HNT’s rally to $10 – Here’s why traders’ interest could be key!

- Token recently bounced off a major support level and started moving north on the price charts

- Rally seemed likely to continue, as metrics suggested favorable conditions for further upside

In the last 24 hours, HNT has posted gains of 12.50%, despite a 16.60% drop over the past week. In fact, its monthly performance stood at 20.14% at press time, with recent developments hinting at strong potential for sustained growth on the charts.

Hence, AMBCrypto analyzed key factors influencing HNT’s current uptrend and explored possible scenarios for its future price action.

Support acts as a lever for HNT’s push

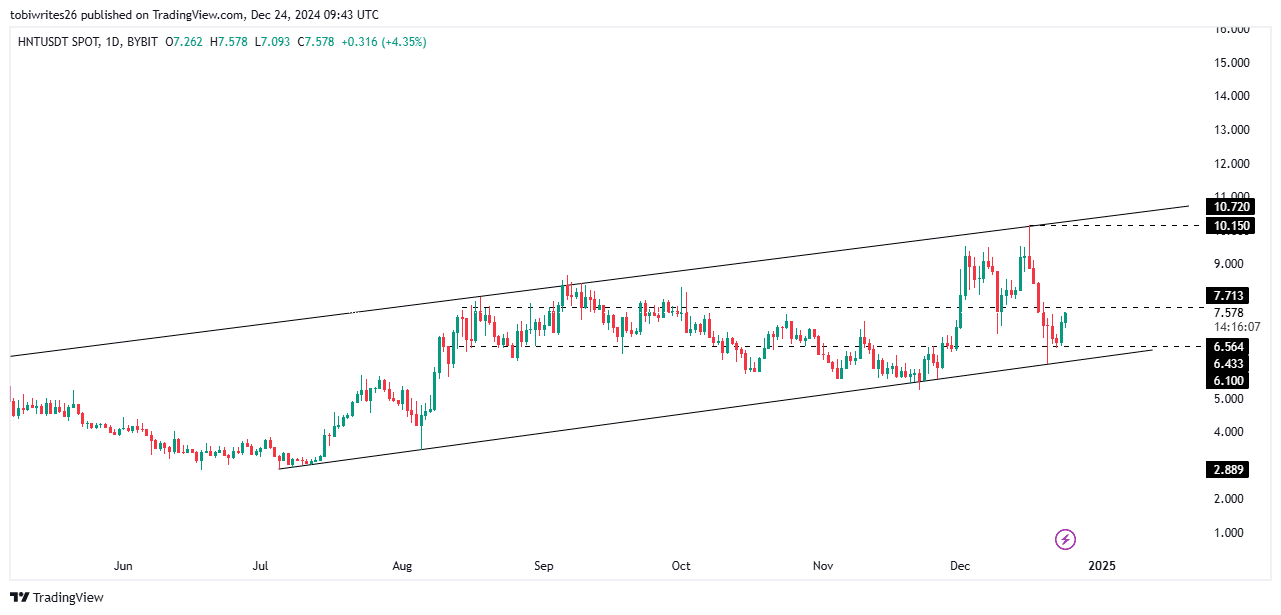

HNT recently bounced off the lower support level of an ascending channel, a price pattern that outlines a clear path for upward movement within defined support and resistance zones.

The recent rebound from the channel’s support was further reinforced by another critical level at $6.564. This dual support has provided the asset with additional momentum, pushing its price higher.

If the prevailing momentum holds strong, HNT could potentially hit $10.15. However, it must first overcome a key resistance at $7.71, as highlighted by the chart.

In its analysis of technical indicators, AMBCrypto observed a predominantly bullish sentiment, though some uncertainties still remain.

HNT remains bullish, despite decline in liquidity flow

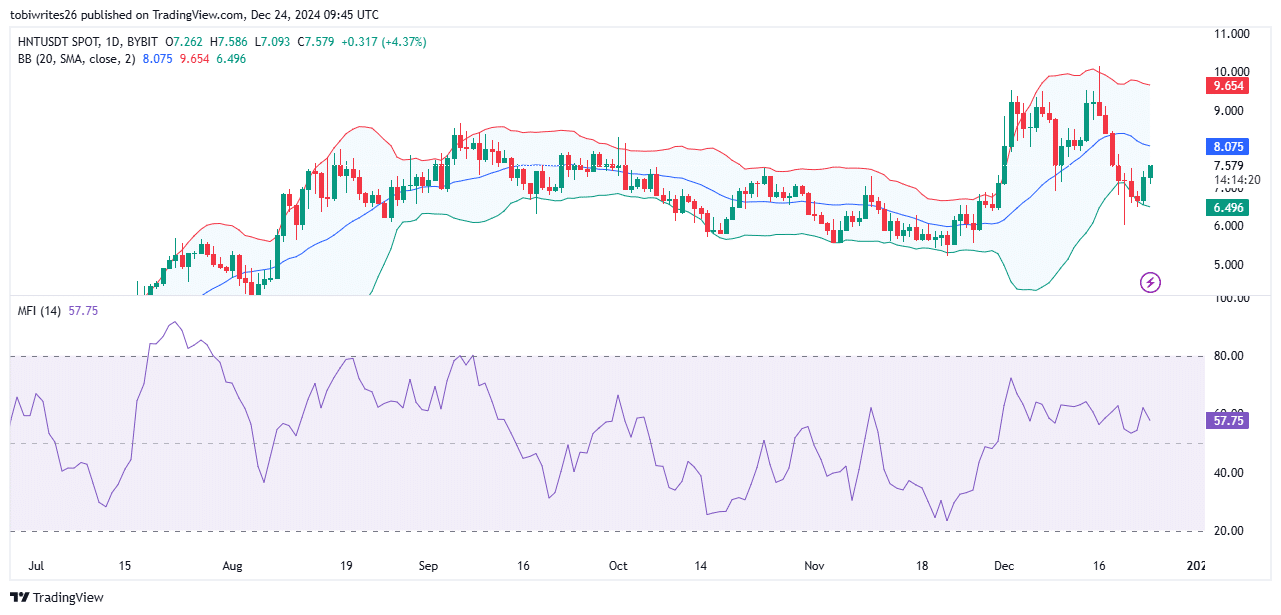

The market sentiment for HNT has remained bullish, with the potential for further upward movement supported by both the Bollinger Bands and the Money Flow Index (MFI).

Bollinger Bands measure market volatility using three lines – A middle band (SMA) and upper/lower bands positioned two standard deviations from the SMA. These bands help identify overbought (upper band) or oversold (lower band) conditions and potential price breakouts.

At press time, HNT had rebounded from the oversold region near the lower band and was trending upwards. It can be expected to continue climbing towards the upper band, which was positioned at $9.654—A price level closely aligned with the technical chart target of $10.

On the contrary, the Money Flow Index, which gauges market sentiment by analyzing price and volume to measure buying or selling pressure, flashed a decline.

While the MFI remained above 50—indicating a bullish zone—the downturn suggested a slowdown in buying activity, likely due to profit-taking by traders.

Traders maintain optimism for HNT’s uptrend

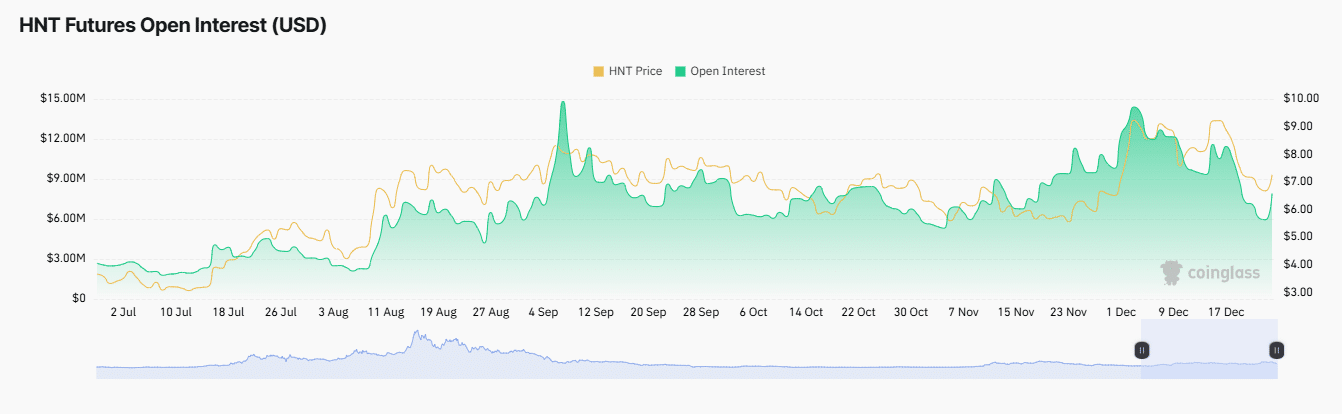

Traders remain optimistic about HNT’s potential to trend higher, as indicated by Open Interest data from Coinglass.

Open Interest, which tracks the number of unsettled derivative contracts in the Futures market, reached $7.45 million in the last 24 hours—A 10.98% hike. This surge suggested growing participation in HNT’s market, with more contracts being opened.

Additionally, the Funding Rate, with a reading of 0.0152% in the positive zone, indicated a market skewed towards long positions.

The Funding Rate reflects which side of the market (long or short) pays periodic fees to balance the difference between spot and derivative markets. A positive Funding Rate, as seen here, means that buyers (longs) hold more open contracts.

Overall, HNT has strong support from market participants, and the asset could continue its uptrend from its press time level.

![Horizen [ZEN] crypto price hits a 32-month high: More gains in store?](https://ambcrypto.com/wp-content/uploads/2024/12/zen-400x240.webp)