Litecoin’s active address surge: What it means for its price trend

- LTC has seen declines after its spike in November.

- It has managed to stay above critical levels despite the declines.

Litecoin (LTC) saw a breather in the last trading session, finally seeing a major uptrend after previous downtrends. With increased market activity and a noticeable rise in daily active addresses, LTC is regaining its footing in the market.

This article dives into Litecoin’s price action, active address trends, and what these signals mean.

Key levels to watch in Litecoins’s price trend

Litecoin’s current price of around $106 sits just above its critical support level of $100. This level is reinforced by the 50-day moving average, which has consistently provided a safety net for the cryptocurrency.

On the upside, $120 remains a formidable resistance, as previous attempts to break through this level in December faced strong selling pressure.

The golden cross, where the 50-day moving average crosses above the 200-day moving average, continues to provide a bullish signal. If Litecoin sustains its momentum and breaches the $120 mark, it could pave the way for a stronger rally toward $140.

Active addresses surge: Growing network activity

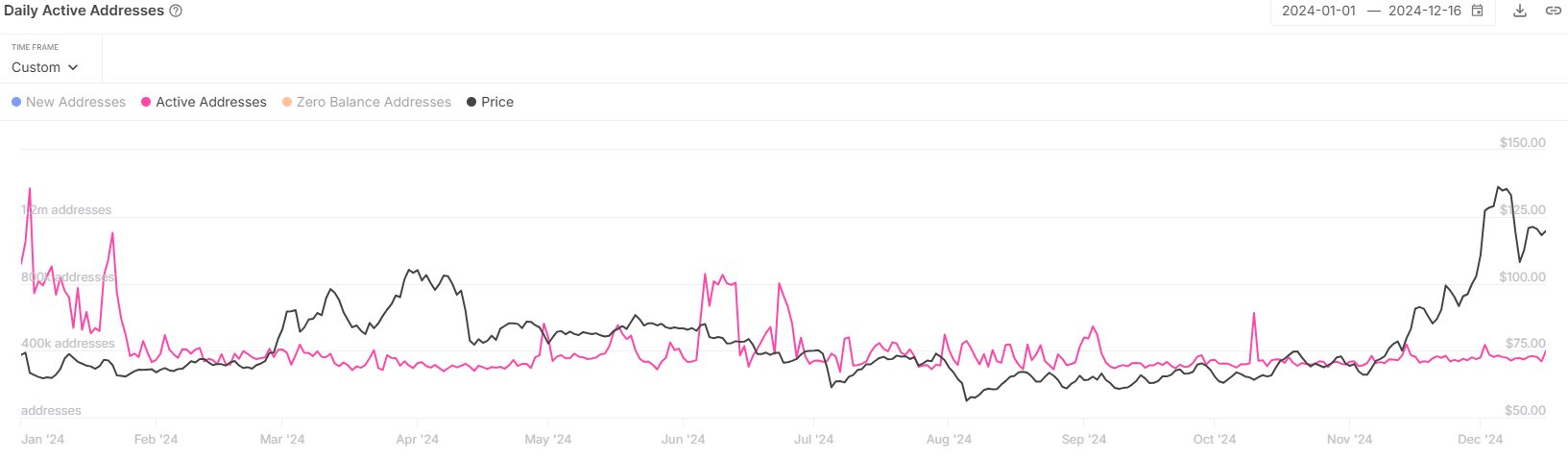

According to data from IntoTheBlock, daily active addresses have shown a consistent rise alongside Litecoin’s price recovery. Analysis showed that the number of active addresses climbed from October to December, reflecting increased user activity and interest.

The average daily active addresses for Litecoin reached 401,000 in 2024, marking an increase from 366,000 in 2023.

This surge is likely driven by traders capitalizing on LTC’s bullish momentum. The chart highlights correlate with price action, particularly during periods of market excitement. This interplay shows the role of increased participation in driving LTC’s value.

Market outlook: Bullish signs persist

Litecoin’s upward trajectory and growing network activity paint an optimistic picture for the cryptocurrency. However, investors should remain cautious as the $120 resistance level looms large.

A breakout above this could signal a sustained bull run, while failure to hold the $100 support might lead to renewed selling pressure.

Is your portfolio green? Check out the Litecoin Profit Calculator

As Litecoin approaches the end of 2024, its performance will be closely watched, with its network activity providing valuable insights into its potential.