XRP’s 10% jump – Is now the time to buy before the next ‘Trump Pump?’

- XRP could be gearing up for some serious volatility, making the next few days crucial for anyone eyeing the asset

- Investors are biding their time, carefully watching for the next ‘Trump pump’

To manage risk, investors often reallocate capital. In light of the volatility of Q1, diversification is about to take off in full force. XRP’s near 10% weekly surge, contrary to Bitcoin’s 5% decline, is a prime example of this shift.

For XRP, $3 is still a long way off

Flashback to Q4, when XRP broke through two psychological targets, thanks to the Trump trade. As Bitcoin hit $99k by November’s end, the XRP/BTC pair surged with long green candlesticks, posting daily gains of over 10%.

Now, a similar move seems to be unfolding. A striking green candlestick revealed a 10.24% single-day jump on the XRP/BTC chart, with the MACD turning bullish. With the market still reeling from a recent crash, investors are being cautious. In such a climate, shifting capital from BTC to XRP feels like a smart play.

And yet, trading at $2.55, XRP faces a familiar challenge. Despite bullish signals – RSI not yet overbought, whales snapping up 26 million XRP tokens, and the XRP/BTC pair turning green – breaking past $2.60 has been tough in the past. Needless to say, hitting $3 might still feel like a stretch.

And with a “Trump pump” potentially on the horizon, strategic investors may shift their focus back to BTC, anticipating higher returns. With such a scenario in mind, XRP’s hike to $3 might just have to wait.

So, proceed with caution

According to AMBCrypto, the ongoing 10% surge might be driven more by speculation than solid fundamentals.

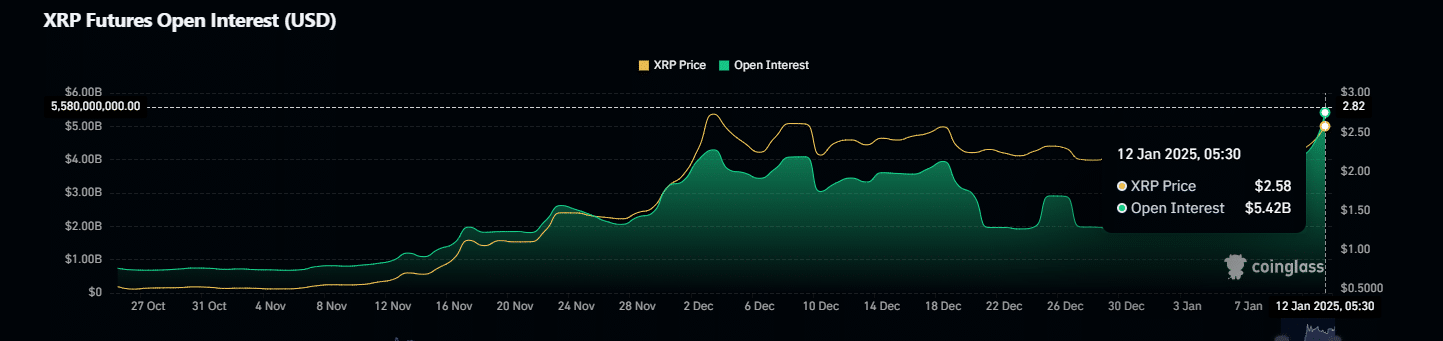

First off, Open Interest (OI) in the Futures market surged to an all-time high of $5.42 billion – Well above the $4.29 billion seen when XRP hit its yearly high of $2.80 in mid-Q4.

While this may appear bullish, the warning signs are hard to ignore. The exchange reserves hit 2.97 billion, historically signaling a potential top for XRP. Adding to the concern, outflows data suggested a lack of retail capital flowing into the market.

When you factor in whale activity, it painted an even clearer picture. Aggressive accumulation by whales pushed “long” positions to new heights, setting the stage for a potential short squeeze. And that’s exactly what happened – $10.79 million in shorts were squeezed out in the last 24 hours.

Read Ripple [XRP] Price Prediction 2025-2026

However, with retail investments thinning out, the XRP/BTC pair could soon turn red, signaling potential trouble ahead. So, while that 10% surge looks tempting, it’s not the “dip” many might be hoping for.

Thus, another correction could be in store before XRP even considers targeting $3. How the market responds to the upcoming “Trump pump” could offer the clarity needed. Unntil then, proceed with caution.

![Decentraland [MANA] vs FET - Active addresses, dev. activity, and more](https://ambcrypto.com/wp-content/uploads/2025/01/MANA-Featured-400x240.webp)