MicroStrategy of Solana? Canada’s Sol Strategies bets $25M on SOL

- Canada-based Sol Strategies has raised more capital for its SOL investments.

- A crypto VC projected a bullish outcome for SOL if ETF is approved.

Solana’s [SOL] MicroStrategy’s equivalent, Sol Strategies, secured a CAD $25M (about USD $17.4M) credit for purchasing SOL tokens and revamping its staking services. Part of the Canada-based firm’s statement read,

“The Company plans to deploy these tokens across its core focus areas within the Solana ecosystem, including decentralized finance protocols, validator operations, and strategic liquidity provision to emerging Solana-based projects.”

SOL ETF expectations

The institutional interest in the layer-1 platform could explode in the coming months amid US spot SOL ETF expectations.

According to Andrew Kang of crypto VC Mechanism Capital, SOL was relatively undervalued compared to its network growth ahead of likely ETF approval in Q1.

Additionally, Kang cited a lack of Grayscale-like supply overhang, as key catalysts for SOL’s value. He stated,

“Almost a given SOL ETF approved this year, if not in Q1 with approval deadlines in Jan-March. No grayscale Overhang like you had with ETH”

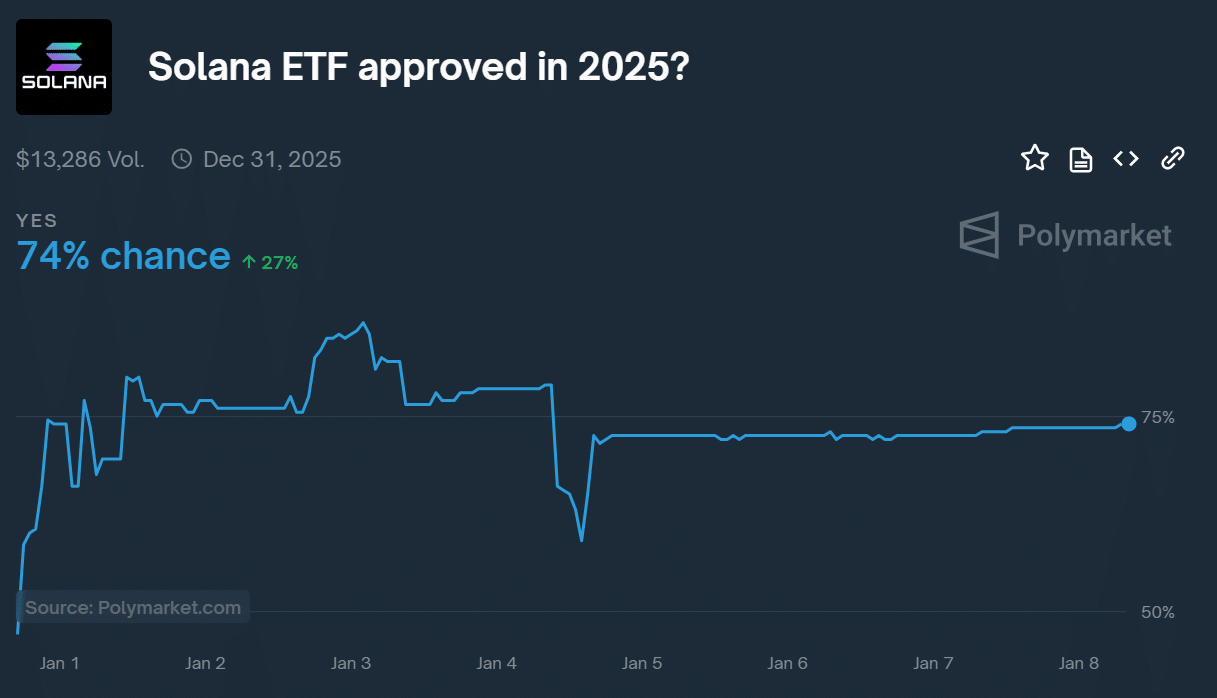

At press time, bettors on the prediction site Polymarket were pricing a 74% chance of SOL ETF approval in 2025.

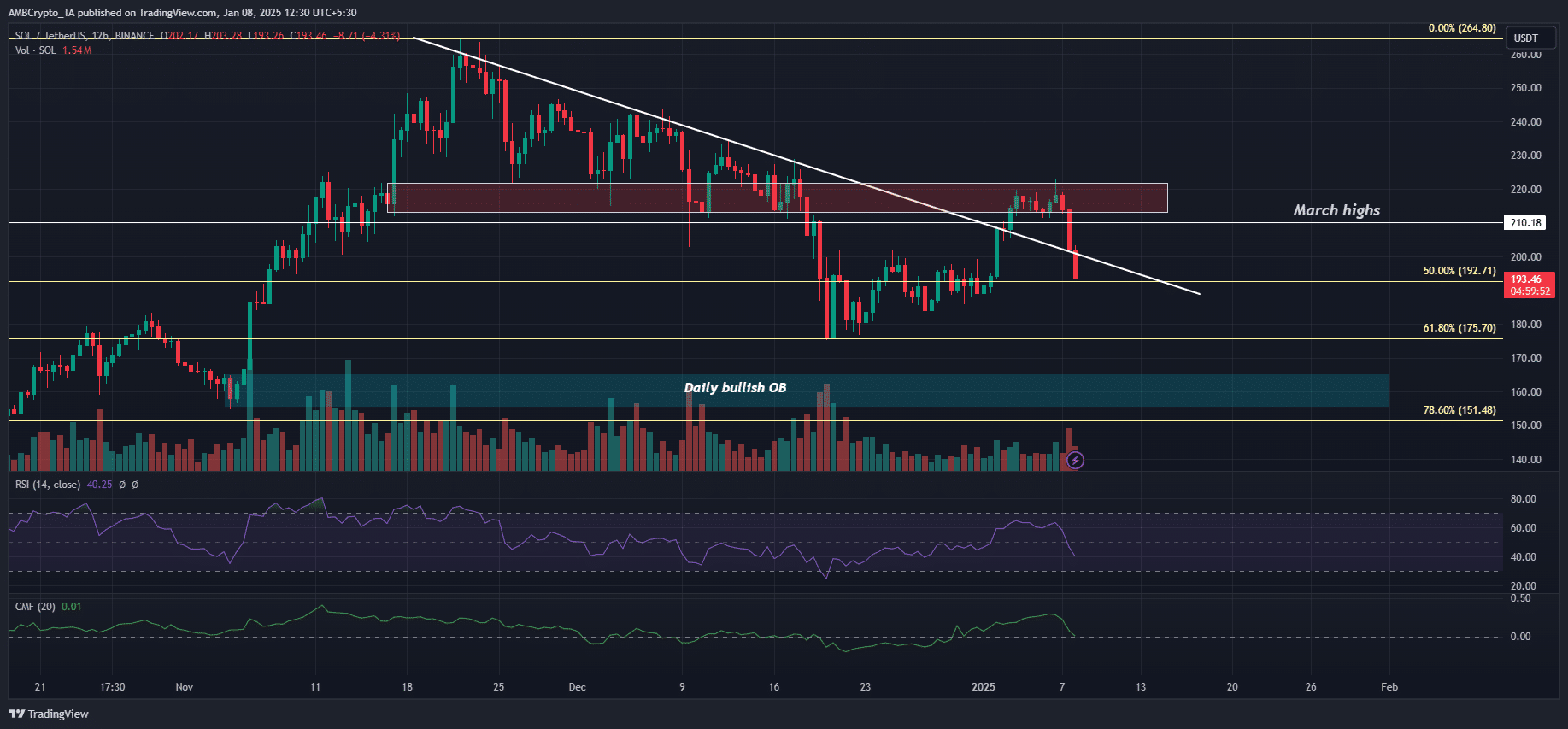

However, SOL struggled with short-term headwinds from the macro environment. Recent US economic data reinforced sticky inflation, which could derail the Fed interest rate cut in 2025 and affect risk-on assets.

Markets tanked after the macro update, but crypto dumped the hardest. SOL gave back recent gains and erased the entire early January recovery.

It was down 13% and slipped below $200 as of this writing. The next key crucial support levels were at $190 and $175.