Judging by all the crypto press today, most news has to do with the price action, who went up and what went down. Every day, people are obsessed with reds and greens, and bulls, and bears. For the cryptocurrency industry, and the blockchain in general, have we all but forgotten about the fundamentals that make a company?

In the land of the giants where pissing contests are dominating the scene, Bitcoin vs Bitcoin Cash, Ethereum vs Ethereum Classic, XRP vs the world, we have forgotten the basic asks.

What technology, how does it solve pain points, or how does it bring about adoption? What features or products or platforms were built that are now helping users become more efficient? Are there enterprise solutions that went live now creating more revenues? Were we able to improve scalability issues, privacy, and other infrastructure features that improve the industry in general?

In a recent interview, Damon Nam, CEO of Coinvest – a technology company that develops solutions to empower the world to execute financial services using blockchain technology – says that “the time for FOMO is over and with the current extended crypto financial crisis, it is most important to bring back the focus to the technology and not whether the bulls won today, or how much an ICO was able to generate.”

Through the end of Q3 of 2018, there were more than 1600 cryptocurrencies in circulation. ICOs were able to generate $6.3 billion – around 118% of the total amount raised in 2017. Which begs the question, which among these projects were able to deliver?

He says that “Many companies are still overvalued with having little to no traction, product roadmap, and revenue model. These include, but are not limited to, many companies that have greater than $100M+ in market capitalization.”

According to him, until the industry witnesses examples of product market fit with sustainable business models, we can anticipate a continued market weakness with a flight-to-quality for companies and assets that demonstrate real value. Like the dot.com bubble in 2000, 2018 is the beginning of a massive retraction as we flush out the bad actors and companies that have no real use-cases in the industry.

“Many companies are still overvalued with having little to no traction, product roadmap, and revenue model. These include, but are not limited to, many companies that have greater than $100M+ in market capitalization.”

Asked about his company, which, incidentally is launching the Beta Release of not one, but two of its flagship projects, Coinvest and Coinvest Plus, he says that as a principle, they believe in #BUIDL -to always lead with building versus marketing.

Nam, a Microsoft alumnus, says that he is proud of how their vision for the company is turning out into a reality. The company has not experienced any hacks or scandals; all code is audited by professional third-party firms and also include community bounties.

With their current Beta Program, they are running a competition and leaderboard in order to get the community excited and give more feedback on their products. This allows them to fail fast and see which of their designs and features are really solving a pain point.

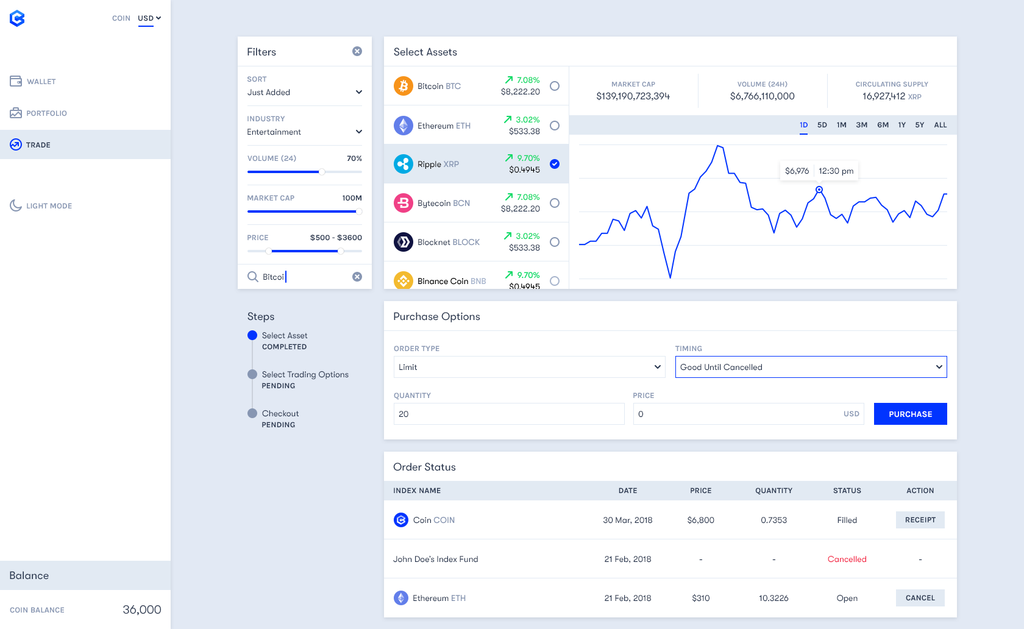

Coinvest – A refreshingly simple and clean UI to trade hundreds of tokens and indexes

With this fail faster principle in mind, despite only being a year old and with only $2 million dollars with the recent drop in crypto prices, they were able to bring to the market three major revenue-generating products.

Coinvest, a cryptocurrency wallet with a built-in investment trading market is generating a buzz with its target market – investors with limited technical experience. Coinvest Plus, a cryptocurrency exchange with an advanced order book matching system that empowers users to exchange cryptonized assets together is similarly getting great feedback for its “Apple-esque” design that allows even advanced users to skip the hoops common in trading with a regular exchange.

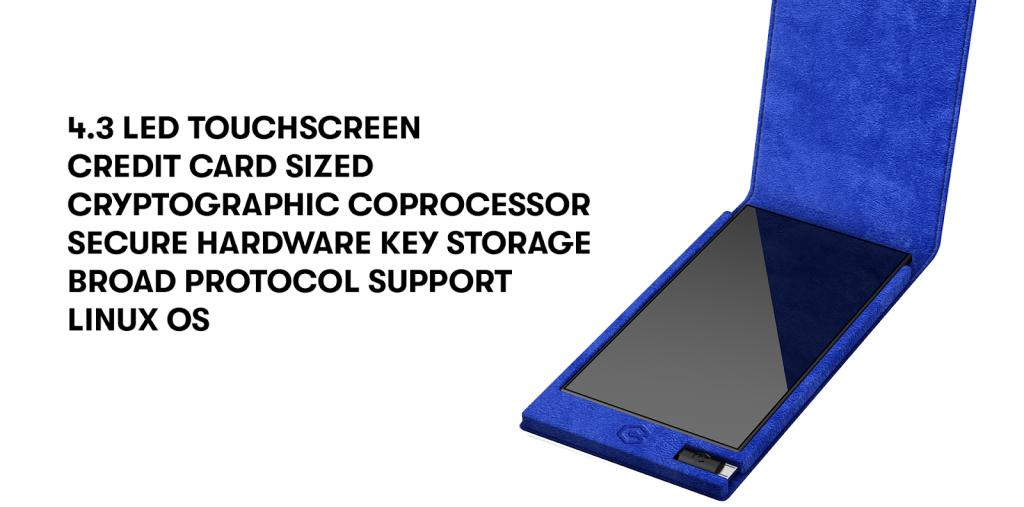

And finally, Coinvest Vault, a premium hardware wallet that offers secure offline cold storage for cryptonized assets with an intuitive and friendly user experience. And not only that, Coinvest has already deployed a variety of solutions in the Coinvest ecosystem including its COIN protocol and CoinDNA – a free educational investment website that aids users in their investment journey in the blockchain industry.

Coinvest Vault – A premium cold storage wallet with an intuitive and integrated user-experience

In an industry that suffers from bad actors, they always strive to protect their community of users and investors. Early on, they had already tried to follow and be compliant with regulatory laws.

They are one of the few crypto companies that are registered with the US SEC and FINRA. Admittedly, he says, there are a lot of regulatory laws that need to be updated in order to protect the common investors – be it in the United States or worldwide.

And yes, it might be true that the company is an underdog of sorts. Coinvest raised approximately $5M in its token sale earlier this year while many others in the industry raised funds north of $15M. While the COIN token is currently available only at HitBTC, IDEX, and Yobit, there have been little signs of selling activity.

This includes the company’s recent bounty distribution, which commonly results in mass selling with ICOs today. Investors turned supporters are holding on to their investments in the belief for the companies’ future.

Fundamentally, Coinvest has a low market cap with high potential. Coinvest COIN token market cap is currently less than $2M; however, financial forecasts for FY2019 are over $40M in revenue.

Marketing based on hype and FOMO is not an accepted principle for the company; which consists of tenured professionals and alumni from companies such as Microsoft, Wal-Mart, and Hotels.com. Coinvest advisors include Founders and C-Level executives from Mashable, Microsoft, Disney, and Republic.

Which is probably why it has gone under the radar for most paid crypto influencers out there. For Damon Nam, he wants the products to speak for themselves. As advocates of the belief, “Execution > Ideas”, Coinvest aspires to be a leader in demonstrating that results [and revenue] can be achieved quickly with lean principles, limited funding, and a lot of hard work.

For more information, click here.