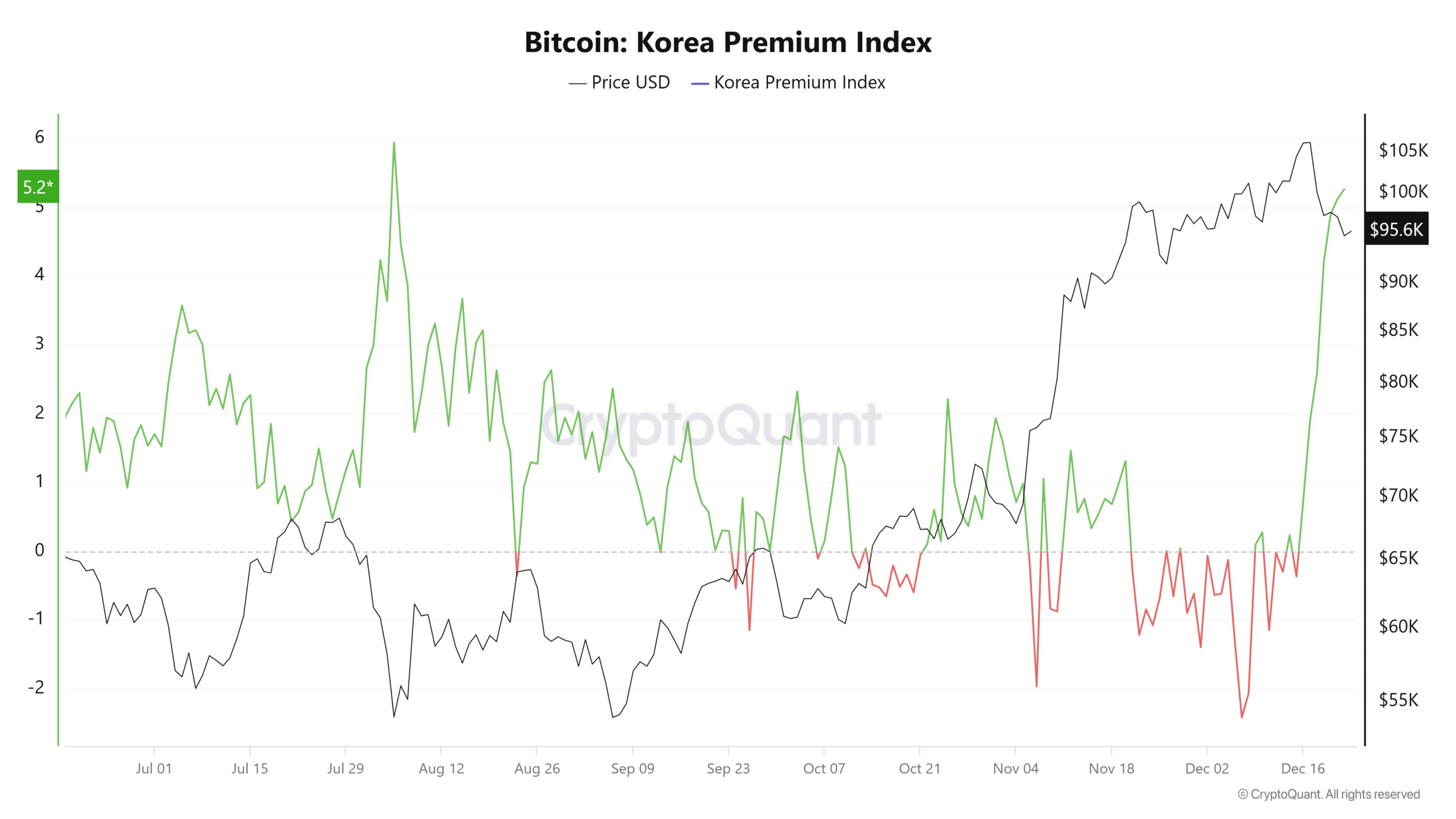

Korean investors accelerate Bitcoin buying

In the last 24 hours, Korean investors have shown a major surge in BTC buying activity, with a spike last seen in August. The current reading of the Korean Premium Index has climbed to 5.26, up from a negative 0.37 on December 15.

This level of heightened buying activity indicates ongoing accumulation, which could soon reflect in BTC’s price, potentially driving it higher in upcoming trading sessions.

In contrast, U.S. investors have shown reduced interest, as indicated by a decline in the Coinbase Premium Index. The index remains in negative territory at -0.1035, a sign of a slowdown in buying activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

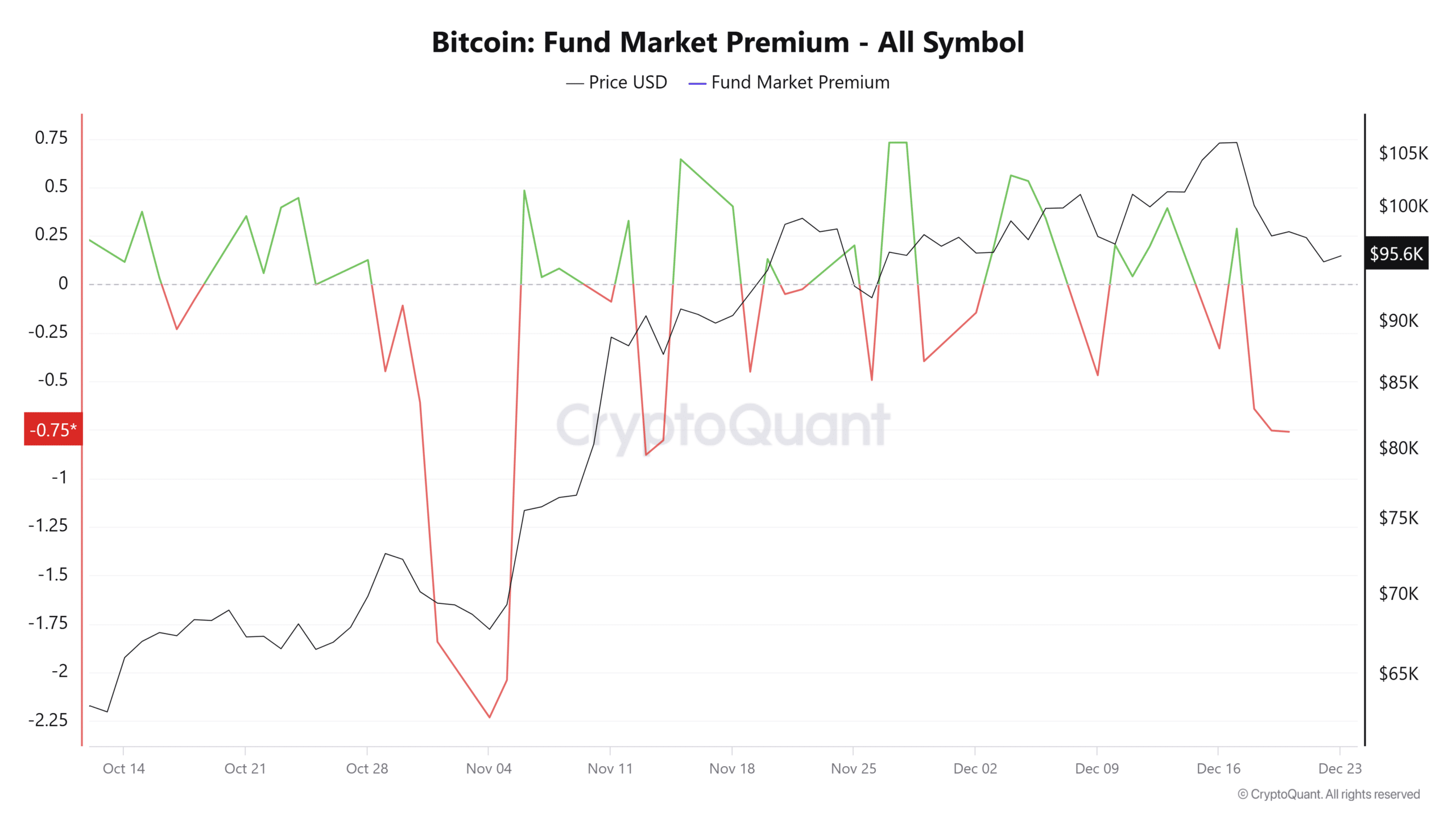

Similarly, the Fund Market Premium Index, which tracks institutional Bitcoin buying and selling, mirrors this bearish sentiment. It currently stands at -0.759, reinforcing the decline in institutional demand.

If U.S. and institutional investors return to buying, their participation—combined with the bullish momentum from Korean investors—could push Bitcoin’s price upward to the $100,000 region.