Altcoin season index hit a pivotal point – Is a rebound likely?

- Altcoin sector may be primed for a strong recovery on the charts

- BTC and USDT dominance seemed to be at pivotal points

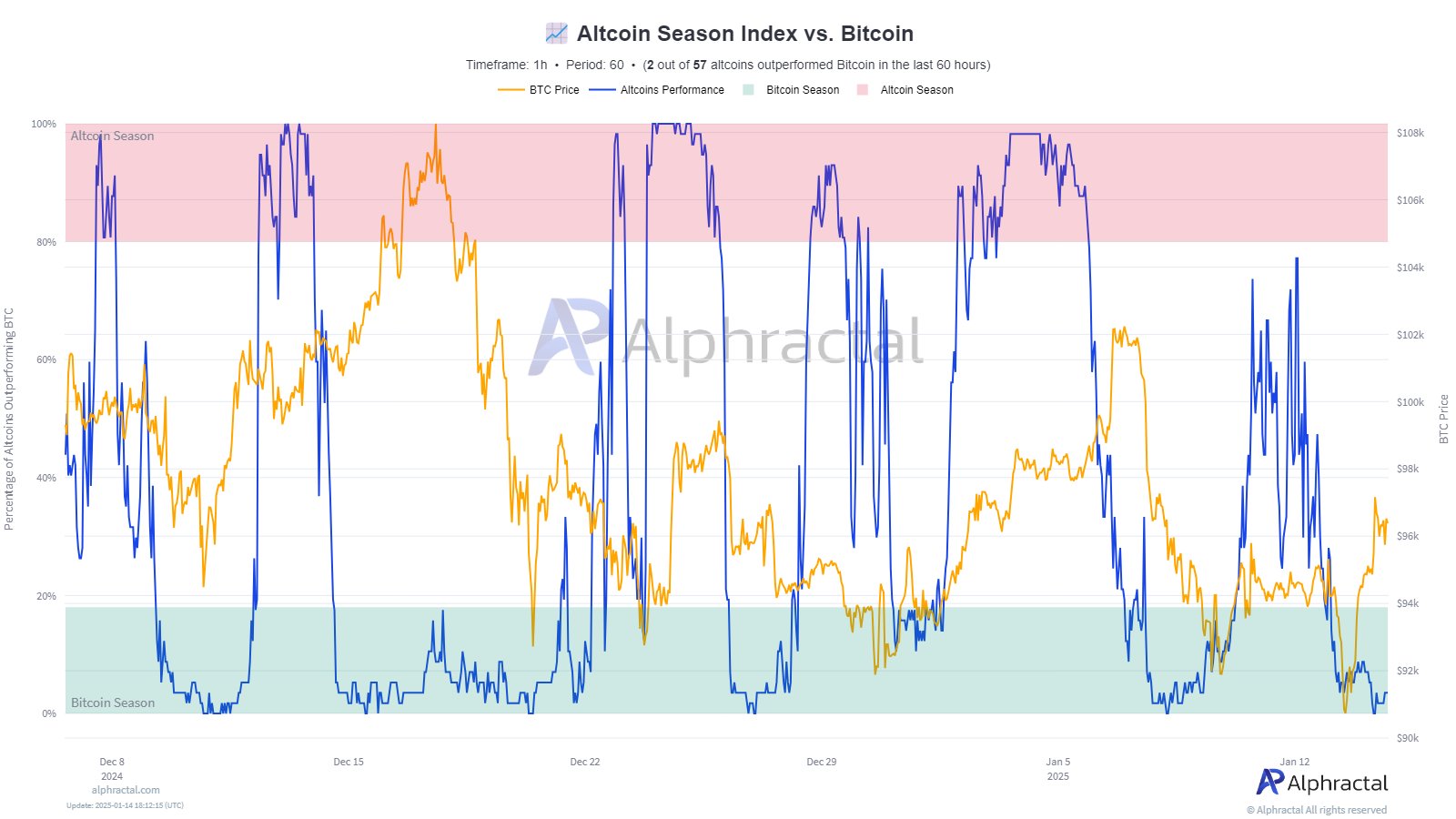

After the latest bout of sell-offs in January, altcoins could be primed for a strong rebound, while also outshining Bitcoin [BTC]. In fact, according to the analytics platform, Alphractal, the Altcoin Season Index has retreated to a pivotal point. This could fuel the sector’s short-term recovery.

Part of the firm’s X’s post read,

“With Bitcoin rising from 89k to 97k in the last 24 hours, the Altcoin Season Index suggests that we are entering a phase where altcoins could start to recover.”

The attached chart revealed that the Altcoin Season Index has historically recovered whenever it hit the lower range. Interestingly, the recovery always followed BTC’s lead. Hence, the recent upswing from under $90k to $97k could lift the sector again.

What’s next for altcoins?

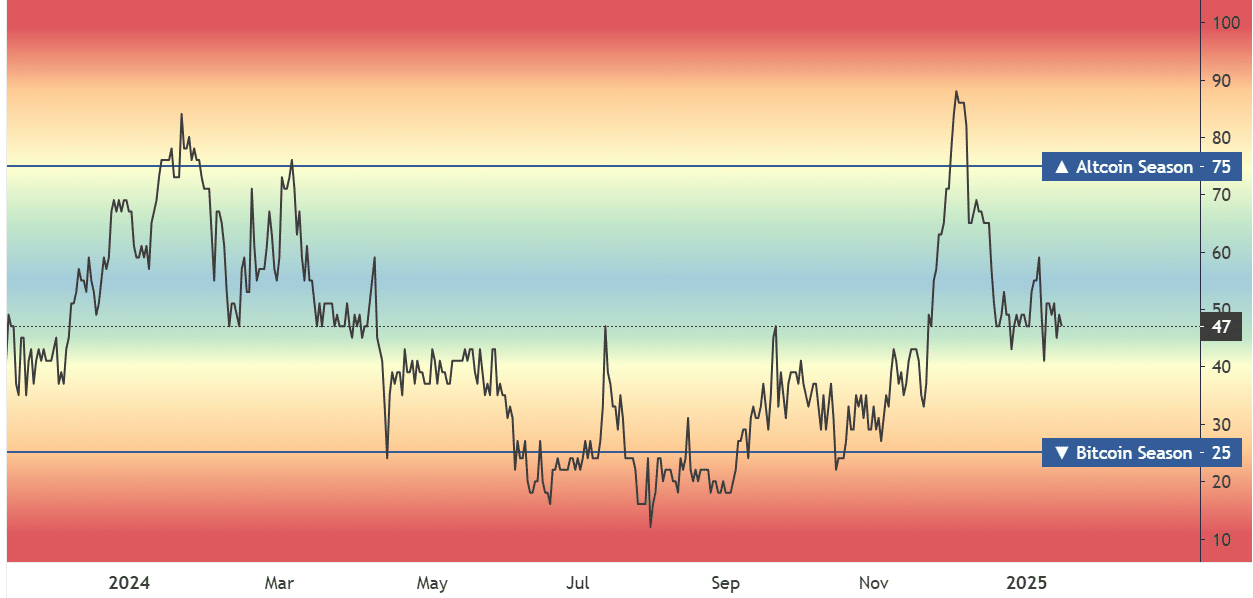

Worth pointing out, however, that another popular altcoin traction indicator from Blockchain Center lay at a neutral level at press time. This implied that it was neither an altcoin season nor a Bitcoin season. Simply put, the market could go in either direction from here.

Source: Blockchain Center

Even so, BTC has the upper hand right now, especially in the face of potentially pro-crypto updates that might follow Donald Trump’s inauguration on the 20th.

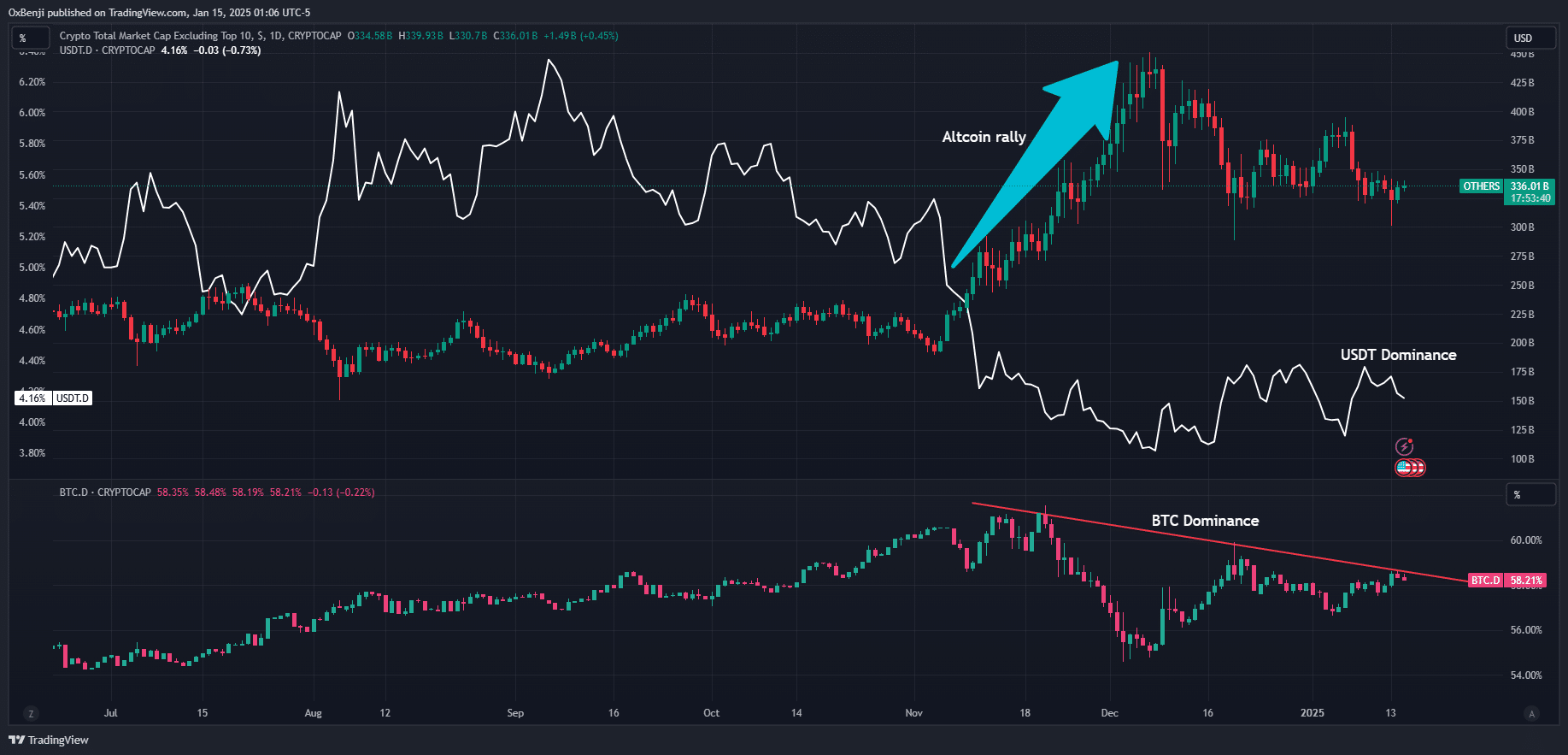

So, what’s next for the rest of the altcoin sector? Well, we explored BTC and Tether’s USDT dominance for extra clues.

For context, both indicators are inversely correlated to altcoin momentum. A drop in BTC and USDT dominance means likely capital rotation from BTC to altcoins and greater buying pressure.

This was evident during November’s altcoin pump too. It coincided with a decline in BTC and USDT market dominance.

At press time, BTC.D had hit a trendline resistance, while USDT.D showed signs of retreating lower. If both indicators retreat over the next few days, the Alphractal projection could be validated.

That being said, some top altcoins, like XRP and Hedera [HBAR], have outperformed the king coin so far. For a 90-day period, XRP and HBAR’s values were up 450% and 600%, respectively. Over the same period, BTC saw just 52% gains.