ai16z – Assessing impact of $3.8M whale action on the coin

- Whale activity and social dominance fuel ai16z’s bullish breakout, with resistance near $1.40.

- Technical indicators and funding rates suggest sustained momentum, but caution around overbought conditions remains.

Whale activity around ai16z [AI16Z] has sparked intrigue, with notable purchases pushing the price up significantly. Recently, a $2.9M Solana [SOL] conversion was used to acquire 2.25M ai16z tokens at $1.29, now worth $3.8M.

At press time, ai16z was trading at $1.36, surging 18.57% over the last 24 hours. While this momentum is promising, traders are questioning whether the rally will continue or if a pullback is imminent.

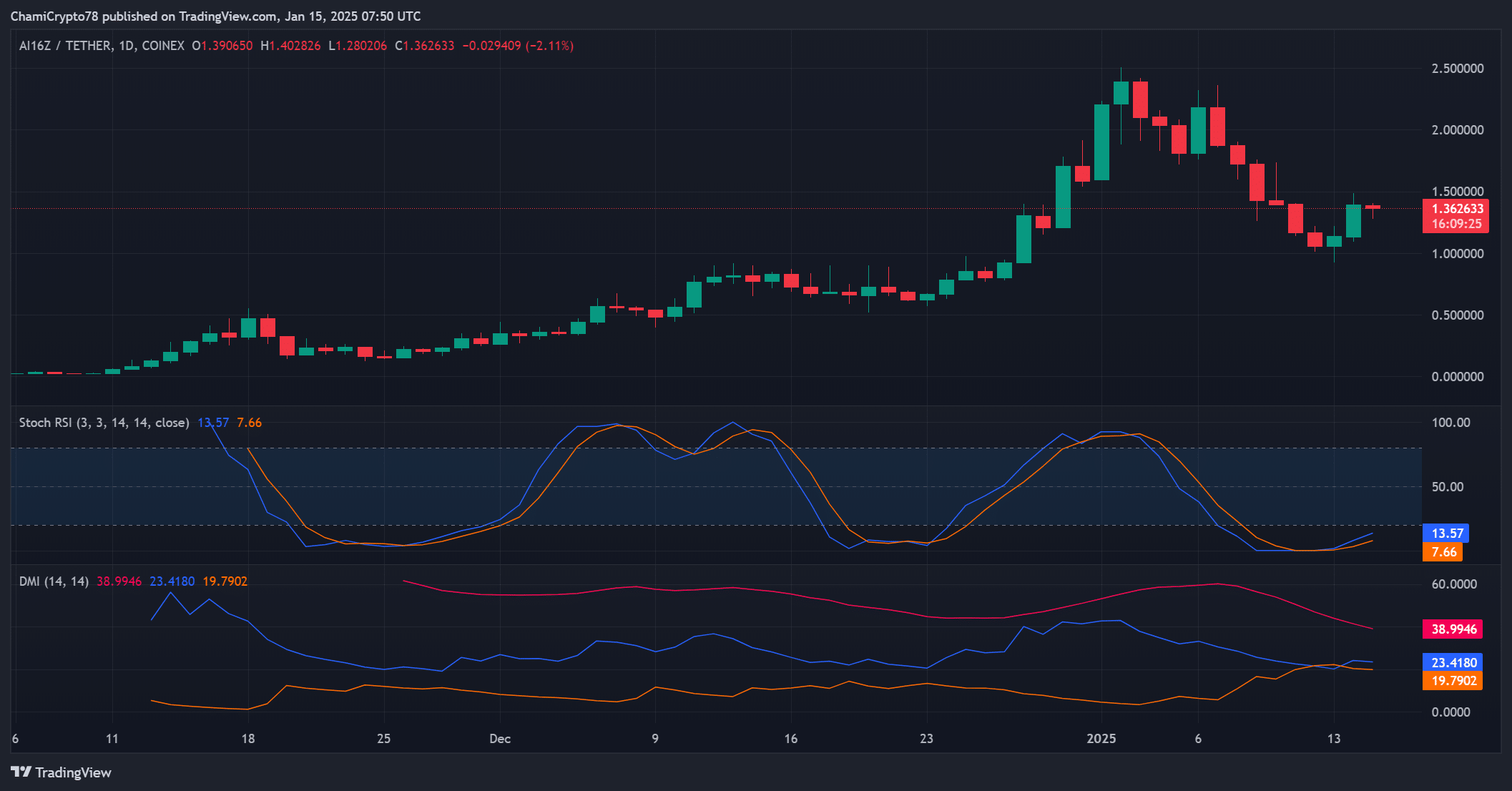

AI16Z price action analysis: Signs of recovery

The price action for ai16z has been eventful, with a breakout from a bullish pennant flag pattern signaling potential further gains. After consolidating around the $1.05 support level, the token surged past $1.30, supported by rising trading volumes.

However, resistance near $1.40 remains a critical hurdle. If the token can close above this level with strong momentum, the next target could be $1.50 or higher. Conversely, a failure to sustain above $1.30 might trigger a short-term correction.

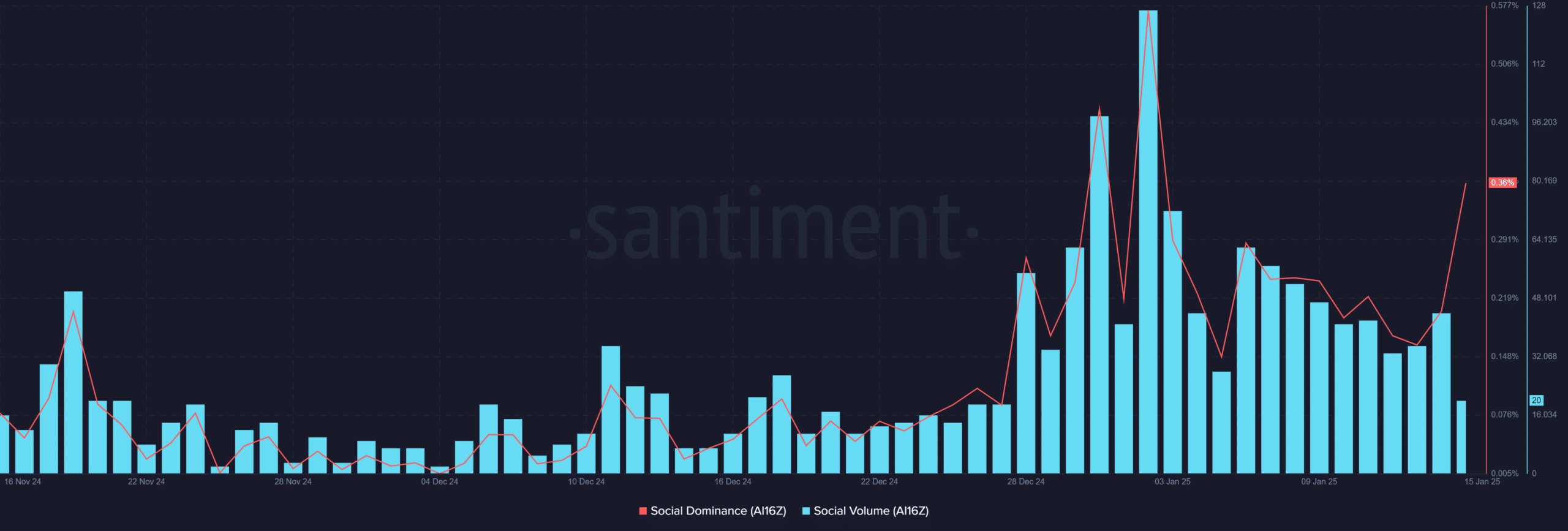

AI16Z social volume and dominance: Steady rise in attention

Social metrics for ai16z have been steadily climbing, reflecting growing interest among investors and traders. Social dominance has reached 0.36%, while social volume shows a moderate rise.

This increase in online discussions and sentiment indicates heightened speculative activity. However, maintaining this momentum is crucial to sustaining current price levels, as waning interest could lead to reduced buying pressure.

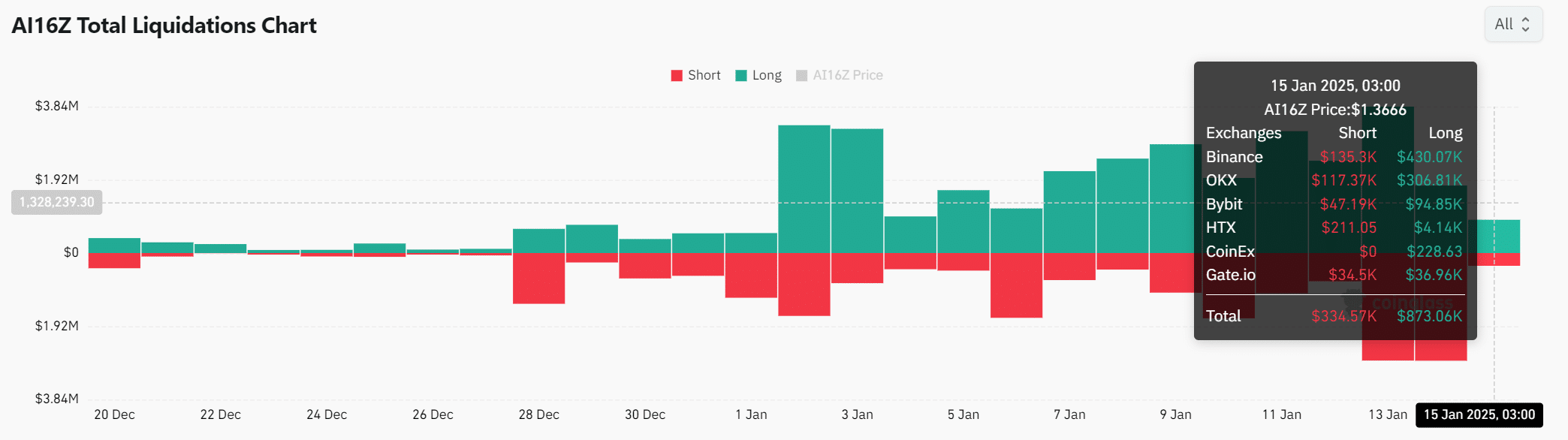

Liquidation trends: Bulls in control

Liquidation data indicates strong bullish sentiment, with $873,000 in long liquidations compared to $334,000 in shorts over the last 24 hours. This skew towards longs shows confidence among traders expecting higher prices.

Recent whale purchases also align with this trend, further bolstering the bullish outlook. However, traders should remain cautious, as rapid price movements can lead to sudden shifts in market sentiment.

Technical indicators: Momentum building

Technical indicators suggest that ai16z is in a strong uptrend. The Stochastic RSI shows an upward cross, with %K at 13.57 and %D at 7.66, indicating a potential continuation of the rally.

Furthermore, the Directional Movement Index (DMI) supports this bullish narrative, with +DI at 23 and -DI at 19, while the ADX at 38 confirms a strong trend. However, traders should watch for overbought conditions that could lead to short-term corrections.

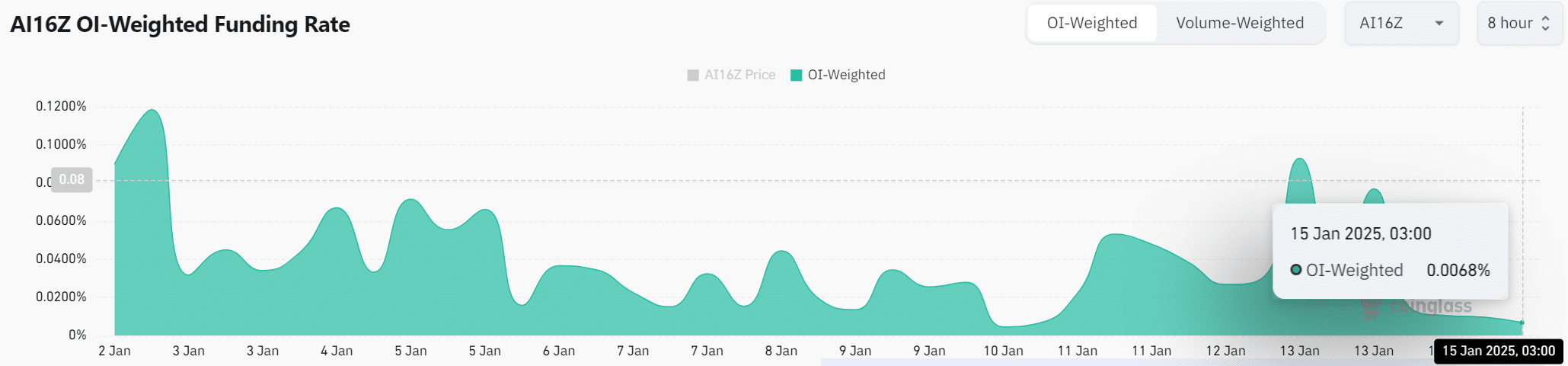

Funding rate: Balanced sentiment

The Open Interest (OI)-weighted funding rate for ai16z remains slightly positive at 0.0068%, suggesting a balanced market sentiment.

While the funding rate leans bullish, it is not overly aggressive, indicating that traders are cautiously optimistic. This neutrality could shift if prices continue to rise, attracting more leveraged positions.

Read ai16z [AI16Z] Price Prediction 2025-2026

The current data and technical indicators suggest that ai16z has the potential to sustain its bullish momentum. However, resistance near $1.40 and the need for continued social engagement pose challenges.

If the token can break through these hurdles, it may target higher levels, signaling a strong rally. For now, ai16z appears poised for further gains, but careful monitoring is advised.

![Will Hedera's [HBAR] 20% hike be enough to push it past its trading range?](https://ambcrypto.com/wp-content/uploads/2025/01/HBAR-Featured-400x240.webp)