Solana’s bullish turn: What the TD Sequential suggests about buying SOL

- TD Sequential issues rare buy signal, positioning Solana for a potential breakout toward $250 resistance.

- Solana’s TVL grows to $8.312B, as strong fundamentals and bullish derivatives metrics drive market excitement.

Solana [SOL] has rebounded from its recent correction and traded at $190.04 at press time, close to a critical support zone.

The crypto has seen a 4.91% price increase over the past 24 hours, despite recording an 11.43% decline over the last seven days.

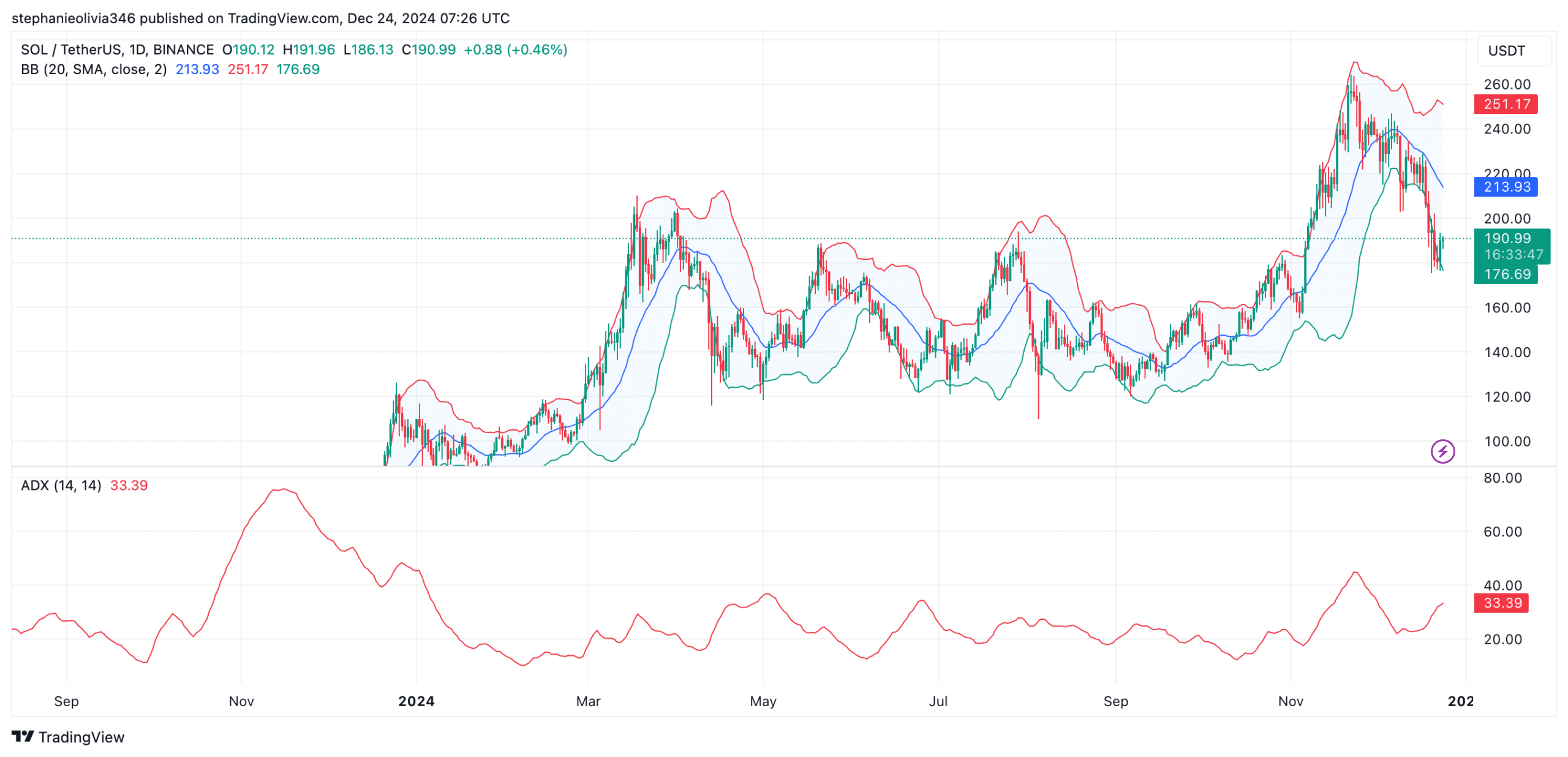

Its 24-hour range of $180.35 to $192.86 reflects a consolidation phase, while the 7-day low of $176.72 indicates strong support near the lower Bollinger Band.

Analysts predict rebound based on technical indicators

The TD Sequential indicator has issued a buy signal on the daily chart, raising anticipation of a price recovery. Crypto analyst Ali (@ali_charts) noted,

“This signal is often a precursor to strong bullish momentum, suggesting an opportunity for long positions at these levels.”

Source: X

According to the daily chart, the Bollinger Bands suggest oversold conditions, with SOL trading near the lower boundary at $176.52. Resistance lies at $213.88, which aligns with the midline of the Bollinger Bands, and $251.24, the upper boundary.

A breakout above these levels could fuel further momentum, though a drop below $186 may lead to a decline toward $165, a historically important demand area.

The Average Directional Index (ADX) currently stands at 33.39, which confirms the strength of the ongoing trend. While the recent bearish momentum has persisted, the ADX level signals that any breakout above resistance could drive a strong upward movement.

On the downside, traders are closely monitoring $186 as an immediate support level.

Source: TradingView

Strong fundamentals back Solana’s growth

Solana’s network fundamentals remain robust, with its Total Value Locked (TVL) at $8.312 billion, reflecting a 1.83% increase over the last 24 hours.

The network also recorded stablecoin market capitalization at $4.972 billion and generated $3.08 million in fees and $1.54 million in revenue within 24 hours.

Activity on Solana’s decentralized exchange protocols continues to surge. Solana outperformed Ethereum (ETH) and other competitors in December, with a trading volume of over $97 billion compared to Ethereum’s $74 billion.

The platform’s active addresses stand at 4.16 million, with 70.34 million transactions processed in the last 24 hours.

Derivatives market signals growing interest

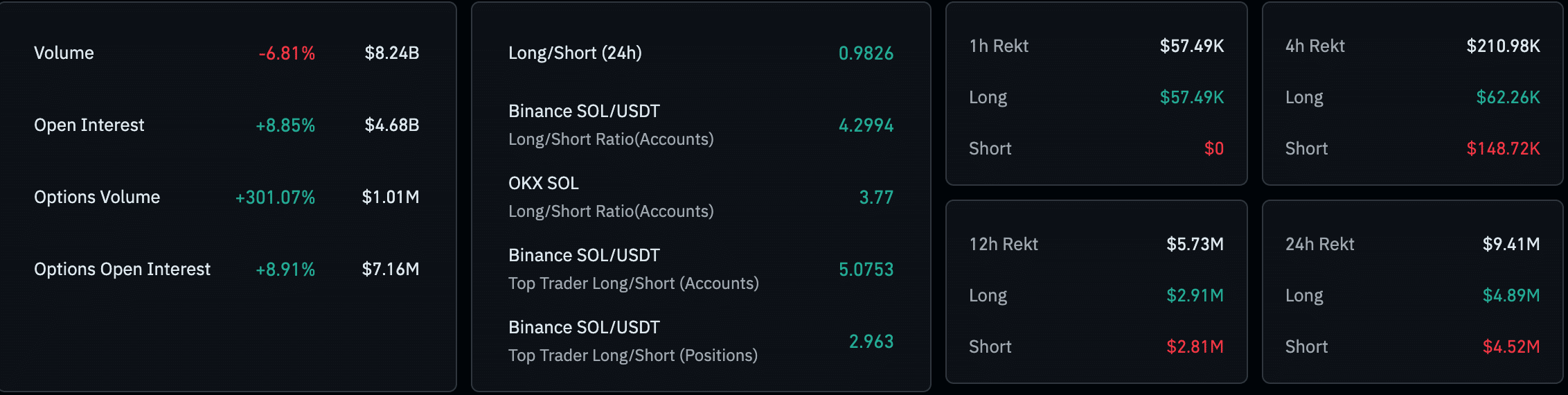

Recent data from Coinglass shows mixed signals in the derivatives market. Open interest increased by 8.85% to $4.68 billion, while options volume surged 301% to $10.1 million, reflecting increased speculative activity.

The Binance long/short ratio for top traders is highly bullish at 5.07, indicating that most traders expect upward momentum.

Source: Coinglass

Despite the optimism, trading volume declined by 6.81% to $9.24 billion, hinting at market caution.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Liquidation data shows balanced pressure, with $4.89 million in long liquidations and $4.52 million in shorts, indicating a tug-of-war between bulls and bears.

Solana’s technical setup, combined with strong network activity, suggests a potential for recovery if key resistance levels are broken.