Dogecoin holds $0.143 support—Will it rally to $1 on ETF hopes?

- DOGE’s daily candle closed and reacted with a rebound from the key level given at $0.143, forming a lower wick low at $0.14297.

- DOGE key liquidation above current price between $0.16 — $0.17 as SEC extends the ETF decision.

Dogecoin [DOGE] daily chart confirmed a bounce off the key support at $0.143 with a lower wick at $0.14297. The rejection of price at this level suggested potential accumulation at this point.

The recent red candles indicate continued downside momentum, suggesting that further downward tests are likely before a reversal occurs.

While the latest green candle highlights short-term buying interest, DOGE must reclaim the $0.17542 resistance level to establish a more stable trend.

Failure to hold the $0.143 support level could result in increased volatility, potentially driving the price down to $0.134 before a genuine rebound takes place.

If DOGE maintains steady support at $0.143 or higher, it could build momentum for a move toward $0.168. Buyers will need to see increased trading volume and higher lows to signal market strength.

Without these factors, any rally risks being a temporary liquidity grab before another drop. A push above $0.14297 might trigger stop hunts, shaking out weaker positions before a potential rally.

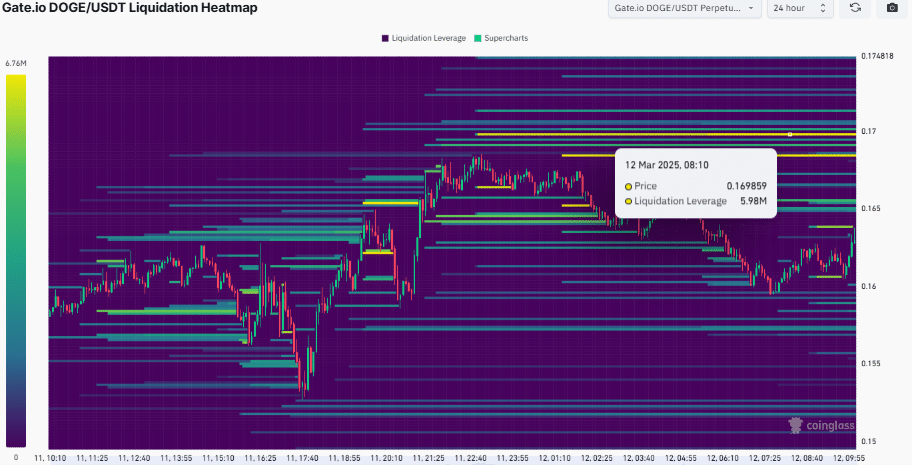

Key liquidation levels

Further analysis showed DOGE’s strongest liquidation area was $0.16 to $0.17 meaning price will be attracted to this level as liquidity attracts activity. The density of liquidations of almost $6 million at $0.169859 could help to validate the upside target.

If momentum is gained, DOGE can trend upward to seek stop orders, causing volatility. But clusters of liquidity follow traders opening and closing positions, meaning new groups of liquidation can form lower, which is what turns the price.

Source: Coinglass

If new liquidity builds below $0.16, DOGE can recapture these levels before attempting to move above.

Not being able to recapture $0.17 can trigger another sell-off, building more pools of liquidity near $0.155, a bear trap leading into the rally.

Implications of SEC’s extension on DOGE ETF

Bloomberg ETF analyst James Seyffart, writing on X (formerly Twitter), noted that the SEC’s 45-day delay shifts the Dogecoin ETF decision, along with other altcoin ETFs, to a deadline of the 4th of April 2025.

This delay could result in mixed price reactions, though Seyffart emphasized that the chances of approval remain high.

If approved, the ETF could provide a significant boost, with Polymarket assigning a 75% probability of approval, potentially driving DOGE’s price to $1 or higher.

Institutional demand and broader acceptance would further support a rally, and a quicker decision could enhance the current bullish outlook.

However, a rejection or further delay may lead to a price decline. DOGE, already down 16% recently, is testing support at the $0.14 level. Heightened uncertainty could amplify volatility, deterring risk-averse investors while attracting speculators betting on gains.

Analysts remain divided, with many optimistic about a possible $2+ rally, while others express concerns about regulatory challenges.

The SEC’s review of Bitwise and Grayscale submissions remains central to DOGE’s prospects.