Bitcoin – Widespread capitulation signals likely bottom, BUT risks remain

- Bitcoin’s massive +$800M per day realized losses could mark a likely bottom

- Overall demand has remained negative, with BTC ETFs bleeding over $5 billion

Bitcoin [BTC] has stayed below $85k on the charts after a brief dip to $76k – A move Bitfinex exchange analysts believe could likely signal stabilization.

In their weekly market report, the analysts noted that traders saw a realized loss of $818 million per day, a market flush that always precedes a potential bottom.

“Such widespread capitulation often precedes market stabilisation, though geopolitical and macroeconomic concerns remain a significant overhang.”

Will BTC rebound?

However, short-term holders (STH) have been selling BTC at a loss for the first time since October 2024. This is a trend that, if extended, could complicate reversal efforts, the analysts added.

They cited the Bitcoin Spent Output Profit Ratio (SOPR), which tracks traders’ profitability, as it dipped below 1. It indicated that holders have been selling at a loss.

“Short-term holder SOPR recorded its second-largest negative print of this cycle at 0.95, signalling that new market entrants are capitulating.”

For the recovery shift, Bitfinex analysts claimed that SOPR must surge above 1 again, which would suggest ‘re-accumulation’ and ‘bullish continuation.’

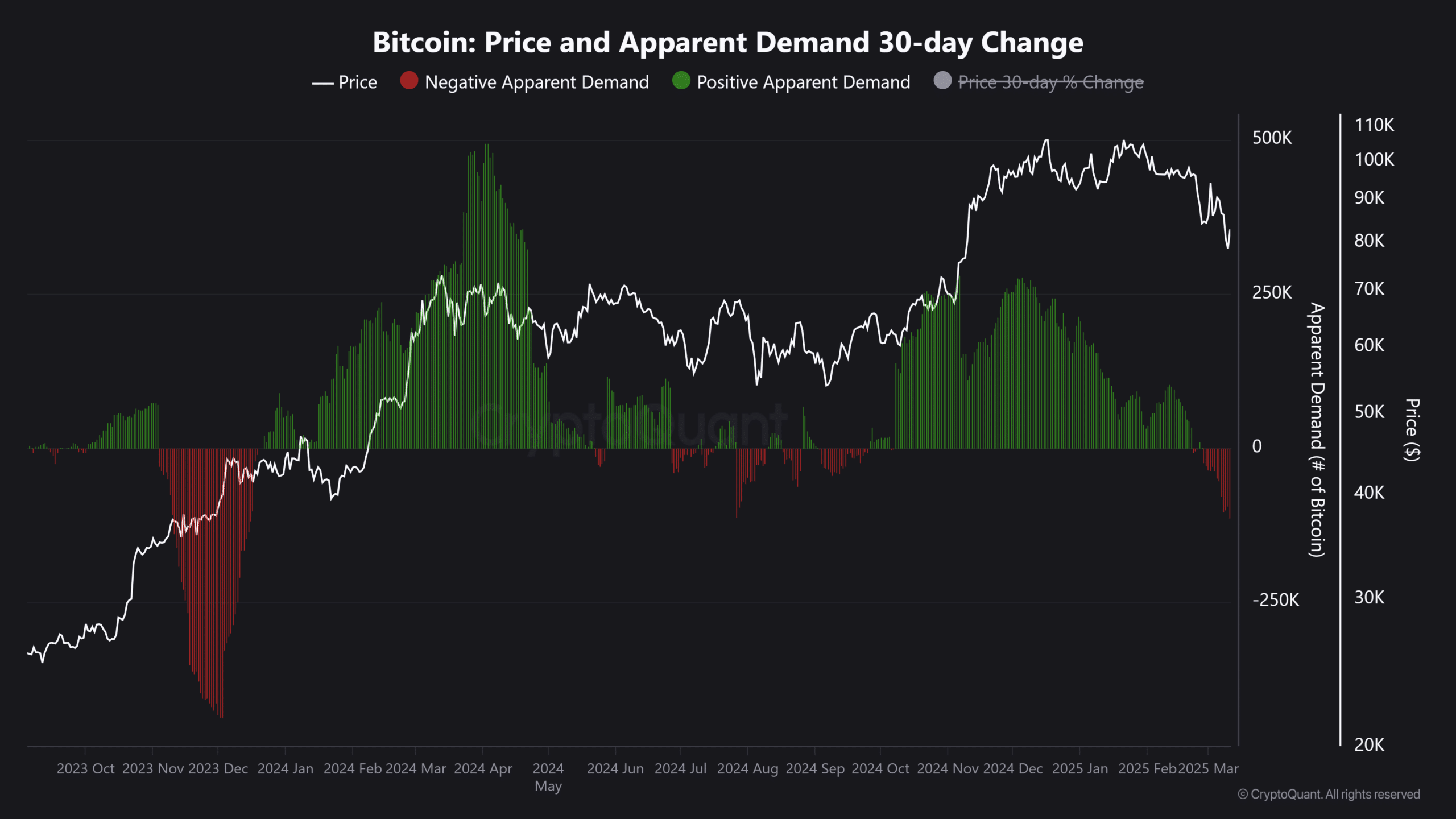

The weak BTC demand corroborated Bitfinex’s warning. In fact, according to CryptoQuant’s data, demand for the cryptocurrency has remained negative since late February.

U.S. spot BTC ETFs have bled $1.5 billion in the first half of March. In February alone, the product saw $3.56 billion outflows per Soso Value. They’ve seen over $5 billion bleed-out in the last 6 weeks.

Bitfinex analysts further warned that the mixed reading on U.S macroeconomic factors could still dent crypto markets. Despite Trump’s tariff wars, the U.S CPI inflation data came in cooler than expected for February.

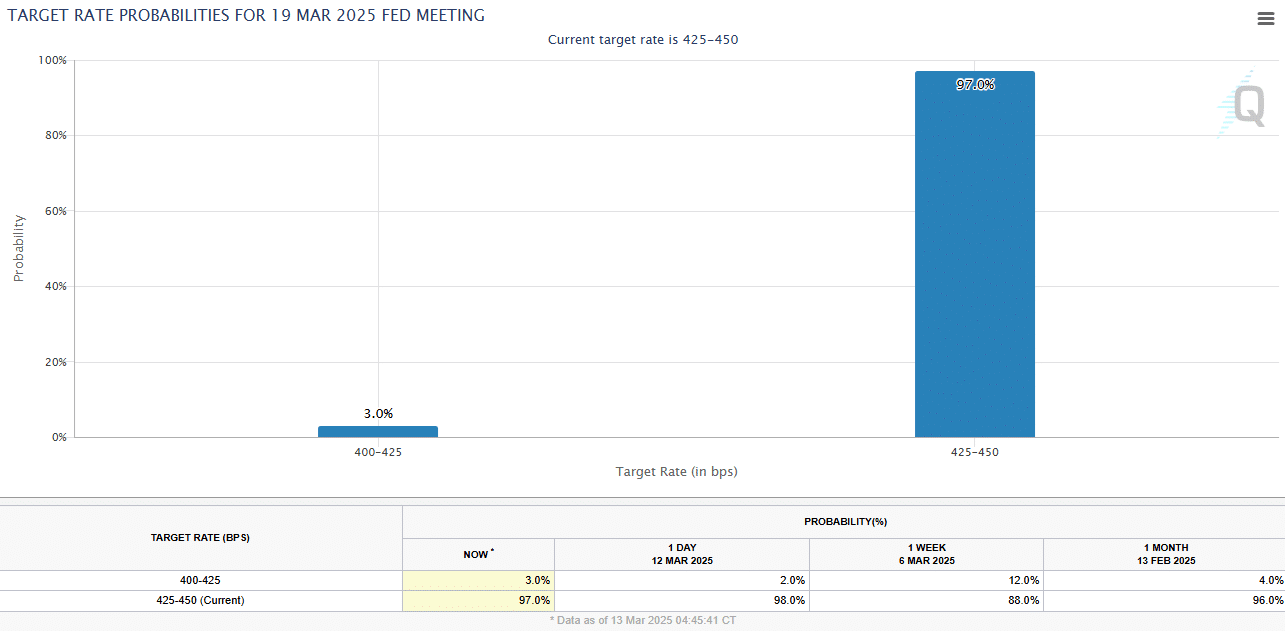

Unfortunately, the market is not expecting any Fed rate cut in the next FOMC meeting scheduled for 19 March. Interest traders have been pricing a 97% chance that the Fed would keep the rates unchanged at the current target of 4.25%-4.50%.

Source: CME FedWatch Tool

There is only a 3% chance of a 25bps rate cut during next week’s FOMC meeting. As such, BTC could still be stuck in choppy waters in the short term.